Why open a savings account even if your child has CDA

![]()

If you’ve only got a minute:

- Unlike the Child Development Account (CDA), which has specific usage restrictions, a savings account allows you to allocate funds for various purposes to cater to your child’s evolving needs over time.

- Teach your child about money management and the importance of saving by involving them in the process of depositing money, setting money goals and tracking their progress.

- It is a valuable tool to instil healthy financial habits and prepare your child for a financially responsible future.

![]()

Being a new parent can be a wonderful but overwhelming experience. Thanks to the Singapore government, every Singaporean child is provided with the Baby Bonus in their Child Development Account (CDA). While the account is useful in helping with certain child-related expenses for parents, good habits are best drilled into us at a young age and building the habit of saving is best started young as well.

Here’s why you should also consider opening a separate savings account for your child.

What is the Baby Bonus and CDA

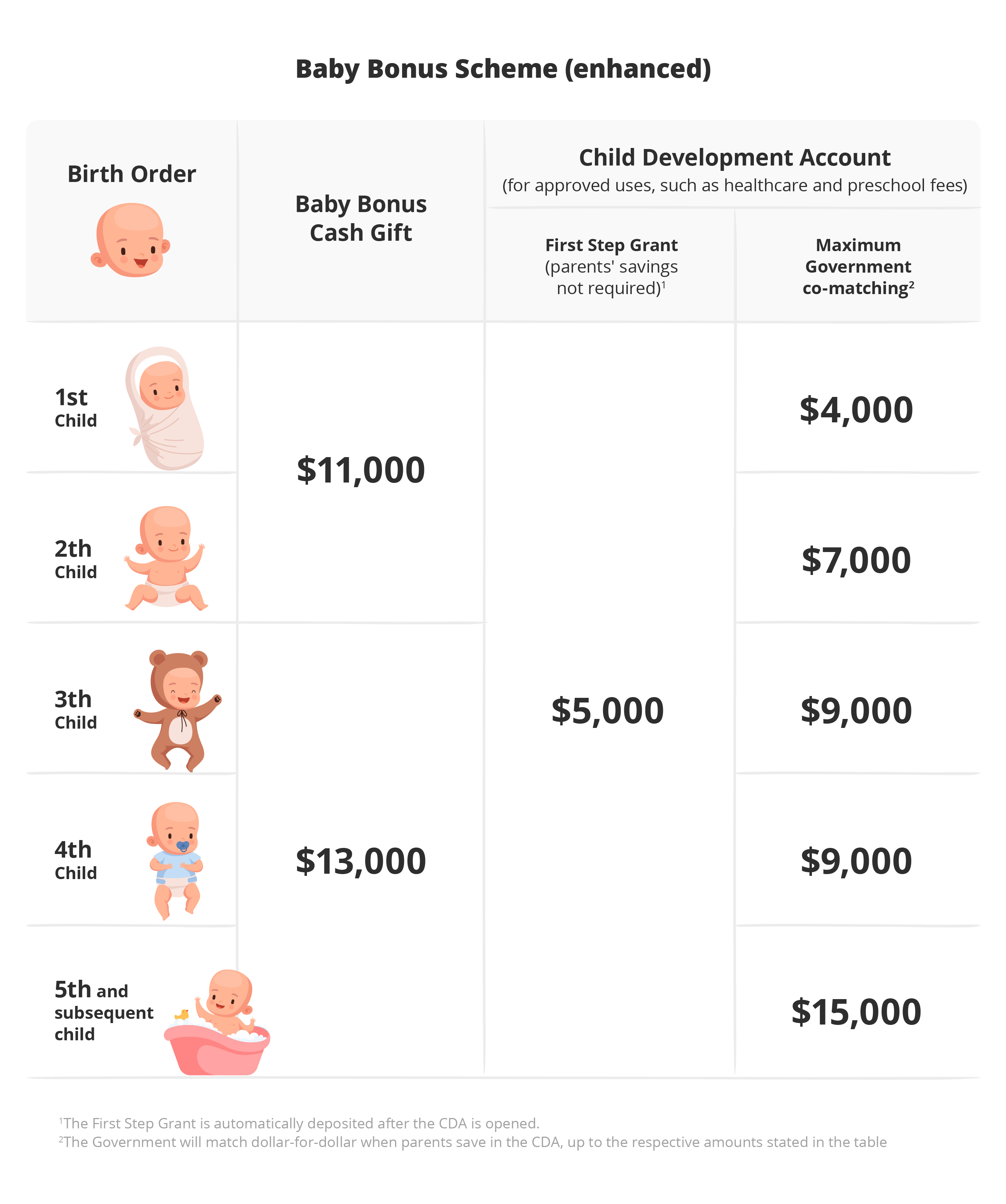

To encourage and support Singaporeans in their decision to have more children, the Baby Bonus Scheme helps to lighten the financial costs of raising children. The scheme includes:

- Cash gift of $11,000 – $13,000,

- CDA First Step grant of up to $5,000, and

- Government matching to savings in the child’s CDA, up to $15,000.

- The enhanced Baby Bonus will be paid out starting 2024, with disbursements upon the child’s birth and at the 6th, 12th and 18th month mark. It will then be followed up with $400 every 6 months from the age of 2 years to 6.5 years old.

|

Source: HeyBaby.sg1

What are the differences between CDA and Savings account for kids

1. Money in the CDA cannot be withdrawn

Many parents would probably have opened a CDA to receive the Baby Bonus. While you may feel that CDA may suffice as a bank account for your child, the account has its limitations.

For instance, you cannot withdraw the money from CDA. Instead, you can only use the account to pay for certain child-related expenses at appointed Baby Bonus-approved institutions, such as childcare centres, hospitals and optical shops.

2. CDA closes when your child turns 13 years old

Another shortcoming of CDA as a savings account is that it will close when your child turns 13 years old. Any money left in the account will be transferred to the Post-Secondary Education Account (PSEA).

So while the CDA is useful as a first account for your child to receive the government aid, it has its limits as a savings account as they grow up.

Why have a separate savings account for your child?

There are 2 main reasons to open a savings account for your child:

1. You can withdraw money from a savings account

Since the money in the CDA can’t be withdrawn, it’s always good to have a separate savings account for your child for other purposes. For a start, you can save any cash gifts you receive from your relatives and friends to your child in the account. In the long term, this account can eventually grow with your child, so that he gets to use the money when he is older.

2. A savings account as their first money management tool

A savings account can also be a helpful tool to teach children money management. For instance, your child can learn the importance of setting saving goals and how money grows by earning interest in a bank account.

You can also educate them on the value of money by giving them an opportunity to "earn money" through work. For example, you can encourage them by matching their savings dollar for dollar when they complete simple chores like tidying their rooms, or sweeping the floor. Through this, they will learn that it takes time, patience and effort to save for items on their wish list such as a bicycle or game console.

How your child benefits from a savings account with customisable add-ons

With a customisable account such as My Account, it grows with your child and meets every stage of their life.

Forget about needing multiple savings accounts – this account allows your child to unlock key banking features as they grow! Furthermore, My Account is automatically bundled with your application for a CDA, making it a convenient process.

1. No minimum balance required

Many deposit accounts require a minimum balance to start. When looking for a kids savings account, you’d want to look for one without a minimum balance, so that there will not be any fall below fees charged. Unless you intend to save a fixed amount into your child’s savings account, opening an account with fall-below fees can easily eat into the savings.

2. No minimum age

Many savings account also impose a minimum age requirement, hence making them unsuitable for kids.

3. Child-friendly

Having a savings account can be an abstract concept for a kid. After all, shouldn’t they be occupied by toys and storybooks? Therefore, it is important that you choose a child-friendly bank account for the little one.

To encourage kids to save, POSB has waived the coin deposit fee so that your child can save more. This not only makes saving money more fun, it also gives your child a head start in their financial literacy journey, setting them up for success with managing their money in future.

Another cool feature your child can enjoy includes a complimentary POPULAR membership which can come in handy when purchasing school essentials and stationery.

4. Versatile

To make saving more convenient, look for banking account that is versatile enough to see your child through childhood to teenage-hood – and beyond.

For instance, a kids savings account that can be switched easily to an adult’s savings account removes the hassle of closing the account and opening a new one in the future. Or perhaps one where you get to keep the same account number after switching.

And if you decide on My Account, it has the added feature of allowing the account holder to pick from a growing suite of services to suit his or her needs.

It will require a little effort to teach your child about the usage of a savings account but it will pay off in the long run. You will be giving them a head start to an important skill set that they'll use for the rest of their lives!

Furthermore, as your child grows older, he or she can activate PayLah! and/or PayNow for mobile payments, or choose to convert to a Multiplier Account for higher interest earning. They can even turn on the multi-currency feature, which could come in handy for overseas exchanges, trips, and online shopping. With My Account, your child’s deposits needs will be met throughout his/her life!

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Source:

1 Made for families, “Baby bonus scheme". Retrieved 7 June 2023

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

DEPOSIT INSURANCE SCHEME

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)