![]()

If you’ve only got a minute:

- A bond is a debt instrument used to raise funds which comes with a promise of repayment of principal with interest upon maturity.

- Bonds are generally issued by two types of entities – governments and companies.

- Bonds come with different features, including but not limited to their tenor, callability, convertibility, and whether or not they pay coupons.

- While bonds are generally viewed as safer investments than equities, they are still subject to risks like credit risks, interest rate risks and prepayment risks.

![]()

At some point in our lives, we would have borrowed something from a family member and/or friend. This can range from a small item like a pen to something of greater value like a mobile device. Regardless of what we borrow, the same principle remains: It is common courtesy to return what has been borrowed to its owner.

In formal borrowing arrangements (e.g. personal, home and/or car loan), there is often compensation that is paid in exchange for the loan. This is charged in the form of interest over the term of the loan.

Similarly, when an entity like a government or company requires extra funds, they can either take up a loan directly with a bank or raise capital by borrowing from individuals and/or institutional investors. To do the latter, they issue (sell) bonds to investors, who then become bondholders after investing in (buying) these bonds.

With most bonds, issuers have a legal obligation to repay the issuer in full by a fixed date to the bondholder, while compensating bondholders with an income stream through regularly paid coupons. You can think of this as similar to interest payments. This is why bonds are known as fixed-income investment instruments.

To understand this form of borrowing better, it helps to be acquainted with bond issuers and types of bonds that are available for investment.

Bond issuers

Bonds are generally issued by two types of entities: Governments and companies.

Government-related bonds are issued by a government and its statutory boards, among others.

In Singapore, government issued debt securities are known as Singapore Government Securities (SGS), which can be used to develop the domestic debt market as well as fund infrastructure projects. Singapore Saving Bonds (SSBs) are a type of SGS that were introduced to provide individual investors with a long-term saving option that offers safe returns.

Examples of bonds issued by statutory boards include those by the Housing and Development Board (HDB) and National Environment Agency (NEA).

Meanwhile, corporate bonds are issued by companies to raise funds, usually for large scale projects. These could include projects like business expansion, infrastructure development, real estate development or even company takeovers

How long are bonds issued for?

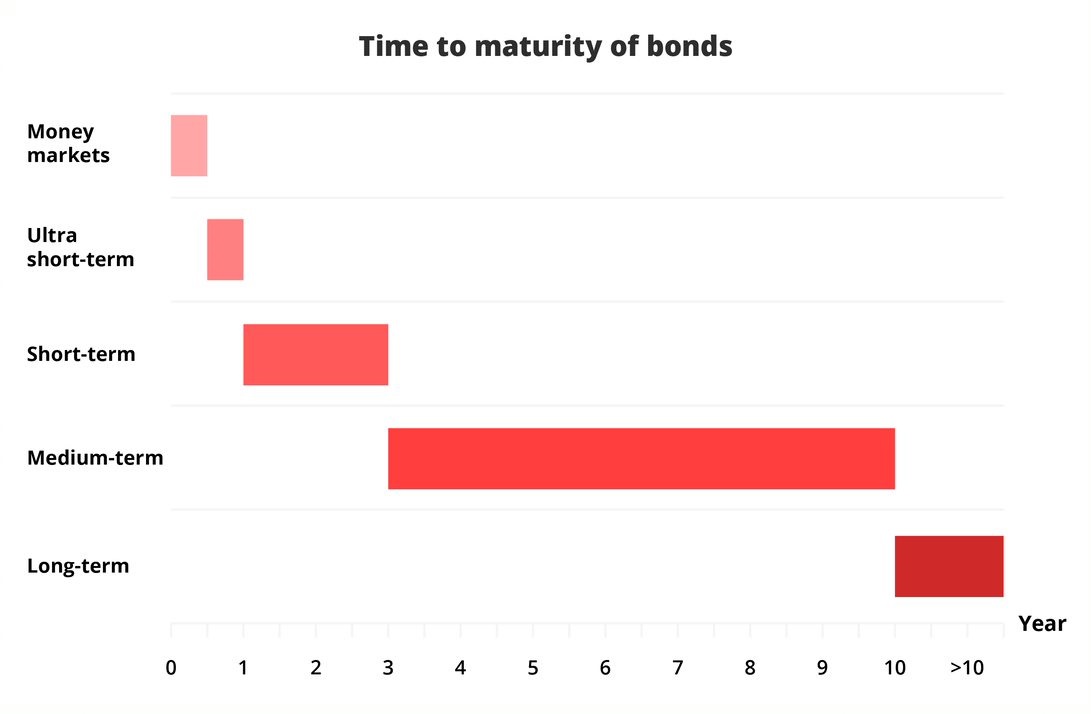

With bonds, the range for how long it matures can be very wide (from a matter of days to as long as 100 years). That said, most bonds mature within 30 years.

Coupon rates from the same issuer tend to be higher for longer-term bonds than short-term ones to compensate investors for holding the bonds for a longer period as the chance of default rises with the duration of the bond.

Money markets

Money market instruments are very short-term debt securities that generally have a higher liquidity. They are considered as a conservative option during volatile times as their liquidity makes it a good option for investors who may need their funds back at shorter notice. Access to the money market is usually done through pooled investments like fixed-income unit trusts.

Ultra-short bonds

In general, these are bonds with a tenor of up to 1 year. Treasury bills (T-bills) are a type of ultra-short SGS that have maturities of either six months or a year. Being a zero-coupon bond, they are sold at a discount and redeemed at their face value upon maturity. For example, a T-bill with a face value of $1,000 can be sold at $950. Upon maturity, it will be redeemed at $1,000.

Short-term bonds

They typically have a tenor of between 1 and 3 years. Similar to money market funds and ultra-short bonds, they are an avenue for investors to gain access to relatively low-risk income streams. Given their longer tenor, they often offer higher yields but are more sensitive to changes in the interest rate environment.

Medium-term bonds

Also known as intermediate term debt, these bonds often have a tenor of approximately 3 to 10 years. Some only consider bonds to be medium term in nature if they have a tenor of 5 to 10 years. While bondholders can get a longer stream of income when compared to short-term bonds, they are also more exposed to changes in interest rates.

Long-term bonds

Long-term bonds have a tenor of more than 10 years. Investors holding long term bonds are subject to higher overall risks like credit, interest, and prepayment risks, since there is a higher chance of these risks occurring through the term of the bond.

Common terms associated with bonds

Unlike equities, the many terms associated with bond investments can be confusing to seasoned investors, let alone beginners. Some of the common ones include bond coupons, face value, market value, maturity, and current yield.

Coupon

In the past, bonds were issued as printed certificates with coupons physically attached to them. The bondholder would have to take the physical coupon and present it to the bank to collect this payment.

Even though physical bond certificates are no longer issued, the term “coupon” remains. Most of the time, the value of coupons is fixed, denoted as a percentage of the face value of the bond, and are paid out at a regular interval (most commonly twice a year).

Maturity

The maturity of a bond is the amount of time that the bond is issued for, usually denoted in years, and set at time of issuance. While the maturity of a bond does not change, the time to maturity gets shorter as time goes by.

Face value

Also known as the par value of a bond, it refers to the dollar value of a bond when it was issued. It is fixed throughout the tenor of the bond. The face value is what the bondholder will receive at the time of maturity.

Market value

It is the price of a bond in the open market. Unlike its face value, the market value of a bond is subject to fluctuation depending on supply and demand which can be driven by factors like changes in interest rates or changes in credit rating of the bond.

Current yield

As bonds can be purchased on the open market at a price different from its face value, an investor may be paying a premium or a discount for it. In this case, the coupon rate (which is expressed as a percentage of the face value) is no longer an accurate reflection of what the investor is receiving.

The current yield is an estimate of the returns the investor will get upon holding his bond to maturity. You can loosely think of this as the “new coupon rate” of the bond. It is the dollar value of the coupon payment expressed as a percentage of the current market value of the bond. The current yield has an inverse relationship with the price of the bond, meaning that when prices fall, the current yield rises and vice versa.

Types of bonds

Plain vanilla bond

This is a bond in its most basic form, which is a debt instrument that has a pre-determined and fixed face value, coupon, payout interval and maturity date. Upon maturity, the bond is then redeemed at face value by the bondholder.

Callable bond

This is a bond where the issuer has the right to repay the bondholder at a date before maturity. The repayment amount includes the principal and any accrued interest up to the date the bond is called. Generally, a callable bond would offer a more attractive coupon rate to compensate for the potential loss in income stream, should the bond be called prior to maturity.

Zero coupon bond

These bonds do not have coupons and instead, are sold at a discount but redeemed at the face value upon maturity.

Convertible bonds

As the name suggests, it is a bond that can be converted into underlying shares in the company that issued the bond. In general, the option to do so is at the discretion of the bondholder, at predetermined time and conversion rate.

Perpetual bonds

Also known as a perp, it is a hybrid between a bond and a stock. Perps offer fixed income coupon payments but have no maturity date. While the issuer of a regular bond has an obligation to repay the principal amount to the investor at a specific date, this does not hold true for the issuer of a perp. Investors usually need to sell them on the market at the prevailing price to get their funds back. In some instances, issuers may choose to redeem their perps, but this is at the discretion of the issuer and is not an obligation.

Here’s an example.

A company issues a bond with a face value of $1,000 and coupon payments of $100 per year with a term of 5 years. Two years after this issuance, the price of the bond has fallen to $900, and you decide to invest into it.

Risks associated with bonds

While bonds are generally viewed as safer investments than equities, lower risk doesn’t mean there is no risk at all. Here are 3 common risks.

Credit risk

When purchasing a bond, understanding an issuer’s capacity and credit worthiness to repay the loan at maturity is paramount. The lower the ability of an issuer to do, the higher its credit or default risk is. Failure to do so results in a default of payment.

If a company becomes insolvent and unable to repay its bond obligations, it is possible for the investor to lose all his/her invested capital.

Interest rate risk

When interest rates rise, investors can find alternative investments with higher potential returns, thus driving demand and prices of fixed-rate bonds down. This will not affect an investor who is planning to hold the bond to maturity. However, if the bond is sold on the secondary market at this point, the investor may have to sell it at a price lower than its face value, risking a loss.

Prepayment risk

This risk applies to callable bonds. If the bond issuer decides to redeem the bond prior to its maturity date, the investor will not lose any capital. However, he/she may not be able to reinvest the funds into an investment which has a similar yield as the bond which had been called.

![]()

This is the first article of our series on fixed-income investments. If you’re keen to learn more about this asset class as well as how you can invest in them, check out the other articles:

Part 2: 8 things to know before buying bonds

Part 3: Investing in SSBs

Part 4: Investing in Singapore Government Securities other than SSBs

Part 5: Investing in T-bills

![]()