8 things to know before buying bonds

![]()

If you’ve only got a minute:

- When you purchase a bond, you are lending money to the organisation that issued it.

- Coupon payments are usually denoted as a fixed percentage of its face value and often paid out quarterly, semi-annually, or annually.

- A bond's credit rating is indicative of the perceived ability of the bond issuer to repay its debt – the higher the credit rating, the stronger the financial standing of the bond issuer.

- You can invest into a diversified pool of bonds through ETFs, unit trusts and/or robo-advisors.

![]()

Most of us are familiar with the concept of borrowing money to pay for big purchases.

At the individual or household level, this may involve getting a home loan to purchase a residential property. Here, funds are loaned to you through a financial institution like a bank. In exchange, you commit to timely repayment of the loan as well as interest payments, which is compensation to the bank for providing you the loan.

Broadly speaking, the concept of a bond is similar but this time round you are the lender and not the borrower. By purchasing a bond, you are essentially lending money to the organisation (e.g. a government or company) that issued it.

Issuing a bond is one of the methods organisations use to raise funds through debt. Like a loan, a bond issued comes with a promise of repayment in full upon its maturity, accompanied by regular interest payments through its term. This is why bonds are called fixed-income investments.

While it’s common to hear investors talk more about stocks than bonds, the global bond market is actually worth more than twice the global stock market. It also doesn’t help that the fixed income asset class is less understood than equities.

That said, it is important for all investors to allocate funds to bond investments as they are great way to add diversification to a stock portfolio, since they are income generating assets.

Before investing in bonds, it first helps to get acquainted with the types of issuers and bonds that are available for investment.

Once you’ve done that, here are 8 points that can help you to understand fixed-income investments better.

1. The coupon is the fixed income compensation you get for your investment

The coupon is paid out at a regular interval – usually quarterly, semi-annually or annually – and is often denoted as a percentage of its original face value at point of issuance.

In general, a bigger coupon typically means that there is a higher risk involved in investing into a particular bond.

Examples of factors that affect the risk and corresponding coupon level include the credit quality of its issuer, tenor of the bond and existing market conditions, among other things.

2. Its fixed-income nature is both a pro and a con

The fixed-income nature of bonds means that they provide regular coupons to investors (a notable exception being zero-coupon bonds). As coupon rates are fixed at the time of issuance of the bond, the dollar value of the coupon payments is set in stone.

It is this predictable cashflow that make bonds an attractive option for those who are looking for alternate streams of income. Moreover, as long as the issuer does not become insolvent, they have a legal obligation to repay the principal of the bond to the bondholder at maturity, thus providing a form of capital preservation for investors.

Assuming you have invested in a bond, and in the months after the interest rates start to dip, this may be beneficial to you as your coupon payments remain the same and more likely to be higher than equivalent bonds that are currently being issued in the market.

Conversely, in an environment where interest rates are rising, the reverse holds as your coupon payments are likely to be less than what new, equivalent bonds are able to offer. Furthermore, if you decide to sell these bonds in the market, they are likely to be sold at a discount to their fair value.

3. The credit risk of the issuer plays a part in determining the coupon rate

When deciding whether to lend money to a friend, you’ll have to assess if this individual is trustworthy enough to repay the loan.

In the same vein, before you purchase a bond, you’ll have to be aware of the likelihood of the issuer to miss repayments or be unable to repay. This is known as the credit or default risk of the issuer, which is determined by independent credit rating agencies.

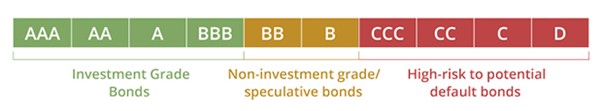

There are 3 major credit rating agencies that analyse certain metrics and financial positions of companies and bonds issued by them, to give out bond ratings accordingly. They are Standard & Poor’s (S&P), Fitch Ratings Inc. and Moody’s Investors Service.

Each of these agencies use a slightly different ratings system, S&P’s and Fitch’s classifications are shown here:

The higher the credit rating, the stronger the financial standing of the bond issuer in the eyes of the rating agency. This classification is useful in deciding whether the coupon you are getting is worth the risk you are taking in lending the company your money. The more risk you are taking on, the higher your expected coupon should be.

Bonds that are issued by companies which have a high capacity to repay them are classified as “investment grade bonds”, and those which have a high risk of defaulting on payments are classified as “junk bonds”.

Government bonds tend to be safer than corporate bonds as they are backed by the finances of the government. However, this is not necessarily always the case, as the credit worthiness of each government differs. Taking the example of SGS, they are AAA-rated, whereas bonds issued by other countries may not be awarded the same standing.

In general, keeping all other things constant, the lower the rating of the bond, the higher the coupon will have to be to compensate for the added risk taken. This is known as the risk-reward trade-off.

4. Be thorough about the features of each bond

As with all investments, due diligence is of the essence. It is important to be aware of the features of each bond as they can differ slightly from issuer to issuer.

Plain vanilla bonds – the simplest form of a bond – are straightforward, having a fixed coupon and tenor. Some examples of bonds with different features include zero coupon bonds, convertible bonds, callable bonds, step-up, and floating rate bonds.

This list is non-exhaustive, so do take the time to get familiar with all the features, and terms and conditions of the bond before making an informed decision.

5. In the event of bankruptcy, bondholders are paid before shareholders

One of the reasons why bonds are viewed as lower risk or “safer” investments than equities is due to their position on the debt hierarchy.

For context, when a company is liquidated, there is a fixed order in which the assets are paid out to its creditors.

What this means is that in the event of a company’s bankruptcy, bondholders are paid before shareholders of common stock. Within bonds, holders of secured bonds, which are backed by collateral like property, are paid first. Secured creditors tend to have a direct claim on certain assets and are bound by a contract.

If there are still funds left after this, the next in line to be paid would be paid to holders of unsecured bonds.

The lowest priority is given to shareholders in this situation, meaning that if there are no funds left, the shareholders will not receive any payment from the liquidation.

6. Bonds tend to have lower liquidity than publicly traded equities

Even though bonds and equities can be traded on exchanges like the Singapore Exchange (SGX), not all bonds are available to the general public like stock listings. Meanwhile, non-retail bonds have to be bought and sold via over-the-counter (OTC) dealer networks like banks.

Since bonds are not able to be bought and sold easily at stable prices, they are not considered to be a liquid asset.

This is not an issue for investors who intend to hold the bonds to maturity. But for investors who may need the funds before the maturity of the bond, they will need to try and sell it at the prevailing market rate. This could result in a loss if the market rate is less than the original invested amount.

When investing into a bond, it is good to consider whether you can hold it through to maturity, and if not, whether the bond you buy is likely to have enough liquidity to be sold at a favourable price.

7. You can invest in bonds through pooled investments or robo-advisors

Corporate bonds are not always the most accessible to the average investor, and they usually have a high entry level of at least $200,000. This would mean that many investors are priced out of making such investments.

Thankfully, there are many affordable ways to invest in a basket of bonds through robo-advisors like DBS digiPortfolio and pooled investment products like unit trusts or exchange-traded funds (ETFs).

By investing in bonds through these products, you are not only able to diversify your investment portfolio but also have more liquid bond-related products. Another advantage of this is that these products can be purchased at a much lower entry price than individual corporate bonds. In the case of bond ETFs listed on the SGX, the board lot size is one unit.

8. There are fees involved with bond investments

If you buy a bond at point of issuance through an initial public offering (IPO) you will pay the face value of the bond. To buy or sell it after the public offer, on the secondary market, you would pay the prevailing market value of the bond and any transaction fees involved.

With robo-advisors and pooled investment products like unit trusts and ETFs, investors are often charged fees for the management of the funds. That said, bond-only funds tend to have lower management fees than stock-only funds and actively managed funds usually have higher fees than passively managed ones.

![]()

This is the second article of our series on fixed-income investments. If you’re keen to learn more about this asset class as well as how you can invest in them, check out the other articles:

Part 1: A beginner’s guide to bonds

Part 3: Investing in SSBs

Part 4: Investing in Singapore Government Securities other than SSBs

Part 5: Investing in T-bills

![]()

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

NNeed help selecting an investment? Try ‘Make Your Money Work Harder’ on the Plan & Invest tab on the digibank app to receive specific investment picks based on your objectives, risk profile and preferences.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)