By Navin Sregantan

![]()

If you've only got a minute:

- Before investing in S-Reits, understand the asset class and what factors affect its performance.

- The economic outlook affects S-Reits in varying sectors (commercial, healthcare, hospitality, industrial and retail), differently.

- Yields, interest rates, weighted average lease expiry and net asset value are some useful metrics to evaluate Reits on.

- Use DBS Group Research's ABCD framework to narrow your options when selecting Reits.

Real Estate Investment Trusts (Reits) are often seen as an attractive investment for dividend-focused investors as they are an affordable way to gain ownership of a wide range of local and global properties.

With property prices steadily rising, Reits can be considered an alternative to purchasing an investment residential property while generating income for you.

In Singapore, Reits are required by law to distribute 90% of their income as dividends to unitholders. These distributions are also tax exempt.

In recent years, most Singapore-listed Reits (S-Reits) have average dividend yields of between 5% and 6%. Even though interest rates have stayed elevated from 2022 to 2023, they remain as appealing alternatives to government bonds and term deposits.

To help you with how to assess which Reits to invest in, here are 6 key things to consider when investing in the asset class. This article also highlights DBS Group Research's ABCD framework for selecting quality S-Reits.

6 key things to consider when evaluating Reits

Unlike traditional real estate investments, Reits are unique in that they trade like stocks. In other words, you are essentially investing in a portfolio of income-generating properties.

As Reits exhibit some stock-like behaviours (i.e. trading on exchanges, being very liquid and providing dividends), they are often analysed like stocks though there are some key differences.

Like most things in life, do your due diligence by understanding the S-Reit landscape and taking note of these key points before jumping into your first Reit investment.

Read more:

An overview of the S-Reit landscape

1. Economic outlook

Like stocks, the state of the economy is an important factor affecting the performance of Reits. Stronger economic growth prospects are generally a good thing.

That said, most Reits have mandates that focus on a particular sector – Commercial, Industrial, Healthcare, Hospitality and Retail. This is why you should have an idea of the outlook of the individual sectors.

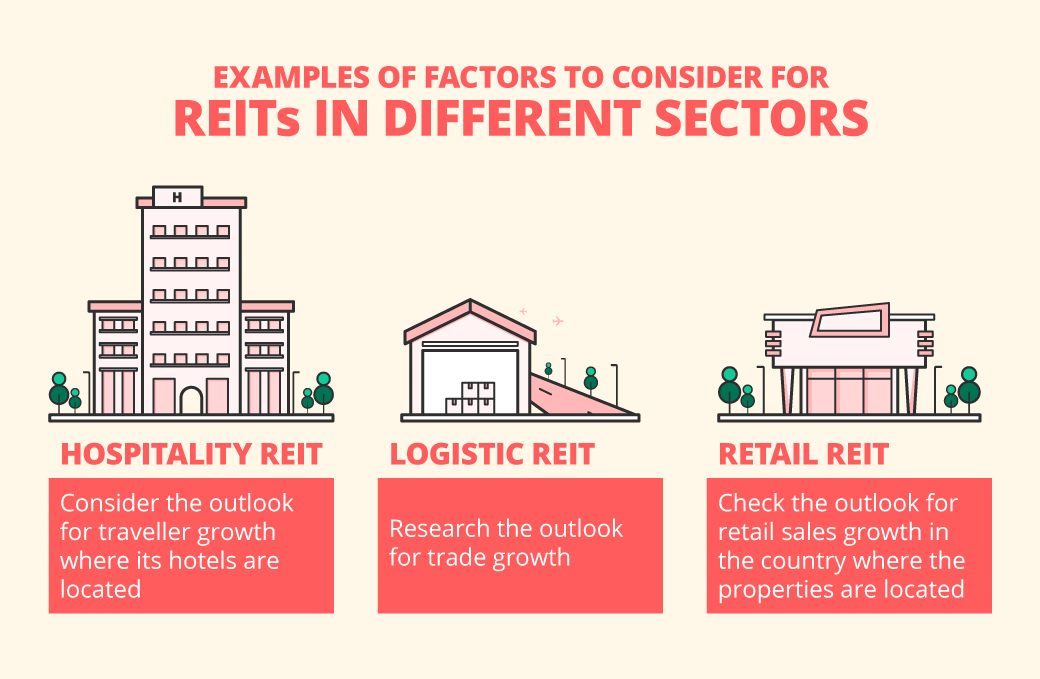

Here are some examples of what to look out for in Hospitality, Logistics (a subset of Industrial properties) and Retail Reits:

When it comes to diversified Reits, be aware of the combined outlook of sectors that the properties in the portfolio form.

In the case of a diversified Reit with a portfolio of commercial, hospitality and retail properties, you should look at the outlook of each sector when you consider investing. It is also helpful to look at how each sector contributes to overall revenue collected by the S-Reit.

When you are considering S-Reits with mandates that require them to invest mostly in foreign property (e.g. Manulife US Reit), understand the economic and property outlook in those countries before deciding to invest.

2. Yield and frequency of payouts

Yield, which is related to the risk potential and growth prospects of a Reit, is one of the main metrics used by dividend-seeking investors. Historical yields are calculated by taking the distribution or dividend per unit in a Reit paid to investors divided by its current unit price.

Higher yields do not make a particular Reit more attractive and may indicate a lower chance of stable distributions. Conversely, lower yields are not indicative of a Reit being a less valued buy and might actually represent a safer investment.

Historical yields are also not indicative of future performance of a Reit. That said, they can be a useful measure in understanding how consistent a Reit has maintained its payouts to unitholders.

In some cases, the frequency of distributions made to unitholders may affect whether individuals choose to invest in one Reit over another. Those who prefer more regular payouts may pick a Reit that pays quarterly distributions over one that pays semi-annually.

3. Interest rate environment

It is generally said that rising interest rates make bonds, dividend income stocks and Reits less attractive. A higher interest rate environment makes the higher dividend yields of Reits less attractive to holding cash deposits and other fixed income securities.

If expectations of future interest rates change suddenly, Reits along with other asset classes have often faced high price volatility.

That said, historical data has shown that a rising interest rate environment does not necessarily result in the underperformance of Reits.

For the most part, Reit returns and interest rates are positively correlated. This is so as a rising interest rate environment is often associated with economic growth and higher inflation. These two factors are likely to be a positive for property-related investments.

A lower interest rate environment may present an opportunity for Reit managers to refinance loans ahead of their maturity at a lower rate as well as take up new loans for future expansion.

But there is a caveat: If interest rates are falling because of a coming recession, they won't help the prices of dividend-paying stocks or Reits.

4. Weighted average lease expiry (WALE)

WALE measures the average time to expiry of existing leases of properties in a Reit based on the area a tenant occupies and the rent it pays to the Reit. If a Reit's WALE is 4.5, this means current leases have an average of 4.5 years before the end of the contract.

That said, do not look solely at the absolute value of this figure in making an investment decision. For example, a lower WALE for an Industrial Reit during a period of strong economic growth should not be viewed as a negative, especially if the supply for industrial property is tight and new rental contracts can be signed at a higher price.

Likewise, a longer WALE can be an assurance to investors during an economic downturn as the tenants are locked into their tenancy agreements for a longer time.

5. Net Asset Value (NAV)

NAV, the difference between total assets and liabilities on a per unit basis, is another commonly used metric to assess the valuation of a Reit. NAV is indicative of the value of a Reit portfolio on a per unit basis.

Theoretically, if the NAV per unit of a Reit is S$1.50, each unit should trade at that price. However, this is rarely the case as Reits mostly trade at a premium or discount to their respective NAVs.

6. Funds from operations (FFO)

Stock investors often look at net income and earnings per share as a gauge for how much a company makes. However, these traditional ways to measure earnings for companies might not be the best approach when evaluating Reits.

FFO is a measure that you can calculate to better evaluate the cashflow from operations of a Reit. In essence, it measures the net amount of cash and equivalents that flows into a Reit portfolio from regular, ongoing business activities.

This measure is often cited as one of the more important metrics to understand when investing in Reits.

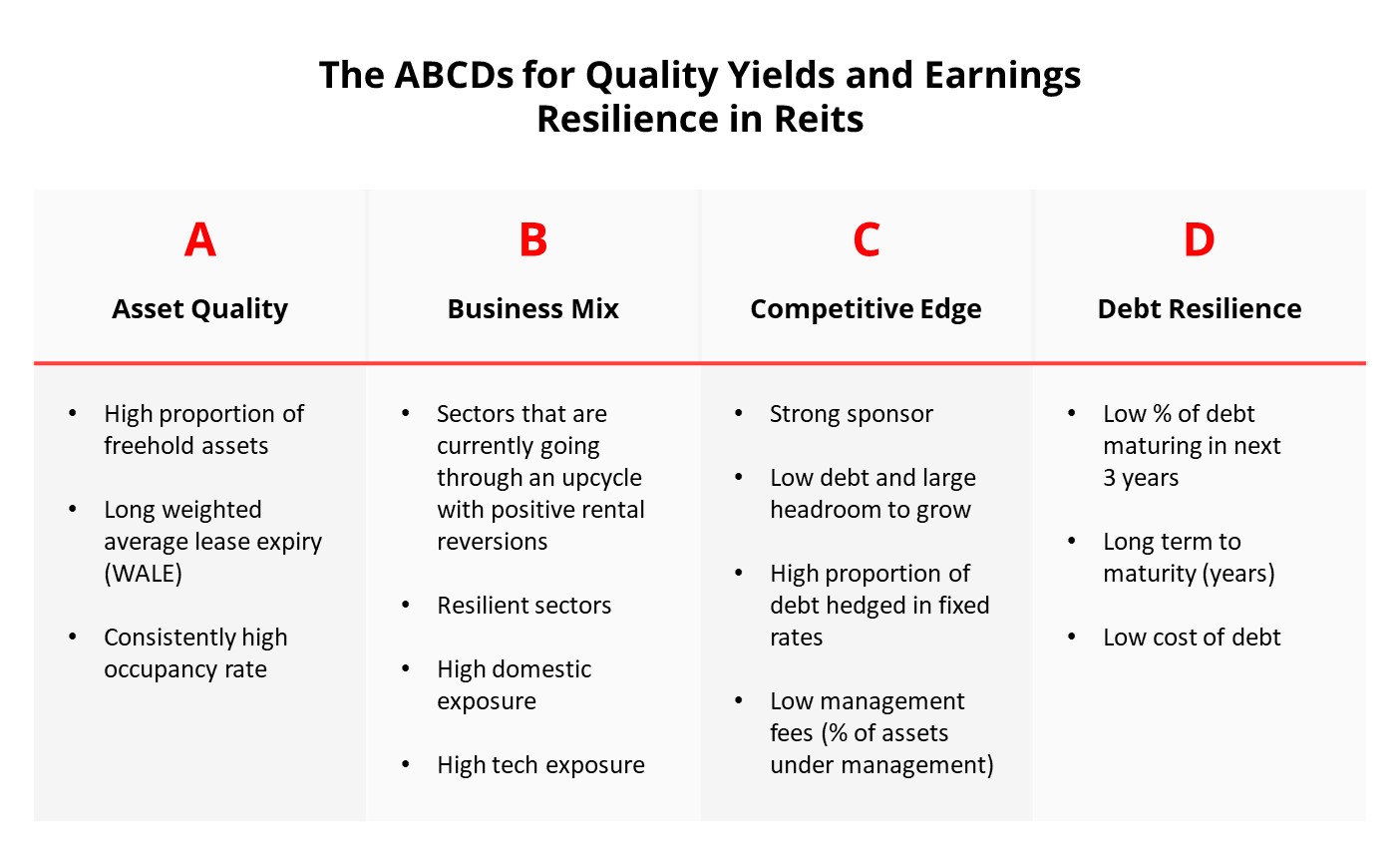

The ABCDs of Reits

For long-term investors, it is advisable to stick to quality S-Reits with a track record of delivering resilient recurring earnings and dividend streams.

Here's what investors should consider when selecting Reits.

DBS Group Research believes that a combination of these quality metrics will drive resilience to earnings and growth in the distributions to unitholders.

Summing up

While not exhaustive, these 6 factors represent a good place to start when evaluating which Reits to invest in. You can then use the DBS Group Research’s ABCD framework to finetune your selection of prospective Reits.

Take the time to read up on each Reit so you can make more informed decisions and are comfortable with investing Furthermore, do bear in mind your risk tolerance and asset mix in your portfolio.

![]()

If you’re keen to learn more about Reits, check out our other articles:

Part 1: The basics of Reits

Part 2: An overview of the S-Reit Landscape

Part 3: Practical ways to invest in Reits

![]()

Ready to start?

Speak to a Wealth Planning Manager today for a financial health check, and how you can better plan your finances.

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on the Plan & Invest tab on the digibank app to receive specific investment picks based on your objectives, risk profile and preferences.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products