What you need to know about Reits

![]()

If you’ve only got a minute:

- Reits are a cost-effective way for retail investors to diversify their portfolio to include non-residential property holdings.

- The mandate for Singapore Reits requires 90% of profits to be paid back to investors, making them an attractive dividend investment.

- Before investing in a Reit, check out the quality of its property portfolio, income characteristics, and economic conditions.

An asset that many aspire to acquire is an investment property. This is especially so in a land-scarce country like Singapore, where older generations who have done so have benefitted from big jumps in the value of homes and investment properties in the past.

The underlying thought process is simple – buy a property, rent it out for a regular income stream and sell it for a profit when the property value has gone up, or even gift it to the next generation as part of legacy planning.

The cooling measures implemented by the government in 2023 – increasing the Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) – have made already high property prices even more so. With that in mind, owning more than one residential property may not be feasible for the average Singaporean.

Besides, even if you can afford a second property for investment purposes, the high outlay and duties would eat into your potential returns.

A DBS research paper on different property asset classes from 1Q2009 to 1Q2021 showed that for every $100 invested, an investor would receive returns of about $399 for their 1st private property and $339 for a HDB flat. Purchasing a 2nd private property would have yielded less – $209 for every $100 invested.2

While these returns are respectable, another property-related asset class – Real Estate Investment Trusts (Reits) – performed better during this period. In the case of Singapore Reits (S-Reits), for every $100 invested, an investor would have received returns of about $486.2 This makes S-Reits an attractive alternative investment vehicle for those looking to invest into the property sector.

A brief history of Reits

When Reits first listed in the US in the 1960s, they provided an avenue for retail investors to hold investments in real estate portfolios, which until then, were only available to institutions and the wealthy.

Reits first made their way to Singapore through the listing of CapitaMall Trust on the Singapore Exchange (SGX) in 2002. The portfolio of properties that were part of this first Reit listing includes well-known shopping malls in Singapore like Raffles City and Plaza Singapura.

Following a merger with CapitaLand Commercial Trust in November 2020, these properties are now part of the CapitaLand Integrated Commercial Trust (CICT) portfolio, the largest Reit in Singapore.

As of 11 May 2023, there are 42 Reits and property trusts listed in Singapore1, of which 7 are part of the benchmark index - the 30-component Straits Times Index (STI).

8 things you should know about Reits

If you are new or not too familiar with Reits, we’ve compiled answers to some key questions or features of Reits for first-time investors.

For those who have experience with Reits, these can act as a refresher!

1. What are Reits?

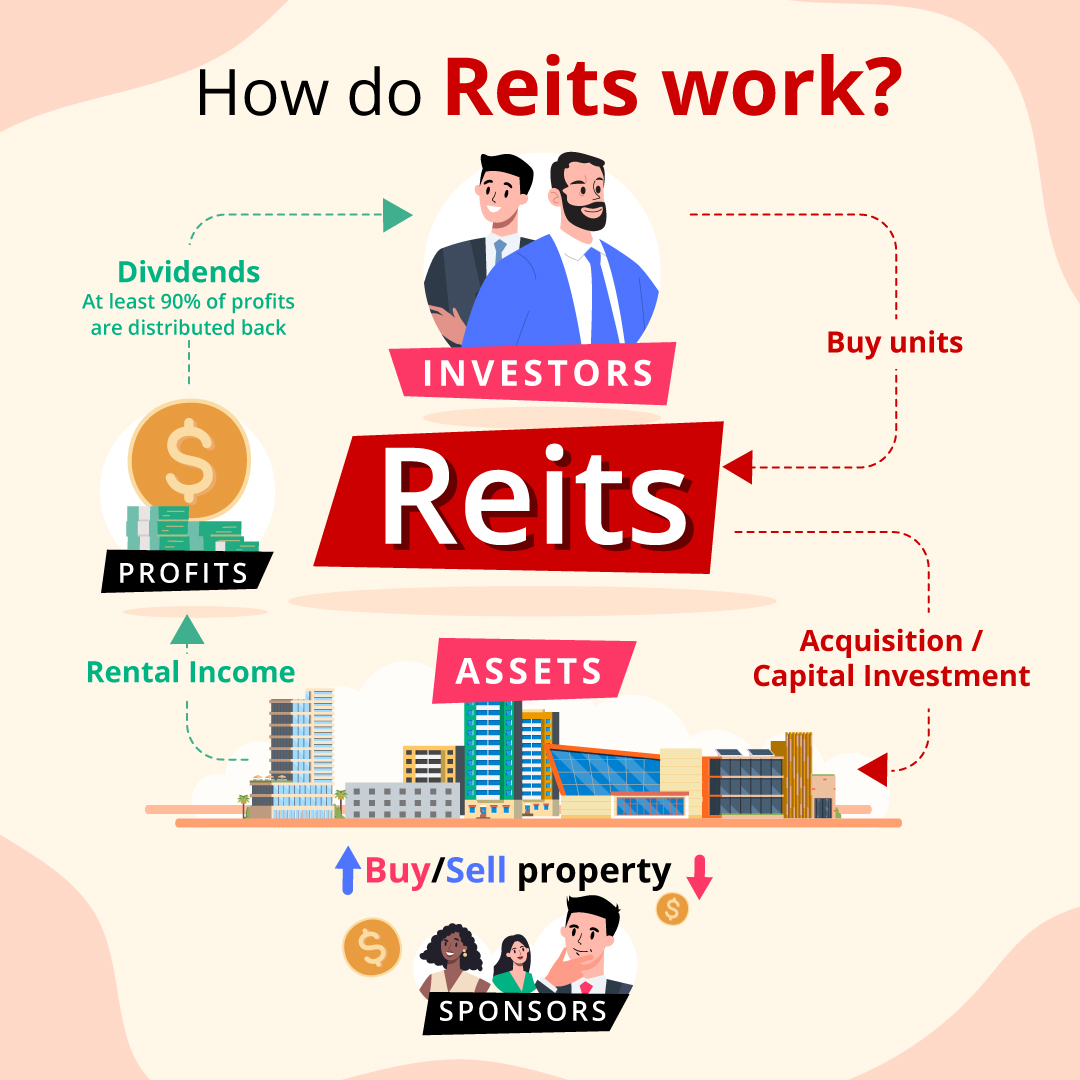

Reits are collective investment schemes that own and invest in income-generating assets (often through rent collection) across various real estate sectors.

These trusts cover a diverse range of properties including office buildings, shopping malls, warehouses, healthcare facilities, hotels and more recently, data centres.

With Reits, retail investors can pool capital to buy into properties both locally and globally, without needing to buy, finance or manage them themselves.

Reits listed in Singapore are known as S-Reits.

Read more: An overview of the S-Reit landscape

2. How to buy Reits?

Most Reits trade on stock exchanges like the Singapore Exchange (SGX) and can be bought through trading accounts on brokerages like DBS Vickers.

Another way to include Reits in your portfolio is through unit trusts, exchange-traded funds (ETFs) and robo-advisors like DBS digiPortfolio.

Since these are publicly traded and more liquid, they can be converted to cash quickly as compared to owning physical properties.

Read more: Practical ways to invest in Reits

Find out more about: DBS Vickers Online Trading Account

3. Reits have different regulations in different countries

For real-estate portfolios to qualify as Reits, a number of requirements specific to where they are listed need to be met.

This means Reits in Australia, the US and Singapore, are each governed by different laws and have to meet different requirements. The total amount of debt a Reit can hold, the minimum percentage of profits that must be paid to unitholders and the number of mature properties it can have will differ from country to country.

4. Cash payouts from Reits

The primary aim of Reits all over the world are identical - to generate a healthy level of income distribution and long-term unit price appreciation for its investors.

Revenue generated by Reits come primarily from rental from tenants. This may come from individuals, small businesses or large corporations who rent premises to conduct their operations.

Income generated from a Reit’s assets are distributed to unitholders at regular intervals. These payouts are often made twice a year, making Reits attractive for income-generation.

These distributions are disbursed to investors after fees for Reit management, property management and trusteeship have been deducted.

5. Sponsors of Reits

Each Reit has a sponsor - a parent or a majority unitholder of the trust. For example, in the case of CICT, CapitaLand Investment Limited is its sponsor. Sponsors usually provide the properties which are transferred into the Reit at the time of its initial public offering (IPO).

By structuring a portfolio of properties into a Reit, sponsors have a platform to sell properties to the trust often at fair or lower-than-market average prices. This, in turn, frees up capital for further investments.

The sponsor can also continue to provide a pipeline of assets for future acquisition by the Reit after its IPO. This is why the attractiveness of Reits is also dependent on the strength of its sponsor.

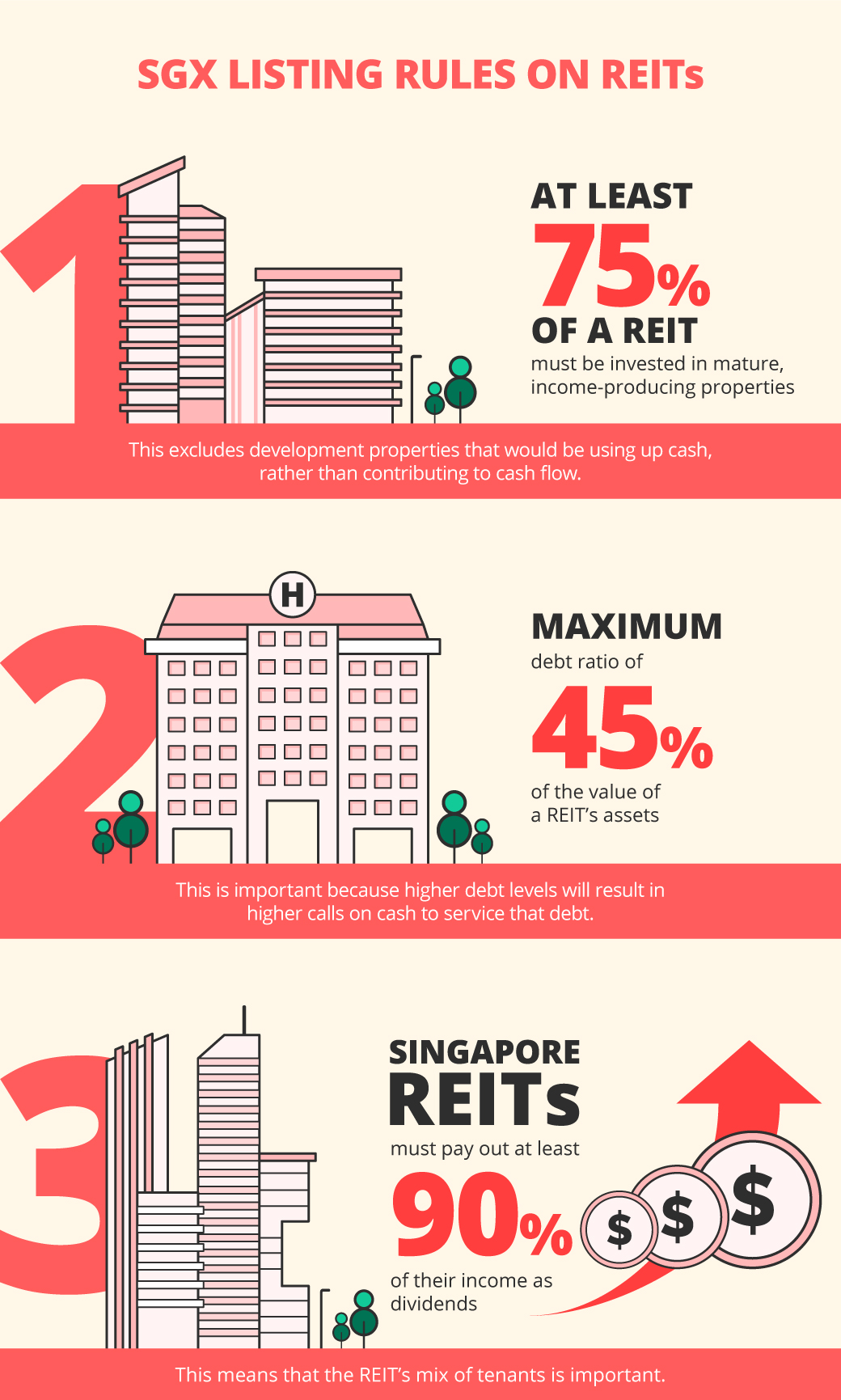

6. Reit rules in Singapore

SGX listing rules for S-Reits make them an attractive investment option.

7. What’s in it for investors?

Although Reits are not identical to stocks and unit trusts, they exhibit characteristics common to both.

Besides financial gains from capital appreciation and dividend income, Reits also offer the benefit of having professional expertise to manage the underlying property investments.

There are 3 main ways investors can benefit from investing in Reits.

Dividend income

S-Reits are mandated to pay out at least 90% of their income as dividends. This income can come from sources such as rental income from the properties in the Reit, and any profits made from the sale of real estate assets.

Capital gains

Just like stocks and ETFs that are traded on the SGX, market fluctuations may result in the prices of the investment rising or falling. This is the same for Reits, meaning there are potential capital gains to be made if the Reit is sold at a higher price than it was purchased at.

Globally, Reits are viewed as an attractive “income investing” play as they have consistently delivered strong total returns (unit price appreciation + distributions to unitholders) over the past 2 decades.

As of 11 May 2023, S-Reits have an average dividend yield of 8.7%1, beating the average dividend yield of the STI, government bonds and term deposits.

Professional expertise

For investors who invest in physical property, there are many matters which require attention, like finding the right tenants, maintaining the property, ensuring tenants pay their rental on time, among other things.

With a Reit, the day-to-day management is left to professional property managers.

Read more: How to evaluate and analyse Reits

8. Selecting Reits

In Summary

While rising real estate prices make purchasing an investment property far from reach for most, Reits are a suitable and relatively affordable alternative. They provide a stream of income, potential for capital gains, diversification, and liquidity in trading.

As with any investment decision, be sure to do your due diligence before choosing which Reits to buy into.

Do remember to take note of the strength of the Reit sponsor, what underlying properties the Reit holds and the current market conditions which might affect the overall Reit or property sector.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on the Plan & Invest tab on the digibank app to receive specific investment picks based on your objectives, risk profile and preferences.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)