By Lorna Tan & Navin Sregantan

![]()

If you’ve only got a minute:

- T-bills offer a low-risk way to grow savings, funded by cash, SRS, or CPF (via CPFIS).

- Investing CPF funds requires careful consideration of "breakeven" yields to outweigh potential interest forfeiture.

- T-bills are bought via uniform-price auctions, where you can submit non-competitive or competitive bids depending on your yield preference.

![]()

Treasury Bills (T-bills) issued by the Singapore Government have gained significant popularity among investors of all risk profiles in recent years.

This surge was driven by multi-year high yields between 2022 and 2024, offering attractive returns on risk-free government securities. For example, the 6-month T-bill yielded 4.07% in September 2023, and the 1-year T-bill had a 3.7% cut-off yield of 3.7% in October 2023.

The Singapore Government’s "AAA" credit rating, which reflects strong creditworthiness and a minimal probability of default, further underpinned the appeal of T-bills as a secure way to grow savings.

However, with the US Federal Reserve announcing its first rate cut of 2025 in September and opening the door to more cuts, deciding whether to invest or reinvest in T-bills does require careful consideration as the attractiveness of T-bills often correlates with prevailing interest rates.

To make an informed decision, it's essential to first understand T-bills and the available investment options.

What are T-bills?

T-bills are short-term Singapore Government Securities (SGS) available for public investment, typically with 6-month or 1-year maturities. They enable individuals to securely lend money to the state, with a minimum bid of S$1,000 and a maximum of S$1 million.

Valued for their safety and simplicity, T-bills offer a reliable, low-volatility option for parking funds, supporting the government's short-term spending and operational needs.

Unlike many bonds, T-bills are sold at a discount to their face value, with investment returns being the difference between the discounted purchase price and full face value at maturity.

T-bills can be funded using cash, Supplementary Retirement Scheme (SRS) funds, or CPF Investment Scheme (CPFIS) funds, making them versatile for low-risk, short-term capital management.

Issuance and application process

As listed on the website of the Monetary Authority of Singapore (MAS), 6-month T-bills are typically issued fortnightly, while 1-year T-bills are issued quarterly.

Investors can purchase T-bills at auction, which usually occurs 3 business days before issuance and announced 5 business days prior on the SGS website.

Applicants must ensure sufficient funds are in their account. For cash-funded new issues, the full bid amount is debited upon application.

Note that application cut-off times submitted via ATMs, internet, and mobile banking can be between 1 and 2 business days before the auction. As such, always verify exact timings with your bank.

Read more: A beginner's guide to bonds

Using cash to invest in T-bills

Investing in T-bills with cash requires a bank account with a local bank like DBS and a Central Depository (CDP) account with Direct Crediting Services activated so that payments can be credited directly into your bank account.

Joint CDP accounts cannot be used for T-bill purchases. However, applications can be funded from a joint bank account via physical branch visits.

Submissions are accepted via bank ATMs, internet banking, and mobile apps. For example, DBS online applications close at 9pm, 1 business day before the auction. Currently, all application fees are waived.

Using SRS funds to invest in T-bills

Investing in T-bills with Supplementary Retirement Scheme (SRS) funds requires an existing SRS account with sufficient deposited funds.

Applications are submitted via the SRS Operator's internet banking portal or mobile app. For instance, DBS SRS applications close online 1 business day before the auction at 9 pm. All application fees are currently waived.

Using CPF funds to invest in T-bills

To invest in T-bills with CPF, funds will be drawn from the OA and/or SA through the CPF Investment Scheme (CPFIS).

Eligibility requires applicants to be at least 18 years old, not an undischarged bankrupt, and to have completed the CPFIS Self-Awareness Questionnaire (for new investors from 1 Oct 2018).

OA savings can be invested after setting aside S$20,000, and SA savings after S$40,000. All CPFIS investments must adhere to CPF investment guidelines.

Application Process

Using OA funds:

- Open a CPF Investment Account with DBS.

- Apply via DBS internet or mobile banking.

- Online applications with DBS close at 9 pm, 1 business day before the auction.

- Agent banks charge a one-time fee of S$2.50 + GST per transaction and a quarterly S$2 service fee per counter.

Using SA funds:

- No CPF Investment Account required.

- Apply in person at any CPFIS bond dealer branch.

- DBS applications close 2 business days before the auction date at 10am.

- No application charges.

To determine eligible OA and SA savings for investment, individuals can:

- Log in to CPF Digital Services with Singpass > Select 'My CPF' > 'My Dashboards' > 'Investment'.

- Log in to the CPF Mobile app with Singpass > Select 'My Investment'.

- Visit any CPF Service Centre with their identity card.

For CPFIS OA online applications, sufficient OA savings must be maintained until the issue date, as validation occurs upon application.

Evaluating prevailing interest rates and comparing them against alternative investment options is crucial for making informed decisions on your next financial step.

Auction Process

T-bills are issued via a uniform-price auction, where successful bids receive securities at the cut-off yield (the highest accepted yield from competitive bids).

Applicants can submit either a non-competitive or a competitive bid.

Non-competitive bid: Specify only the investment amount. Ideal for those willing to invest regardless of return or uncertain of a suitable bid. These bids are allotted first, up to 40% of the issuance (pro-rated if oversubscribed).

Competitive bid: The remaining issue amount goes to competitive bids, from lowest to highest yields. For this bid type, specify the desired yield (e.g., 2 decimal places). This option suits investors who will only invest if their yield target is met.

Note that the full applied amount may not be allotted, depending on your bid's relation to the cut-off yield.

Tip: A lower yield bid is more competitive, implying acceptance of a lower interest rate. Multiple competitive bids can be submitted.

Auction results

Auction aggregate results are available approximately 1 hour after closure on the issuance calendar, with T-bills issued 3 business days following announcement.

Successful bids will have the securities reflected in their respective accounts post-issuance.

For cash applications: Check your CDP statement.

For SRS application: Check statements from your SRS Operator.

For CPFIS OA application: Check the CPFIS statement from your agent bank.

For CPFIS SA application: Check your CPF statement.

Unsuccessful or invalid bids will be refunded to the application account within 1-2 business days after the auction day.

As with all investments, please consider that the T-bills meet your investment goals, risk tolerance investment time horizon, overall financial situation and opportunity costs before investing in them.

Read more: After T-bills, what's next?

When your T-bills mature

Upon maturity, T-bill proceeds are returned to the account from which they were initially invested.

For investments made with CPF funds via the CPF Investment Scheme (CPFIS), prompt action is crucial to minimise the loss of CPF interest. To ensure only one additional month of CPF interest is foregone, transfer funds from your CPF Investment Account (IA) back to your OA promptly upon T-bill maturity. Otherwise, the automatic transfer to your OA may take approximately two months.

This transfer can be initiated easily via DBS Internet Banking. Log in and follow these steps:

- Select "More Investment Services" under the "Invest" tab.

- Under "Manage Investments," select "Refund to CPF Board."

- Choose "Refund Full Amount" or "Refund Partial Amount."

- If "Refund Partial Amount" is selected, enter the desired amount.

- Review the agreement and click "Next."

- Verify details and click "Submit."

- Print the completion page and note the Transaction Reference Number.

Funds will be transferred to your OA within 3 business days.

Should you invest T-bills?

For cash investments, T-bills provide a low-risk option for parking funds, particularly in a rising interest rate environment. They suit those seeking capital preservation with modest returns, offering an alternative to low-yielding savings accounts.

For SRS funds, T-bills appeal to low-risk investors. While idle SRS funds earn a nominal interest rate 0.05% p.a., T-bills offer higher, low-risk returns, helping to combat inflation and grow retirement savings more effectively. However, in a falling interest rate environment, exploring higher-yielding, longer-term investments might better align with retirement goals.

For CPF monies, careful consideration is essential, given OA balances earn at least 2.5% p.a. and the SA yields a minimum 4% p.a..

For those aged 55 and above, withdrawing OA monies for T-bill cash investment means maturity proceeds cannot be re-deposited into the OA. Investing OA savings via CPFIS ensures funds return to CPF accounts upon maturity. Investing CPF balances carries risks.

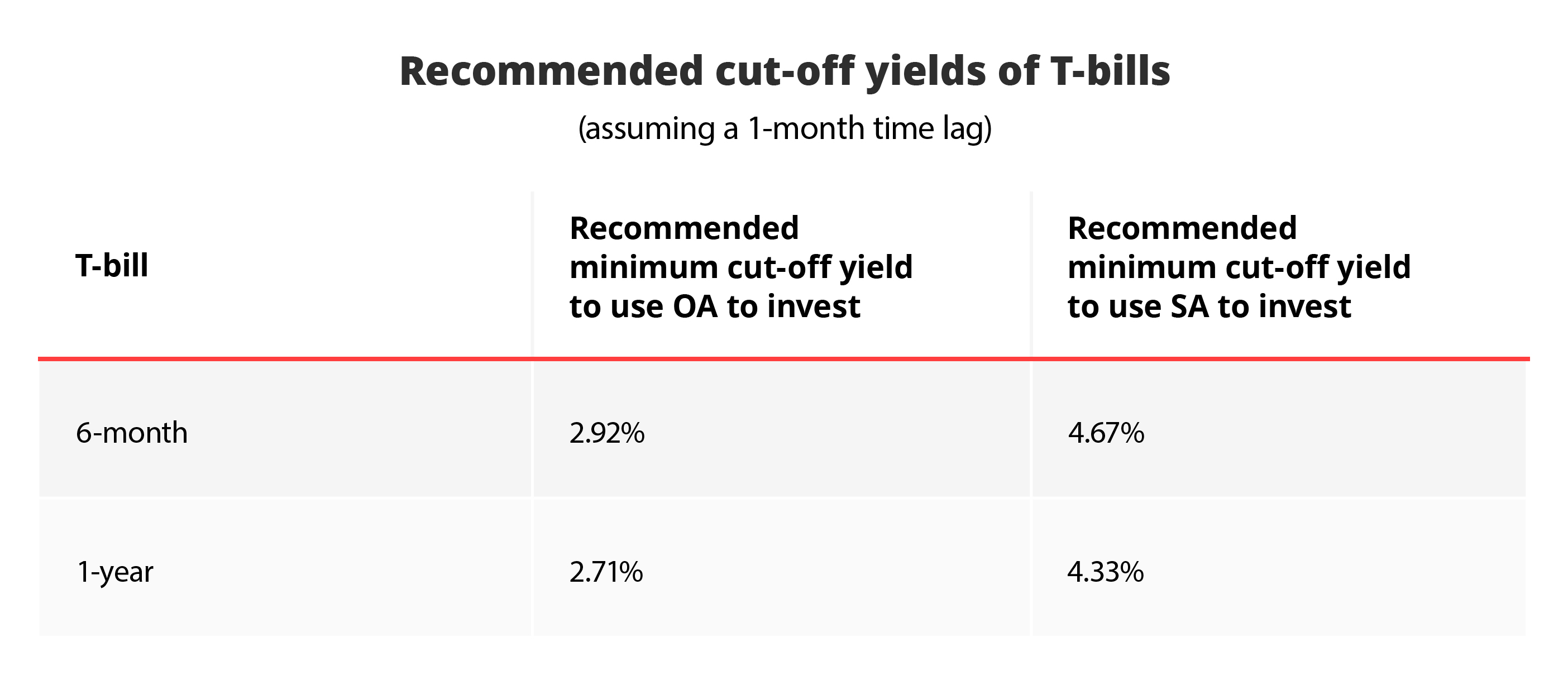

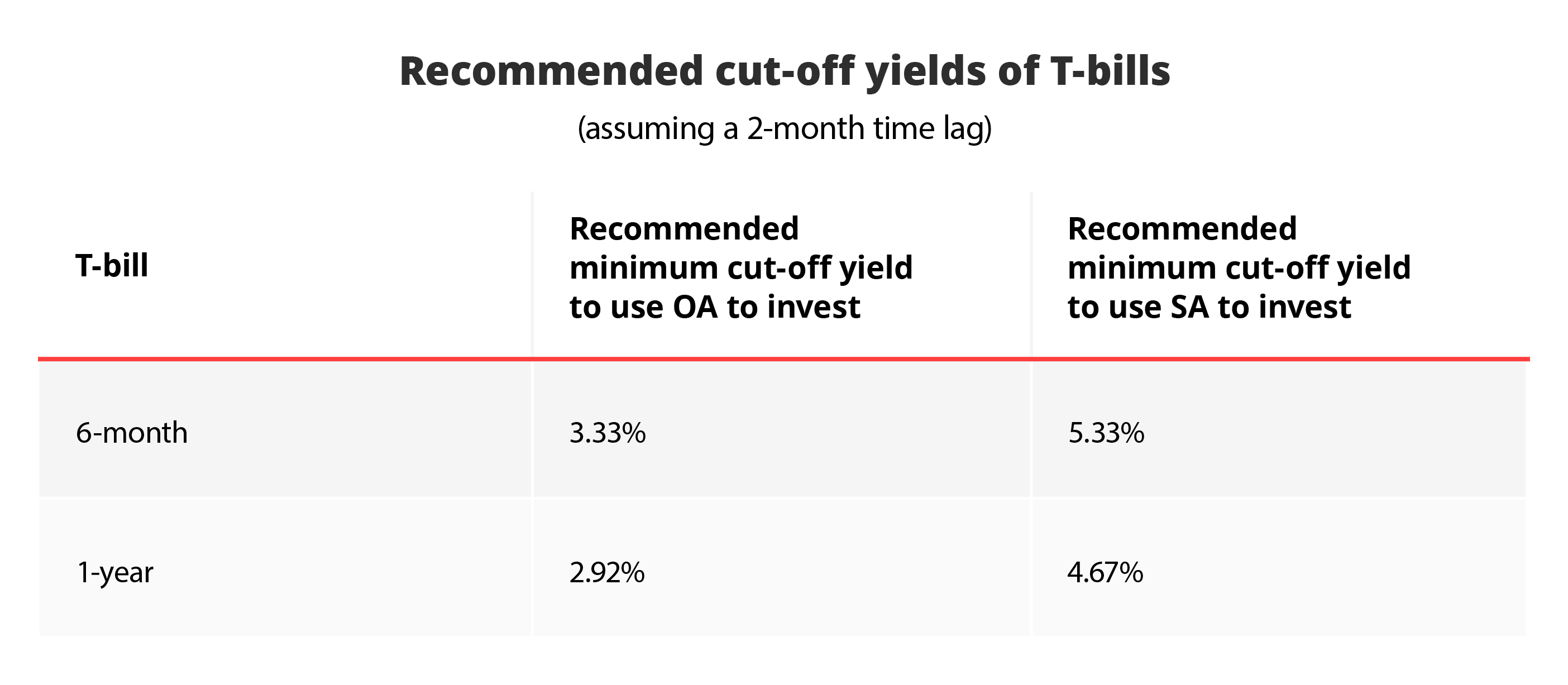

Calculating a "breakeven" T-bill yield is crucial due to the way CPF interest is computed. Contributions earn interest from the following month, but withdrawals cease earning interest from the current month. This can result in up to 2 months of forfeited CPF interest. necessitating T-bill cut-off yields higher than CPF OA/SA rates to achieve a superior return.

Here are the recommend cut-off yields in order for investment in T-bills with CPF monies to make sense.

In summary

Before investing, ensure T-bills align with your goals, risk tolerance, time horizon, financial situation, and opportunity costs.

Upon maturity, critically assess whether to reinvest, considering current market conditions, your evolving financial goals, and risk appetite.

Evaluating prevailing interest rates and comparing them against alternative investment options is crucial for making informed decisions on your next financial step.