![]()

If you've only got a minute:

- It is important to consider the charges incurred when investing as costs will eat into the returns.

- For investments using cash, brokerage commission, clearing and trading fees as well as GST will be incurred.

- In addition, using CPF funds to invest will incur other settlement, agent, and recurring fees.

![]()

Many of us are more than familiar with the saying: “Nothing in life is free”. The same can be said of investing.

Investment products can carry different types of fees and charges, which will eat into your final returns.

In most cases, these fees are unavoidable. So, take the time to understand what they are, how they will impact our overall returns, and whether you are getting a worthwhile benefit in relation to the cost.

These costs related to investing are either tangible or intangible. Tangible costs are those which are apparent, quantifiable, and charged directly on the investment amount, like brokerage or commission fees. Intangible costs are at times unseen or unknown to the investor and can be easily overlooked by new investors.

Let’s explore some common costs involved with trading in equities so that you are better acquainted with them when you invest.

Read more: Costs and fees of investing in ETFs

Investment fees associated with unit trusts

Commission, redemption, or brokerage fees

These are incurred at the time of purchasing or selling of a product, as a fee for executing the trade.

A front-end fee is charged at the initial point of the investment. This happens when you buy equities and Real Estate Investment Trusts (Reits).

On the other hand, back-end fees are incurred when you sell or close your position. Most distributors usually charge one or the other, not both.

These fees cover the costs of:

Depending on the size of the contract, commission is charged as either a flat dollar amount, or as a percentage of the total investment amount.

Most brokerages in Singapore charge a minimum fee for each transaction. Depending on the brokerage, this can range from S$12 to S$40 for Central Depository (CDP) linked accounts.

Simply put, brokerages will charge commission fees of between 0.12% and 0.375% (depending on the contract value), or the base fee, whichever is higher.

As such, it is more costly to make multiple small transactions, as compared to making a single large transaction. Some platforms offer amalgamation of trades which allows for all trades performed during the same day to be combined.

With this, instead of paying a minimum charge for each smaller trade, you can total up the individual trades, thus saving on the fees to be paid.

In general, commission fees are charged at a lower rate, the higher the pricing tier a contract falls in.

In the example, assume a brokerage charges a minimum fee of S$25 and a commission rate of 0.28%. If 1,000 shares of Stock A are purchased, instead of a commission fee of S$8.40 being charged at a rate of 0.28%, the brokerage will charge the investor the minimum of S$25. If the investor decides to purchase 10,000 shares of Stock A, the commission fee will be charged at 0.28% of the contract value or S$84.

Custody fees

These are charged for holding and administrating your assets and can be a percentage or a flat rate fee.

In the past, these were physical custody papers that required safekeeping. This has been digitised but still requires the services of a custodian. Some examples of these services include dividend entitlement, corporate event notifications and regulatory reporting.

Other fees incurred

Commissions are not the only type of fees investors face.

Besides commission fees, other fees include platform fees, holding fees, clearing fees, trading fees, settlement fees and Goods and Services Tax (GST).

When you trade using CDP-linked accounts, a clearing fee of 0.0325% of the contract value is charged. In addition, there is also an SGX trading fee of 0.0075% per contract. The prevailing GST rate of 9% is then charged on the total fee.

Case study

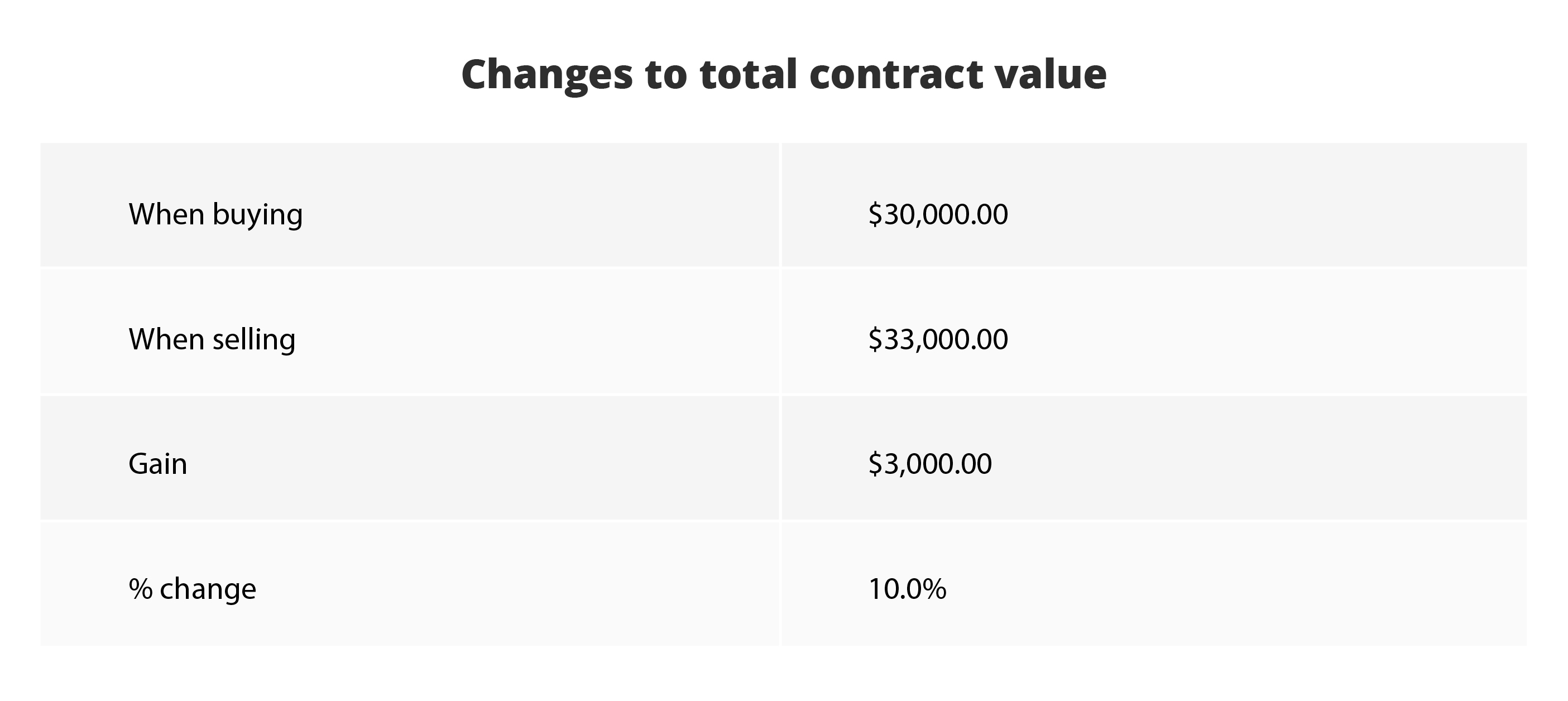

Consider an investor who has made the decision to purchase 10,000 shares in Stock A at S$3 apiece. While the total outlay for the stocks would be S$30,000, there will also be a commission fee of 0.28% of the contract value, a clearing fee, trading fee and prevailing GST charges on the fees charged.

In this example, the breakdown of the investment costs incurred are as follows:

A purchase of 10,000 shares of Stock A will thus incur S$104.64 in fees and taxes.

Closing out this position will also incur costs which in turn will reduce the overall profits. In the same example, selling the entire position of 10,000 shares in Stock A at S$3.30 per share would result in a total contract value of S$33,000. This would net a profit of S$3,000 excluding fees and tax.

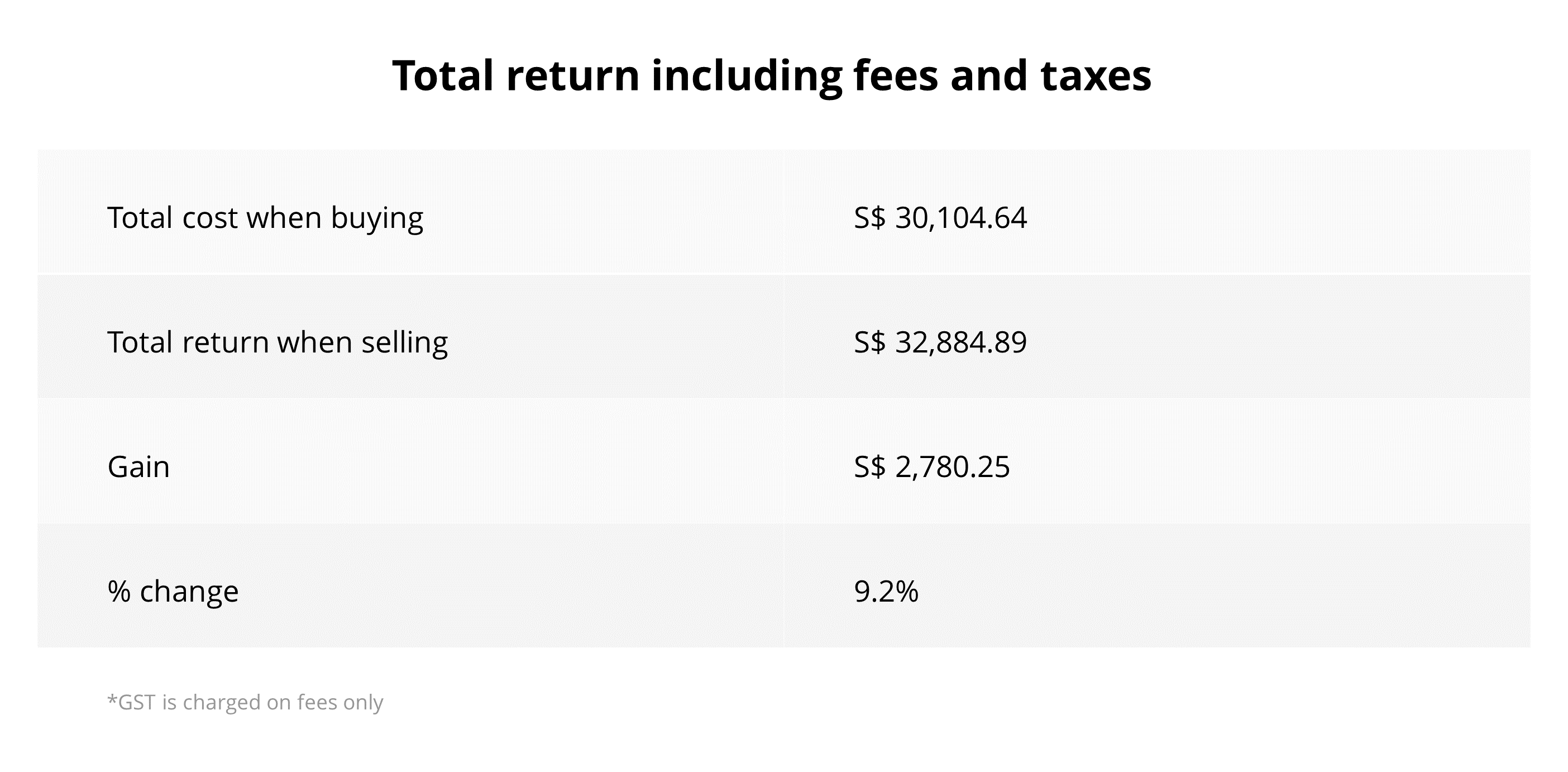

After fees and taxes are factored in, the profits will be reduced as illustrated below:

Without considering the fees, the gain from the investment would be S$3,000. However, due to the fees, gains from the investment only amounts to S$2,884.89. Overall, front-end and back-end loads have lowered profit from 10% to 9.2% as shown below.

Read more: Using DBS Vickers and DBS digibank for stock research

Investing in equities using CPF funds

Other than purchasing equities with cash, you can also use the funds in your CPF Ordinary Account (OA) and Special Account. To do this, you would need to open a CPF Investment Account with an approved CPF Investment Scheme (CPFIS) agent like DBS Bank.

Using your CPF funds to pay for investments will incur additional costs on top of the ones discussed so far. This includes a CDP settlement fee of 35 cents per transaction, which the CPFIS agent will collect on behalf of CDP.

Further upfront costs include agents charging up to S$2.50 per 1,000 shares or units, with a maximum charge of S$25 per transaction (excluding GST).

As fees charged differ from platform to platform, it is important to check the website of your bank or broker for the detailed fee schedule when calculating your investment costs.

Read more: Is my CPF enough to beat inflation?

Find out more about: CPF Investment Account