By Navin Sregantan

![]()

If you’ve only got a minute:

- Reits are a cost-effective way for retail investors to diversify their portfolio by including non-residential property holdings.

- Gains from investing in Reits can be captured through dividends and capital gains.

- You can invest in Reits by buying them directly through brokerages, purchasing unit trusts, through Reit exchange-traded funds or via robo-advisors.

Real Estate Investment Trusts (Reits) are an essential component of investment portfolios that focus on income generation through dividends. By investing in Reits, investors gain ownership of a wide range of properties - both local and global - at low entry costs.

Reits are a type of collective investment where funds are pooled in a trust and managed by real estate and investment professionals who invest in a portfolio of income generating real estate assets, from shopping malls to offices and hotels.

Keen to invest but are unsure of how to go about purchasing Reits?

Here’s a guide to help you get started with investing in Reits!

How do you get returns from investing in Reits?

Before investing, it helps to understand the 2 ways – dividends and capital gains - you can gain from investing in Reits.

Dividends

A portfolio of income generating real estate assets in a Reit allows an investor to earn rental income from the properties much like a landlord would.

For example, shopping malls like Bugis+ rent out shop spaces and commercial developments like Capital Tower rent out office spaces (both owned by CapitaLand Integrated Commercial Trust) to tenants. The rental income received is accounted as the taxable yearly income of the Reit.

In Singapore, Reits are legally obligated to distribute at least 90% of its taxable yearly income to unitholders through the form of regular distributions. This done either semi-annually or quarterly.

Capital gains

Like stocks, you get investment returns through the appreciation of the unit price of a Reit. Just like any real estate, the properties within the Reit portfolio will also grow in value.

Valuation growth can come from activities such as acquiring into new and/or undervalued assets, growing the value of existing assets through asset enhancement initiatives, or unlocking of value through capital recycling.

These activities are likely to increase the value of the Reit, leading to capital gains for its unitholders.

Read more: How to evaluate and analyse Reits

How investors can purchase Reits

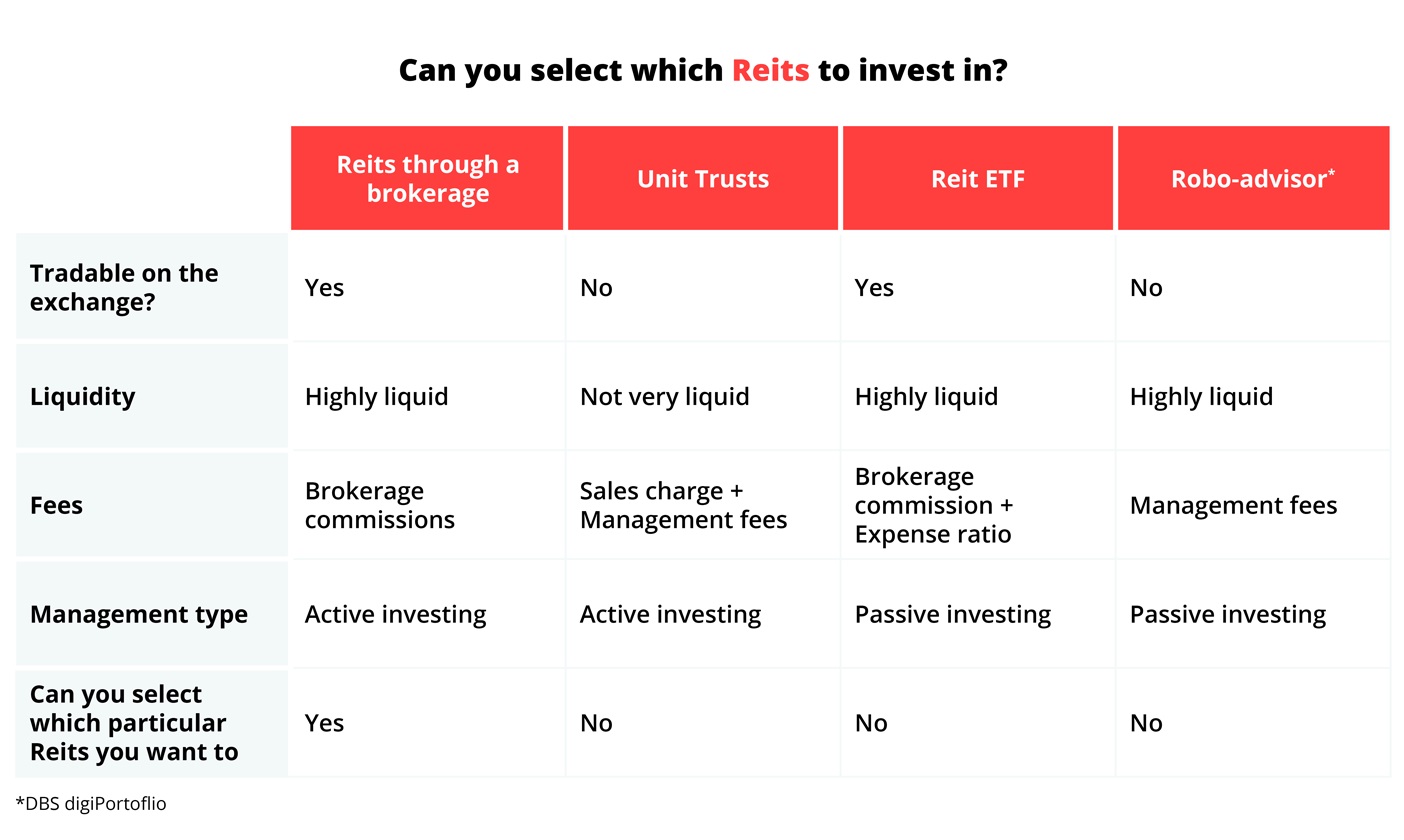

For retail investors, there are 4 ways to invest in Reits.

You can do so by purchasing Reits through stock exchanges, investing in them via unit trusts, through Reit exchange-traded funds (ETFs) or by gaining exposure to Reit ETFs through robo-advisors.

Here are the different ways of investing in Reits.

1. Buying Reits with an online stock trading platform

Singapore Reits (S-Reits) are listed on the Singapore exchange (SGX). This means that you can invest directly in Reits on the SGX, just like how you would buy any other equity through trading platforms such as DBS Vickers.

If investing directly in Reits is a suitable way for you to start your investing journey, all you need is a brokerage account, which will allow you to invest in the asset class immediately.

Alternatively, investments can be made using Central Provident Fund (CPF) Ordinary Account and Special Account savings through a CPF Investment Account with an approved CPF Investment Scheme agent like DBS Bank.

What you can do:

If you don’t have a brokerage account yet, you can open one with DBS Vickers.

If you already have one, simply login to digiBank to trade.

Read more: Beginner’s guide to stock investing for Singaporeans

Find out more about: DBS Vickers Online Trading Account

2. Buying Reit unit trusts

This option may be appropriate if you are new to investing or prefer to delegate the task of investing to a third party to do it on your behalf. With unit trusts, you can let professionals handle your Reit investments for you.

Each unit trust comes has its own investment mandate. Based on the mandate, the unit trust invests your money in a portfolio of Reits.

For example, Manulife GF APAC Reit P SGD is a unit trust that invests at least 70% of its net assets in Asia Pacific ex-Japan Reits. On top of that, it also invests up to 30% of its net assets in real estate (but non-Reit) companies for diversification.

Find out more about: Investing in unit trusts with DBS

What you can do:

Head over to Fund Search, filter with “All Geographies/Themes” for any of the property themes (e.g. Property – Asia). Select from the filtered results to find out more about the fund.

Once you have made your decision on which unit trust to invest in, click on the “Buy Now” button and login to your digiBanking account to start investing today.

If you’re already logged into digiBank, you can access the same information and filters using the Invest tab.

3. Buying Reit ETFs

ETFs are funds that seek to track a benchmark index such as the Straits Times Index (STI) or the S&P 500. Just like the broad market indices, Reits also have their own benchmark indices. There are 5 Reit ETFs listed on the SGX, each tracking a separate benchmark index.

You can also invest in S-Reits through a Regular Savings Plan (RSP) like DBS Invest-Saver. Those keen on the DBS Invest-Saver RSP are able to purchase units in the Nikko AM-StraitsTrading Asia ex Japan Reit ETF and/or the CSOP iEdge S-REITs Leader ETF for as little as $100 each month.

What you can do:

There are 2 ways you can purchase Reit ETFs directly.

If you prefer to buy them on the stock exchange, you can do so using an online brokerage, such as DBS Vickers Online.

If you prefer to buy them on a regular basis, you can do so with a Regular Savings Plan (RSP) like DBS Invest-Saver. This option lets you invest a fixed amount of money into a Reit ETF every month using a dollar cost averaging strategy.

Read more: What to know about dollar-cost averaging

Find out more about: DBS Invest-Saver

| ETF | Benchmark Index | DBS Invest-Saver | DBS Vickers |

|---|---|---|---|

CSOP iEdge S-REITs Leader ETF | iEdge S-REIT Leaders Index | ✓ | ✓ |

NikkoAM-StraitsTrading Asia Ex Japan REIT ETF | FTSE EPRA Nareit Asia ex Japan Net Total Return REIT Index | ✓ | ✓ |

Lion-Phillip S-REIT ETF | Morningstar® Singapore REIT Yield Focus Index | ✕ | ✓ |

Phillip SGX APAC Dividend Leaders REIT ETF | SGX APAC Ex-Japan Dividend Leaders REIT Index | ✕ | ✓ |

UOB APAC Green REIT ETF | iEdge-UOB APAC Yield Focus Green REIT Index | ✕ | ✓ |

4. Robo-advisors

Robo-advisors are digital platforms that provide automated, algorithm-driven investment services with little human intervention.

You can think of it as an automated portfolio manager that helps you optimise investing strategies after asking you a few simple questions about your investment experience, risk appetite and investment preferences.

With DBS digiPortfolio’s Asia Portfolio, investors can gain access to Reits through the Nikko AM-StraitsTrading Asia ex Japan Reit ETF.

What you can do:

Login to digibank and click on Invest tab, followed by digiPortfolio. Once you have done that, select Asia Portfolio.

That said, do note that how much exposure you get to the Nikko AM-StraitsTrading Asia ex Japan Reit ETF depends on the risk level of the portfolio you select.

In summary

With Reits, you are able to invest in a wide range of properties - both local and global – with relatively little cash outlay. Reits are also popular investments due to their income-generating qualities and high liquidity.

Retail investors can invest in Reits through stock exchanges, via unit trusts and ETFs or through robo-advisors.

But before you take the plunge, always remember to do your due diligence before deciding on which Reits to invest in.