Understanding CBDCs

![]()

If you’ve only got a minute:

- More central banks are working on the possibility of issuing central bank digital currency (CBDC) as a digital complement to cash in the future.

- Blockchain or Distributed-Ledger-Technology is likely used to facilitate transactions using CBDCs.

- Some potential benefits of CBDCs include cheaper and faster cross-border payments, and cheaper better monitoring of corruption and money laundering.

![]()

With cryptocurrencies very much a part of the vocabulary of the mainstream investing community, more attention is also being placed on other digital assets. One of these are central bank digital currencies (CBDCs).

In recent years, central banks around the world have been working toward pilot programs, consultation papers and research projects on the possibility of issuing CBDCs as a digital complement to cash in the future. This has been prompted by technological advances in the last decade as well as the decline in cash usage globally.

What are CBDCs?

A CBDC is a digital currency issued by a country’s central bank or monetary authority. It uses an electronic record or digital token to represent the virtual form of a fiat currency (e.g. Chinese Yuan, Singapore Dollar) of a particular country or region (e.g. China, Singapore).

Similar to cryptocurrencies such as Bitcoin and Ethereum, Blockchain or Distributed-Ledger-Technology (DLT) is likely used to facilitate transactions using CBDCs.

CBDCs are likely to be centralised using a private Blockchain or DLT network and regulated by a country’s monetary authority. This allows a central bank to have control of overall money supply, like how it does with cash.

This is one of the ways CBDCs differ from cryptocurrencies, which operate on a decentralised blockchain network. This means that no single person or organisation has control over the network and can decide when to issue new units of cryptocurrency.

CDBCs are also regulated, expected to be stable and the value is likely to be similar to its physical currency counterpart.

Central banks are keeping an eye

In 2021, the Bank for International Settlements (BIS), a global organisation for central banks, published findings from a 2020 survey that showed 86% of central banks are engaging in research and projects relating to CBDC, up from 80% in 2019.

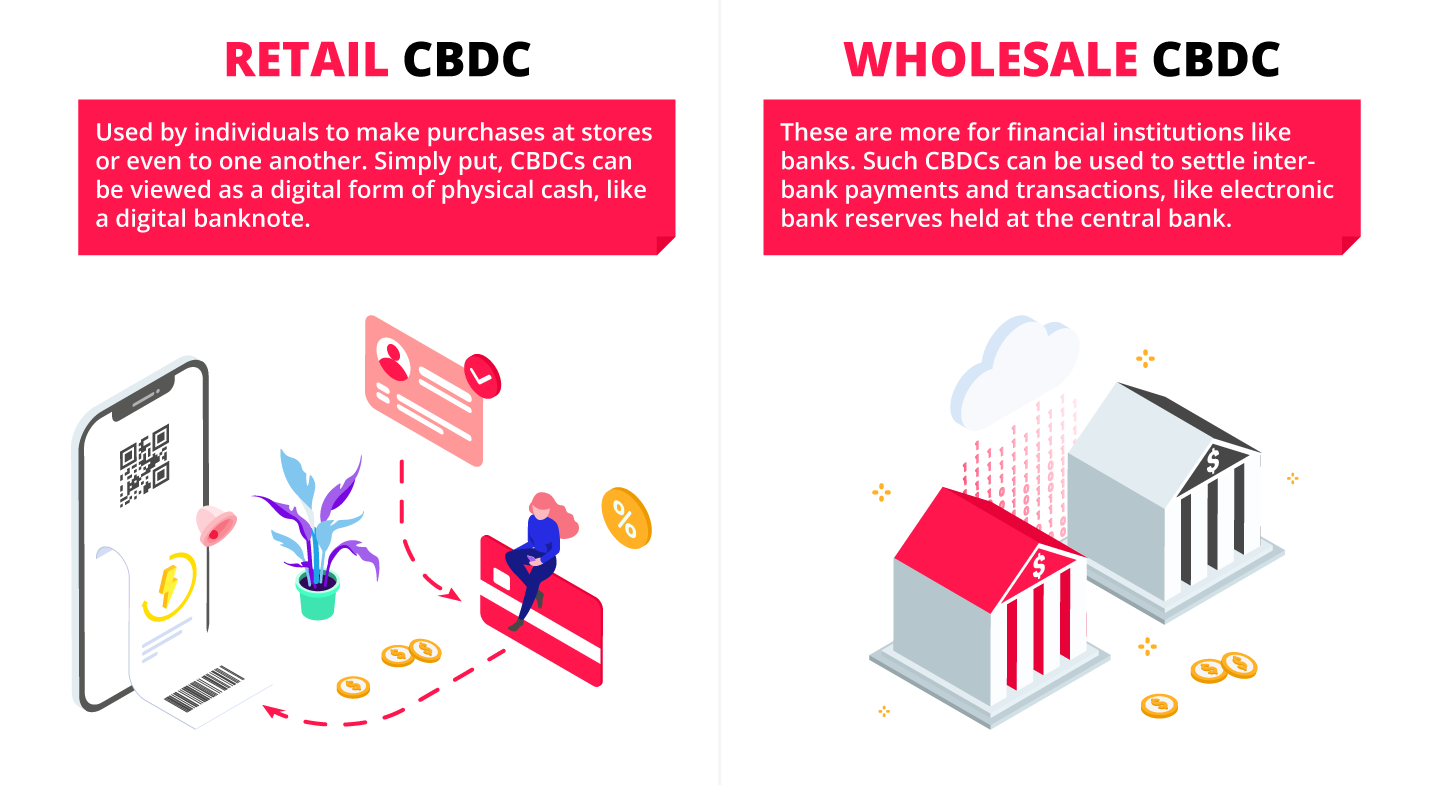

According to the survey, increasing work is being done on retail CBDC relative to wholesale CBDC, with central banks choosing either to work on both wholesale and retail, or focusing instead on retail alone.

While several governments are looking into the viability of creating and issuing CBDCs, no country has yet to officially launch a CBDC.

Examples of countries whose central banks are working on proposals for the consideration of CDBCs include China, England, Sweden, Singapore and Thailand, among others.

Of the lot, China is the closest to officially launching a CDBC. In fact, the People’s Bank of China - China’s central bank - has issued the digital Yuan under trial since April 2021.

Here, the Monetary Authority of Singapore worked with financial institutions including DBS Bank on developing a payment system prototype using DLT, which will allow bank users to exchange currency with one another.

MAS has also been working with industry partners like BIS Innovation Hub and other central banks to design, develop and test new multiple CBDC models for cross-border settlement.

If central banks do choose to pursue CBDCs in the future, there are two types of CBDCs they are likely to issue.

Benefits of CBDCs

Central banks are exploring issuing CBDCs as there are many potential benefits of issuing them.

Understanding CBDCs is part of a series of articles covering Digital Assets. If you enjoyed the read and want to learn more about other digital assets, do check out the other articles in this series:

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Sources:

DBS Economics & Strategy, “Update on Digital Assets: NFTs, DeFi, Cryptos, CBDCs” (April 2021). Retrieved 25 May 2021.

Monetary Authority of Singapore, Deloitte, “Project Ubin: SGD on Distributed Ledger” (December 2020). Retrieved 25 May 2021.

PwC, “The Rise of Central Bank Digital Currencies (CBDCs)” (November 2019). Retrieved 28 May 2021.

DBS Economics & Strategy, “Digital Assets Update 4Q23: Managing in a high interest rate environment” (October 2023). Retrieved 06 Feb 2024.

DBS Technology of the Future, “Cryptocurrency versus CBDC”. Retrieved 06 Feb 2024.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)