NFTs, explained

![]()

If you’ve only got a minute:

- Digital assets are not just limited to cryptocurrencies and include other assets like non-fungible tokens (NFTs).

- Unlike fiat currency and cryptocurrencies, NFTs are unique and non-interchangeable.

- Use cases for NFTs are mostly in the digital collectibles, music and art space, but it can expand into other areas in due course.

![]()

2021 is shaping up to be quite the year for digital assets. They have been rising in value, product offering, and use cases.

Digital assets are content or resources that can be stored digitally. This is a rather broad definition and a more specific one would be the representation of resources that are issued and transferred using blockchain technology.

In recent months, we have seen a wide variety of innovative applications of digital assets coming to the market. They have been adopted by numerous mainstream financial service providers and public sector initiatives. At the same time, there are heightened levels of volatility due to speculation along with scepticism and regulatory risks.

Digital assets are not just limited to cryptocurrency. Though many cryptocurrencies are hovering around all-time highs, non-fungible tokens (NFTs) are another type of digital asset that has been making waves.

NFTs captured mainstream attention in February 2021 when a piece of video art by an artist going by the name of Beeple sold for US$6.6 million. This figure was bettered shortly after in March 2021 when a collage of digital art produced by the same artist sold for more than US$69 million!

What was common between both transactions was that the purchaser did not receive anything physical; all that was received was a crypto asset known as an NFT.

What exactly are NFTs?

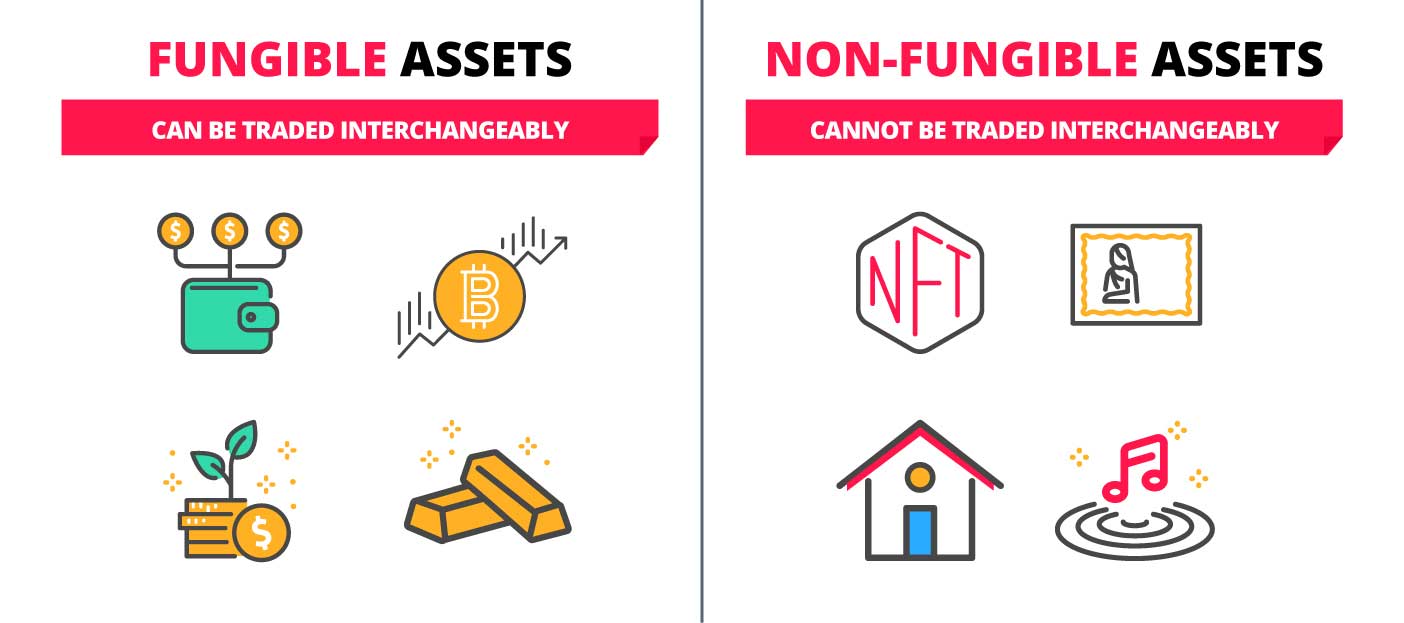

As its name suggests, NFTs are non-fungible. This means it is not interchangeable with other forms of currency at the same value, making it unique.

It contrasts with fungible assets like fiat currency (i.e US dollars or Singapore dollars) and cryptocurrencies (i.e Bitcoin or Ethereum) – in that they can be interchanged easily. For example, you can exchange a S$50 note for five S$10 notes and it will have the same value.

A NFT represents an ownership of an asset, making it by extension, a virtual certificate of authenticity. Presently, NFTs are being transacted in digital marketplaces with cryptocurrencies as the medium of payment and the Ethereum blockchain as the decentralised ledger of choice. The use of NFTs through a blockchain establishes ownership and provenance with the help of smart contracts and metadata.

The transparency surrounding ownership and transaction solves problems that can sometimes be associated with various non-virtual markets, in particular, art, jewellery, and property. NFTs can disintermediate dealers and other forms of middlemen, allowing buyers and sellers to capture a larger chunk of value of each transaction.

NFTs are programmable and portable, which allow a piece of content, once uploaded to the blockchain, to be augmented or attached to other content by third parties. For example, an NFT representing a backstage pass to a concert can be made more valuable or collectible by combining it with other content from the musical act.

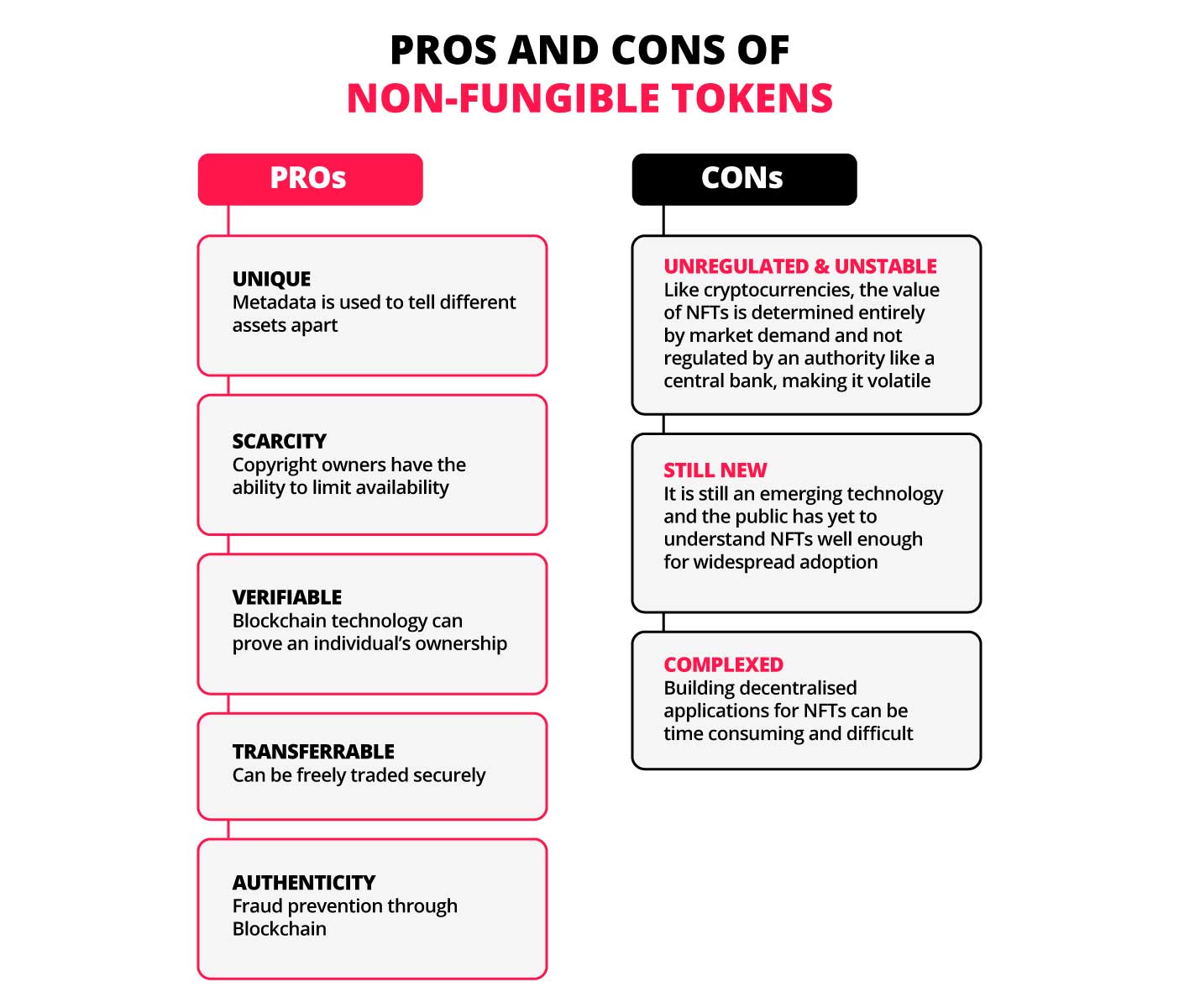

For all its pros, there are still cons to NFTs. For example, is unregulated and be volatile. Moreover, it is an emerging technology and it will still take a good amount of time before reaching widespread adoption.

NFT adoption & use cases

Beeple may have caught the headlines in 2021 but in 2017, much attention was on Cryptokitties, a game blockchain-based virtual game where players could adopt, raise and trade virtual cats.

It is widely believed to be the first famous use of NFTs. Cryptokitties are digital cats each with unique identification through Ethereum’s blockchain. They can reproduce among themselves and have different attributes from their parents and along with that, different valuations. People spent around US$20 million on Cryptokitties shortly after the game went live in November 2017!

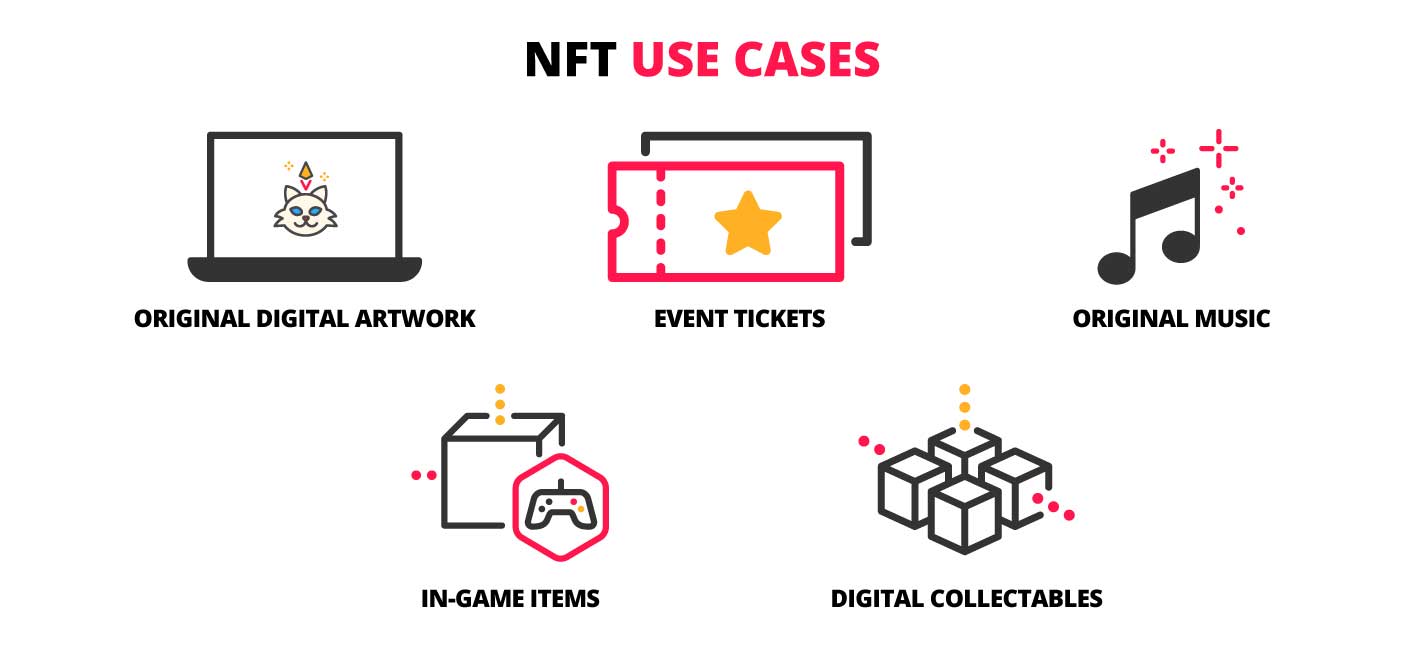

Today, most use cases for NFTs are seen in the transaction of a wide range of virtual collectibles, ranging from digital collectables like NBA virtual trading cards, digital art and music to internet memes and tweets.

Once purchased, the token can be displayed on monitors or placed in a virtual gallery. Between music, video games, and art, there are hundreds of billions of dollars’ worth of annual transactions that be conceivably tokenized, giving more control and value to the content creator. Potentially, the royalty from an NFT can flow back to the creator every time it changes hands.

It can be vexing to think through the idea of attaching value to replicable pieces of digital art, but NFTs may well turn out to be an organizing principle much needed in the seemingly endless supply of digital content. They may also usher in new modes of marketing and advertising.

Even large corporations like IBM, Nike and Samsung, among others, are exploring NFTs use cases which gives a boost to NFTs further adoption.

Given most finance systems already consist of complexed trading and loan systems for a range of assets, it may have a similar impact for this sector in the near future.

This article is part of a series of articles covering Digital Assets. If you enjoyed the read and want to learn about digital assets in greater detail, do check out the other articles in this series:

Ready to start?

Speak to a Wealth Planning Manager today for a financial health check, and how you can better plan your finances.

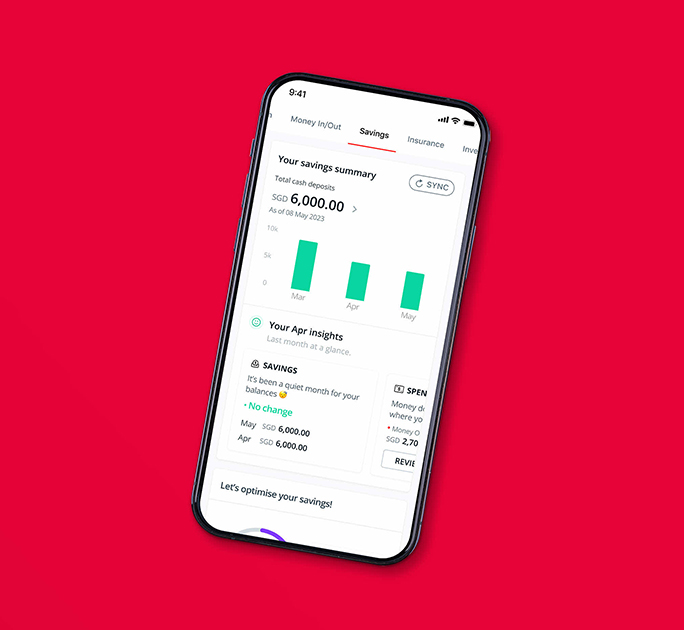

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on the Plan & Invest tab on the digibank app to receive specific investment picks based on your objectives, risk profile and preferences.

Sources:

DBS Economics & Strategy, “Update on Digital Assets: NFTs, DeFi, Cryptos, CBDCs”, (April 2021). Retrieved 24 Apr 2021.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)