Understanding the New Classification for HDB BTO Flats

By Lynette Tan

![]()

If you’ve only got a minute:

- HDB has rolled out the newly classifed Build-to-Order (BTO) flats in October 2024.

- The new classification - Standard, Plus and Prime flat - aims to keep home ownership affordable, maintain a good social mix in every town, and keep the system fair.

- Singles above 35 years old will be eligible to buy BTO flats across the 3 types of housing (i.e. Standard, Plus and Prime).

![]()

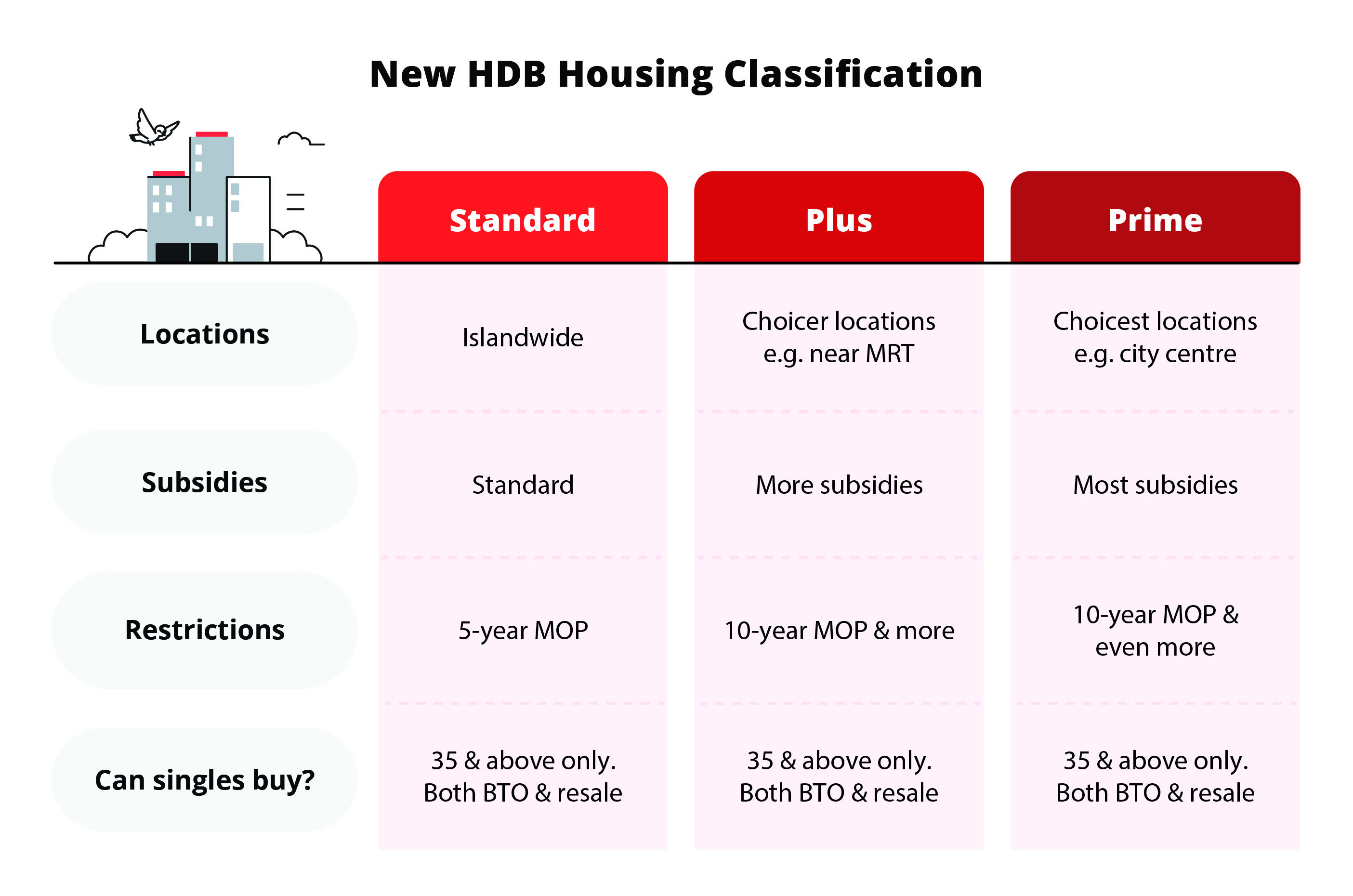

Since October 2024, HDB Build-To-Order (BTO) flats have followed a new classification, moving away from the previous categorisation of mature and non-mature estates. Instead, they are categorised as Standard, Plus or Prime HDB flats.

Previously, HDB flats that were classified under mature estates, are usually more centrally located with more amenities. They tended to be more popular and their prices reflected the higher demand.

On the other hand, non-mature estates are further out in the suburbs. While they lost out in terms of location and convenience, they made up for their lower BTO flat price.

However, as non-mature estates grew and developed, these non-mature estates also became “mature”.

Thus, there is a need for a new housing classification framework to help achieve 3 important objectives:

- Keep home ownership affordable for all income groups.

- Maintain a good social mix in every town and region.

- A fair system for everyone.

From 2H2024, under the new classification framework, HDB BTO flats are split into 3 categories: Standard, Plus or Prime.

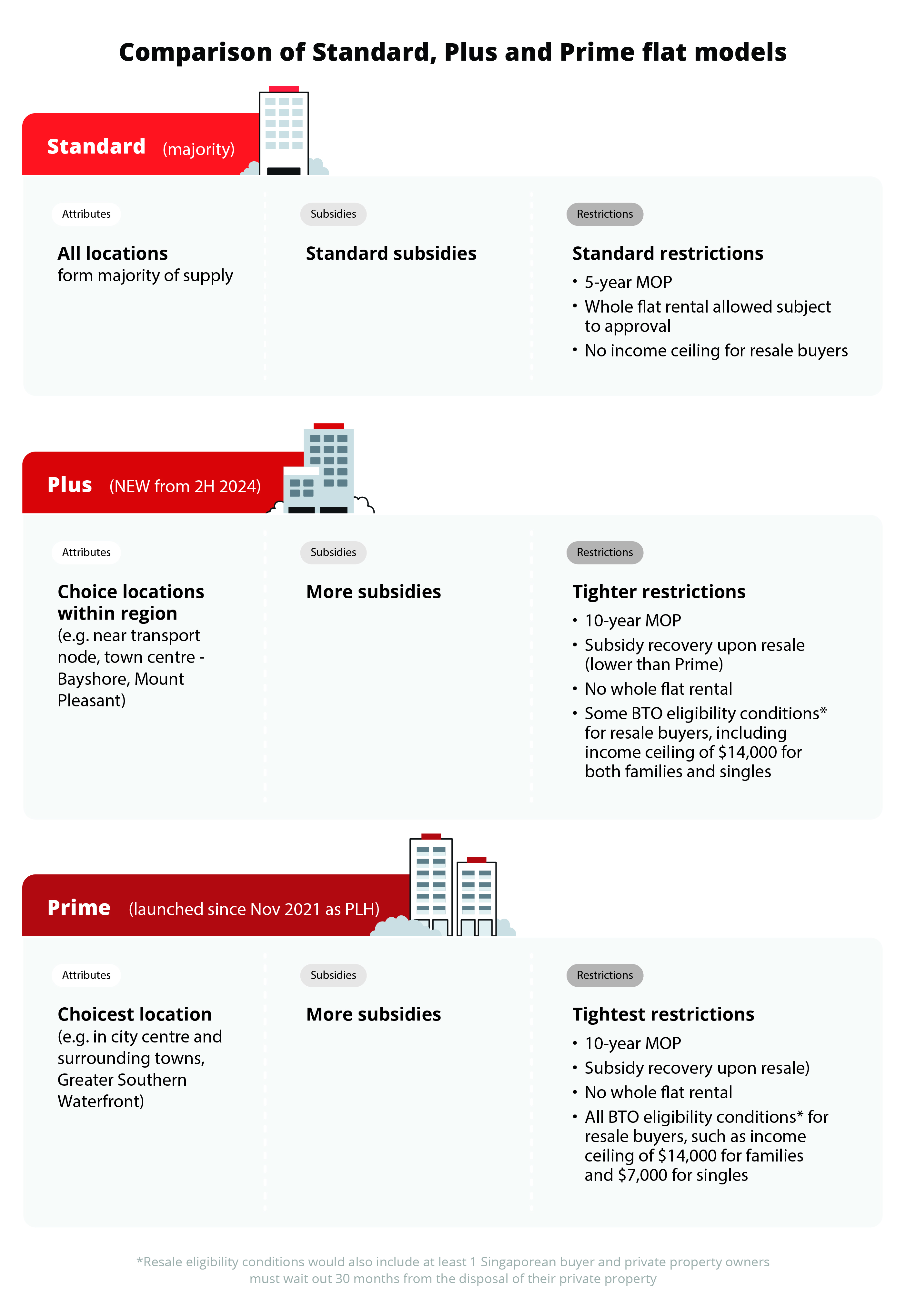

- Standard flats will form the majority of the housing supply, with standard subsidies and restrictions such as the existing 5-year minimum occupancy period (MOP).

- Plus flats will be located in choicer locations within each region across Singapore (e.g. near MRT station, town centre). Flat owners will enjoy more subsidies, but tighter restrictions compared to the Standard BTO flats.

- Prime flats are in the choicest locations within Singapore, usually closer to the city centre. They will come with the most subsidies across the 3 categories and will have the tightest restrictions. These flats are currently offered under the Prime Location Public Housing (PLH) model.

Key features of the new HDB BTO housing model

More subsidies to ensure affordability

Prospective buyers of BTO Plus flats can look forward to more subsidies, on top of those already provided for Standard flats today. This helps to ensure affordability of the Plus flats, given that their attractive locations will likely command higher prices.

Subsidy recovery upon resale of flat

Plus and Prime flat owners will have to “return” the subsidy should they choose to sell their flats later. This is to mitigate excessive windfall gains and ensure equity with other flat owners who do not enjoy these additional subsidies. As of October 2024, the subsidy recovery for Prime flats are set at 9% of resale price, and between 6% and 8% for Plus flats.

HDB has also mentioned that the subsidy claw back may vary with each BTO launch.

Tighter sale restrictions

The MOP for Plus flats will be similar to that of Prime flats, which is 10 years. This means that flat owners will need to occupy their flats for at least 10 years before they can sell their flats in the open market.

Furthermore, only Singaporeans with a household income ceiling of $14,000 will be able to buy Plus flats on the resale market. There will also be a 30-month wait-out period for private property owners before they can acquire a Plus flat. The time period requirement does not apply to Singapore citizens (and their spouses) aged 55 and above if they intend to buy:

- Short-lease 2-room Flexi flat (for those aged 55 and above) or Community Care Apartment from HDB (for those aged 65 and above); or

- 4-room or smaller non-subsidised resale unclassified/ Standard flat without an HDB housing loan.

Besides the resale restrictions, Plus and Prime flat owners will be restricted from renting out their entire flat.

Implications of the new HDB BTO classification for homeowners

With a longer MOP and tighter resale conditions, the move will steer homeowners away from the mindset of “profiteering” from the sale of Plus flats.

Additionally, Plus and Prime flat owners are forbidden from renting out their entire flat as well, thus reducing their chances of earning high rental income due to the choice location.

Since the new classification applied to BTOs that are available or launched from October 2024, it will take more than 10 years before the first Plus and Prime flats are available on the resale market.

Will it make financial sense to buy Plus and Prime flats?

While the new BTO Plus and Prime flats are more expensive when compared to Standard BTO flats and come with more restrictions, they can still be a good buy for flat-owners for the following reasons:

- Plus and Prime flats are located in choicer locations and nearer to the centre of the city compared to Standard flats, making commute times shorter for residents, especially those using public transport. With regards to the location, Plus and Prime flats are likely to be the cheaper option compared to resale HDB as well as private housing in similar areas.

Using the released BTO prices from the October 2024 launch, we can see that current Plus & Prime flats are priced about 35% to 40% cheaper compared to resale HDB flats in the same area. - Compared to other housing options (HDB resale or private homes) in these areas, Plus and Prime flats would still be considered a “steal”, given that eligible residents have access to government subsidies which will make these homes more affordable. Moreover, they come with a fresh 99-year lease, making them more “valuable” compared to older flats.

- While the resale criteria for Plus and Prime flats are more restrictive compared to standard flats, it is quite likely that residents will still make a profit on their flat, notwithstanding the subsidy clawback. However, how much the property prices may have risen during the 10-year period is another factor to be considered.

Looking at the HDB Resale price index, resale HDB prices have almost doubled in the last 15 years. If we assume the same trend in the next 15 years (10-year Minimum Occupancy period + 5 years’ wait), a current 4-room Plus flat that cost $600,000 could sell for around $1.2 million in year 2039, assuming the same trajectory. With a subsidy clawback of 8% ($96,000), a couple can likely still make a profit of about $500,000, excluding transaction costs.

More housing options for singles

Currently, singles who are above 35 years old can only apply for a 2-room flexi flat in a non-mature estate.

With the new classification, eligible first-timer singles can:

- Apply for 2-room Flexi BTO flats in all locations across Standard, Plus and Prime housing projects

- Buy a Standard or Plus flat of any size (except 3Gen flats) in the resale market

- Buy a 2-room Flexi Prime flat in the resale market

While singles are still restricted to the size of BTO flats they can buy, they will now have more choice of locations.

With the new BTO classification, the government wants to align the purchase of HDB flats with the aim of providing affordable housing for Singaporeans, instead of viewing it as a means to “profit” from the sale.

Buying a home is one of the largest financial commitments we may have in our lifetime and home buyers should remain prudent when making the decision.

Start Planning Now

Check out DBS MyHome to work out the sums and find a home that meets your budget and preferences. The best part – it cuts out the guesswork.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)