Should you upgrade your MediShield Life?

- You can use your MediSave account to pay for premiums of approved medical insurance schemes.

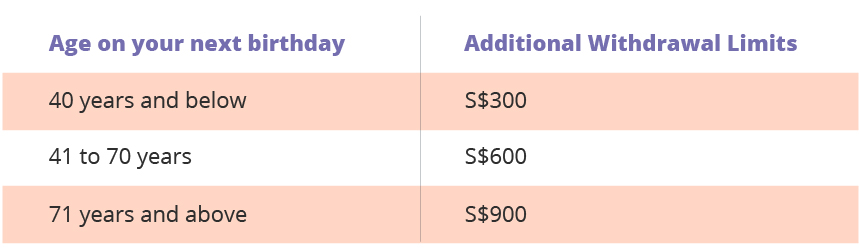

- You can use your MediSave account to pay for an Integrated Shield Plan but there is a limit placed on the amount.

- There are a few key things to consider before purchasing an Integrated Shield Plan; your treatment preference, budget and any Integrated Shield Plan riders.

A basic hospitalization & surgical insurance cover is a must-have for all of us. In Singapore, our Central Provident Fund (CPF) MediSave account can be used to pay the premiums of approved medical insurance schemes such as MediShield Life.

If you would like to enhance your coverage for your bills in private hospitals or A and B1 wards in public hospitals, you can use MediSave funds to pay for your Integrated Shield Plan (IP) but only up to the following limits. The excess must be paid in cash.

How does the cover stack up?

MediShield Life is a basic health insurance plan that protects all Singapore Citizens and Permanent Residents against large hospital bills for life such as dialysis and chemotherapy, regardless of age or health condition. It is structured so that patients pay less MediSave/cash for large hospital bills.

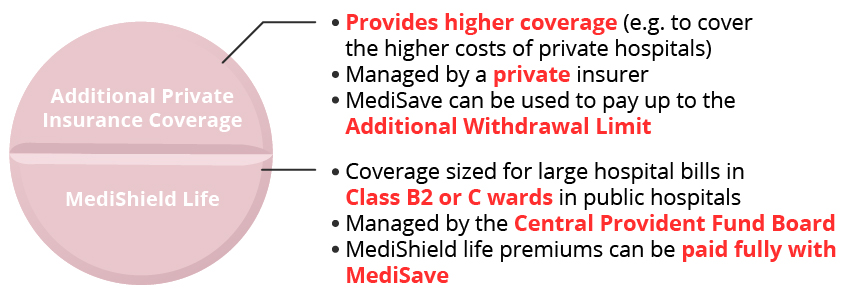

IP comprises two components:

1. MediShield Life by CPF

2. Additional private insurance coverage component by an insurance company typically to cover A/B1 type wards in public hospitals or private hospitals

This means that if you have an IP, you are already covered by MediShield Life. The insurance company that you have engaged will act as your single point of contact. It will act on the CPF Board’s behalf for premium collection and claims disbursement for the MediShield Life component.

Should you get an IP? Listen to your own needs first.

Here are a few things you should consider before you purchase an IP.

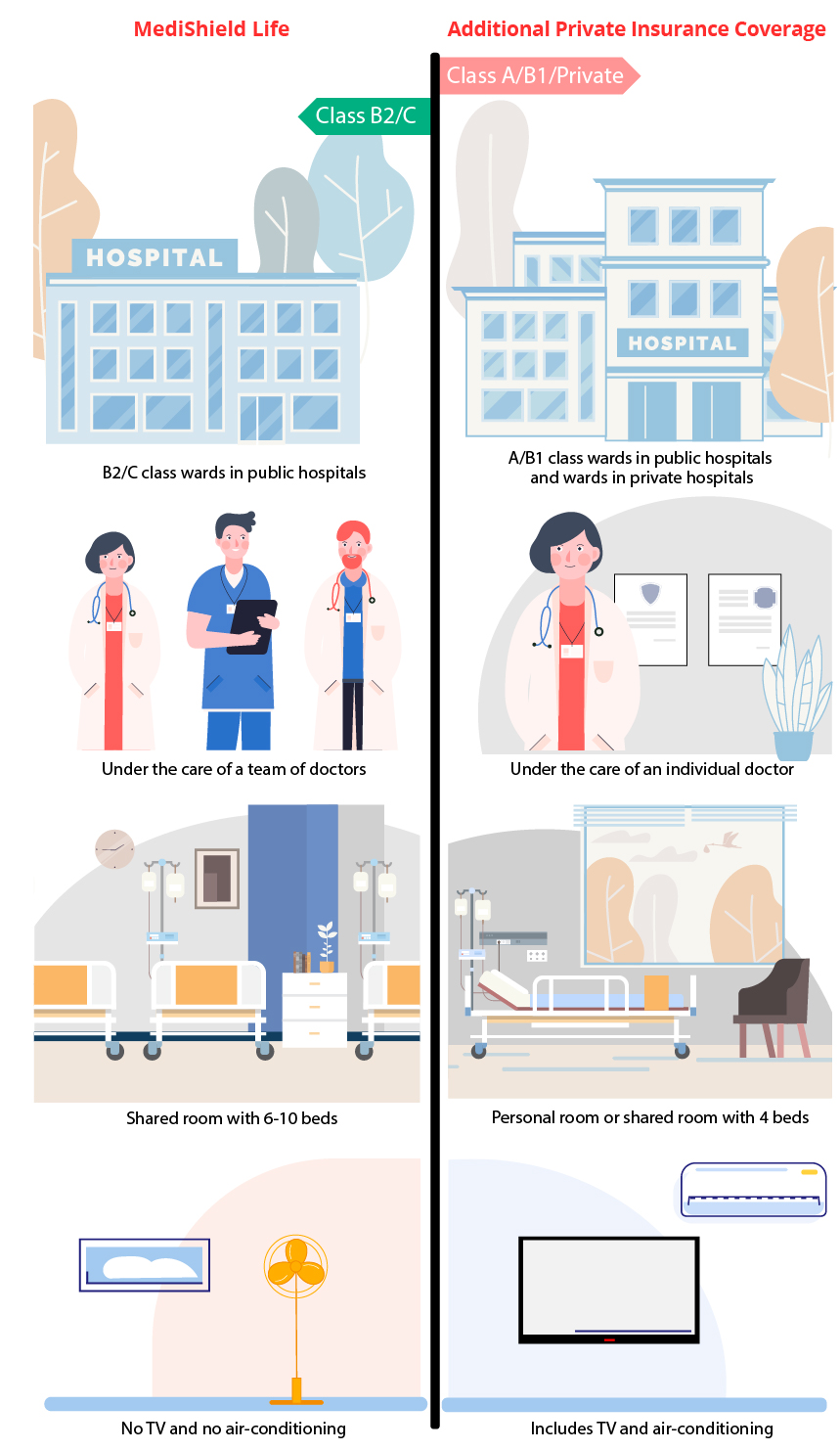

1. Treatment preference

2. Budget

Consider how much you are able and willing to fork out for your premiums. Do bear in mind that the price of the premiums will increase as you age and there is a limit to how much you can use your MediSave to pay for such premiums.

3. IP riders

They are optional add-ons to your IP and are used to reduce the amount you need to pay such as co-payment, deductible and coinsurance when you are hospitalised.

Co-payment is a fixed amount that a patient pays for covered medical services while a deductible is a fixed amount a patient must pay each year before their health insurance benefits begin to cover the costs. If your plan’s deductible is S$1,000, you will pay 100% of your expenses until the bills total S$1,000 after which you will share the cost by paying coinsurance – for example, your plan pays 70% while you pay the remaining 30% (coinsurance).

DBS has partnered with major insurers in Singapore to make health insurance easily accessible online for purchase. You can now independently learn, compare and buy a plan most suited to your own needs. Find out more on DBS Health Marketplace.

Ready to start?

Check out digibank to analyse your real-time insurance coverage. The best part is, it's fuss-free - we automatically work out your gaps and provide planning tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)