Charitable gifting as part of estate planning

By Lorna Tan

If you’ve only got a minute:

- Instead of ad hoc donations or donating only during seasonal times such as Christmas, they can be part of your legacy planning.

- Planned giving is a simple and convenient way to show that you care for the less fortunate – a personal way of rendering help that is meaningful to both givers and receivers.

- Planned gifts come in different forms, such as requesting through your will or gifting of your Central Provident Fund savings, to help the disadvantaged.

![]()

When a crisis like the Covid-19 pandemic strikes, it can bring out the best in many of us. Many Singaporeans opted to donate the Government’s Care & Support cash handouts of up to S$1,200 per individual to the disadvantaged via charitable causes and organisations.

Many may not know that instead of ad hoc donations or donating only during seasonal times of the year, donations can be a part of your legacy planning.

Planned giving is a simple and convenient way to show that you care – a personal way of rendering help that is meaningful to both givers and receivers. Apart from the freedom of choosing the cause(s) that hold(s) special meaning to you, you also become a role model for friends and loved ones. A planned donation gives you control on how to manage your assets to do good while having no effect on your current financial standing. This is because your assets are transferred to your preferred charity only after you have passed on.

You can also offer a planned gift upon the death of a loved one. This final parting gesture could gently comfort those around and motivate them to lead a meaningful life. These donation gifts can also be a source of inspiration for the receivers to encourage them to persevere in the face of difficulties and to let them know they are not alone in their struggles.

The process of planning giving requires you to consider how much and to whom you wish to help and documenting your wishes which can be in different forms.

Community Chest

Set up in 1983, Community Chest (ComChest) is the fundraising and engagement arm of the National Council of Social Service, supporting some 80 social service agencies. Having their fundraising needs supported by ComChest lets these agencies focus on caring for the disadvantaged.

ComChest’s fundraising and operating costs are covered mainly by the Tote Board Group, so 100 per cent of the donations received goes towards empowering the lives of the social service users.

These social service programmes are reviewed on a yearly basis to ensure that they comply with its criteria and are in critical need, meaning they are unable to obtain full funding and have less than two years of reserves.

You can designate it to one or more of the five causes supported by ComChest: children with special needs, youth-at-risk, adults with disabilities, families in need, vulnerable seniors and persons with mental health issues.

Otherwise, you may also direct your donation to the general ComChest fund where donations are channelled towards recommended programmes that are not receiving the required funding. You can choose from a few simple methods (listed below) to prepare a planned gift, knowing your contribution will go a long way for those in need.

Ways to bequeath a legacy gift to Community Chest Planned Gifts come in different forms, such as requesting through your will, gifting of your Central Provident Fund savings or life insurance or donating condolence gifts to help the disadvantaged.

5 ways to bequeath a legacy gift to ComChest

1. Will nominations

You can give a bequest through a will which can include a specific sum of money, property, shares and bonds, and residuary bequest.

You can add the following suggested statement in your will when making a bequest to ComChest. You should discuss it with your legal adviser: “I, (full name as in NRIC), give, devise and bequeath (nominate your type of gift) unto the National Council of Social Service – For Community Chest (UEN: T08GB0034K) for its general purpose, free from all duties, the following:

(Option 1): __ % of my estate of the residue

(Option 2): The sum of S$__ from

- Property situated at (address of property)

- Life policy no: _______Other: _______.”

2. CPF nominations

To nominate ComChest, you will need to fill in the following information under Section 2 of the CPF’s nomination form.

- Name: National Council of Social Service – For Community Chest

- NRIC / Passport / Registration / UEN: T08GB0034K

- Type of entity: Organisation

- Mailing address: 170 Ghim Moh Road #01-02 Singapore 279621

- E-mail: NCSS_Legacy@ncss.gov.sg

3. Insurance policy nominations

To make a gift to the ComChest through your insurance policy, please indicate the following information in your policy nomination:

- Name: National Council of Social Service – For Community Chest

- UEN: T08GB0034K

- E-mail: NCSS_Legacy@ncss.gov.sg

4. Memorial giving

In memory of your loved ones, you can encourage your family and friends to donate instead of giving wreaths. Alternatively, you can choose to channel part of the contributions received during the wake to ComChest.

After you collect the proceeds, you can issue a cheque made payable to Community Chest and send it to 170 Ghim Moh Road, #01-02, Singapore 279621 and attention to: Lee Lu Theng. And indicate your contact details on the back of the cheque for ComChest to follow up.

For more information, you may visit ComChest’s website on Legacy Planning at https://www.comchest.sg/Ways-to-Give/Donate/Create-a-Planned-Legacy-Gift.aspx

5. Endowment fund

Donors can donate a sum to ComChest and the capital will reside with a financial institution or National Council of Social Service in perpetuity or term period, with returns donated to ComChest. This option leads to a sustainable source of funding with long-term impact.

OneFor10 Philanthropic Program

Legacy giving is just one of the few offerings under the ComChest’s OneFor10 philanthropic program. If you have philanthropic goals that you would like to realise in the present day, ComChest can help create a customised giving plan, tailor volunteering opportunities or help you support and/or pilot new projects to solve emerging social problems.

There will also be opportunities for you to gain insights and have fulfilling giving experiences through exclusive networking lunches and round-table sessions with like-minded philanthropists and thought leaders.

To begin your philanthropic journey with ComChest, visit www.onefor10.sg.

Ready to start?

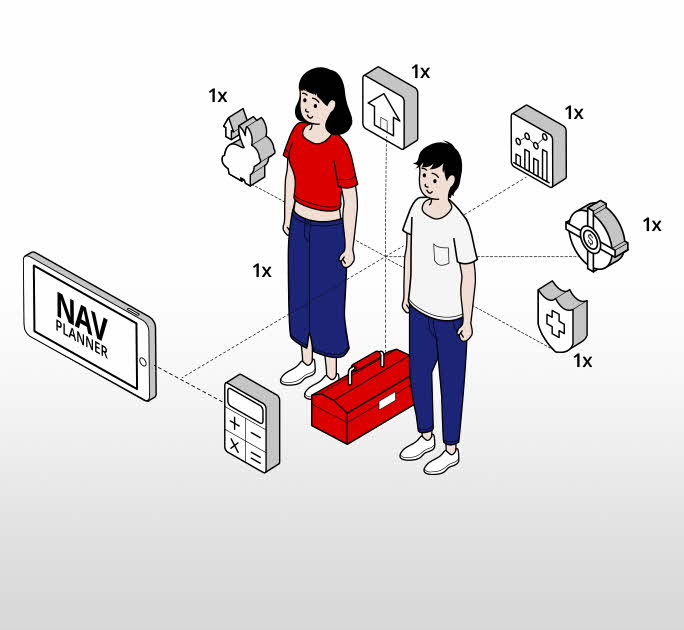

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)