9 CPF ‘hacks’ to grow your nest egg

by Lorna Tan

![]()

If you’ve only got a minute:

- Taking small steps like CPF transfers and cash top-ups can help build up your nest egg and secure a desired future lifestyle.

- With the Special Account (SA) shield hack, you will effectively retain most of your SA savings and continue to enjoy the attractive interest of 4% per year.

- When calculating how much you can top up to your Retirement Account each year, ignore the interest component.

![]()

Retirement may seem distant for some of you, but it is never too early to start preparing for it. In Singapore, retirement planning is invariably linked to our Central Provident Fund (CPF) savings. Whether you’ve just started working, about to buy a home, raising a family or nearing retirement, taking small steps like CPF transfers and cash top-ups can help build up your nest egg and secure a desired future lifestyle.

Here are 9 CPF hacks to game the CPF system. Some will be particularly useful for those reaching 55 or are already 55 and above. These tips will help you accumulate savings in both your Special Account (SA) and Retirement Account (RA) so that you can leverage their higher interest rates. To recap, RA savings earn up to 6%, SA savings earn 4% and OA savings earn 2.5% per year.

Hack #1 Shielding your Special Account

When we turn 55, our savings in SA followed by OA will be swept into the newly created RA. The amount that will be transferred automatically is up to the Full Retirement Sum (FRS) which is S$205,800 in 2024.

To get around the withdrawal from your SA, do this a few weeks before you reach 55: Bear in mind that you cannot invest all your SA savings. Leave behind S$40,000, which is the minimum amount, and invest the rest temporarily in a short-term and relatively safe investment product under the CPF Investment Scheme.

On your 55th birthday, S$40,000 from your SA and savings from your OA – up to the FRS – will be transferred to your RA. You can then liquidate your temporary investment and the amount invested plus gains (if any) will return to your SA.

With this hack, you have effectively retained most of your SA savings and continue to enjoy the attractive interest.

Of course, this shielding strategy comes with risks so be careful about picking a suitable investment product to park your SA savings temporarily. If the fund value drops during the investment period, you may have to stomach losses, or you may consider liquidating it later.

Hack #2 Topping up to Enhanced Retirement Sum (ERS)

If you are age 55 and above, and wish to receive higher CPF LIFE payouts, you can top up your RA to the prevailing ERS each year with either CPF savings or cash.

Assuming you are 55 in 2024 and have the ERS amount of S$308,700 in your RA, you will receive a monthly CPF LIFE payout of S$2,260-S$2,430 under the CPF LIFE Standard Plan, when you turn 65. You can continue to top up to the prevailing ERS in subsequent years to get higher monthly payouts later.

When calculating how much you can top up to your RA each year, ignore the interest component. For example, if you already have the ERS of S$298,200(excluding interest) in your RA in 2023, you can top up another S$10,500 into your RA in 2024 to hit the prevailing ERS of S$308,700.

Hack #3 Using the CPF voluntary contribution scheme

Let’s assume you have maxed out your CPF savings by topping up to the current FRS in your SA (if you are under 55) or the ERS in your RA (if you are 55 and above).

To enjoy the attractive CPF interest rates, you can consider the CPF voluntary contribution (VC) scheme – the “VC-3A” scheme – to top up monies to your three CPF accounts (Ordinary, Special and Medisave Accounts), subject to an annual limit known as the CPF Annual Limit.

This annual limit takes into account both mandatory and voluntary contributions. The maximum amount of voluntary contribution to the 3 CPF accounts that you can make this year is the difference between the CPF Annual Limit (S$37,740) and the amount of mandatory contribution received for the year.

The excess contribution above the CPF Annual Limit will be refunded without interest from your voluntary contribution payment. Use the CPF contribution allocation calculator on the CPF Board’s website to find out how much is allocated to each of the 3 CPF accounts.

Hack #4 Topping up CPF accounts of your spouse and parents

By doing so, you stand to potentially enjoy tax relief of up to S$8,000 while your spouse and/or parents earn attractive CPF interest too. Do note that only cash top-ups qualify for tax relief. There is no tax relief for top-ups beyond the prevailing FRS each year, and there is a personal income tax relief cap of S$80,000.

You can do a CPF transfer to your spouse and/or parents’ CPF accounts, up to a cap, after setting aside the Basic Retirement Sum in your own CPF account. Conditions apply.

They will benefit from the extra interest that will be paid in the respective accounts and there will be greater peace of mind as they will have their own source of retirement payouts.

Hack #5 Doing CPF top-ups in January

If you already intend to top up every year, why not do it in January instead of December? This is because CPF members can earn more interest by topping up earlier in the year. So don’t procrastinate.

Let’s assume you regularly top up your SA by S$2,000 a year for 10 years, a total sum of S$20,000. If you had performed the top-up in January, the total interest earned at 4% per year over 20 years works out to S$16,800. This is higher than the S$15,500 interest from topping up in December.

Hack #6 Doing CPF top-ups in small bite sizes

Topping up does not have to be one lump sum. You can still make small but regular top-ups. Through auto-transfer, you can consider allocating a small amount from your monthly salary to your CPF account. For example, you need not add S$8,000 to your SA or RA at one time. Split it into 12 payments over a year.

Hack #7 Maximising your child’s Child Development Account (CDA)

Consider maximising your child’s CDA which earns an interest of 2% a year. Unused CDA savings will eventually be channelled to your child’s CPF OA.

This is how it works: unused CDA savings will be transferred to your child’s Post-Secondary Education Account (PSEA) when he/she turns 13. The PSEA money also earns an interest of 2.5%. At age 30, those funds will go into your child’s CPF OA which earns an interest of up to 3.5%.

These OA savings can give your children the head start in growing their CPF savings and can be used to finance their first home.

Hack #8 topping up your child’s Special Account

If your retirement needs are well catered for, and you have plenty of surplus cash or just won TOTO, you can consider topping up your child’s SA to leverage attractive interest rates and compounding.

If your child has zero SA savings, you can top up to S$205,800, which is the FRS in 2024. Assuming an annual interest of 4%, the amount will grow to more than S$1.7 million over 55 years.

Of course, this assumes no change in CPF policies and interest rates. Do note that there is no tax relief for top-ups to your child’s CPF accounts.

Hack #9 Investing your CPF monies in T-bills

With Treasury bills (T-bills) offering more than 3% yield in recent issues, you may consider investing your CPF savings in them. T-bills is a safe, short-term investment option issued by the Singapore Government which you can use to diversify your investment portfolio.

You can buy T-bills using cash, Supplementary Retirement Scheme (SRS) savings and CPF balances.

However, before you invest in them, it is worth your time to understand the potential risks of investing your CPF savings in T-bills. This is partly because the interest computation of CPF balances is affected by the transactions in your CPF account.

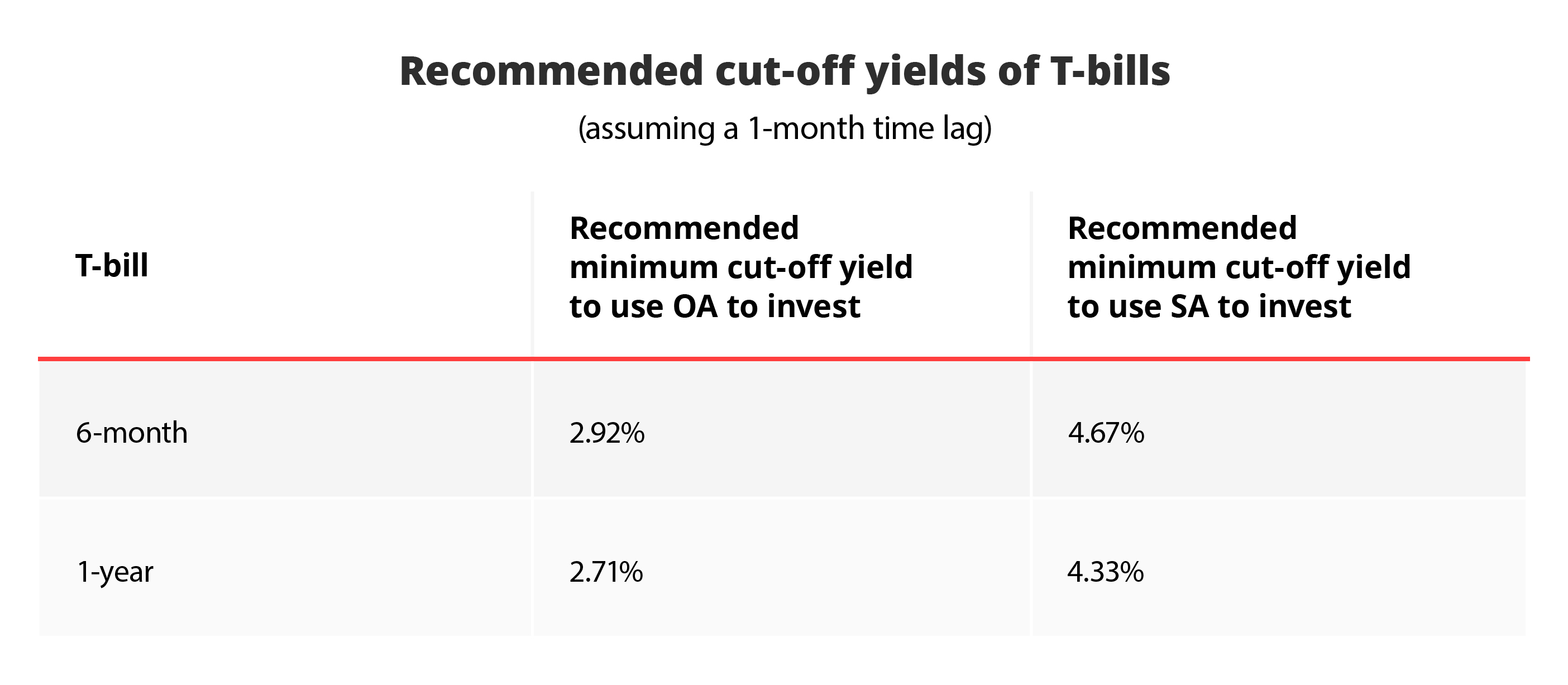

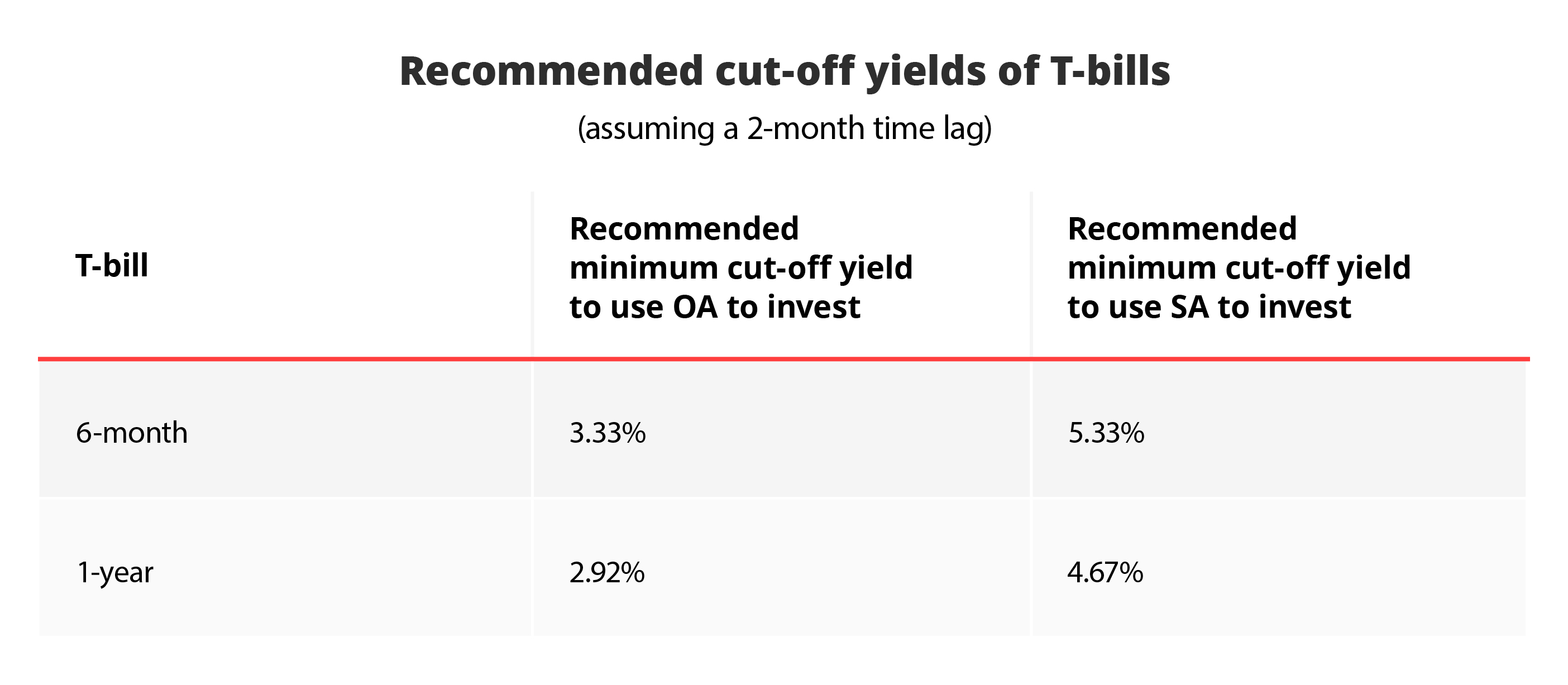

Depending on when the deduction is done from your CPF account, you might lose up to two months of CPF interest. Taking that into account, these are the cut-off yields for T-bills that will result in a higher return than that of CPF-OA and SA yields.

Do note that agent banks charge a one-time fee of S$2.50 for each transaction and a quarterly S$2 service fee per counter as well.

You can invest your remaining OA savings after setting aside S$20,000 in your OA and your remaining SA savings after setting aside S$40,000 in your SA, although I would recommend that you leave your SA balance uninvested to earn the attractive interest of at least 4% and grow over time.

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)