Do more with your CPF

By Shawn Lee

![]()

If you’ve only got a minute:

- You can potentially earn higher returns on your CPF OA and SA balances to grow your nest egg.

- The CPF Investment Scheme (CPFIS) allows you to invest your CPF OA and SA savings.

- DBS offers a wide-range CPFIS-approved unit trusts that provide exposure to a variety of asset classes and geographies.

![]()

Your savings in the Central Provident Fund (CPF) are a key part of your retirement plan. If you are employed and aged 55 or younger, you could be contributing 20% of your salary to your CPF, while your employer contributes an additional 17%. That’s a total of 37% of your monthly pay.

As of Q3 2024, CPF members’ total balances reached a record S$593.5 billion. It’s essential to maximise your CPF savings to help fund your retirement.

Growing your CPF

Your CPF Ordinary Account (OA) savings earns a minimum interest rate of 2.5% p.a., while funds in your CPF Special Account (SA) earn at least 4% p.a. You can also earn additional interest on the first $60,000 of your combined CPF balances.

One way to earn higher returns on your OA balance is to transfer funds to your SA, as the interest rate is higher. However, be mindful of your financial commitments, such as housing loans or property purchases, which can only be paid with OA funds. Transfers from OA to SA are irreversible, and SA funds cannot be used for housing or education needs.

For CPF members aged below 55, you can estimate your CPF LIFE monthly payouts with “Your CPF” in digibank.

Investing with CPF

The CPF Investment Scheme (CPFIS) allows you to invest your OA and SA balances. You can invest OA savings above S$20,000 and SA savings above S$40,000.

As of Q3 2024, more than 1 million CPF members had invested their OA funds through CPFIS, with total holdings exceeding S$2.6 billion.

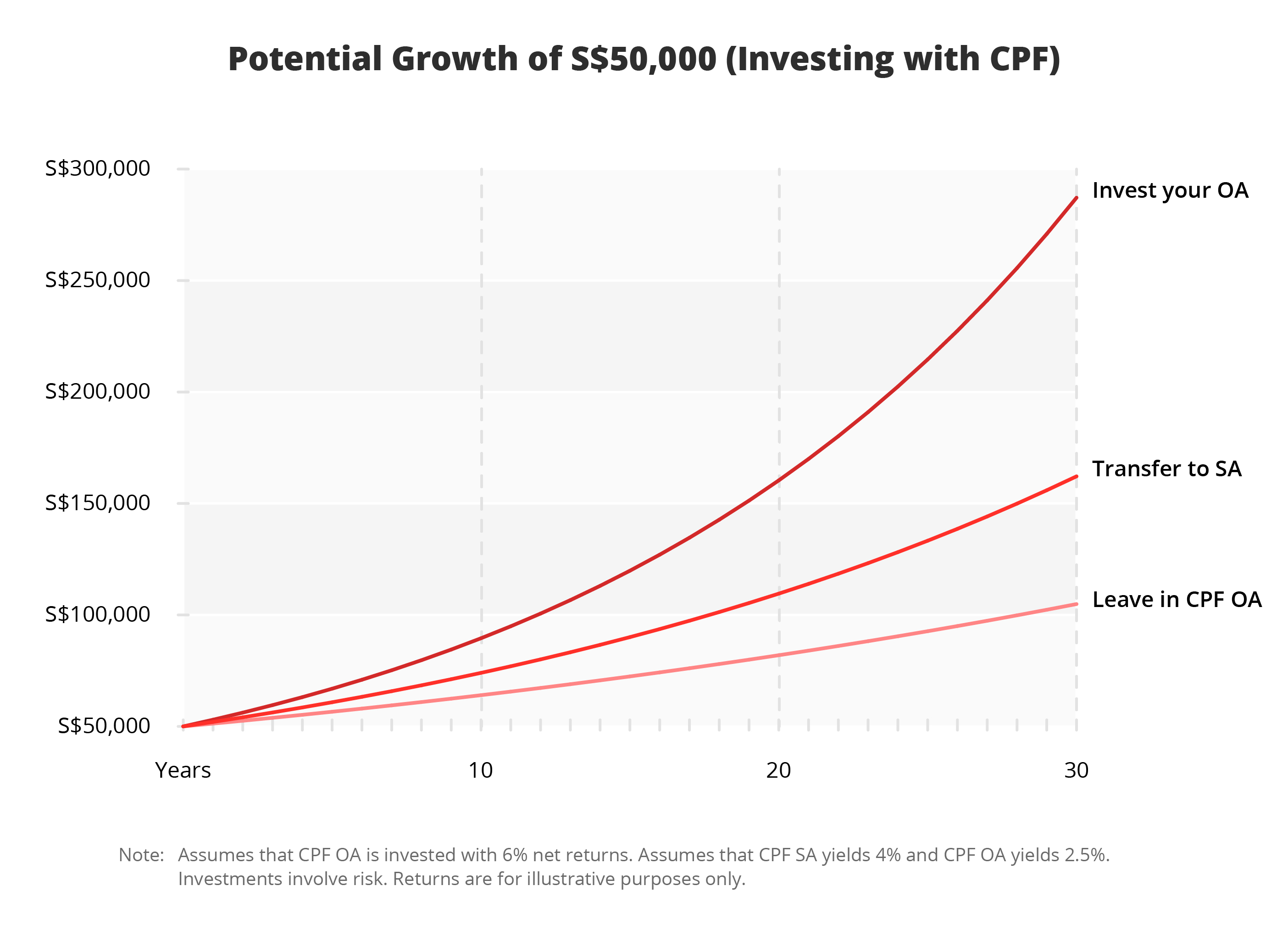

With the OA interest rate at 2.5% p.a, you can consider investing your OA balance to potentially earn more than this base rate. For example, by investing a one-time amount of S$50,000, the difference between getting a return of 6.0% p.a compared to 2.5% p.a would be an additional S$182,296 more for your retirement nest egg in 30 years.

A larger nest egg offers more options for your retirement lifestyle. So do consider making full use of the magic of compounding by investing your CPF OA savings.

The main objective of CPF is to save up for your golden years. As the monthly lifetime payouts from the national annuity scheme CPF LIFE start from age 65, it means that you have a long-time horizon before you draw down from your CPF.

If you do not have any short-term needs for your OA, by investing over the long-term and potentially enjoying a higher rate of return, you can better mitigate against longevity, inflation and healthcare risks in retirement.

There is a growing suite of products that you can invest with your OA such as unit trusts, annuities, endowment policies, exchange traded funds, shares and gold ETFs. Unit trusts allow you to invest in a basket of stocks which can diversify your investments. This helps to ride out market volatility while potentially achieving higher returns than the OA base rate.

Your investment choices will depend on your risk tolerance, time horizon, financial knowledge, and investment objectives.

Before you begin investing, ensure you understand your financial goals and when you may need the funds. Consider your ability to absorb short-term losses and assess your overall financial situation.

Investing with DBS

DBS offers a wide range of CPFIS-approved unit trusts that you can invest with ease. These funds from reputed global investment managers have undergone due diligence by the CPF Board’s appointed consultant, Morningstar.

The availability of a wide variety of asset classes, geographies, including narrowly focused region and sector funds provide the flexibility to construct an investment portfolio according to your preferred asset allocation and make your CPF savings work harder for you.

Top 10 CPFIS-approved funds available at DBS Bank (as at 7 Jan 2025),

|

Fund Name |

5Yr Annualised Returns |

|---|---|

| Franklin US Opportunities Fund - SGD - Acc | 35.30 |

| PineBridge US Large Cap Research Enhanced Fund - A5CP - SGD - Acc | 34.09 |

| Allianz Best Styles Global Equity - ET - SGD - Hedged - Acc | 30.83 |

| Abrdn Singapore Equity Fund - SGD - Acc | 26.66 |

| Schroder Singapore Trust - SGD - Qdis | 26.10 |

| Allianz Global Artificial Intelligence - ET - SGD - Acc | 24.38 |

| Allianz GIPF -Aillianz Global High - SGD - SAdis | 21.77 |

| Schroder Isf Sustainable Asian Equity - F - SGD - Acc | 21.12 |

| Abrdn India Opportunities Fund - SGD - Acc | 19.90 |

For the full list of CPF Funds available via DBS, click here.

Getting Started with DBS

1. Open a CPF Investment Account (CPFIA)

To invest your OA savings, you can easily do so online. Apply for your CPFIA with the new DBS digibot

2. Invest at your convenience online with digibank or link your CPFIA to your DBS Vickers Account

a. For digibank users, go to “Invest” to get started: [Login]

b. Alternatively, if you have a DBS Vickers Account, choose CPF as your settlement mode: [Login]

Happy growing your CPF!

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)