![]()

If you’ve only got a minute:

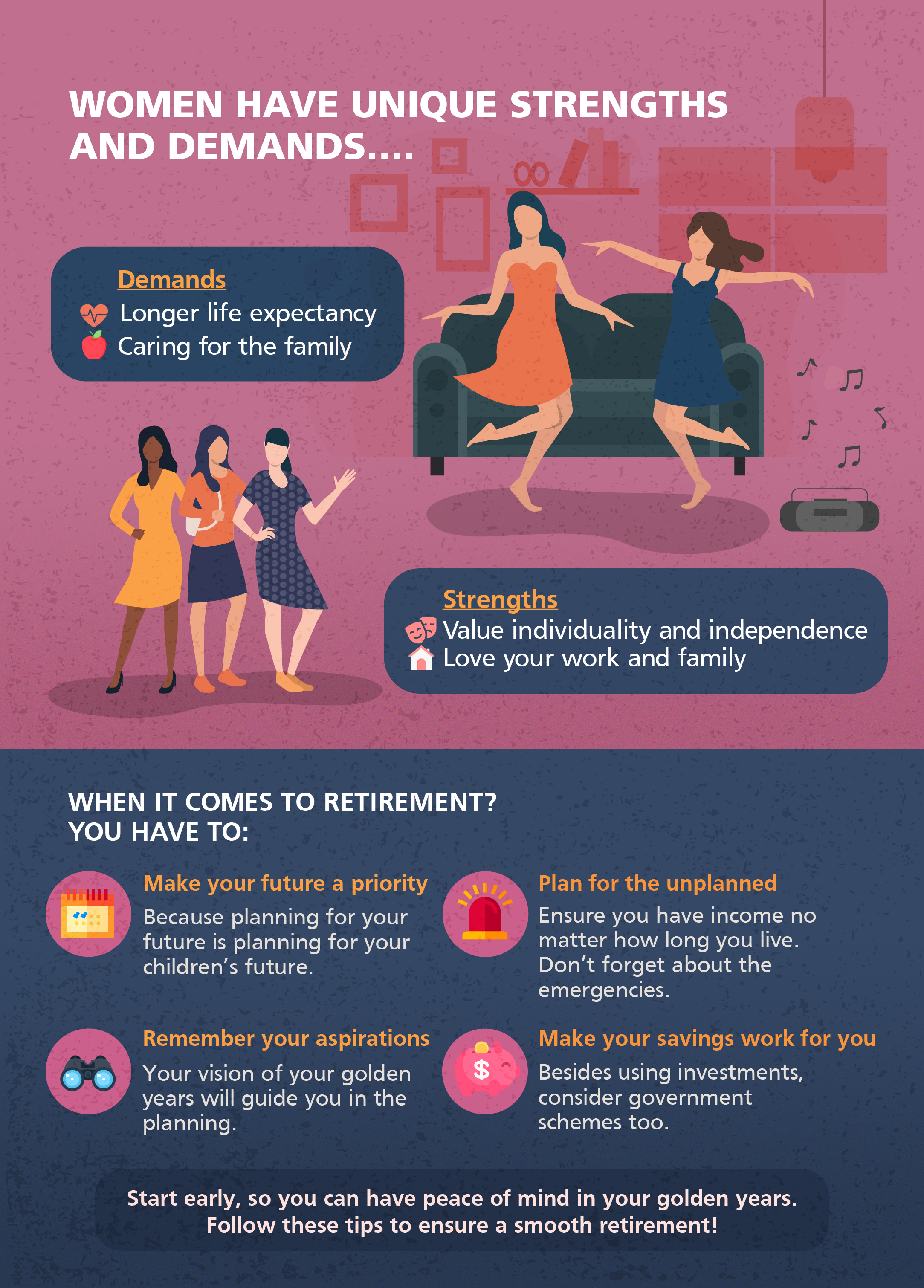

- Women face longer life expectancies, potential income gaps, and career disruptions. Maximize your income and diversify your retirement income sources to mitigate these challenges.

- Secure your finances for the future by ensuring you have multiple income streams, including guaranteed sources to fund your basic needs and higher-yielding investments to fund your wants.

- Start early and plan wisely: Begin planning for retirement as early as possible by considering your retirement aspirations to maximize your savings potential.

![]()

Women face a unique set of challenges: longer life expectancy, and possibly less savings from disrupted careers to take care of things at home.

Yet, this is where the strength of a woman lies. You value your individuality and independence as much as you love your work and family. And as you make the most of your prime years now, you’re also determined to enjoy the same quality of life three, four or even five decades on.

How do you do that?

1. Make the future a priority

It’s easy to focus on your present needs, such as financing a home, paying for childcare, or funding regular overseas vacations, as these seem more immediate and urgent. However, if you relish the idea of achieving financial freedom and having the liberty to pursue your passions sooner rather than later, then now’s a good time to take active steps in planning your retirement.

The earlier you start, the more you will be able to set aside, and the less stressful the process will be.

2. Consider your retirement aspirations

How you envision your golden years will guide you in the planning. Do you dream of travelling the world? Spending hours at the golf course? Learning a foreign language? How will your daily routines change? And how would your current money mindset affect your retirement plan? Ask yourself how much you wish – and are able – to set aside to fund your lifestyle and passions, and what you can compromise on. Itemising and putting a value to your likely retirement spend will help in your planning. Tracking the income flows to fund these expenses will help to manage your retirement expectations and give some clarity on when you can achieve financial freedom.

3. Assess your current circumstances

Some unique challenges that women face include a longer life expectancy than men (hence needing retirement savings to last longer), possibly lower earnings arising from the gender pay gap, and career disruptions due to childbirth, caregiving, and other domestic demands.

You may, for instance, have left the workforce for some years to care for a family member, or taken on a lower-paying job that offered more flexible working hours. With fewer opportunities to fund your nest egg, it’s crucial that you put aside money regularly for retirement, and maximise your current income.

4. Multiple and diversified income sources

Securing your finances for the future involves planning for the unplanned. This includes ensuring you have an income no matter how long you live and making provisions for emergencies.

It’s important to factor in rising costs of living too, especially when it comes to medical expenses. Relying on your Central Provident Fund (CPF) savings alone may not be enough. Diversifying your retirement income sources is one way to manage this risk. Be mindful to build multiple sustainable sources of income, some of which should be guaranteed to fund your basic needs. With your surplus cash, you can invest in higher yielding investments that can potentially fund your wants.

One plan that you can consider is RetireSavvy, an affordable, customisable and flexible plan for your retirement.

If you plan on financing retirement by downgrading your property, remember that the value of your property changes with the market, and with time.

5. Seek higher returns on your money with government schemes

Savings are a secure way to stash funds, but you can also consider making your money work harder. Besides using investments, such as unit trusts and stocks, consider government schemes such as the CPF and the Supplementary Retirement Scheme (SRS).

Our CPF savings enjoy attractive interest rates of up to 6% per annum so consider building your retirement income by contributing to your Special and Retirement Accounts. Your spouse and loved ones can also help to do this by performing a CPF top-up to your accounts.

The SRS may be a suitable tool to help you save more for retirement. Contributions to SRS are eligible for tax relief, and investment returns may be tax-free – so long as you withdraw it within the stipulated limits. As you can only withdraw your SRS savings at age 62 or 63, depending on the statutory retirement age that was prevailing when you made your first SRS contribution. (or the stipulated retirement age when you made first SRS contribution), leverage the long-time horizon by investing your SRS savings, instead of leaving it idle and earning negligible interest.

6. Manage the uncertainties

Whether you’re single, married or widowed, your goal for retirement would be self-sufficiency. You’ve probably looked into estate planning to make sure your loved ones and dependents are cared for in your absence. Besides having a will which helps to distribute your estate according to your wishes upon your death, it is prudent to have a Lasting Power of Attorney as well. The latter helps you appoint people you trust to act on your behalf if you should lose mental capacity.

And have you done your CPF nomination? Doing so enables you to specify who will receive your CPF savings (which cannot be distributed via a will), and how much each nominee should receive, upon your demise. Increasingly, more people are aware of the benefits of doing an Advance Medical Directive early. It is a legal document that you sign in advance to inform the doctor treating you (in the event you become terminally ill and unconscious) that you do not want any extraordinary life-sustaining treatment to be used to prolong your life.

7. Get an alternative viewpoint

Finally, the big question remains: Just how much is enough?

While the sum will vary from person to person, a useful rule of thumb is 60% to 80% of your pre-retirement income.

It’s also prudent to seek advice from financial planning professionals, who can help you conduct a financial health check, and manage your wealth portfolio. With their training, expertise and resources, they will also provide you a valuable alternative perspective in planning for your future, especially where medical and property costs are a key concern. Get started on retirement planning – it’d be one of the best financial decisions of your life.

If you’d like someone to work through a plan with you today, let us know. After all, what are neighbours for?