What you need to know before investing with CPF and SRS

Most people will consider the monies in your CPF Ordinary Account (CPF-OA) and Supplementary Retirement Scheme (SRS) separately. But here at DBS, we recognise that both schemes are meant to fund your retirement lifestyle and expenses. And so, we consider them together so your money can work as hard as you are.

Here’s what you need to know before investing your CPF-OA and SRS monies.

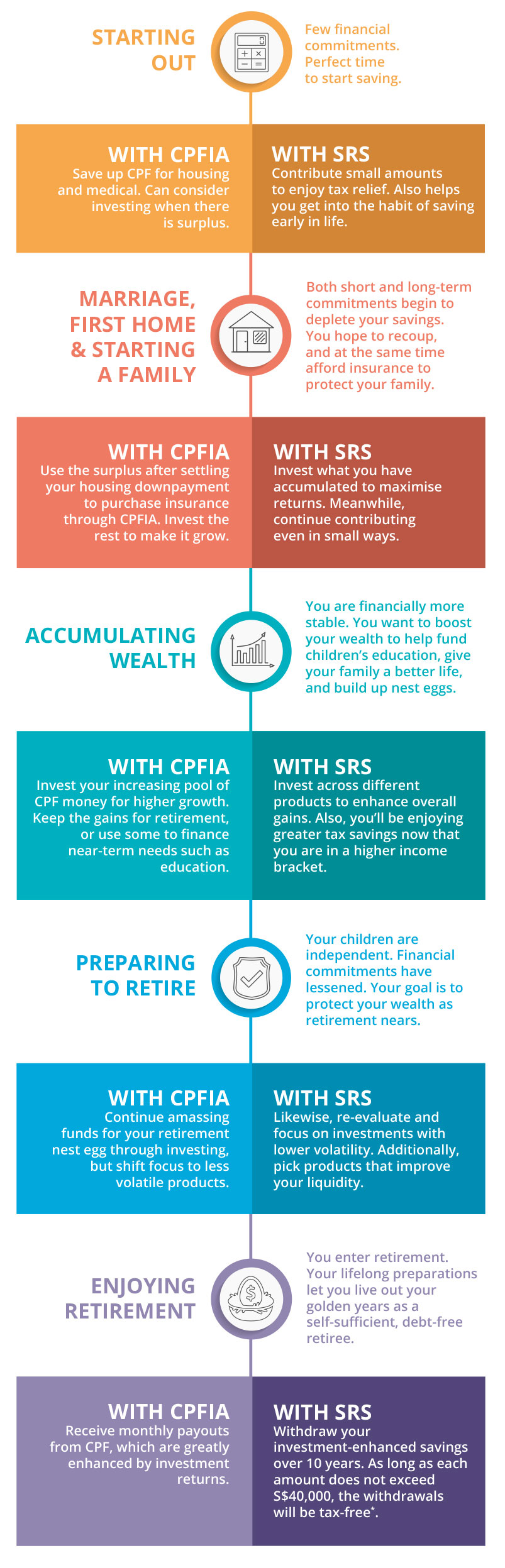

Role of CPF and SRS at every stage of your life

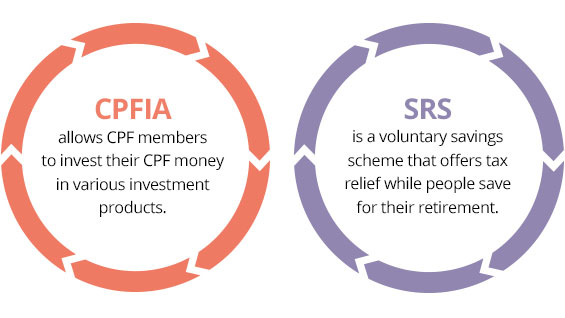

Both the CPF and SRS are national schemes initiated by the Singapore Government to help locals and foreigners in Singapore to plan for retirement.

* Since 50% of SRS withdrawals are taxable, you only need to pay taxes if your chargeable income exceeds S$20,000 as stated by law.

Investing with CPF and SRS

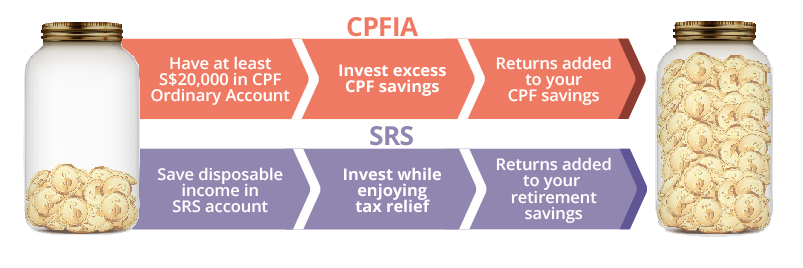

You can invest using the savings in both your CPF-OA and SRS. All you’ll need is an account with a local bank like DBS.

With your CPF savings, the CPF Investment Account (CPFIA) allows you to invest your CPF-OA savings. To open a CPFIA account, you will need to:

- Be at least 18 years of age;

- Not be an undischarged bankrupt;

- Complete the Self-Awareness Questionnaire (SAQ); and

- Have more than S$20,000 in your CPF-OA.

With SRS, all you need is an SRS account and digiBank to maximise those savings. To open an SRS account, you will need to:

- Be at least 18 years old;

- Not be an undischarged bankrupt; and

- Not mentally disordered and therefore capable of managing yourself and your affairs.

Why invest with your CPF and SRS monies?

Left alone, the funds in your CPF-OA would earn an interest of up to 3.5% per annum, while your SRS funds would earn an interest of just 0.05% per year. By investing these funds, you can get a better return than the prevailing interest rate, and grow your retirement nest egg.

As an example, John Lim, 45, is intending to invest S$10,000 of his SRS funds in the Apr 2021 tranche of the Singapore Savings Bonds (SSBs).

If he holds his investment to maturity in 2031, he would have made a total return of S$1,173 or an effective return of 1.15% each year.

Even if he chooses to withdraw his investment after 3 years, he would still have made a return of 0.41% each year, which exceeds the 0.05% interest earned if he had left his savings untouched in his SRS account.

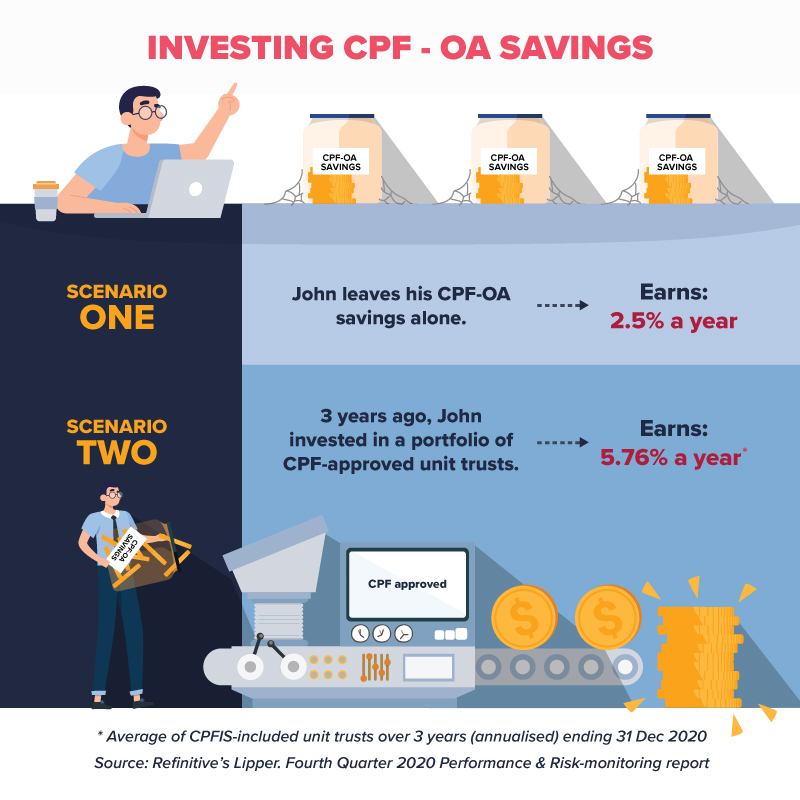

What if John Lim decided to invest his CPF funds into a portfolio of CPF approved unit trusts three years ago in 2017?

Based on the data collated by Refinitiv’s Lipper, CPFIS-included unit trusts recorded an accumulated return of 18.31% over a three year period, or an annualized return of 5.76% as of end 2020.

Depending on the type of unit trusts he invested in, his accumulated returns would have ranged from 12.82% for bond unit trusts, to 16.94% for mixed asset unit trusts, and 20.84% for equity unit trusts. That exceeds the 2.5% interest rate he would have earned from leaving his OA savings alone.

Investment comes with an element of risk, as there is no guarantee that markets will perform as they have in the past, so your investment may see lower returns during bear markets, and higher returns during a bull market.

What happens to the returns you earn?

With the CPFIA, the funds will go back into your CPF and will become part of your retirement funds that you will receive as an annuity with CPF LIFE when you retire.

When investing with SRS, your accumulated investment returns go back to your SRS account while enjoying tax benefits. You will only be subject to a 50% tax on your savings when you withdraw the monies after your prevailing retirement age. Withdrawals can be done as a lump sum, over a period of time, or as an annuity if you purchase one.

Whether you choose to invest with CPF or SRS, your returns will be added your retirement savings.

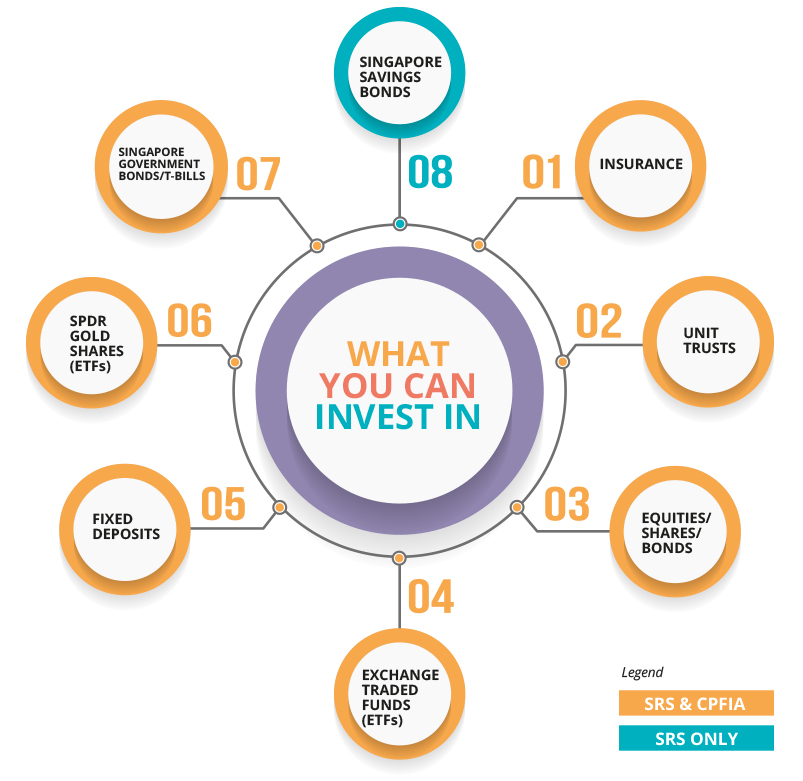

What can you invest in when using your CPFIA and SRS?

Using your CPFIA and SRS accounts, you are allowed to invest in a curated selection of investment products. That list includes insurance, unit trusts, equities, shares, bonds, ETFs, FD, SDPR Gold Shares (ETF) and Singapore Government T-bills. For Singapore Savings Bonds, you can only invest in them with your SRS account.

How do I get started investing my CPF?

If you are an existing DBS account holder, you can login to your DBS digibank online account and follow the steps below.

How do I get started investing my SRS?

If you have an existing SRS account with another bank, and wish to transfer your account to DBS, you may visit any DBS/POSB branch to do so.

Alternatively, plan your finances with the Plan & Invest tab in digibank and invest your SRS.

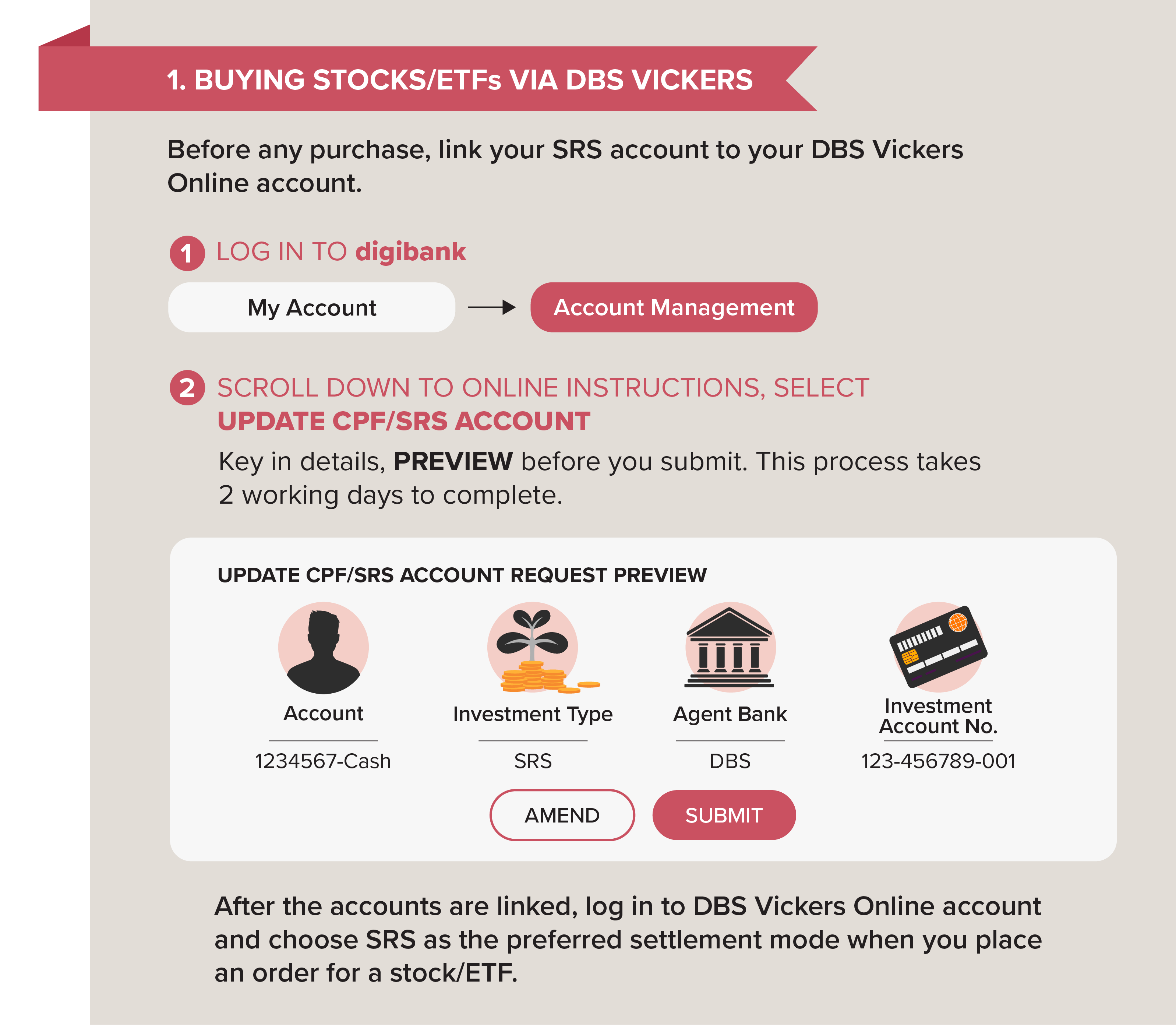

Buying stocks and ETFs via DBS Vickers

You will first need to link your SRS account to your DBS Vickers Online account, following which you can select CPF or SRS as the desired ‘Investment Type’, by following the steps below.

Returns and dividends you receive from your investments in stocks and ETFs will be credited directly back into your CPF savings and SRS accounts respectively.

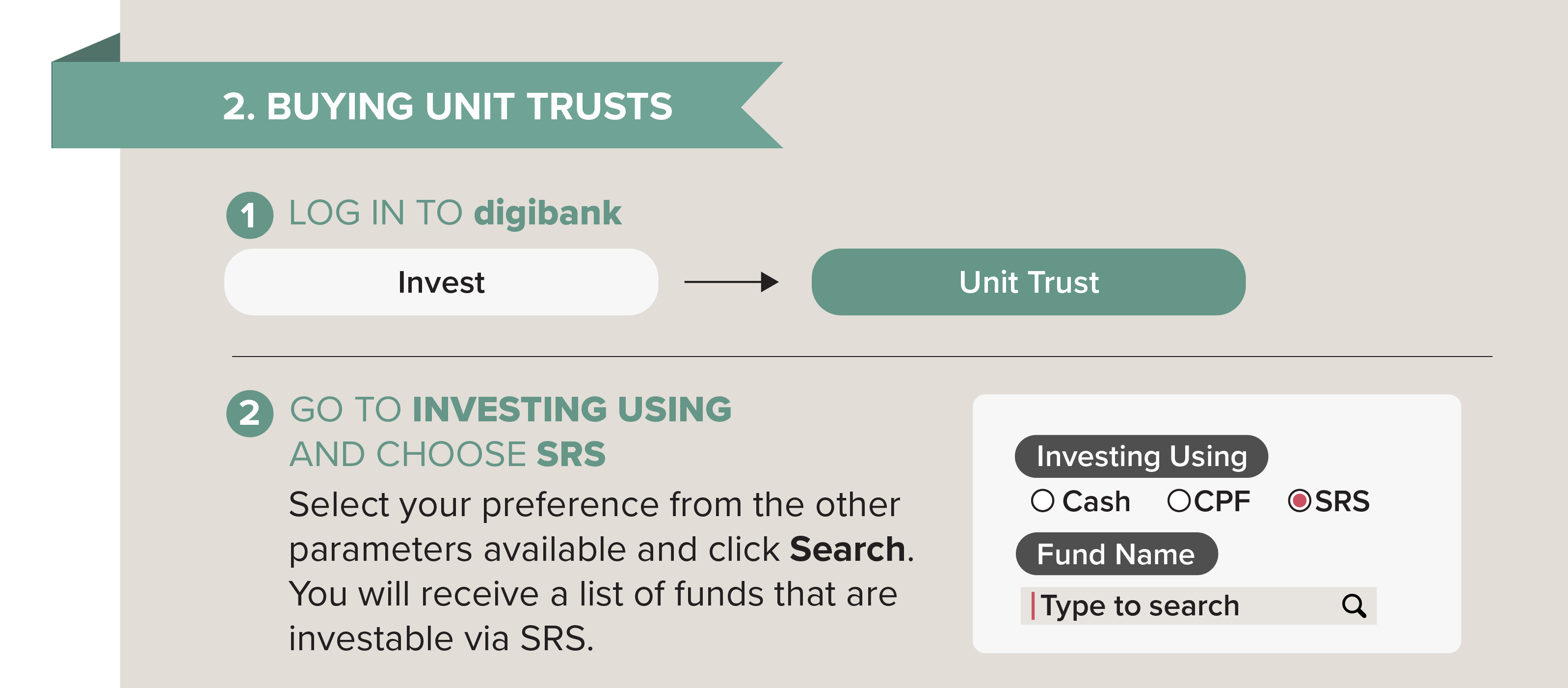

Buying unit trusts

Simply log in to digiBank, and navigate to the “Invest” tab and “Unit Trust” drop-down. You can filter the list of unit trusts for those that can be purchased using CPF, and SRS.

Do take note that the returns and dividends you receive from your investments in unit trusts will be credited directly back into your CPF savings and SRS accounts.

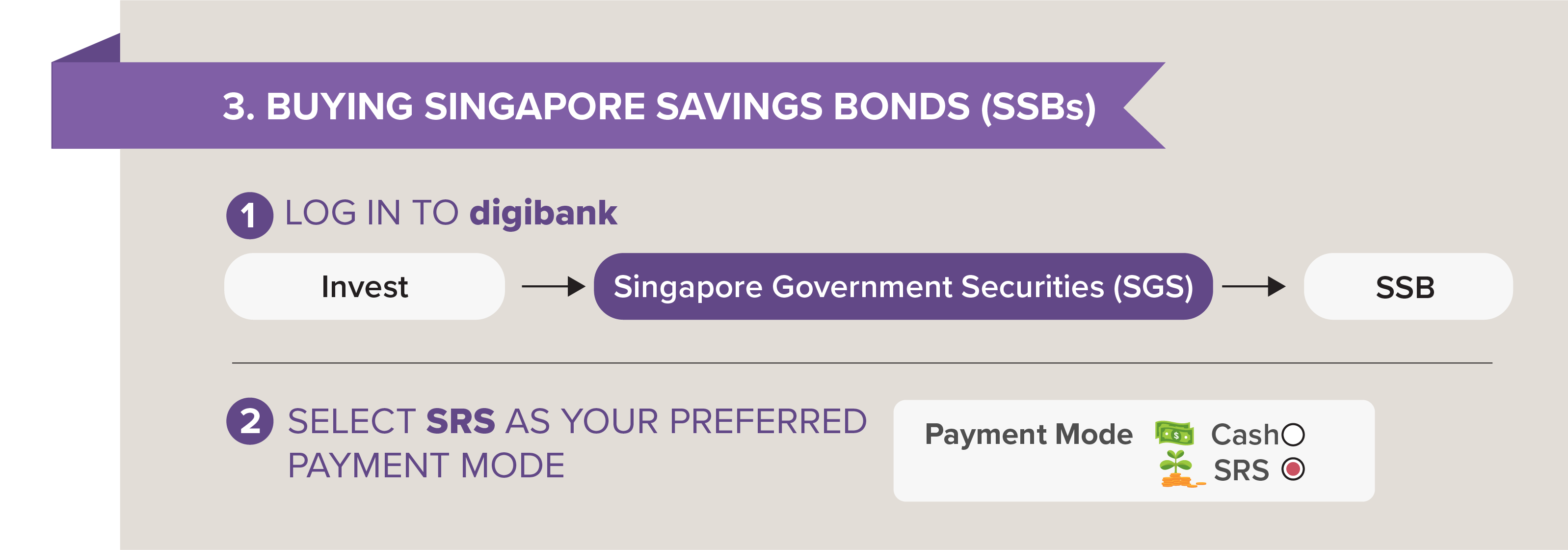

Buying Singapore Savings Bonds (SSBs)

You can only purchase SSBs with Cash and SRS monies. There is a transaction fee of S$2 for each SSB application and redemption request. All other fees and charges are waived.

The returns and interest payments you receive will be credited directly back into your SRS account.

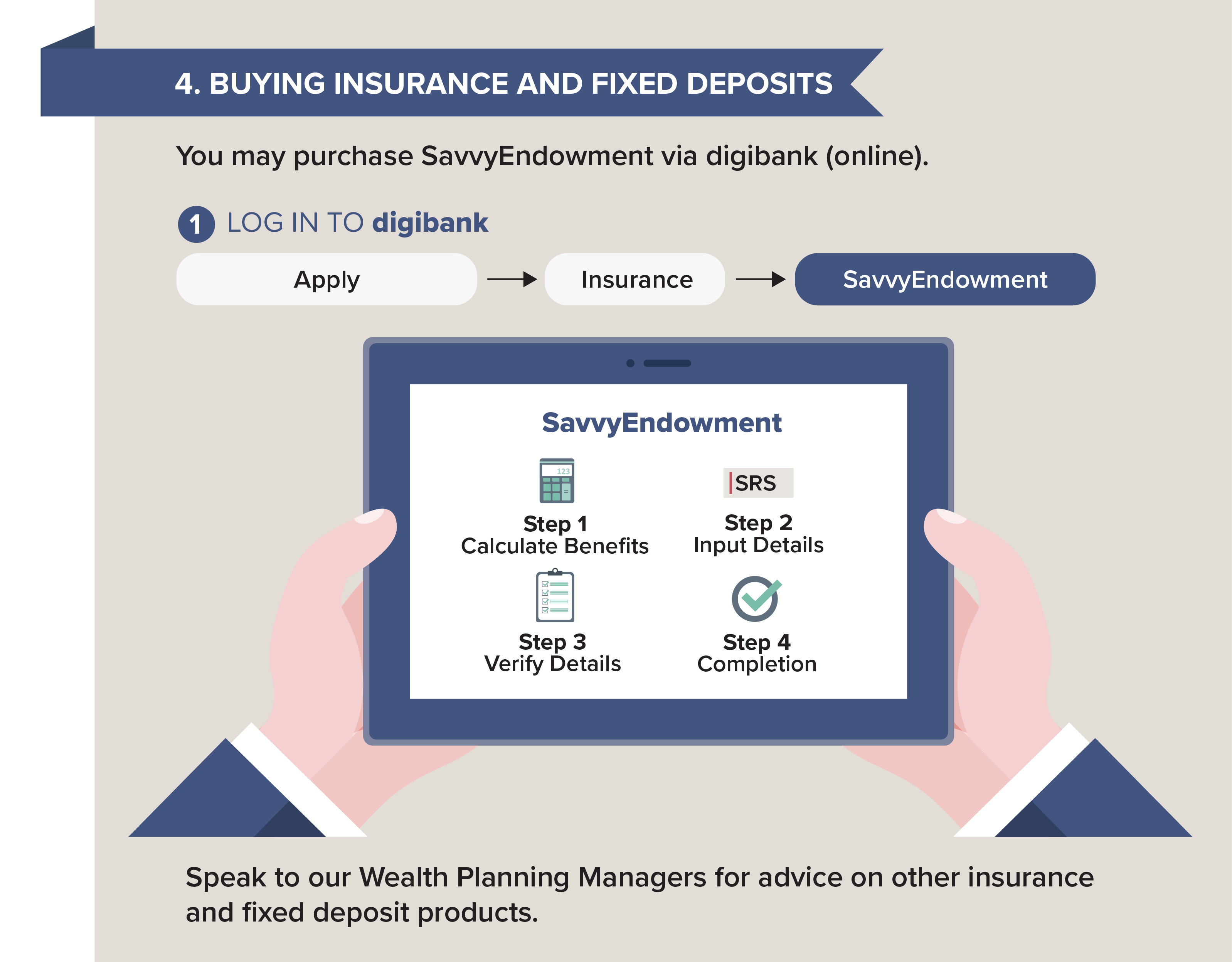

Buying insurance and fixed deposits

You can get single-premium insurance policies using your SRS monies, and investment-linked policies using your CPF monies. These can be purchased online via digiBank.

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Start planning for retirement by viewing your cashflow projection on Plan & Invest tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment.

Disclaimer for Investment and Life Insurance Products

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)