Low-risk ways to grow money with CPF

![]()

If you’ve only got a minute:

- Achieve higher returns on your CPF Ordinary Account (OA) savings by transferring them to your Special Account (SA).

- Invest your CPF and Supplementary Retirement Scheme (SRS) savings for potentially higher returns.

- Optimise and grow your money by investing and topping up your CPF and learn more about Voluntary Housing Refund (VHR) scheme, Matched Retirement Savings Scheme (MRSS) and Supplementary Retirement Scheme (SRS).

![]()

Investing has long been recognised as an effective way to grow wealth. It is especially important in an inflationary environment to invest so that the value of our money is not eroded. Yet, many continue to have doubts on how to start or are simply fearful of the risks involved.

Despite these challenges, there are ways to optimise and grow our money with CPF and still stay on the safer side of things. Here are 6 steps you can take.

1. Topping up your CPF

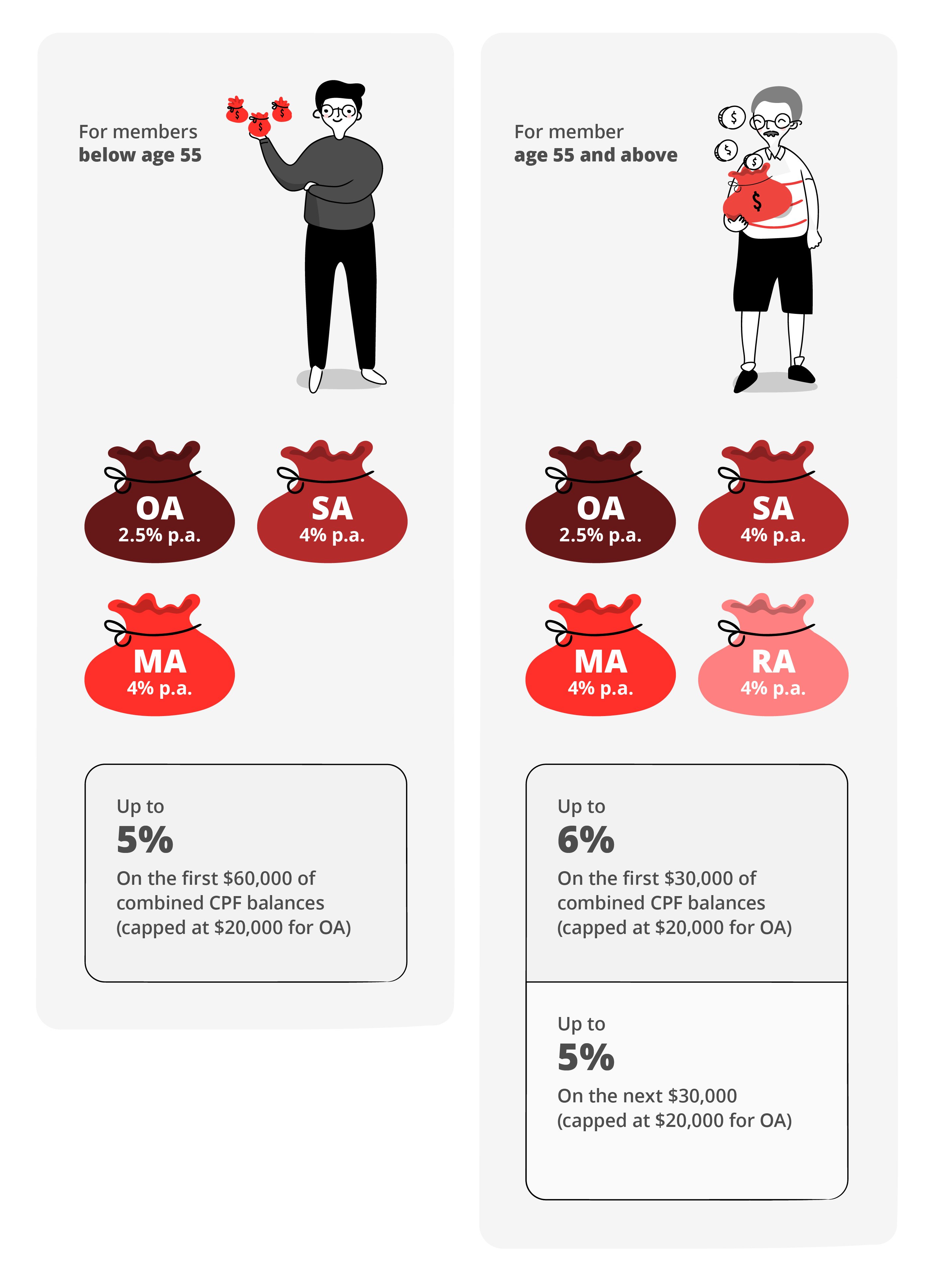

Your CPF monies in your Ordinary Account (OA) attract a risk-free interest of 2.5% p.a. while your CPF Special Account (SA) balance grows at a rate of 4% p.a. (4.01% from 1 Jul 2023 to 30 Sep 2023). You can also earn additional interest on the first S$60,000 of your combined CPF balances (up to 5% for those below age 55, and up to 6% for those above age 55). The difference of up to 2.5% between your OA and SA may seem little but it is significant when compounded over time. Since the SA interest is higher, it makes sense to park your money there if you have no need for your OA.

CPF transfer

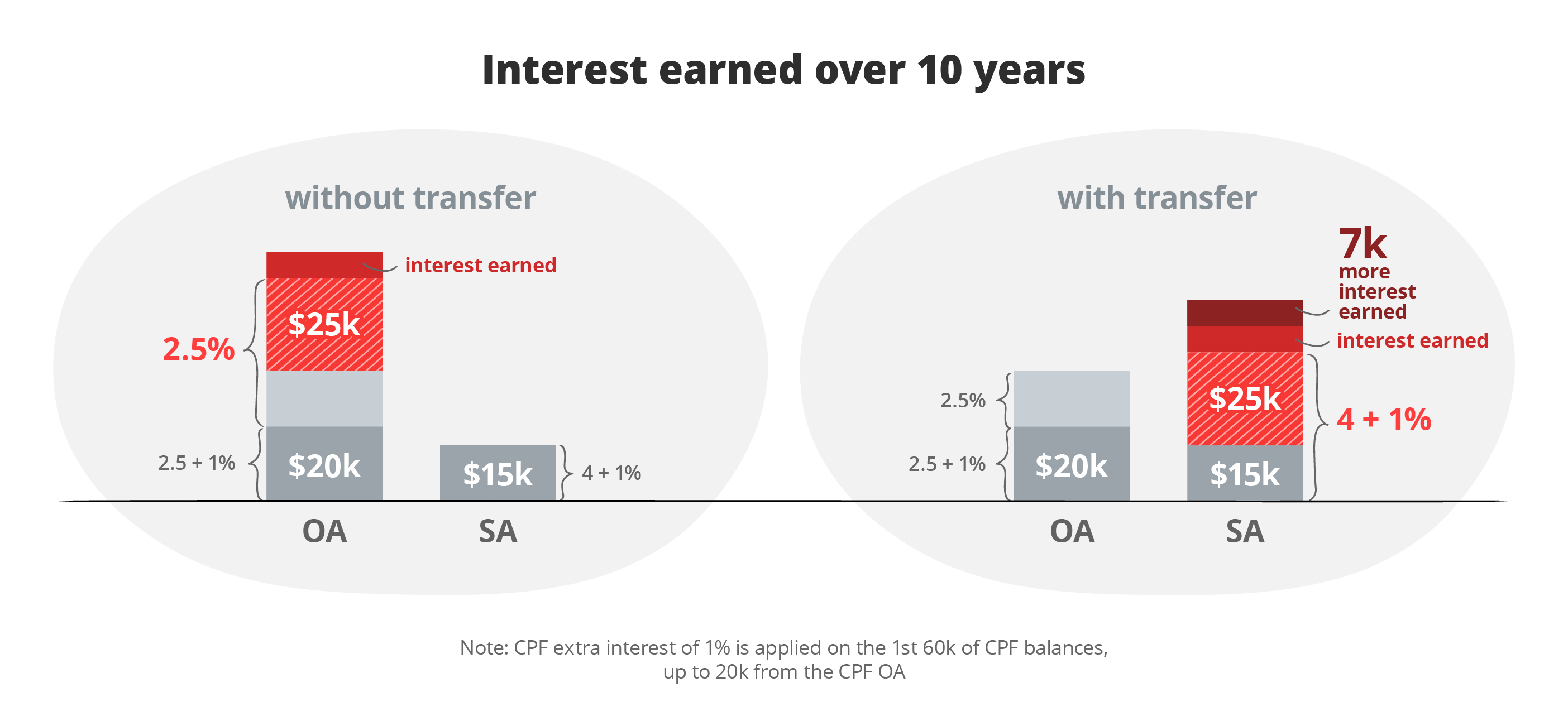

One way to achieve higher returns on your OA is by transferring your OA savings to your SA.

Here’s an example on the difference it will make

Prior to the transfer, do carefully assess your financial obligations because the transfer is irreversible. Unlike the savings in your OA, the funds in your SA cannot be utilised for housing or educational expenses. If you require the money in your OA to fund your home purchase or existing home loan repayments, this option may not be suitable for you.

Cash top-ups

Alternatively, if you have spare cash and sufficient liquidity, you can consider making cash top-ups to your CPF accounts to earn risk-free interest and build up your nest egg.

There are 2 types of top-ups you can make.

- Retirement Sum Topping-Up Scheme (RSTU)

The RSTU is meant to boost your CPF savings so that you will have higher monthly payouts under the Retirement Sum Scheme, or CPF LIFE once you reach your Payout Eligibility Age. You can top-up your SA - for those below age 55 - to the prevailing Full Retirement Sum (FRS) or your Retirement Account (RA) - for those age 55 and above to the prevailing Enhanced Retirement Sum (ERS).

Find out more: CPF LIFE or Retirement Sum Scheme?

- CPF Voluntary Contribution (VC)

While you may already be working and making mandatory monthly contributions to your CPF account, you can still boost your CPF savings with cash top-ups via the VC scheme – the “VC-3A” - to your 3 CPF accounts (Medisave Account (MA), OA and SA), subject to the CPF annual limit of S$37,740. These cash top-ups are particularly beneficial for freelancers as an effective way to compound and grow their savings over time.

It is important to note that both top-up methods are irreversible, and only cash top-ups qualify for tax relief.

Read more: 6 ways to optimise your CPF for retirement

2. Voluntary Housing Refund (VHR)

Since a considerable portion (20%) of your monthly salary is contributed to your CPF accounts, you may rely on your OA funds to finance housing expenses, such as the initial downpayment, stamp duties, legal fees as well as subsequent monthly home loan repayments.

If you decide to sell the house, you are required to refund the OA funds used for the property, along with the accrued interest of 2.5% p.a. This is the interest that you would have earned if the money had remained in your OA.

The VHR is a scheme that allows you to refund OA savings for housing in cash, even if you have no immediate plans to sell your home. Full or partial cash refunds can be made at any given point, up to the total principal amount that was withdrawn for the property plus the accrued interest. Refunding your OA can help you avoid a significant reduction in your sales proceeds in the future due to the substantial amount of accrued interest owed.

3. Matched Retirement Savings Scheme (MRSS)

If you’re looking to enhance your retirement savings, you may consider the MRSS. From 2021 to 2025, eligible CPF members can take advantage of this scheme to receive a matching government grant for every dollar of cash top-ups, up to S$600 annually.

You are eligible if you’re aged 55 to 70 with RA savings below the current Basic Retirement Sum (BRS), draw a monthly salary of less than S$4,000 and own no more than one property with an annual value of S$13,000 or less.

With estimated returns of up to 6% p.a., the MRSS offers an avenue to boost your retirement funds. Other than the dollar-for-dollar matching, the added bonus here is the tax relief you enjoy after making the top-ups.

4. Investing with CPF

Are you seeking to maximise the potential returns on your CPF monies and make them work harder? One option is to invest using your CPF savings. However, this only makes financial sense if you are confident of beating the guaranteed risk-free 2.5% p.a. (OA) and 4% p.a. (SA) interest provided by the CPF Board. For some, using CPF funds for investment purposes may present fewer psychological barriers than investing with cash savings, especially when liquidity is a concern.

CPF Investment Scheme (CPFIS)

The CPF Investment Scheme (CPFIS) consists of 2 separate schemes for the OA and SA savings, each with different requirements.

To be eligible, you must be at least 18 years old, not an undischarged bankrupt, and have an OA balance of minimally S$20,000 and/or SA balance with at least S$40,000. If you’re a new applicant, you are required to complete the CPFIS Self-Awareness Questionnaire (SAQ) to assess your suitability for investing under CPFIS.

Generally, OA offers more flexibility in terms of investment product choices, while SA has stricter limitations. For example, you can invest in shares, gold, bonds, mutual funds, real estate investment trusts (REITs), higher-risk ETFs and higher-risk unit trusts under CPFIS-OA. For CPFIS-SA, you will only be able to invest in less-risky products such as T-bills, Singapore Government bonds (SGS), endowment policies, annuities and lower-risk unit trusts and Investment Linked Policies (ILPs).

Read more: Investing with CPF and SRS

Should you invest your CPF funds?

The OA typically earns a lower interest rate compared to other investment options. For example, the cut-off yield for the 6-month Singapore T-bill (3 Aug) was 3.75% p.a., which easily triumphs the OA interest rate of 2.5%. By investing in higher-return assets, such as stocks or bonds, you can potentially achieve better long-term growth, outpace inflation, and preserve the value of your CPF monies.

If you are buying a HDB flat and taking up a HDB loan to finance your property purchase, investing your OA monies allows you to shield them from being fully withdrawn. For instance, one of the requirements is that you must utilise all your CPF-OA balances when you take up a HDB loan to finance your property purchase, leaving S$20,000 as a buffer to cover monthly mortgage instalments should you decide to take a break from work for a couple of years.

To keep a larger amount in your OA (for example, S$80,000), temporarily invest the additional amount (S$60,000) before the transaction and liquidate the investments (funds will be returned to you OA) once the transaction is completed. Since it’s a short investment period, it’s best to choose a product that is lower-risk, such as T-bills instead of higher-risk ETFs or unit trusts to avoid losses.

However, do bear in mind investing involves market fluctuations and the possibility of incurring losses and you may risk having to liquidate your investments during a market downturn should you require urgent access to your CPF funds. It is thus important to only invest your savings if you do not foresee using them in the near future.

Read more: Do more with your CPF

5. Supplementary Retirement Scheme (SRS)

The SRS is a voluntary savings scheme that offers tax savings and complements your CPF savings for retirement. You can contribute any amount, as many times as you wish throughout the year to a cap of S$15,300 for Singaporeans and Permanent Residents (PRs), and S$35,700 for foreigners.

Every dollar you contribute to your SRS account is eligible for tax relief (subject to a yearly total relief cap of S$80,000). This helps to reduce your taxable income and maximise tax savings.

It’s worth noting that leaving your contributions in your SRS account only earns 0.05% p.a., comparable to rates offered by banks for savings accounts. Consider investing your SRS monies to potentially reap higher returns. For those who are risk-averse, they can consider safer instruments like fixed deposits, insurance plans, T-bills, Singapore Savings Bonds and short duration investment grade bond funds.

Find out more: Why and where to invest your SRS savings

Carefully assess your personal financial circumstances to ensure that your SRS contributions are savings that you can commit to for the long term. This is because there is a 5% withdrawal penalty if you start withdrawals before the penalty-free withdrawal period.

Grow your money to beat inflation and longevity risks

In today’s high inflation environment, it is important to safeguard the value of our money and not let it idle in a plain vanilla savings account. With increasing life expectancy and medical advancement, the chances of us outliving our savings are greater too. To mitigate these risks, it is essential to pursue certain investing strategies to make our money work harder so as to achieve financial security in the long term.

There are many ways to grow your money and it does not always require investing in high-risk products. Start maximising the growth of your CPF monies and surplus savings today. Meanwhile, continue to empower yourself with financial knowledge so that your confidence in the area of investing will be enhanced over time and you can make informed decisions and take on more investing risks if necessary and when you are ready.

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)