The importance of Estate Planning

By Lorna Tan

![]()

If you’ve only got a minute:

- Estate planning helps to ensure that the people you love get what you wish to give them efficiently.

- There are 6 common estate planning tools in Singapore and they are: Will, CPF nomination, insurance nomination, Lasting Power of Attorney, Trust, Advance Medical Directive.

![]()

Whether you are a millionaire or not, it’s important to have things set in place while you are in control of your finances and have a lucid mind.

Firstly, you’ll feel better knowing that you have done what you can to ensure that your loved ones will be cared for. Secondly, once your estate plan is set up, it’s easier to review it and make changes along the way.

That’s why estate planning is for everyone – not just the rich.

Estate planning is about setting out how you want your estate (or your assets) to be managed and transferred.

To get started, make a list of all your assets. This includes your properties, bank accounts, Central Provident Fund (CPF) savings, investments, insurance plans, artwork, jewellery, antiques, and anything of monetary value. Be sure to update the list regularly.

You should also consider your liabilities, which include everything that you owe, such as property and car loans, credit card debts, and so on. The net value of your estate takes into account your assets, liabilities, fees and expenses, and the nature of ownership (for owned property).

Here are 6 common estate planning tools in Singapore.

Will

A will enables the efficient distribution and management of your estate, which includes your assets. It takes effect after your death.

You might wonder: Why write a Will when you can simply relay your wishes to your loved ones?

Well, the main benefits are that it provides clarity and prevents unnecessary delays in the transfer of your estate. A Will is a legally binding document that lets you state in certain terms how and to whom you wish to distribute your assets to.

This will not only prevent misinterpretation but also reduces stress for your family at a difficult time. If you do not have a Will, Singapore’s intestacy laws (or for Muslims, Islamic inheritance law) will determine who gets what. The asset distribution may then not be aligned to your wishes, and the settlement could be a long-drawn process.

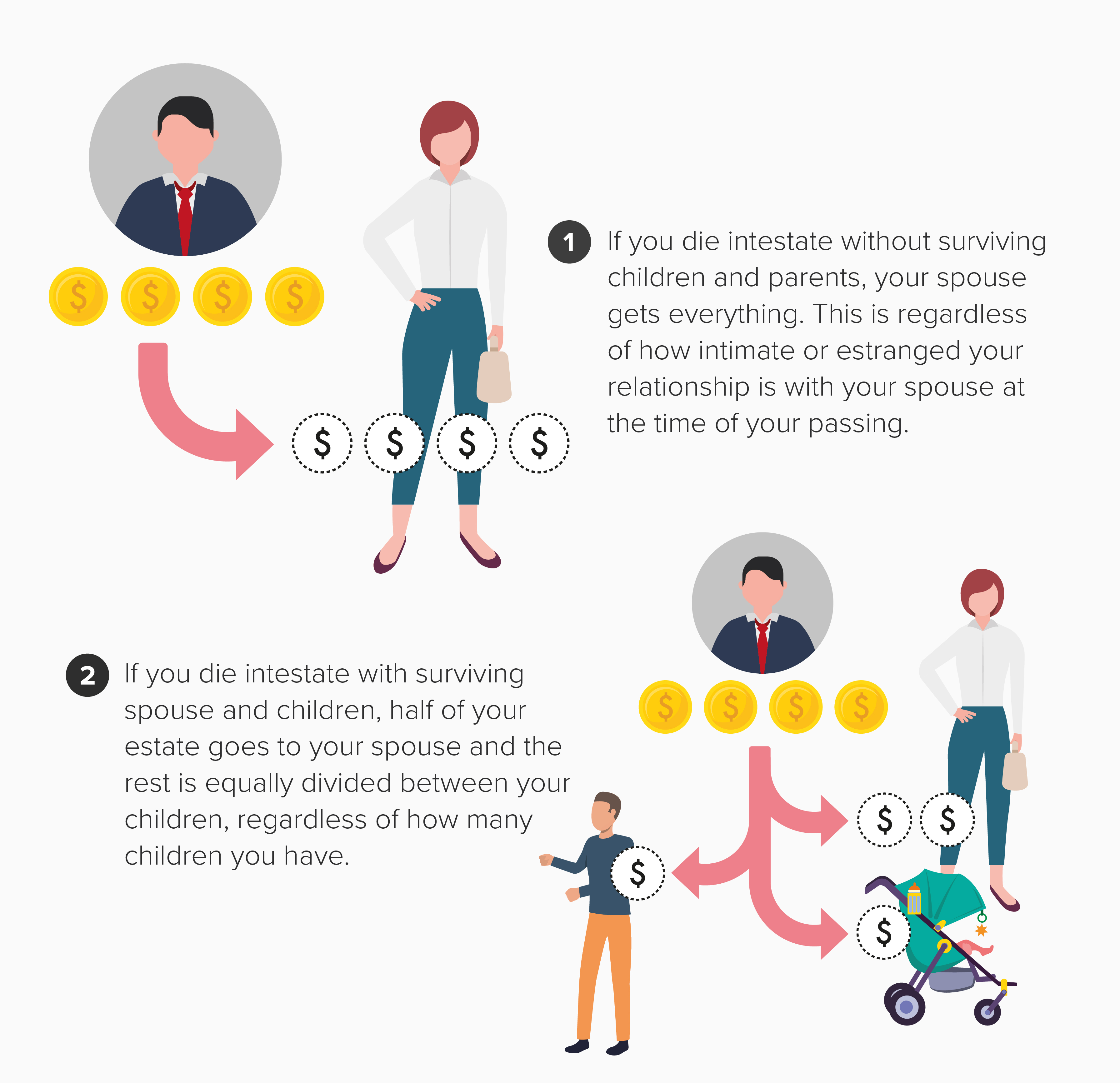

Here are two examples of what happens if you do not have a Will:

When writing a Will, the key decisions include things like:

- Who to distribute your assets to;

- In what proportion; and

- Who will ensure your wishes are carried out (executors and trustees)

You can approach a lawyer to help you draft a Will or you can use an online Will writing service.

Think through these in detail:

-

Decide who gets what and how much

Make a list of beneficiaries, that is, the people (or even charities) receiving your estate. Next, decide what and how much to allocate to each beneficiary. You might wish to distribute your estate by proportion or allocate specific assets.In planning how to distribute your assets, think about how you wish them to be used. You might, for instance, want your home to be kept for your spouse’s use, instead of being sold off. Or you might want to dedicate some money for a child’s university education, and a separate amount for supporting an elderly parent. These intentions will guide you in the decision-making process.

-

Decide who will care for your dependants

Is there someone you trust to handle your assets on your behalf?If you have a child aged under 21 years, you should appoint a legal guardian. for him/her in your Will to ensure your little one will be under good and responsible care.

If you’re single, you may wish to ensure that your parents, siblings and/or pets will be cared for.

You should review your Will regularly, especially when your life status changes. For example, did you know that marriage revokes a Will that you made while you were single? However, having children and even having a divorce have no effect on the validity of the will.

Changes can be made at any time, as long as you have the mental capacity to do so.

Central Provident Fund (CPF) nomination

Even if you already have a Will, you will need a CPF nomination as CPF savings cannot be distributed via a Will. Furthermore, you will likely have specific people or charities that you want to bequeath your CPF savings to. In addition, there’s lesser administrative delay, and your estate can avoid paying a fee to the Public Trustee’s Office for administering un-nominated CPF money.

To make a nomination, simply fill in a CPF nomination form and submit it online, or in person at any CPF Service Centre.

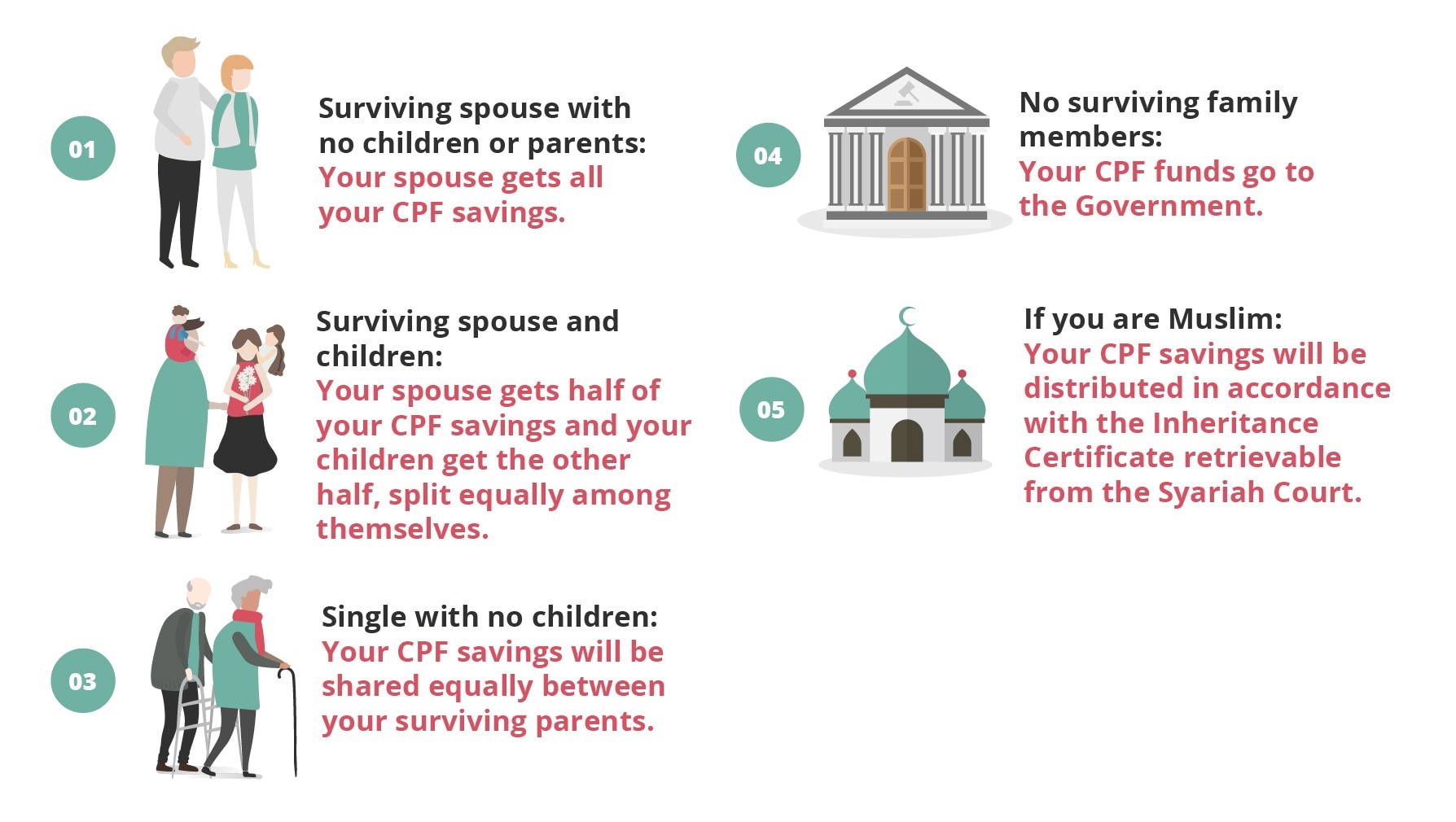

If you do not have a CPF nomination, your savings will be distributed according to Singapore’s intestacy Laws (or Islamic inheritance law). Here’s what it could look like:

When making a CPF nomination, the key decisions include things like:

- Who to distribute your CPF savings to;

- In what proportion; and

- How your beneficiaries should receive the funds (known as the Nomination Payment Options):

- Default setting: One-time cash payout.

By default, your beneficiaries will receive the CPF funds in cash, through cheque or GIRO. The funds will be paid at one go. - Via CPF account

If you opt for the Enhanced Nomination Scheme (ENS), your beneficiaries receive your CPF funds via their own CPF accounts. - Monthly payouts

If you have children with special needs, consider opting for the Special Needs Savings Scheme (SNSS), which pays out the CPF savings every month.

- Default setting: One-time cash payout.

As with a Will, review your CPF nomination regularly, especially when your life status changes. For instance, getting married invalidates the CPF nomination that you made while you were single. However, getting divorced has no effect on the validity of the CPF nomination as you may still wish to provide for your former spouse and children.

You can update your CPF nomination at any time, so long as you have the mental capacity to do so. Here are some reasons to make a new CPF nomination:

- One of your nominees passes away

- You get married, divorced or remarried

- You have children after your nomination was made

- You wish to add a new nominee

Insurance Nomination

In this unpredictable world that we live in, there are many reasons to protect against life’s unannounced curveballs. Insurance acts as a financial safety net and keeps your loved ones from inheriting a pile of bills and debts should anything happen to you.

It is not compulsory for policyowners to make insurance nominations, especially if they have already made a Will to distribute their estate. Still, insurance nomination offers an avenue to distribute your policy proceeds to your loved ones according to your wishes. This may come in handy especially if there are delays in the probate process for your Will.

Under the Insurance Nomination law, policyowners of life policies or accident and health insurance plans with death benefits are given 2 options. As a policyowner, you can opt to make a trust (irrevocable) nomination or a revocable nomination.

For the former, the policyowner loses all rights to the ownership of the policy and it can only be revoked with the consent of all nominees. This form of nomination can be a useful avenue if you wish to protect your estate from falling into the hands of your creditors. For trust nomination, only your spouse and children can be nominated as beneficiaries. In the case of a revocable nomination, the policyowner is free to change, add or remove nominees without their consent.

Lasting Power of Attorney (LPA)

An LPA is drawn up to appoint people (donee) entrusted to look after you (the donor) and make decisions on your behalf, at a time when you lose mental capacity. Caregiving has two aspects - personal welfare and property, and financial affairs.

There is no automatic "right" for families to manage their loved one's affairs, even if they have their best interests at heart. Without a LPA, some families may get caught up in unnecessary and lengthy court proceedings to gain control of accounts and assets including insurance proceeds.

A LPA also helps protect your estate from being squandered away by irresponsible caregivers, if you suffer from mental incapacity. As such, it goes hand in hand with setting up a Will which takes effect upon death.

In order for a LPA to be valid, it must be registered by the Office of the Public Guardian (OPG). Do note that the OPG has extended the LPA Form 1 application fee waiver for Singapore citizens to 31 March 2026. This is to encourage more Singaporeans to plan ahead and apply for a LPA.

Trust

A trust serves to protect family assets that might otherwise go to beneficiaries too young to get substantial inheritances, or who are spendthrifts, financially immature or vulnerable.

The ultimate distributions to them should be delayed for a certain time to ensure they get their inheritance when they reach a certain age or maturity.

Advance Medical Directive (AMD)

An AMD expresses your intention that no extraordinary life-sustaining treatment should be applied if you suffer from a terminal illness and become unconscious or incapable of exercising rational judgment.

By doing so, your family members will not be burdened to make a decision that could create an immense amount of guilt and avoid incurring financial burdens from life-preserving treatments.

Look ahead confidently

Estate planning is ultimately about ensuring that the people you love get what you wish to give them efficiently. If you’re not sure how to evaluate your assets, seek help from a financial advisor.

You may not be a millionaire. But no matter what postal code you stay at, it is important to have things set in place.

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)