![]()

If you’ve only got a minute:

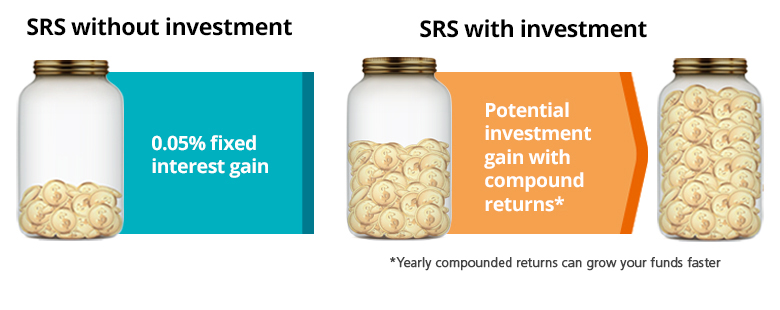

- Idle SRS accounts risk losing value. Leaving money in a SRS account with its low-interest rate of 0.05% per annum can result in diminished purchasing power due to inflation over time.

- To combat inflation and maximise returns, consider investing your SRS funds in various assets such as bonds, stocks, unit trusts, or even fixed deposits.

- To optimise the benefits of a SRS account, careful planning of withdrawals is essential. Only 50% of post-retirement withdrawals are taxable.

![]()

Setting up a Supplementary Retirement Scheme (SRS) account may play an important part in your retirement planning. That’s partly because of the tax relief that the voluntary contributions attract. However, if you stopped at opening the account, you may be selling yourself short. That’s because money that is left in the SRS account only earns 0.05% per annum.

Here’s a guide on how you can let your SRS account work harder for you.

(Not quite sure what SRS is about? Read our ‘Guide to SRS accounts’.)

Why you shouldn’t leave your SRS account idle

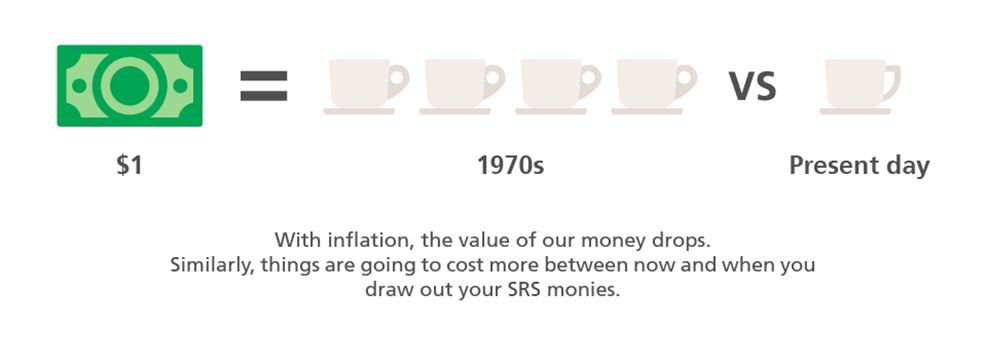

With inflation, the value of your money drops. In the 1970s, a dollar could buy you 4 cups of coffee. These days, you will struggle to buy even 1 cup. Similarly, things are going to cost more at the time when you withdraw your SRS monies.

According to SRS statistics as at end December 2024, 19% of total SRS contributions (S$3.91 billion) remained as idle cash.

Unlike CPF funds which earn 2.5% interest per annum, the interest rate on SRS funds is fixed at 0.05% per annum. It’s probably not such a great idea to just maintain your retirement savings and save for rainy days ahead. This is especially so if you have a long-term horizon ahead before you start withdrawing your SRS funds penalty-free at age 62 or 63 depending on the statutory retirement age when you made their first SRS deposit.

Thus, it’s crucial that you invest your funds to stay ahead of inflation and enjoy the benefits of compounding over time.

7 ways to maximise your SRS monies

There are many investment products that you can explore. Simply take your pick from the range below:

|

|

For the more conservative investor, you may wish to consider Singapore Government Securities or single premium insurance products, where the overall risks are relatively lower. Even placing funds in a fixed deposit and earning 1.40%-a-year interest could turn out to be a better option than letting your contributions sit idle.

For more diverse investments, you can consider Unit Trusts, Exchange Traded Funds or REITs. As all investments carry an inherent risk, you should be prudent about what to invest or you can seek professional advice.

And if you need to see some projections, use the SRS calculator to gauge your expected returns through the years, and check how much tax savings you can enjoy when you regularly contribute to the account.

How to start investing with your SRS

It is easy to invest with your SRS money, but first you need to be clear about what you want to invest in.

Familiarise yourself with basic investment concepts, such as risks vs returns; simple financial ratios; passive vs active investing; and diversification. A good financial advisor will be able to explain them to you and help work out your risk profile.

Consider fees which may come with the investment as different banks/firms may charge different brokerage and transaction fees, or offer different incentives and promotions. Should you choose to invest in stocks using your SRS account contributions, you can do so through a DBS Vickers account.

Finally, know that all profits made from investing your SRS contributions will return to your SRS account.

Unsure how to grow your SRS funds? Try the digiWealth in digibank to get personalised recommendations for your needs.

You can now earn higher interest rates when you invest or insure through DBS/POSB with your CPF Investment/SRS Account. Dividends count too!

Check out how DBS Multiplier makes it easier for you to multiply your money.

Striking the right balance between SRS contributions and your earned income

While it is wise not to let your SRS money lay stagnant, understand that contributing to your SRS account is a regular, stretched-out process and there are other priorities you may want to consider, such as saving on taxes.

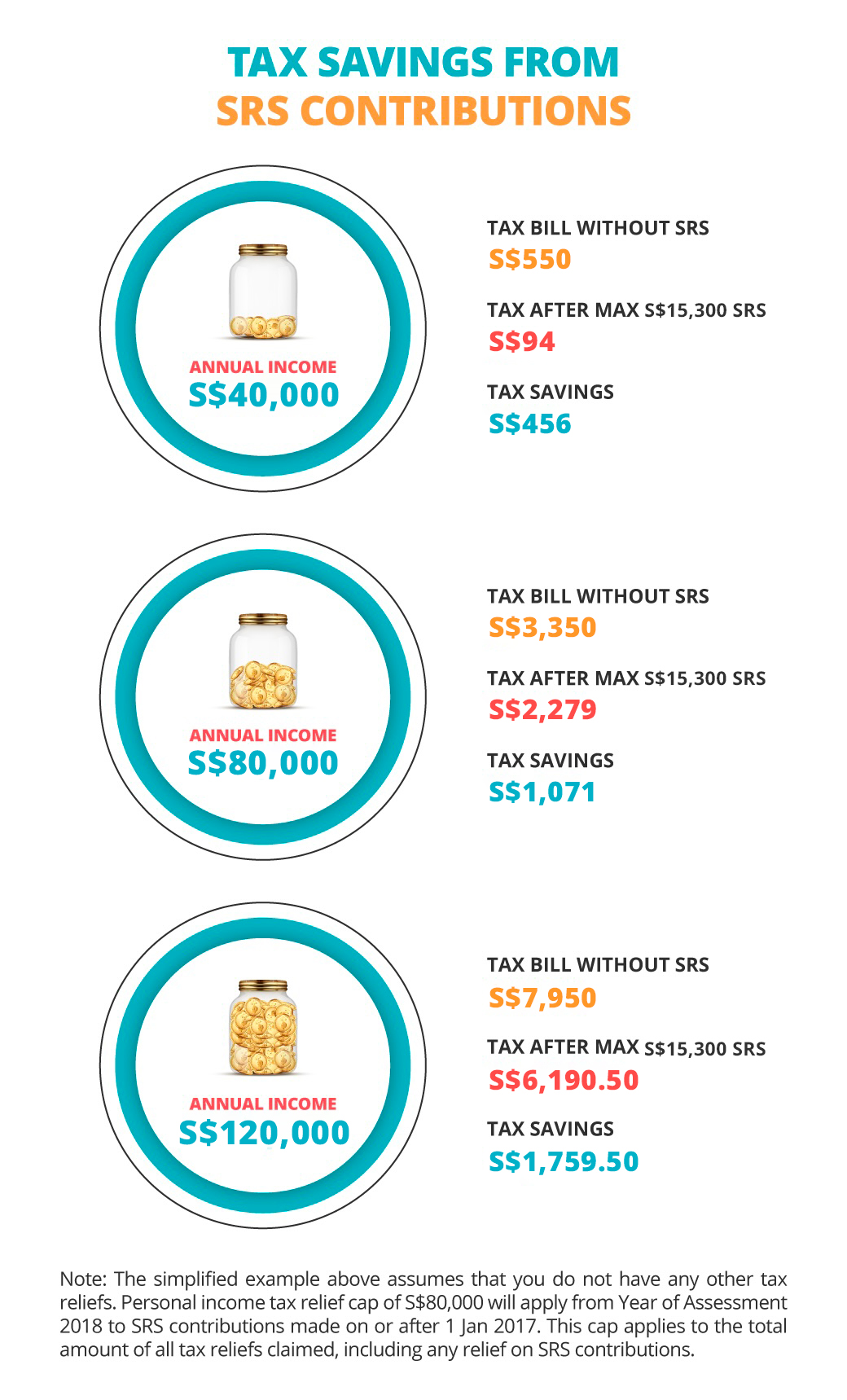

It is important to strike a balance between how much you earn (and tax paid), and how much you put into your SRS account. To do so, it helps to know your tax bracket, as Singapore’s system of tax is progressive.

If you fall into the higher income brackets, the tax reduction from maxing out the SRS contribution for the year can be significant. (The maximum contribution allowed by Singapore citizens / Permanent Residents is S$15,300, and foreigners can contribute up to S$35,700 a year.)

For example:

Knowing when to withdraw

Another consideration when it comes to maximising the benefits of your SRS account is the time of withdrawal.

Only 50% of withdrawals (post statutory retirement age) are taxable, so to reduce your tax burden, carefully plan your withdrawals. For example, for a Singapore Resident:

- If you withdraw S$40,000 per annum, 50% of that amount (S$20,000) will be taxable each year.

- Should you have no other source of taxable income, you will not be liable for any income tax (first S$20,000 of total annual income is tax-exempted).

Withdrawals are penalty-free only if they take place on or after the statutory retirement age that was prevailing at the time of your first SRS contribution. The current retirement age is 63 and will be raised to 64 from 1 July 2026. You can make withdrawals from your SRS account over 10 years from the date of your first penalty-free withdrawal.

If you have already opened an SRS account and made your first contribution, any subsequent change in the statutory retirement age (e.g. up to age 65) will not affect you.