A Premier Income Account (PIA) is a Singapore Dollar Fixed Deposit account for those 55 years or older, with a minimum deposit of SGD10,000 per placement.

Please note that this is only applicable for Singapore Dollars Fixed Deposit.

PIA Features & Benefits

- Choice of tenors from 6 months

- Earn additional 0.10% p.a. interest*, on top of the prevailing board rate for your deposits

- Automatic renewals: Upon maturity, your deposit will be automatically renewed for the same tenor at the prevailing interest rate.

*Rates are subject to change without prior notice

Total Balance refers to the total amount of all placements in an SGD Fixed Deposit (FD) account. The amount includes all new and existing placements/renewals.

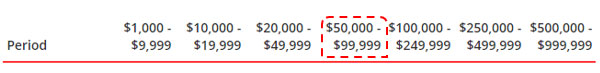

With the new S$30,000 placement, the total FD account balance will be S$50,000 (S$20,000 + S$30,000). Hence, interest rate corresponding to the $50,000 - $99,999 range will apply. Learn More

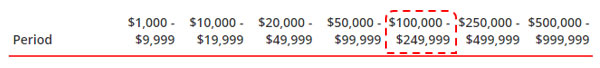

The total FD account balance is S$100,000 (S$30,000 + S$70,000). Hence, interest rate corresponding to the $100,000 - $249,999 range will apply.

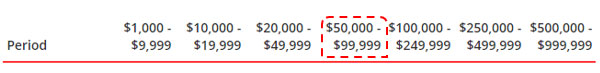

The placements are in different SGD FD accounts. Hence, interest rate corresponding to the $50,000 - $99,999 range will apply for each renewal.

Yes, you may select one of the following maturity instructions:

- Renew the principal and interest amounts;

- Withdraw the principal and interest amounts; or

- Renew the principal amount and withdraw the interest.

Yes, you can. However, you may earn less or no interest if you withdraw your fixed deposit before maturity. An early withdrawal fee may also be imposed. Learn More

You may perform a SGD FD withdrawal via digibank online. You will be able to check the interest received and the early withdrawal fee (upon premature withdrawal) during your withdrawal request via digibank online.

Foreign Currency Fixed Deposit, SRS SGD Fixed Deposit and SGD Structured Deposit accounts are not eligible for withdrawal via digibank online.

Learn moreAn early withdrawal fee may be imposed. Also, you may earn less or no interest if you withdraw your fixed deposit before maturity. Learn More

We will close your account if the balance remains zero for 12 months.

You can refer to our foreign exchange rates here.

For personal account, only the administrator or executor of your estate can make a claim on your account. Upon receiving notification of your death, the existing maturity instructions (e.g. credit to Savings account) given previously will no longer be valid. Upon maturity, the Fixed Deposit (principal and interest) will be automatically renewed for the same tenor at the prevailing interest rate. If your Fixed Deposit Account is a joint account, the surviving account holder can claim the money in the account.

We are working on creating that seamless one-glance option for you and will keep you updated.

In view of the rise in scam volume over the years, we have reviewed our Fixed Deposits feature to help you safeguard your assets with us. From 02 September 2024, all Fixed Deposit placements done over the counter will automatically be placed under digiVault protection, unless you inform us otherwise at the point of transaction. This is as an added layer of security against scammers by preventing unauthorised digital withdrawals from your Fixed Deposit placements during your tenor.