DBS Cashline

Promotions

Frequently Asked Questions

| DBS Cashline | Personal Loan | |

|---|---|---|

| Description | DBS Cashline is a personal line of credit for your short-term borrowing needs. Think of it as a standby stash of cash. | Personal loans however, are long-term loans spanning anywhere from 1-5 years. |

| Repayment | Repaying your DBS Cashline amount is flexible. Repay it in days, weeks or months. There is only a minimum monthly repayment of 2.5% of your outstanding amount or S$50, whichever is higher. | Personal Loans offer a fixed monthly repayment plan ranging from 1-5 years. |

| Interest/Fee | Interest is accrued daily at 22.9% p.a. (or 0.07% per day) with no processing fee. | Fixed interest is charged upfront over your loan tenure. From 3.88% p.a. + 1% processing fee (E.I.R 7.56% p.a.) |

| Cashline | Cash Advance | |

|---|---|---|

| Description | DBS Cashline is a personal line of credit for your short-term borrowing needs. Think of it as a standby stash of cash. | Cash Advance is a feature on your credit card that offers funds up to your available credit card limit. |

| Interest/Fee | Interest is accrued daily at 22.9% p.a. (or 0.07% per day) with no processing fee. | Interest is accrued daily at 28% p.a. (or 0.07% per day) plus a 8% upfront processing fee on the amount withdrawn. |

Interest will be calculated on a daily basis by multiplying the outstanding balance at the prevailing interest rate applicable to you and dividing it by 365/366 (in a leap year). Interest is subjected to a minimum charge of S$10.00.

For example: You made a withdrawal from your DBS Cashline account S$5,000 for 30 calendar days.

DBS Cashline withdrawal: S$5,000

Interest for 30 days: (30/365) x 22.9% p.a. x S$5,000 = S$94.10

The following functions can be performed. Refer to Guide.

- Fund transfer

- Bill payment

- Top up DBS Cashline

- GIRO setup for Cashline repayments

Skip the queue and enjoy a smooth repayment experience. Repayments made are instantly reflected in your DBS Cashline account when you use:

- DBS digibank online

- DBS digibank app

Other repayment options (requires 1 – 3 working days for processing):

- Using AXS

- AXS Station – self-service kiosks

- AXS QuickBill – over-the-counter at Cheers & Fairprice Xpress stores

- AXS e-Station – online at www.axs.com.sg

- AXS m-Station – mobile app on IOS & Android

- Using our DBS/POSB ATMs

- Cash Repayment at DBS/POSB branches

How do I apply for DBS Cashline after I click “Apply Now”?

You can apply for DBS Cashline in 3 ways:

- iBanking Login: Input your iBanking username and password to apply for DBS Cashline.

- Debit/ATM Card PIN: Input your Debit or ATM Card Number along with the PIN number you use at your ATM. Please select ‘Credit Card’ if you only have a Personal Credit Card.

- If you are new to DBS: Select ‘I have none of the above’ and proceed to fill up the form.

Can I access my DBS Cashline account instantly?

For existing DBS/POSB customers, if your salary is currently credited to a DBS/POSB deposit account, you can enjoy Straight Through Processing. Once approved, your DBS Cashline account is active and accessible immediately.

My DBS Cashline account is approved. Can I drawdown the cash straight away from my DBS Cashline account?

Yes, once your DBS Cashline account is approved, you can drawdown cash and perform other financial transactions through DBS Cashline.

How much can I use through my DBS Cashline?

Feel free to use up to your available credit limit in your account. When you’ve repaid your borrowed amount back into the account, your credit limit will be restored to the original amount.

How much do I have to pay back?

You only need to repay the monthly minimum payment of 2.5% of the outstanding balance or S$50, whichever is higher, plus any overlimit or overdue amount.

How do I know when and how much to pay?

Your DBS Cashline monthly statement of account will inform you of your minimum payment due as well as your due date. The monthly statement of account will detail all your withdrawals and deposits within one month from the statement date.

How can I apply for a credit limit review?

To apply, please complete the DBS Cashline Credit Limit Review Form, print, sign and mail (or fax) the application form to us with the mandatory income documents.

What is CashCare Protector?

CashCare Protector is an optional credit life protection insurance underwritten by Manulife (Singapore) Pte Ltd. It pays off the outstanding balance on your DBS Cashline account up to S$100,000 in the event of diagnosis of critical or early cancer**, terminal illness, death or total permanent disability. For death due to accident, the amount doubles to a maximum of S$200,000.

** This plan does not cover pre-existing medical conditions. A waiting period of 90 days applies for claim of critical or early cancer benefit.When will an interest adjustment be added to your account?

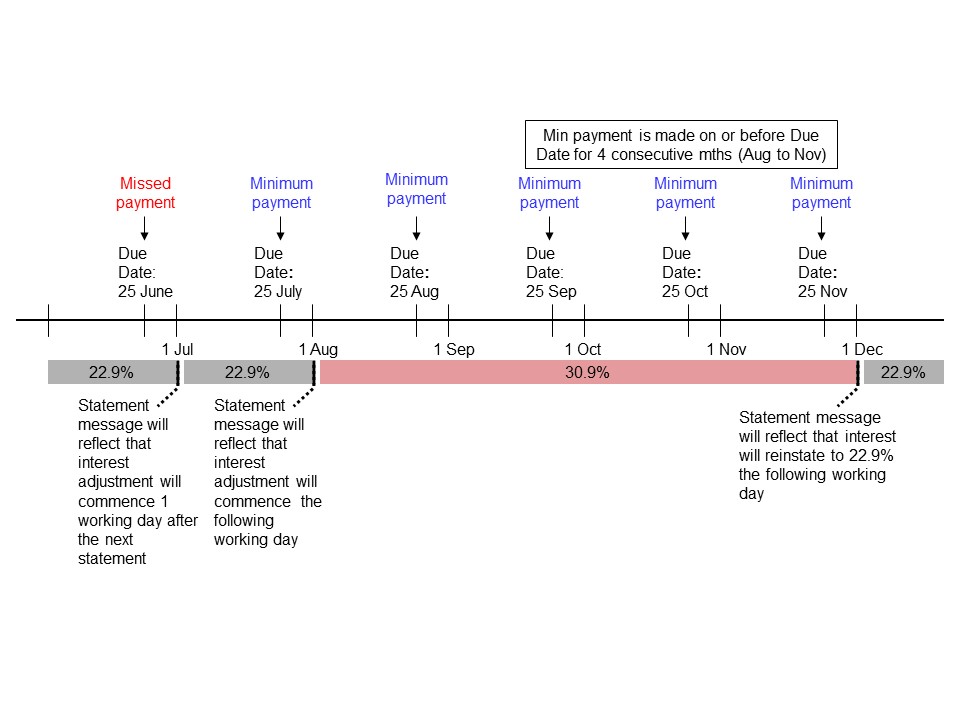

If the Bank does not receive the required minimum payment by its due date (for example, due date on 25 June as illustrated in the example below), the interest rate applicable to your DBS Cashline account will be increased by 8% p.a. on top of the Prevailing Interest Rate (“Increased Interest Rate”). This Increased Interest Rate shall be applied to the outstanding balance in your DBS Cashline account from the first working day after the date of the subsequent DBS Cashline account statement following your DBS Cashline account statement (i.e. August’s statement) and used to compute the finance charges applicable to your DBS Cashline account.

This additional interest rate shall be applied even if minimum payment is received by the Bank on or before the due date of the following month (i.e. in July).

In the event that the minimum payments are made in full on or before their respective due dates for 4 consecutive months (i.e. for August, September, October and November statements), the Increased Interest Rate shall be reinstated to the Prevailing Interest Rate on the first working day after your next Statement Date (i.e. December’s statement).Example:

Click here for a larger image.

Note: In this example, the Prevailing Interest Rate is assumed to be 22.9% p.a.