By Navin Sregantan

![]()

If you’ve only got a minute:

- Reits are a cost-effective way for retail investors to diversify their portfolio to include non-residential property holdings.

- The mandate for Singapore Reits requires 90% of profits to be paid back to investors, making them an attractive dividend investment.

- Before investing in a Reit, check out the quality of its property portfolio, income characteristics, and economic conditions.

![]()

For many in land-scarce Singapore, an investment property remains a highly coveted asset. Older generations have long seen the value in acquiring real estate, benefiting from rental income, and leveraging it for capital gains or legacy planning.

However, the property cooling measures such as increased Buyer's Stamp Duty (BSD) and Additional Buyer's Stamp Duty (ABSD), have made direct property ownership, particularly for multiple residential units, more expensive and harder to attain.

The substantial upfront outlay and ongoing duties can significantly erode potential returns, making this traditional path challenging for aspiring property investors.

According to a DBS research paper, for every S$100 invested in a first private property between Q1 2009 and Q1 2021, an investor would have seen returns of about S$399. An equivalent S$100 investment in an HDB flat would have returned about S$339, while purchasing a second private property would have yielded considerably less, at S$209 for every S$100 invested.¹

While these returns are respectable, another property-related asset class, Real Estate Investment Trusts (Reits), delivered better returns during the same period. For every S$100 invested in Singapore-listed Reits (S-Reits), investors would have would have yielded about S$486.¹

What are Reits and how do they work?

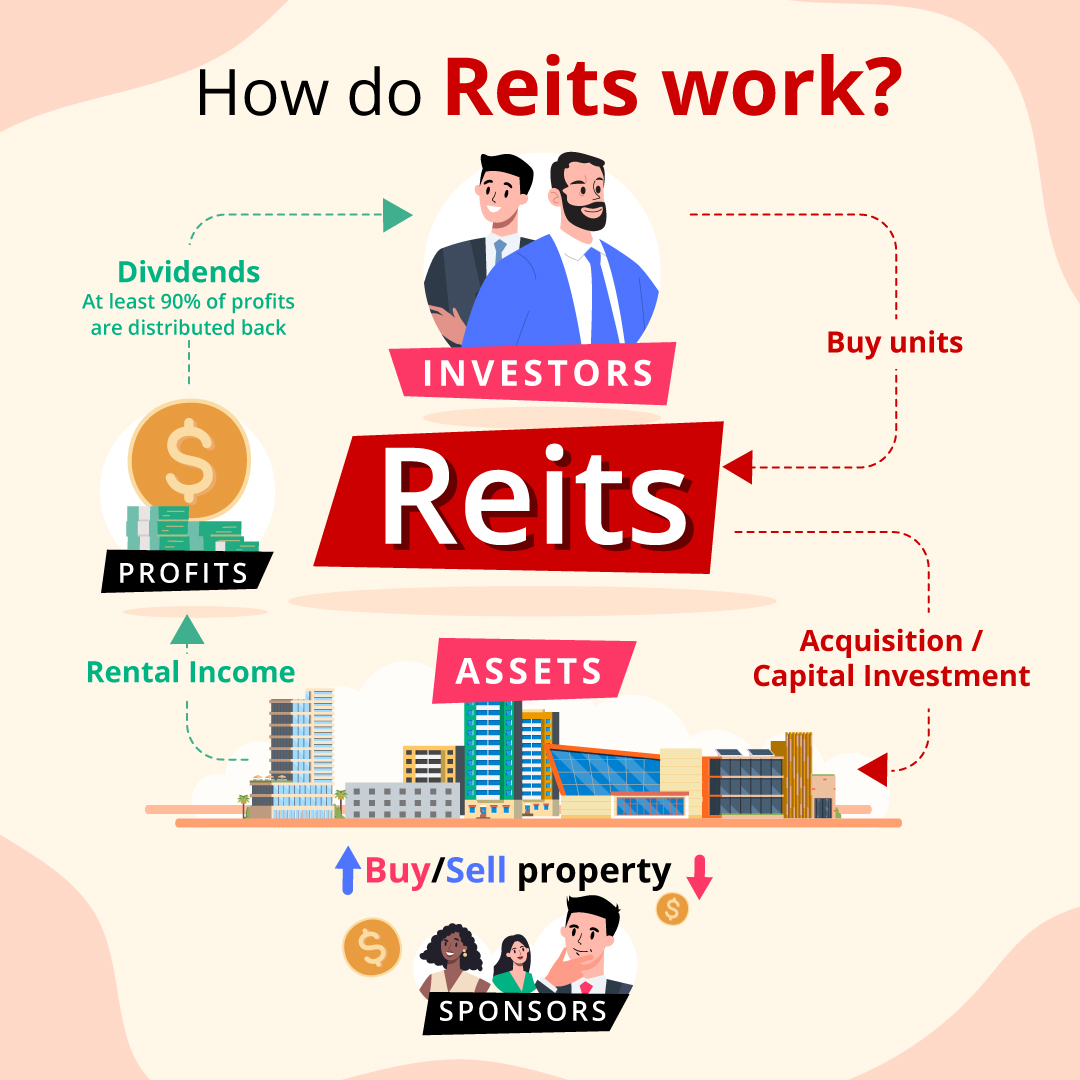

At its core, a Reit operates by pooling capital from many investors to acquire and manage a portfolio of income-generating real estate like office buildings, shopping malls, warehouses, healthcare facilities, hotels, and more recently, data centres.

The primary objective of Reits is to generate a healthy level of income distribution and foster long-term unit price appreciation for investors.

Revenue is primarily derived from rental income collected from tenants – whether individuals, small businesses, or large corporations – that lease the Reit's properties. This income is then distributed to unitholders at regular intervals, often biannually, making Reits particularly attractive for income-focused investors.

Reits offer a convenient way to pool capital and gain exposure to properties both locally and globally, without the significant capital outlay, financing complexities, or direct management responsibilities of owning physical real estate.

For instance, if an S-Reit’s unit price is S$2, the minimum investment of 100 units would require an investment of just S$200 (excluding brokerage fees and tax).

When Reits first emerged in the US in the 1960s, they transformed real estate investment by providing an avenue for retail investors to hold stakes in diversified property portfolios. Until then, these opportunities were largely exclusive to large institutions and the very wealthy.

Singapore's first S-Reit, CapitaLand Mall Trust, listed on the SGX in 2002, included prominent malls such as Raffles City and Plaza Singapura. Its portfolio is now part of CapitaLand Integrated Commercial Trust (CICT), Singapore's largest Reit.

As of May 30, 2025, Singapore's Reit market boasts 40 Reits and property trusts, with 8 of these being constituents of the benchmark Straits Times Index (STI).2

Read more: Investing in S-Reits for income growth

Why invest in Reits?

While Reits share similarities with both stocks and unit trusts, they offer distinct advantages for investors. There are 3 main reasons why investors buy Reits.

Dividend income

S-Reits are legally mandated to distribute at least 90% of their taxable income to unitholders as dividends. This income primarily stems from rental collections from properties within the Reit's portfolio, as well as profits from any asset sales.

As of May 30, 2025, S-Reits offered an average dividend yield of 6.8% – a compelling return that significantly outpaces the Straits Times Index’s (STI’s) 5.1% yield, the MAS Benchmark 10-Year Government Bond’s 2.4% yield, and typical term deposit rates.2

Potential capital gains

Like stocks and ETFs, Reits are subject to market fluctuations. This means there's potential for capital appreciation if a Reit's unit price rises, allowing investors to realise gains when they sell their units at a higher price than purchased.

As a whole, Reits have consistently delivered strong total returns (combining unit price appreciation and distributions) over the past 2 decades.

Professional expertise

A significant advantage for investors is the hands-off nature of Reit ownership. Unlike direct property investment, where owners contend with finding tenants, property maintenance, and rent collection, Reits entrust the day-to-day management of their vast property portfolios to professional managers.

The role of Reit sponsors

Crucial to the success and growth of each Reit is its sponsor, typically a parent company or majority unitholder. For example, CapitaLand Investment Limited acts as the sponsor for CICT.

Sponsors contribute the initial portfolio of properties to the Reit during its Initial Public Offering (IPO). This structure provides sponsors with a platform to monetise properties, often at fair or lower-than-market average prices, thereby freeing up capital for new investments.

Furthermore, sponsors serve as a vital pipeline, providing assets for the Reit's future acquisitions post-IPO, which underscores why a Reit's long-term attractiveness is often closely linked to the strength and commitment of its sponsor.

Regulatory framework and rules

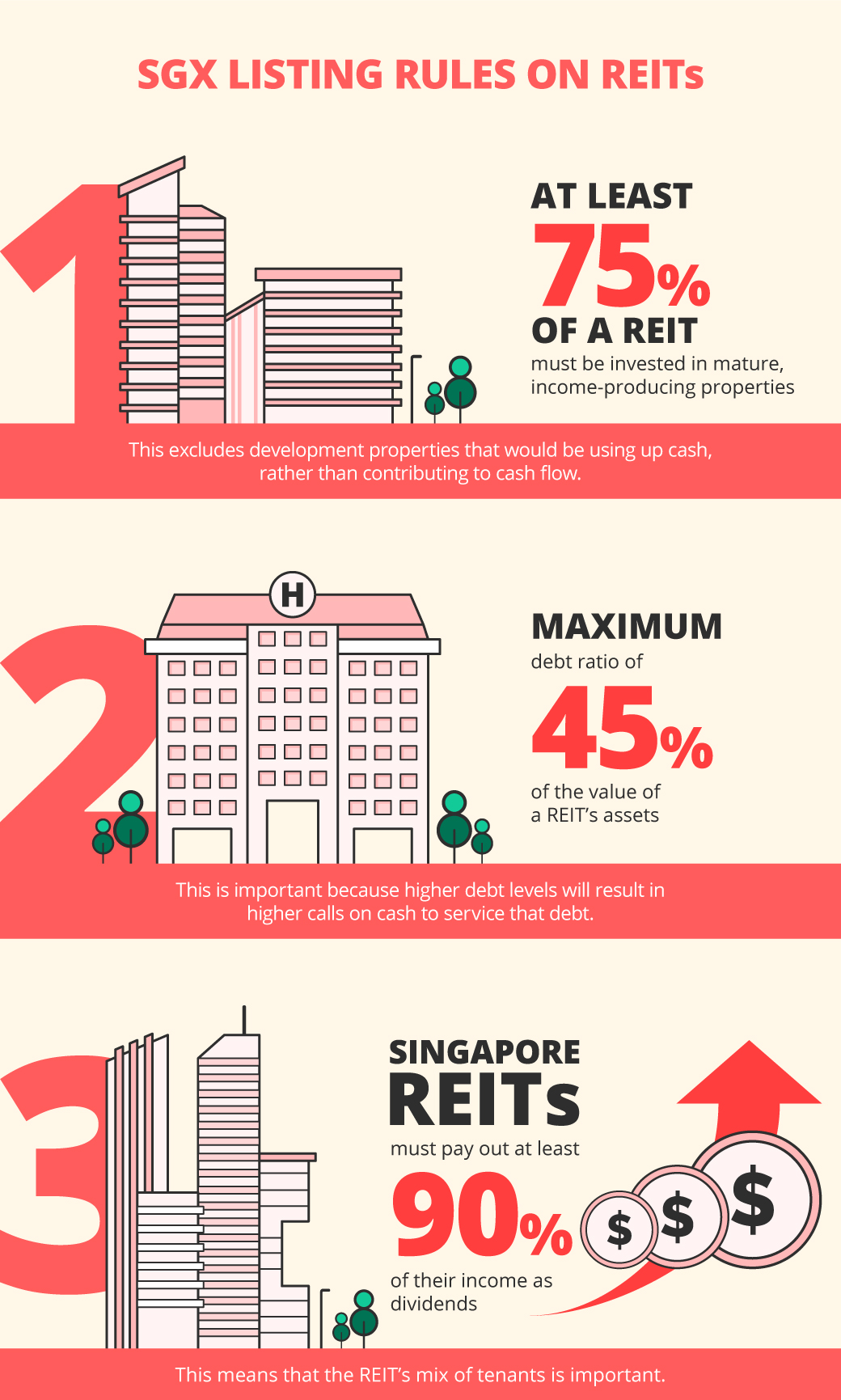

To qualify as a Reit, a real estate portfolio must adhere to specific regulatory requirements unique to its listing jurisdiction. Consequently, Reits traded in different countries, like Australia, the US, or Singapore, operate under distinct laws and compliance criteria.

These differences often extend to areas such as allowable debt levels, the minimum percentage of profits distributed to unitholders, and portfolio composition requirements.

Here’s are some SGX listing rules.

Read more: How to evaluate and analyse Reits

How to buy Reits?

Most Reits are publicly traded on stock exchanges, like the SGX, making them readily accessible for investors through trading accounts with brokerages like DBS Vickers.

Alternatively, for those preferring not to invest in individual Reits, seeking broader exposure and professional management exposure can also be gained through exchange-traded funds (ETFs), or discretionary managed solutions like digiPortfolio's Asia Portfolio.

Compared to physical properties, a key advantage of Reits is their liquidity as they can be converted to cash much more quickly than physical properties

This makes Reits an appealing and efficient way to gain exposure to the property market.

Find out more about: DBS Vickers Online Trading Account

What can you do via digibank?

You can invest in S-Reits through a Regular Savings Plan (RSP) like Invest-Saver, where you can buy units in the Nikko AM-StraitsTrading Asia ex Japan Reit ETF and/or the CSOP iEdge S-REITs Leader ETF for as little as S$100 each month.

An alternative is to consider a discretionary portfolio like digiPortfolio. For example, the Asia Portfolio, has an up to 8% exposure (high risk portfolio) to S-Reits through Lion-Phillip S-REIT ETF as of June 30, 2025.

Read more: Practical ways to invest in Reits

Find out more about: Invest-Saver

Taking the next step

Having understood the fundamentals of Reits, the next crucial step is to determine which ones align with your investment goals.

When assessing a Reit, it's essential to consider the quality of its property portfolio, its income characteristics, and the prevailing economic conditions.

Though not exhaustive, asking yourself these questions will help guide your investment decision-making process:

In summary

Reits are a suitable and relatively affordable alternative to buying investment properties. Among its benefits include a consistent stream of income, potential for capital gains, portfolio diversification, and the advantage of liquidity in trading.

As with any investment, thorough due diligence is paramount before committing to a specific Reit. Do take note of the strength of the Reit's sponsor, examine the underlying properties the Reit holds, and stay informed about current market conditions, which can significantly impact both the broader Reit and property sectors.