Rolling over credit card debt is no game

![]()

If you’ve only got a minute:

- With a credit card, you are essentially taking a loan from the card-issuer, which must be repaid in the next billing cycle to avoid interest charges.

- Late payment of a credit card bill will result in high interest charges which are charged and compounded on a daily basis, making it easy to snowball quickly.

- Credit limits do not reset like a data plan. You must repay every last dollar, with interest.

![]()

Credit cards are an ubiquitous part of our lives, and still relevant (in Singapore, at least), even in the age of e-wallets and other modes of digital payments.

The speed of a swipe (or tap), the ease of payments, and even the prestige of "platinum" or "titanium" cards are among their attractions. On top of that, those shiny, sometimes colourful pieces of plastic, offer rebates, rewards, or miles when you make purchases.

But before you happily swipe, swipe, swipe (or tap, tap, tap), it is important to know that when you use a credit card, you are not actually making payments out of your own pocket at the point of transaction.

Unlike a debit card, where charges are deducted directly from your bank account, charges made to your credit card are essentially short-term loans from the card issuer (e.g. bank), which must be repaid. As with any loan, amounts owed are subject to interest charges.

On the upside, if you pay your card bills in full before the due date, you do not have to pay any interest on it.

Read more: Knowing the different types of payment cards

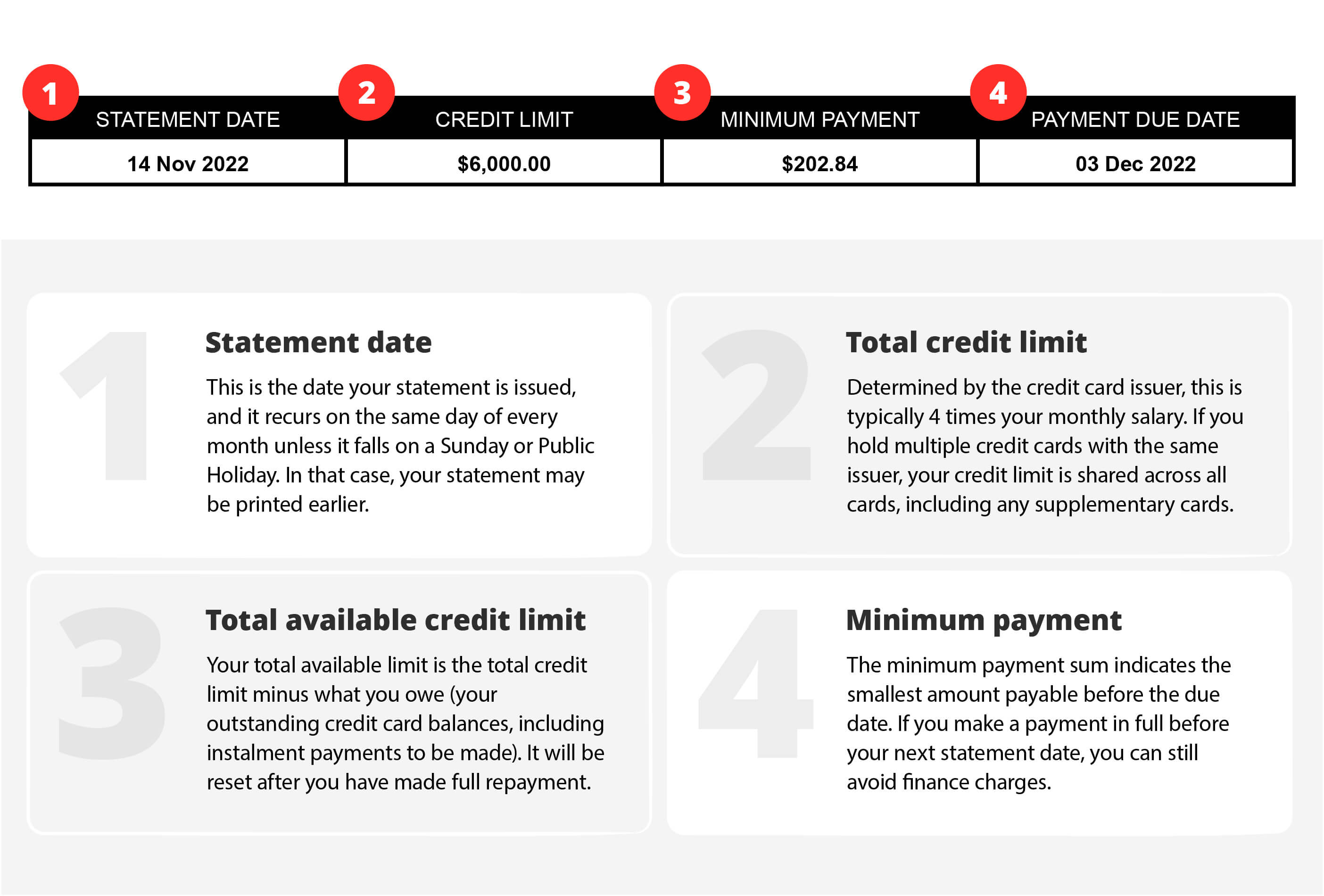

Making sense of your credit card bill

Many people get confused with the jargon of credit card bill statements.

Do you have trouble speaking credit card? If so, you've got plenty of company.

The lexicon of credit card terms is pretty confusing. Here’s the lowdown on 9 credit card terms that consumers commonly find confusing.

Now that we understand the common terms used on our credit card bills, you might wonder - how exactly do we risk racking up credit card debt, and how can we avoid it?

If you can, pay off every dollar on time, every time

When you use a credit card, you are essentially borrowing money from the card issuing organisation or bank. These funds are available to you up to a predetermined limit decided by the card issuer. Credit cards offer an interest-free period of about 20 to 25 days from your date of spend. This means that if you pay for your bill on time (within the interest-free period) and in full, you will not incur any interest charges.

On the other hand, late payment will result in substantial late payment fees, interest, and administrative charges, which may affect your cash flow for months or even years. The late payment fee is typically upwards of S$100.

While you can opt to repay only the minimum amount, it is not advisable since interest charges are still levied on any remaining unpaid amount beyond the due date. These generally range between 26% per annum (p.a.) and 28% p.a.

Credit card interest charges are charged on a compounding basis. This means that the interest is charged on not only the outstanding transactional amounts, but also any existing interest charges. As this is calculated on a daily basis, the amounts can snowball before you even realise it. Simply put, for each day you defer or roll over your outstanding debt, the additional interest charges are piling up.

|

Your credit limit: $5,000 |

|

Monthly credit card expenditures: $500 |

|

Minimum payment required: 3% of outstanding balance or $50,whichever is higher |

|

Interest rate: 27% p.a. |

Why you should avoid paying only the minimum each month

Since credit card interest is calculated on a daily compounding basis, if you only pay the minimum balance each month, the remaining amount continues to roll over and grow every day. In the example, you will hit your credit limit of $5,000 in approximately 1 year.

When this happens, you will no longer be able to spend on your credit card and have a hefty balance to repay. Your minimum payment every month would have jumped from $50 to $150 (3% of $5,000) – taking you 197 months (16.4 years!) to clear that one year of spending. In total, your interest charges on the $5,000 spend would amount to $15,473.

Having to pay the credit card bill for more than 16 years can strain your monthly financial resources, leaving less cash on hand for other expenses.

Read more: Debt repayment programmes in Singapore

If you have outstanding amounts, there are 2 components– the total remaining balance, and any outstanding interest charges.

It is worth noting that when you pay only the minimum amount due on your credit card, this always goes to paying any outstanding interest charges first. This means that if you pay only the minimum and it is less than the outstanding interest charges, you are not reducing your outstanding balance at all.

Not paying your credit card bills on time will affect your personal credit rating and ability to secure another loan or the amount you can get. This can come as a rude shock to young couples trying to apply for a home loan, only to discover the amount they are eligible to borrow is limited due to their past credit repayment behaviour.

In extreme situations, if the amount of debt exceeds S$15,000, bankruptcy proceedings may be initiated.

Read more: Why is my credit score important?

A warm fire is essential for life, such as for cooking or keeping us warm in winter. But if the fire is unbridled and unwatched, it can easily burn our houses down.

Similarly, a credit card may offer us a host of benefits, but unbridled and unwatched, it can leave us in heavy debt, or worse – bankruptcy. As with the analogy of fire, the key lies in how we choose to oversee and manage the use of these resources available to us. If you feel that a credit card is too much of a hassle for you at your life stage, you may also opt to use other suitable payment cards.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)