Costs and fees of investing in ETFs

![]()

If you've only got a minute:

- Most fees associated with investing in ETFs are similar to that of equities, like commission, trading, clearing fees and GST.

- With ETFs, you also incur management, trustee, and custodian fees, which are deducted from a fund’s net asset value at the end of a year.

- The TER reflects the total costs incurred by the ETF as a percentage of its total assets.

![]()

When we make financial decisions, whether it is a matter of purchasing an item or making an investment, we seek to maximise the value we get out of it. This means getting the greatest perceived benefit, from the lowest possible perceived sacrifice.

In the context of investing, these benefits are relatively straightforward. We often ask ourselves:

“What are my potential gains from making this investment?”

However, investors often forget to consider the costs or fees of making investments, which can impact returns. There are different types of costs that apply to different types of investments, including some which are embedded in the investment product.

This is why it is good practice to do your due diligence and be aware of what they are along with how they can impact your returns on your investment, before making any investment decision.

Read more: How to start investing in ETFs

Find out more about: DBS Invest-Saver

ETFs are pooled investment funds that seek to track the performance of a market index like the S&P500 or Straits Times Index. They are often viewed as a more affordable option compared to buying stocks individually, as they provide individuals with the opportunity to invest in a basket of companies according to their risk profiles.

Like equities and Real Estate Investment Trusts (Reits), ETFs can be purchased or sold on a stock exchange. As such, similar front-end and back-end fees apply to them. Front-end costs are charged at the initial point of investment, and back-end costs are incurred when you sell or close out your position.

Some examples include commission, clearing, trading fees as well as the prevailing goods and services tax (GST). In addition, there are other costs to investing in ETFs that are not applicable to direct equities.

Read more: Investment fees for equities in Singapore

Investment fees associated with unit trusts

Commission, clearing, trading fees and GST

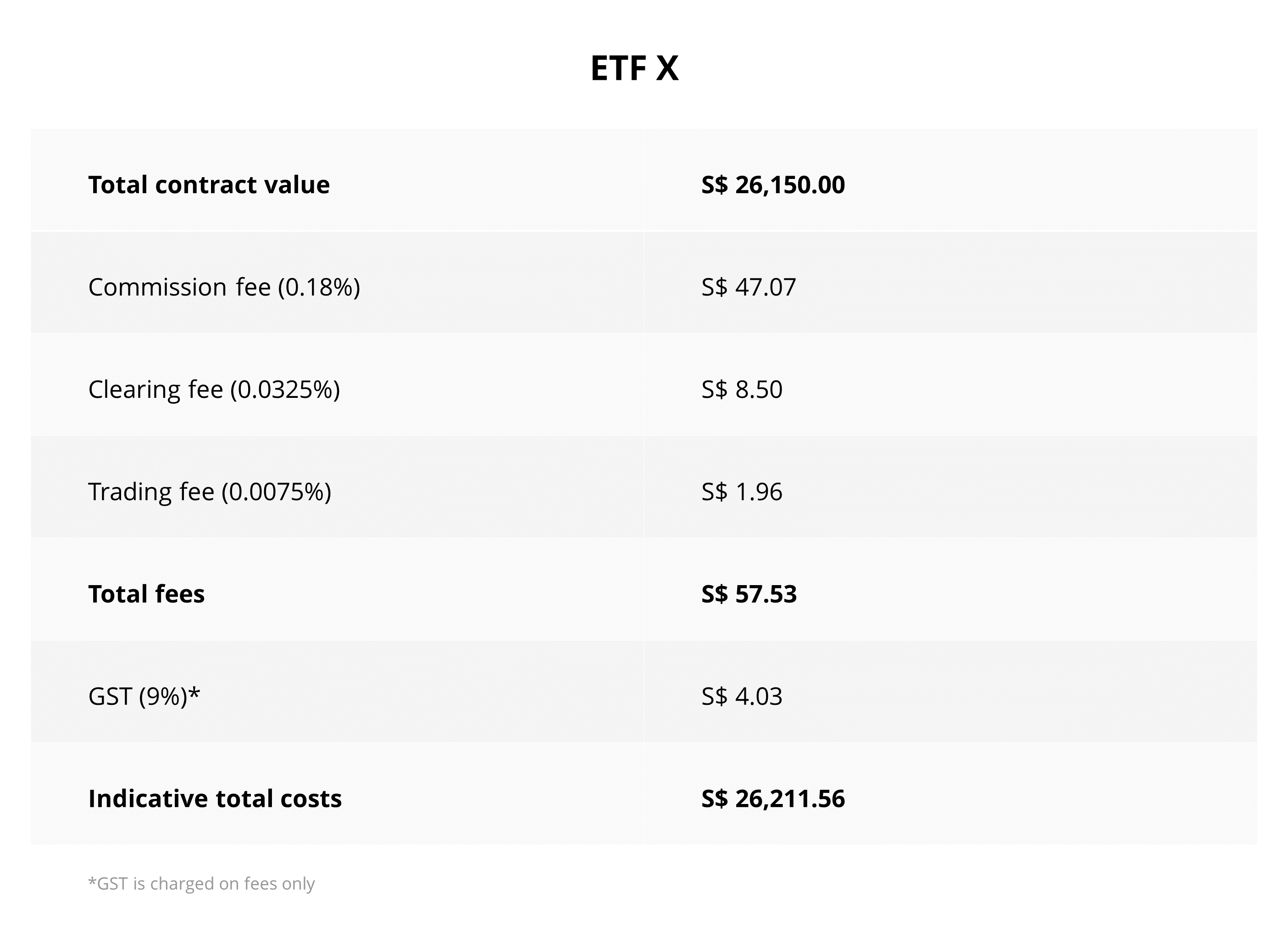

Assuming an investor wants to purchase 10,000 units of ETF X at S$2.615, the front-load fees are listed below:

When making an investment worth S$26,150, the investor will have to incur an additional S$61.56 in the form of commission, clearing, trading fees, and GST.

Additional fees and charges

On top of these upfront costs, investors also face other fees when purchasing ETFs. These include management fees, administrative fees, operating costs, trading costs and other costs which may be specific to the individual ETF.

As these costs are deducted from the net asset value (NAV) of the ETF and not paid by the investor directly, they are easily overlooked. However, they still have an impact on the overall returns and are important to take note of.

The sum of these costs expressed as a percentage of its total assets, is known as the total expense ratio (TER). This reflects the costs of managing and operating the fund. Generally, passively managed funds like ETFs have a lower TER than actively managed funds like unit trusts. This is because they tend to be less time and labour intensive.

In 2019, ETFs across the globe had an average TER of 0.44% per annum (p.a.). In other words, for every US$1,000 invested in an ETF, unitholders will incur an annual fee of US$4.40. This figure has since gone down.

Assuming ETF X has an annual return of 5% and is an expense-free fund, the investor’s initial investment would be worth S$33,374.76 after 5 years.

If the TER of ETF X is 0.3%, the returns from the investment would be reduced to S$32,941.28. If the TER of ETF X is 0.5% instead, the returns from the investment would be reduced even more, to S$32,652.29.

Compared to the expense-free investment, the returns of the investment with 0.3% and 0.5% TER were 1.32% and 2.21% lower respectively.

This shows that even a slight difference in expense ratios can affect the returns on the investment over a period of time.

While it may seem logical to assume that a fund with lower TER is always the better option, that may not always be the case. Sometimes costlier funds which are actively managed may result in better performance thus accounting for the higher TER.

As such, it is important to use the TER hand-in-hand with other metrics and considerations in determining whether a particular fund is an appropriate investment for you.

Read more: Investment terms and metrics to learn

Other (not so) hidden costs

Some ETFs make their investments through other funds. In such scenarios, hidden costs could exist in the form of costs levied by the underlying funds. For example, an ETF which invests in Reits will incur the embedded costs charged by the ETF, as well as the ones charged by the Reit. While uncommon, it is still important to note if you are considering investing into such a product.

Investing in ETFs using CPF balances

Investors are also able to purchase selected ETFs through the CPF Investment Scheme using CPF Ordinary Account (OA) and Special Account savings. To invest your CPF OA savings in shares, open a CPF Investment Account with an approved CPF Investment Scheme (CPFIS) agent like DBS Bank.

Using your CPF funds to pay for investments will incur additional costs on top of the ones discussed so far. This includes a CDP settlement fee of 35 cents per transaction, which the CPFIS agent will collect on behalf of CDP.

Further upfront costs include agents charging up to S$2.50 per 1,000 shares or units, with a maximum charge of S$25 per transaction.

Recurring costs include a S$2 fee per ETF holding per quarter, with a minimum charge of up to S$5.

Read more: Is my CPF enough to beat inflation?

Find out more about: CPF Investment Account

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)