If you’ve only got a minute:

Tips to grow your CPF retirement pot:

- Transfer from CPF Ordinary Account (OA) to Special Account (SA).

- Pay your mortgage in cash.

- Top up your SA in cash.

- Top up your Medisave Account (MA) in cash.

Tips to grow your CPF Retirement pot

The Central Provident Fund (CPF) is a key pillar of our social security system here in Singapore. It helps Singapore Citizens and Permanent Residents set aside funds to build a strong foundation for retirement.

It also addresses important aspects of our lives such as healthcare, home ownership, family protection and asset enhancement.

If you are an employee below 55 years old, you will be contributing 20% of the first S$7,400 of your monthly income to CPF. These savings add up to a large amount over time hence it is worthwhile to understand how you can maximise and grow your CPF savings for retirement.

Transfer from OA to SA

Through the Retirement Sum Topping-up (RSTU) scheme, you can consider transferring your OA funds to your SA up to the Full Retirement Sum (FRS) if you are below 55 years old or transfer your OA funds to your RA up to the Enhanced Retirement Sum (ERS) if you are 55 years old and above.

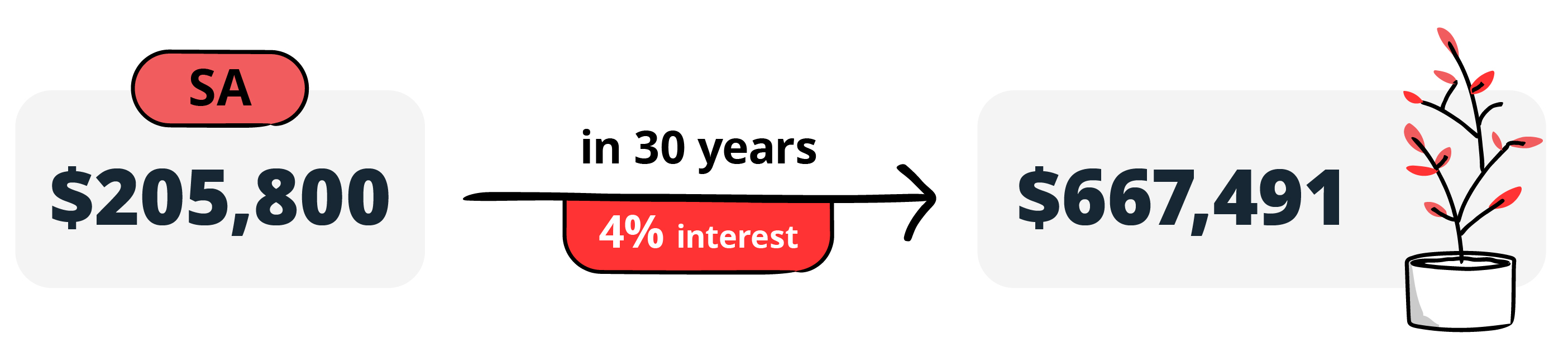

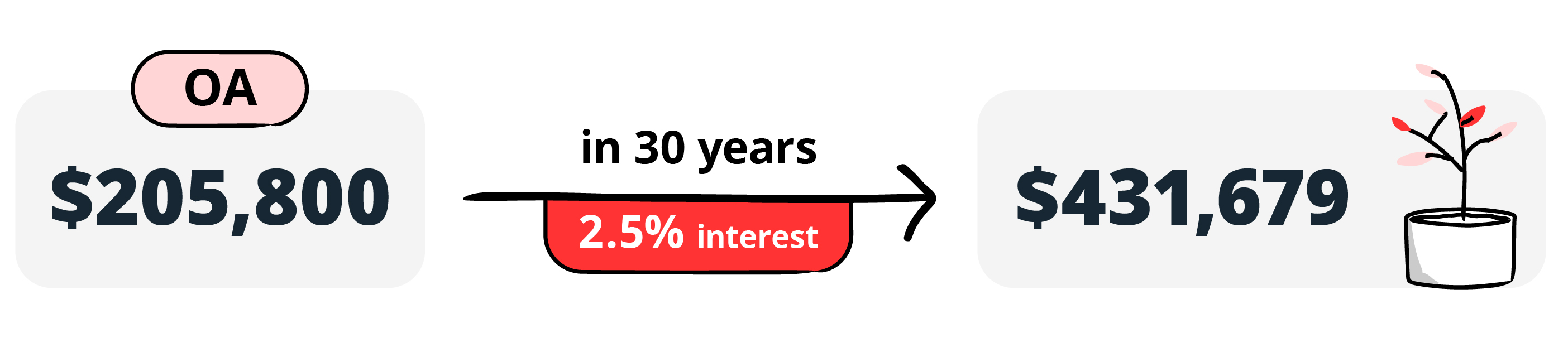

The CPF-OA pays at least 2.5% interest annually, while your CPF-SA pays at least 4%. While the difference of 1.5% may not seem like much, it makes a big difference when compounded over time.

( Note: You get extra 1% interest for the first S$60,000 in your combined CPF-OA and CPF-SA balances too, but we’ll exclude that here for ease of calculation.)

If you have set aside the FRS amount of S$213,000 , in 2025 with your SA, and compounding this at 4% per annum, your funds could grow to S$690,843 at the end of 30 years.

But if you had left that amount in your CPF OA that earns 2.5% interest, you would end up with S$446,782 – nearly S$244,000 less.

So it makes sense to park your money in the SA to earn the higher interest.

But there is a catch: it is a one-way trip. You can only transfer money from your OA to SA, but not the other way. Do note that CPF transfers do not qualify for tax relief as well.

If you require the money in your OA to fund your home purchase or your children’s education in future, you might want to put off doing this.

But if your housing needs are comfortably taken care of, transferring money to your SA will go a long way towards funding your retirement.

Pay your mortgage in cash

Besides using CPF-OA to fund downpayment for a home, many Singaporeans also use it to service their monthly mortgage.

But if you can afford to, there are several advantages to paying your mortgage in cash instead.

- The main benefit is that it will allow your CPF monies to compound much further, especially if you transfer it to the SA.

- In the meantime, your CPF-OA can be used as “back up” funds to service your mortgage. In the event you wish to stop paying with cash, you will not have to worry about losing your home in the event of emergencies such as a retrenchment or a severe disability that puts you out of work.

Top up your SA

If you are aged below 55 and the funds in your SA has not reached the FRS, you can also make a voluntary cash top-up.

Cash top-ups to SA come with a tax relief equivalent to your top-up amount of up to S$8,000 per calendar year.

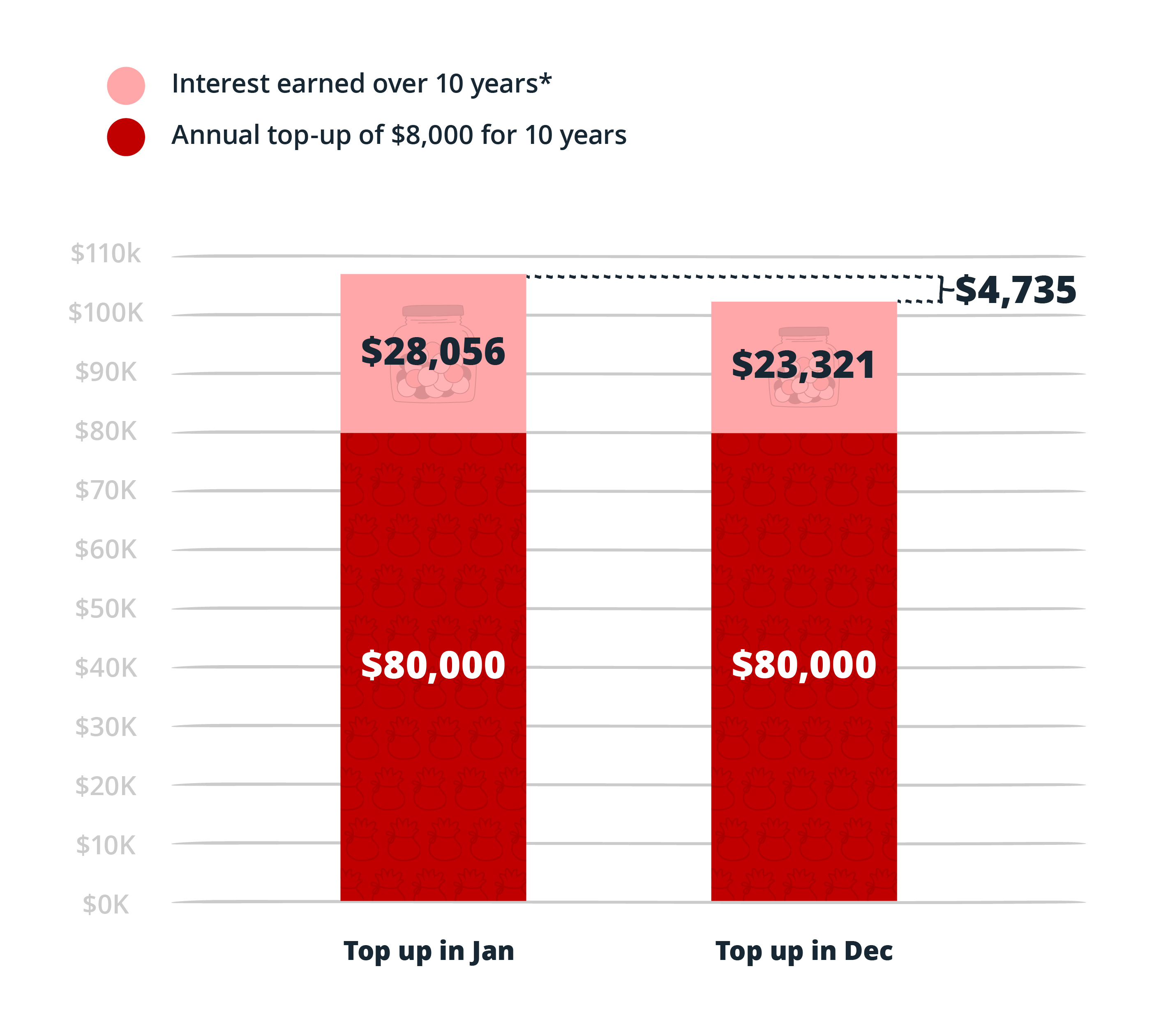

Additional tip: Perform your top-up at the beginning of the year. As CPF interest is calculated monthly, if you make a top up in January instead of December each year, you will earn 20% more in interest over 10 years.

Top up your MA

If you plan on making voluntary cash top-ups to your SA, consider topping-up your MA as well. Your MA also earns the same 4% annual interest as the SA, but has the added flexibility of providing for your medical care and hospitalisation expenses.

The following table summarises the Basic Healthcare Sum (BHS) for respective cohorts aged 65 and above in 2025:

Age in 2025 | Year when cohort turned age 65 | Cohort BHS (fixed for life) |

|---|---|---|

65 | 2025 | $75,500 |

66 | 2024 | $71,500 |

67 | 2023 | $68,500 |

68 | 2022 | $66,000 |

69 | 2021 | $63,000 |

70 | 2020 | $60,000 |

71 | 2019 | $57,200 |

72 | 2018 | $54,500 |

73 | 2017 | $52,000 |

74 and above | 2016 or earlier | $49,800 |

Source: CPF

The BHS from 1 January 2025 is S$75,500 for all CPF members aged 65 years old and below in 2025. The BHS applicable to you will be adjusted yearly to account for increasing life expectancy and healthcare costs until the year you turn age 65. For instance, if you are aged 65 in 2024, the BHS that is applicable to you will be S$71,500 for the rest of your life.

You can save up to the prevailing Basic Healthcare Sum (BHS) in your MA if you have not turned age 65.

The interest earned in your MA covers even the most expensive premium for MediShield Life. In essence, adequately funding your MA can pay for your basic health insurance in Singapore.

Voluntary contributions to your MA allows you to enjoy tax relief as well. This gives you an additional reason to contribute if you are considering to do so.

Consider your personal circumstances

These are the 4 ways you can maximise and grow your CPF savings for retirement. Before doing so, it is wise to evaluate your personal financial situation before making any decision.

For example, voluntarily topping up your SA may be a great idea if you have excess cash that you may not need in the near term but it may not work if you are facing a cashflow issue and need the liquidity.