Retirement in phases: A time-segmented strategy

![]()

If you've only got a minute:

- Continue investing your portfolio with some degree of risk, to ensure your assets do not run out during your lifetime.

- You can proportion your assets into various buckets or portfolios, each with a different time frame, risk profile, and allocation.

- Bucket 1 should comprise low-risk assets such as cash, money market funds, and short-term bonds. Bucket 2 and subsequent ones should contain riskier assets, due to their longer time horizon.

![]()

The idea of longevity has intrigued mankind continually. In modern times, seeking the proverbial "fountain of life" has seen rapid developments in genome research, drug manufacturing and advancements in medical science and technology. With longer lifespans inadvertently come the quest for better standards of living into our silver years.

One way to look at the income needed in retirement is in relative rather than absolute terms. In other words, looking at it relative to the lifestyle you have become accustomed to.

The recommended replacement rate/ratio—the amount of income in your retirement measured against your pre-retirement income—varies quite widely from around 60% to 80%. The average for the developed nations of the OECD (Organisation for Economic Cooperation and Development) in 2023 was 50%. A 2023 report by the Mercer CFA Institute Global Pension index found the average Singaporean in full time employment could expect an income replacement ratio (that is, a retirement income compared to pre-retirement income) of around 60%.

Retirees will need to continue to invest with some degree of risk to ensure their assets do not run out during their lifetime.

The time-segmented bucket strategy

A time-segmented bucket strategy tries to address the need to reduce risk in a more realistic way to extend the life of your portfolio.

There are many variations of the time-segmented, bucket strategy. This is one version. Once you understand the concept, it can be adjusted to suit the many variations of personal circumstances and risk appetites.

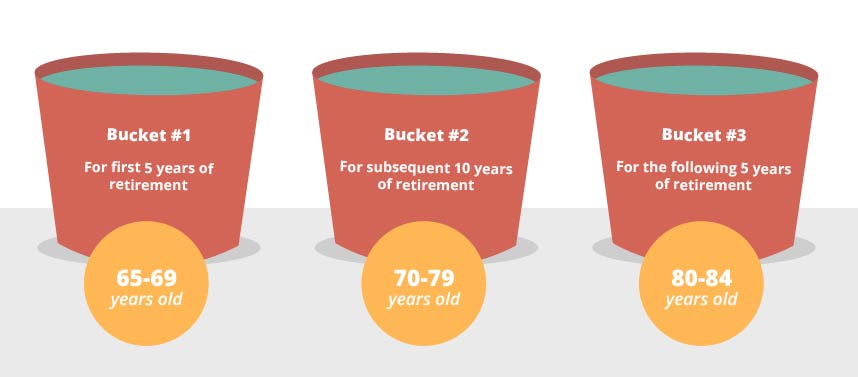

Rather than having all your assets in a single portfolio—with a single risk profile and asset allocation—you can split your assets into three buckets. In that sense, you split your assets into three different portfolios, each with a different time frame, risk profile and asset allocation.

Each bucket has a specific time frame. In our example:

You can adjust the details to suit yourself. For example, if your parents lived to 90 or more, you may be genetically predisposed to an above average lifespan. So, you may want to adjust your finances and your implementation of the bucket strategy accordingly.

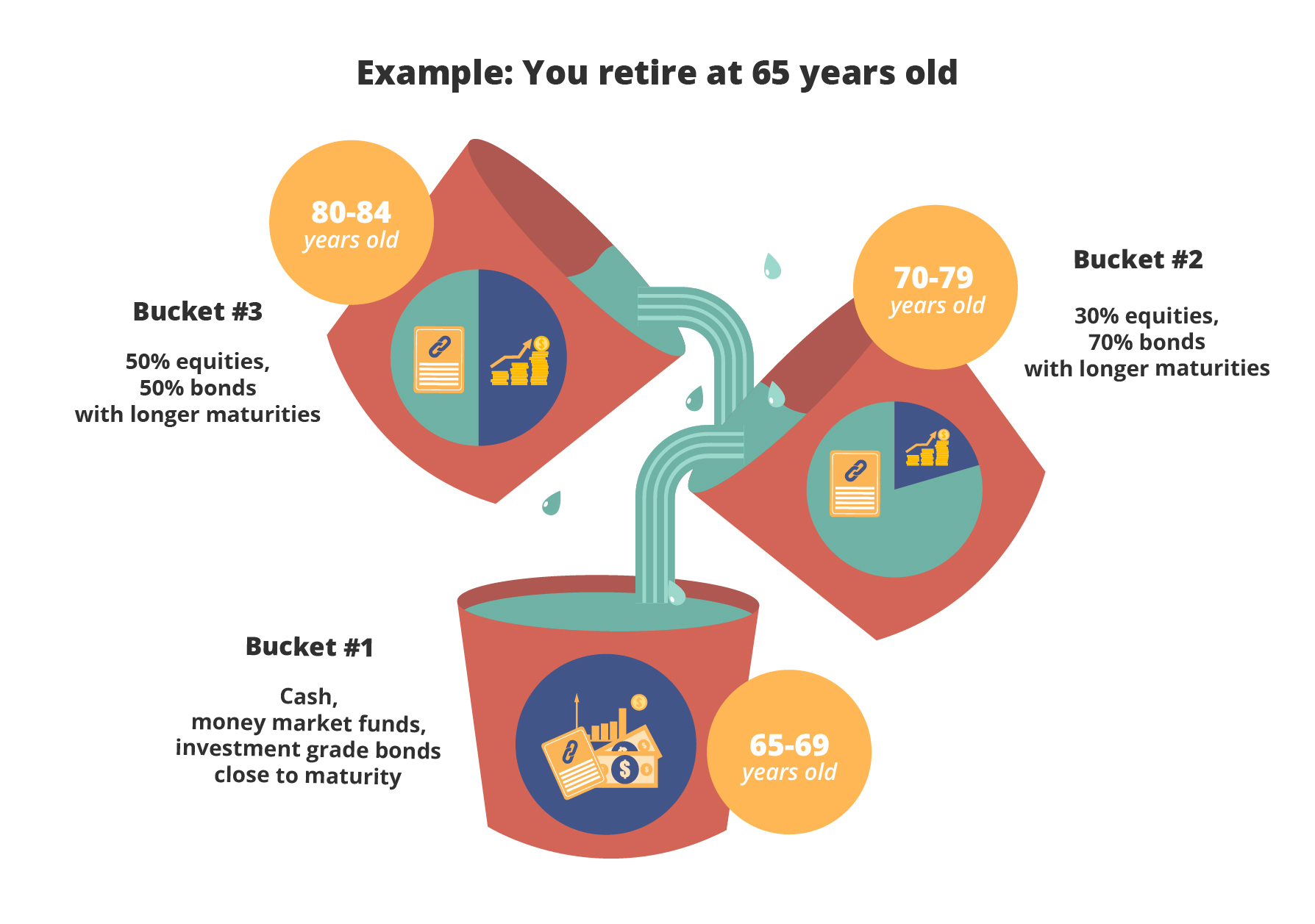

Bucket #1: For the First Five Years of Retirement (Age 65-69)

- Because of the shorter time horizon of the immediate 5 years, bucket #1 should be a very low risk portfolio. It should comprise cash, money management funds or investment grade bonds very close to maturity.

- As you sell down assets in bucket #1—typically once a year—you can simultaneously sell an equivalent amount of assets (ideally, assets that have already made capital gains) from bucket #2 to re-invest in lower risk assets for bucket #1.

- In that way, there will always be a bucket #1, for near-term (immediate next 5 years) expenditure.

Bucket #2: For the Subsequent 10 Years (Age 70-79)

- Because of the longer time horizon of 6-15 years from retirement, this portfolio can take on more equity risk. So, the portfolio in this bucket can have, say, 30% equities and 70% bonds with longer maturities.

- As you sell down assets in bucket #2 to transfer to bucket #1—typically once a year—you can simultaneously transfer or re-invest an equivalent amount of assets from bucket #3 to bucket #2.

- In that way, as the transfers from the different baskets take place, the highest risk portfolio in bucket #3 is diminishing in assets.

Bucket #3: For the Following Five Years (Age 80-84)

- Because of the longer time horizon of 16-20 years from retirement, this portfolio can take on even more equity risk. So, the portfolio in this bucket can have, say, 50% equities and 50% bonds with longer maturities.

- As you sell down assets in bucket #2 to transfer to bucket #1—typically once a year—you can simultaneously transfer or re-invest an equivalent amount of assets from bucket #3 to bucket #2.

- In that way, as the transfers from the different baskets take place, the highest risk portfolio in bucket #3 is diminishing in assets.

- After 5 years into retirement, bucket #3 will cease to exist. It would have been all transferred to bucket #2.

The final rundown of the portfolio

- Eventually, bucket #1 will take over more and more assets from bucket #2, such that the portfolio lifespan of bucket #2 will correspondingly decrease, until all that is left is a portfolio in bucket #1 with a lifespan of only 5 years by age 81.

There are many variations of the time-segmented bucket strategy. Some have five buckets, each corresponding to five years of retirement. And the asset allocations can vary quite considerably, with some financial advisors recommending up to 70% equities (30% bonds) for the bucket with a 16-to 20-year time horizon.

There are no rigid rules for the implementation of this strategy. They are for you to decide in discussion with a financial advisor, taking into account your personal circumstances, the size of your retirement portfolio, and your preferences.

Ready to start?

Start planning for retirement by viewing your cashflow projections on digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Sources:

APG, Pensions, housing, healthcare in conjunction in Singapore | APG, retrieved 24 May 2024

OECD, Pensions at a Glance 2023 : OECD and G20 Indicators | OECD Pensions at a Glance | OECD iLibrary (oecd-ilibrary.org), retrieved 24 May 2024

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)