SRS withdrawals: Stagger and save

If you’ve only got a minute:

All you need to know about withdrawing your Supplementary Retirement Scheme (SRS) savings:

- You can begin drawing down on your SRS savings on or after retirement, over 10 years.

- If you withdraw before the retirement age, you will face a 5% withdrawal penalty on your withdrawal sum, except under certain conditions.

- Consider spreading out your SRS withdrawals to save on taxes.

The Supplementary Retirement Scheme (SRS) is a voluntary scheme that can complement your Central Provident Fund savings. SRS contributions also help you lower your taxable income.

The tax angle can be viewed from three lenses:

- Contributions receive dollar-to-dollar tax reliefs, capped at the annual contribution limit (S$15,300 for Singaporeans and Permanent Residents, and S$37,500 for foreigners) and personal income tax relief of S$80,000

- Investment gains, if left in your SRS account and not withdrawn, are tax-free

- Withdrawals are subject to a 50% tax of the amount withdrawn, if made at or after the retirement age

Withdraw only post-retirement

As mentioned, you can begin drawing down on your SRS savings, penalty-free, upon retirement – defined as the statutory retirement age prevailing at the time you made your first SRS contribution.

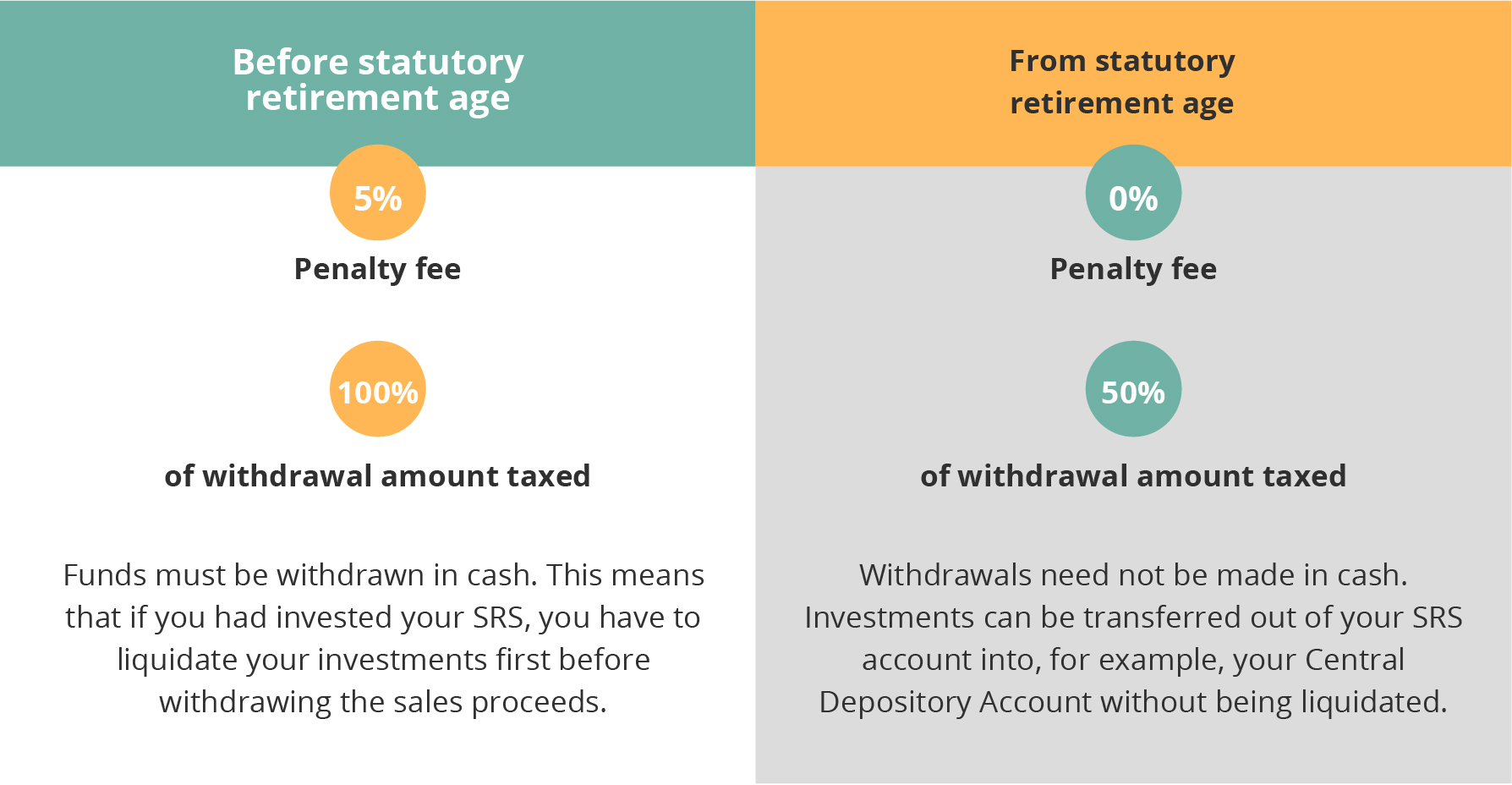

However, do note that if you withdraw before the retirement age, you will face a 5% withdrawal penalty on your withdrawal sum, except under certain conditions, such as bankruptcy, illness, or death. Pre-retirement withdrawals must also be made in cash.

Stagger your withdrawals to save on taxes

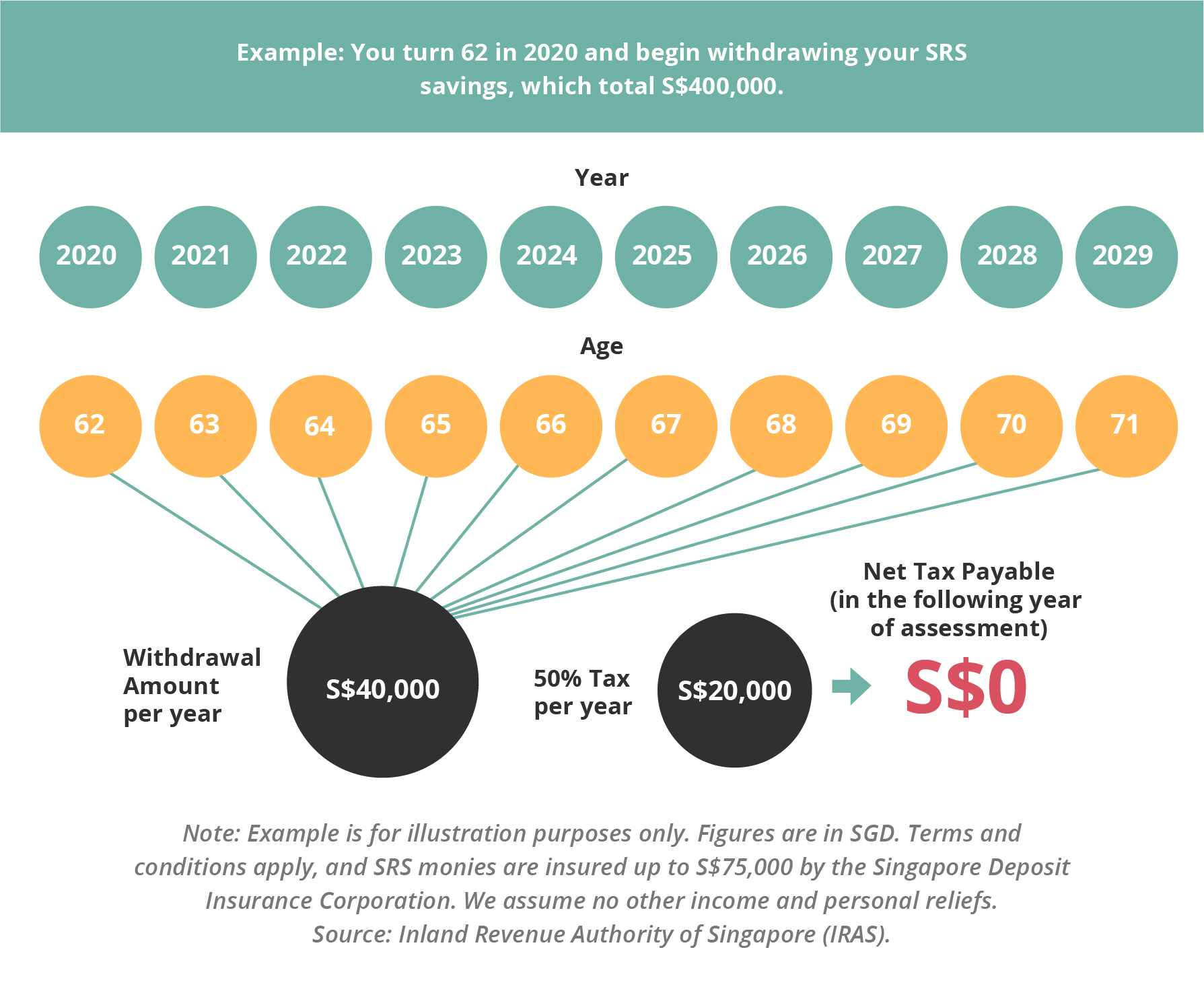

To lower your taxes, consider spreading out your SRS withdrawals, instead of fully drawing down what you have saved. You can withdraw over 10 years, and can determine your withdrawal amount.

As you would presumably have little to no income at retirement, you may end up paying little, if any, tax—if you start withdrawing from the retirement age.

You can potentially withdraw up to S$40,000 a year, tax-free, over 10 years, as the first S$20,000 of an individual’s chargeable income is not taxed. Note that the taxes will be payable in the following year after the withdrawals are made.

If you have more than S$400,000 in your SRS account, 50% of the remainder at the end of the withdrawal period will be taxed.

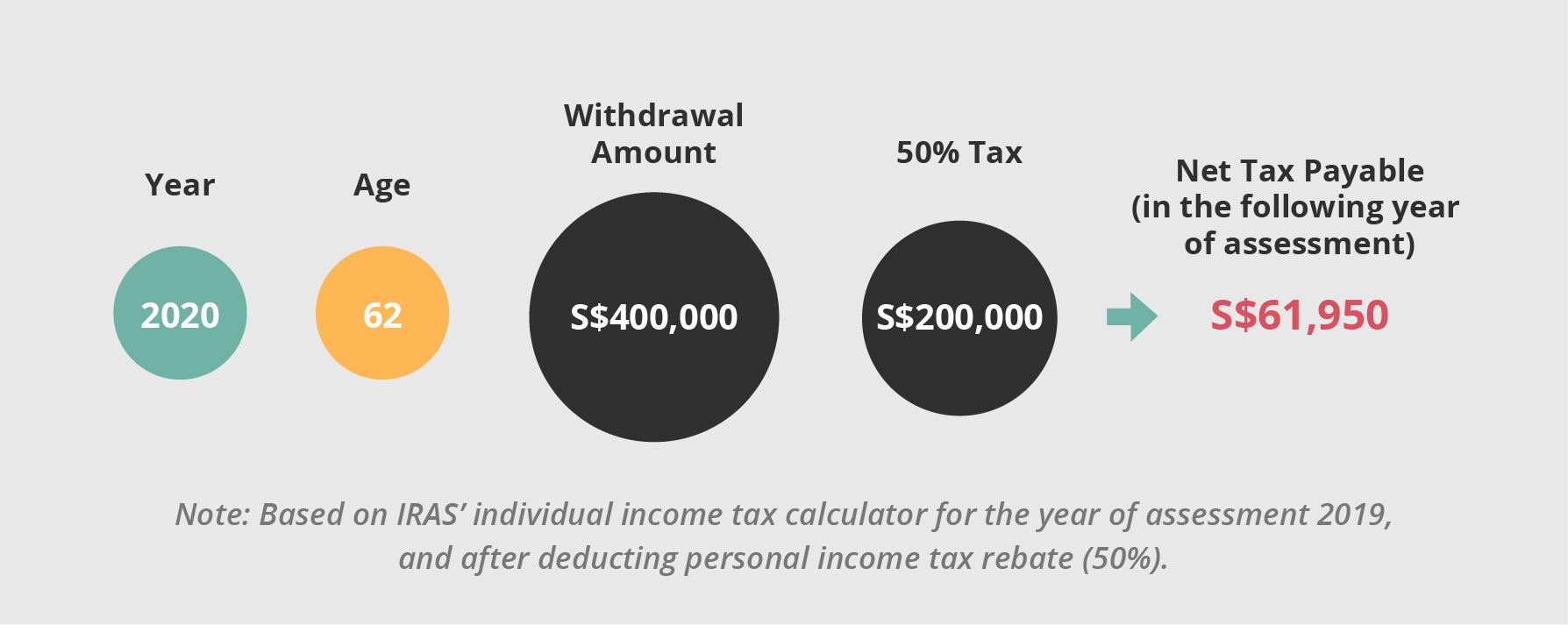

In comparison, if you had withdrawn the full S$400,000 at age 62, here is how much taxes you would have to pay:

Note that if you have bought an annuity that gives you a payout for life, 50% of the payouts withdrawn will also be subject to tax, but the annuity stream is not limited to 10 years.

SRS withdrawals need not be in cash

Do you know that you can withdraw your SRS funds in investments by transferring them out? This means that you can hold on to your SRS investments instead of having to liquidate them before withdrawing them in cash. This is only applicable for the following types of withdrawals, which qualify for the 50% tax concession:

- withdrawal on or after the statutory retirement age prevailing at the time of an SRS member’s first contribution (prescribed retirement age);

- withdrawal on medical grounds;

- withdrawal in full by a foreigner, subject to conditions[1]; and

- actual withdrawal made by an SRS member or his legal personal representative (if he is deceased) from his SRS account, after the SRS investment that is to be withdrawn had earlier been deemed withdrawn upon death or after the expiry of the 10-year withdrawal period.

All other withdrawals from an SRS account, including premature withdrawals, must be made in cash.

Withdrawals in the form of investments are not allowed in the following conditions:

- Withdrawals on the grounds of bankruptcy

- Withdrawals before the statutory retirement age

- Withdrawals of contributions in excess of the SRS contribution cap

As the primary purpose of SRS funds is for retirement, the flexibility to make withdrawals in the form of investments would not be extended to withdrawals made before the statutory retirement age. Early withdrawals would only be allowed in the form of cash, are fully subject to tax, and attract a 5% penalty.

1The conditions are that the foreigner:

- is neither a Singapore Citizen nor a SPR on the date of withdrawal and for a continuous period of 10 years preceding the date of withdrawal;

- has maintained his SRS account for a period of not less than 10 years from the date of his first contribution to his SRS account; and

- makes a one-time full withdrawal from his SRS account.

Ready to start?

Start planning for retirement by veiwing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)