Tips to pick quality dividend stocks

![]()

If you’ve only got a minute:

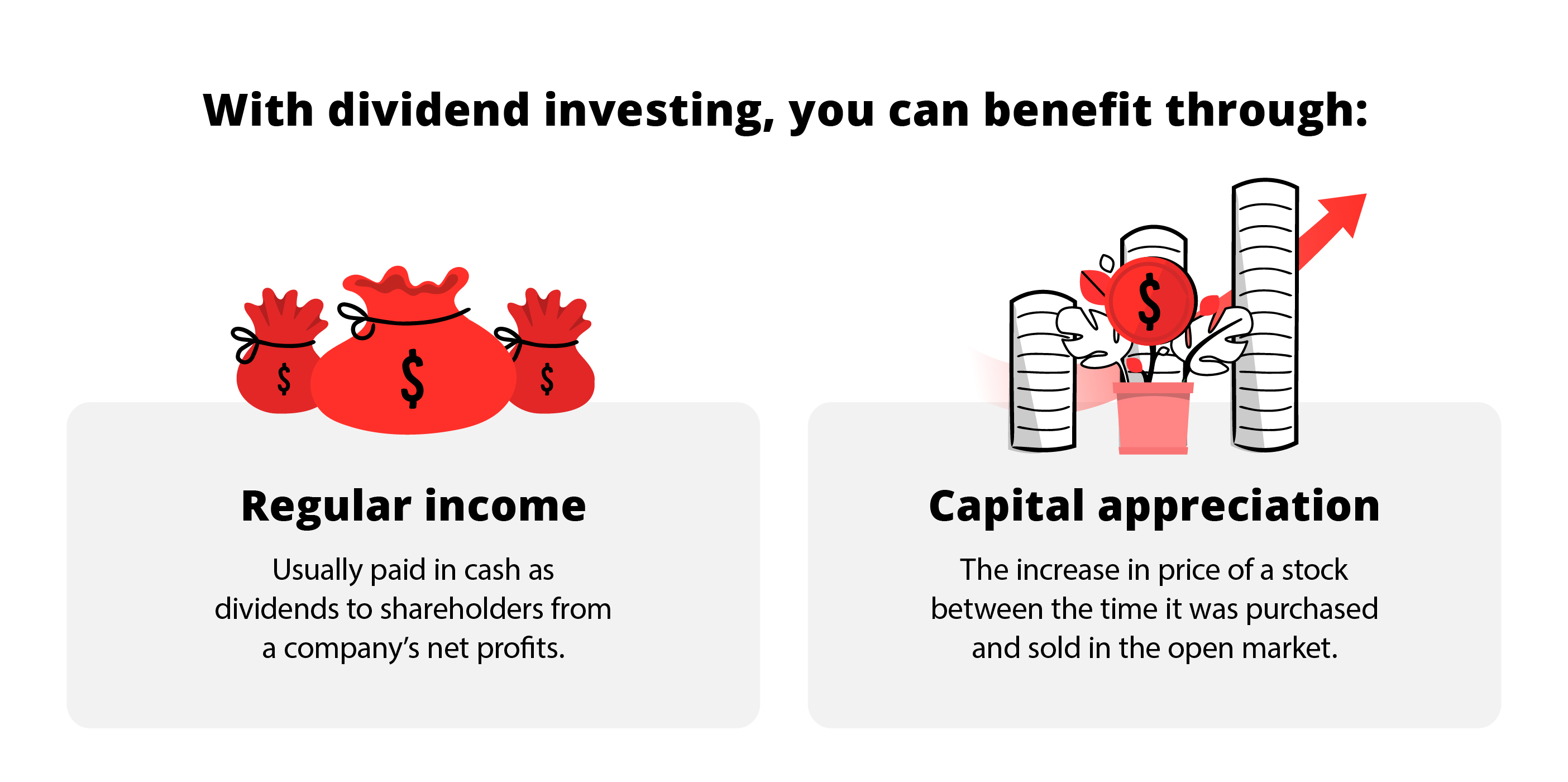

- With dividend investing, you can benefit from both regular cash distributions to share holds and capital appreciation when selling stocks.

- The tips for choosing a quality dividend stock include focusing on Blue-Chip stocks with a dividend payout ratio of 50% or more, and having a track record of consistent dividends.

- While dividend yield is an important measure, do not use it as the sole measure for which dividend stock to invest in.

- Even though they are not exactly dividend stocks, investors often add Reits into dividend-focused investment portfolios.

![]()

One of the reasons we invest is so that we can build a steady stream of passive income. It is a means to enhance our financial wellness as it offers a platform to generate extra cashflows.

Among the most accessible ways to earn passive income is through dividend investing or income investing. It is not hard to see why this is a popular way of investing in Singapore, a market that has relatively high dividend yields.

Income earned passively can supplement our salaries, tide us over between gigs, and help us prepare for retirement better. Moreover, receiving dividends or distributions from your investments is the most tangible way to feel the benefits from investing.

By using this method of investing, you would want to focus on picking up dividend stocks.

Tips for picking dividend stocks

While dividend stocks have many similar attributes, you should focus on investing in only quality dividend stocks.

Here are 7 pointers to take note of so that you can select quality plays.

Look for mid-to-large cap stocks

Among dividend stocks, those that tend to be popular or favoured by income investors are usually mature companies with stable revenue, profits and cashflow. Stocks of many of these companies are also known as Blue-Chips.

Often, these companies are not high-growth businesses, but they have exhibited consistent earnings growth for many years and are often thought of as lower risk than high growth stocks.

While there might be more upside for high growth stocks, at present, such companies use up a lot of cashflow for expansion, leaving little for dividends.

Because more mature companies are not usually expanding aggressively, most of their earnings can be returned to shareholders as dividends.

Conversely, smaller, high-growth companies need more cash and resources to grow and expand their businesses, leaving less cash to pay shareholders dividends.

Dividend payout ratio of 50% or more

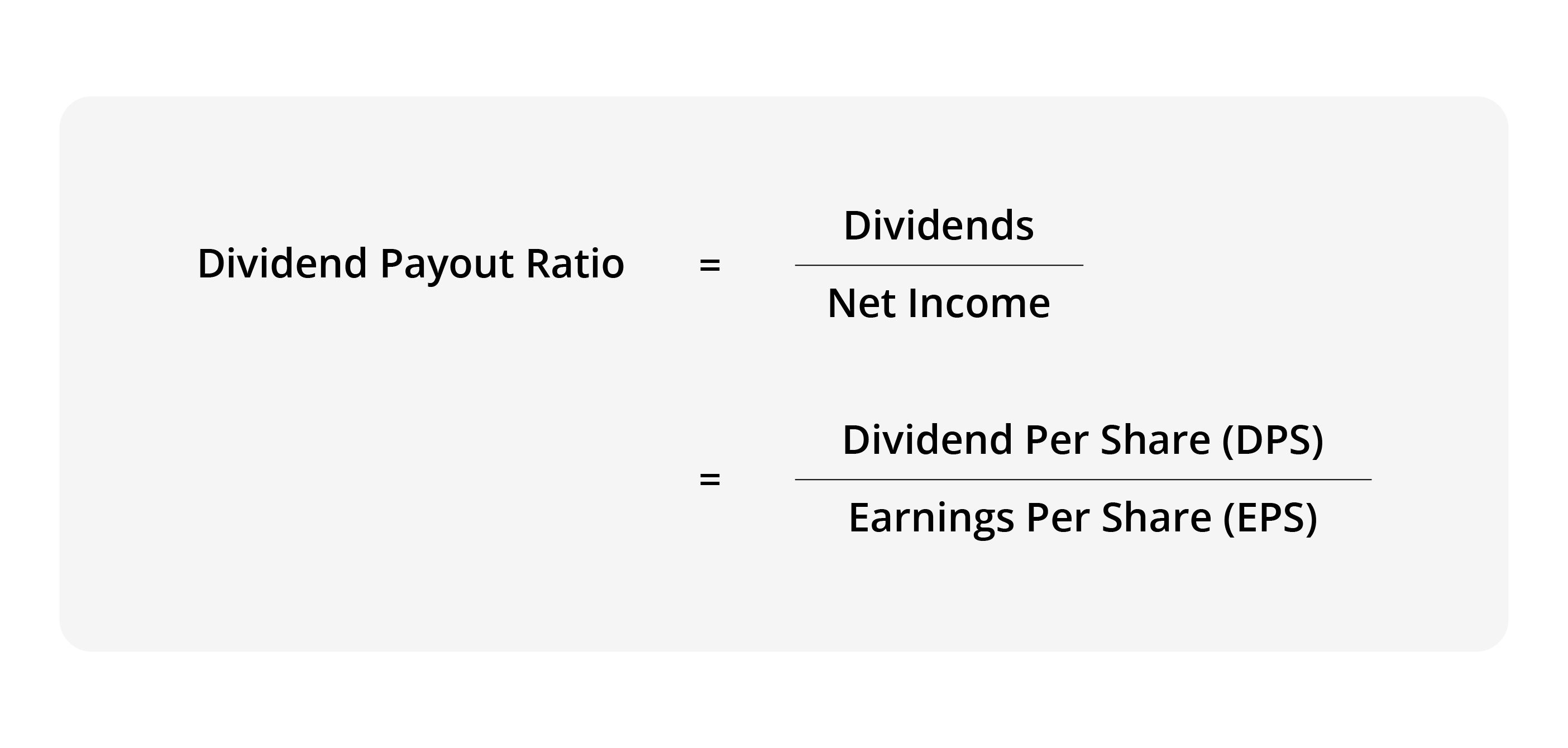

The dividend payout ratio is the percentage of a company’s earnings paid to shareholders as cash dividends. This figure is usually expressed as a percentage.

Among other things, it is viewed as an indication of the sustainability of a company’s dividend payment stream.

If a company is large, stable and isn’t seeking to grow aggressively anymore, then the bulk of the profits it makes should be returned to shareholders.

There is no universal benchmark for the ideal payout ratio. But given that dividend-seeking investors are on the hunt for a relatively high payout ratio – a reliable figure to work with can range from 40% to 50%, depending on who you talk to.

On the other hand, you might consider avoiding companies that have too high of a payout ratio (> 80%).

There are two reasons for this. The first, is that a company is vulnerable to cutting dividends when earnings decline. The second, is that a very high ratio indicates that a company is issuing more dividends to shareholders instead of reinvesting profits for sustained growth, which might result in a lower probability of capital gains for investors.

If a company has a low payout ratio, ask yourself why the company is holding on to the cash. A company might do so to fund a future acquisition.

Unless they have a good reason to do so or have a way to generate exceptional returns for shareholders, the majority of profits should be paid out as dividends.

Overall, the sweet spot can be a payout ratio of (roughly) between 50 and 70%.

Track record of consistent dividends

The company should have a long and stable track record of paying consistent/growing dividends to shareholders.

Dividend investors will get no joy from a large and successful company – with profits to distribute – if the company chooses to pay dividends inconsistently.

Keep a look out for companies that pay rather consistent dividends along with dividend issuance programmes.

Also, check to see if companies are paying a growing dividend over the last 5 to 10 years. This shows that as the company grows more successful, the management is also willing to share the fruits of its labour with its shareholders.

In the US stock market, companies on the S&P 500 index have a track record of annually increasing their dividends paid to shareholders for at least the last 25 years.

Sustainable company fundamentals

Many dividend investors tend to ignore the overall aspects of a company’s fundamentals as they focus primarily on the value of dividends they can receive.

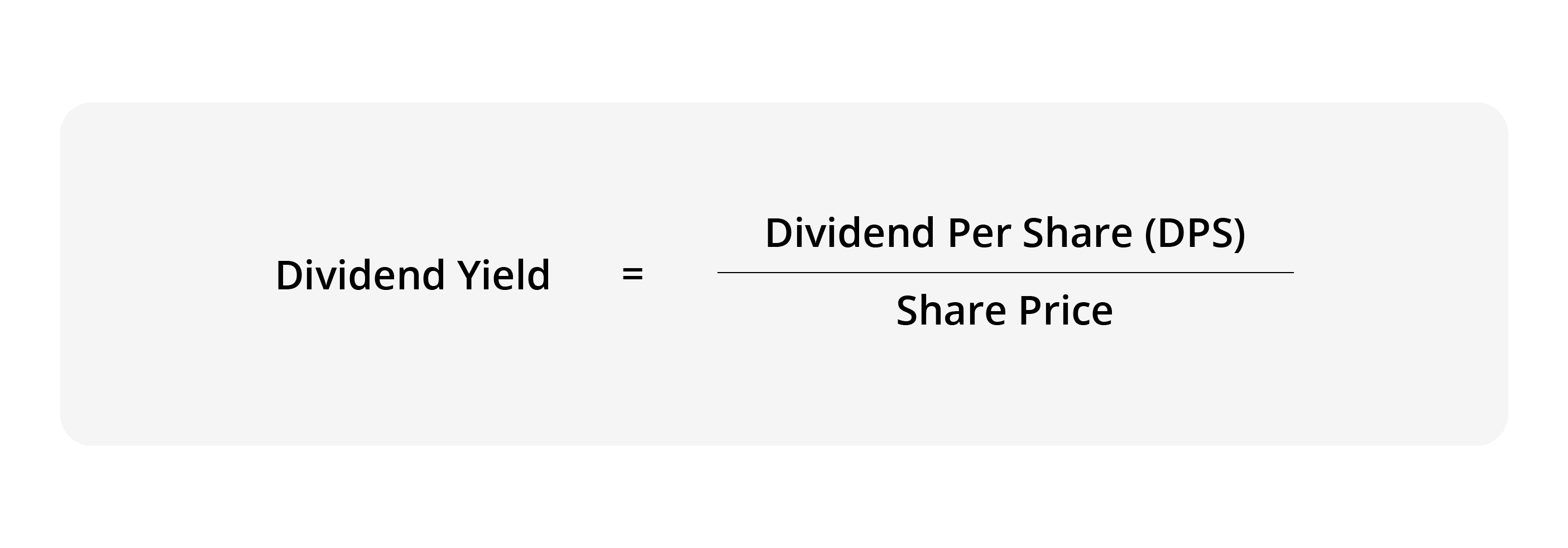

These investors are only looking at the dividend yield of the stock, which is often calculated as the ratio of its dividends per share in the past 12 months to its current share price.

This can be myopic if investors are only focusing on high dividend yields without other considerations.

As the most commonly used dividend yield measure factors in the dividend per share of the past 12 months, it is a historical measure based on current prices. In this case, the dividend yield does not take into account dividend projections for the future.

This is why even though dividend yield is an important metric for income investors, it is also crucial to consider the overall health of the company.

A company with deteriorating fundamentals (e.g. declining revenue, profits, cash flow, competitive advantage) cannot sustain its dividend payout in the long-term. The less revenue and profit it makes, the less dividends it can pay.

Over time, a company with falling revenues and profits will see its stock price fall when investors realise that the company is no longer performing. This fall in value will eat into any dividend gains you might have had at the start – leaving you back at square one.

So always make sure the company you want to invest in will remain fundamentally strong and robust for many years to come.

Low Capex

As a dividend investor, you might prefer to invest in a company with low capital expenditure (Capex) commitments and plans.

A company with high Capex is continually reinvesting its profits to expand its business, which leaves less to distribute as dividends. For example, airlines have very high Capex as they need to continually maintain and upgrade their aircraft fleets.

So, if you’re looking for dividend stocks, look for a company that’s able to maintain/grow its business with minimal Capex requirements.

Company has stable free cash flow

Ultimately, a company must have real cash (not just accounting profits) to be able to pay dividends to its shareholders.

A company can show accounting profits but suffer negative or inconsistent free cash flow. Such companies will have trouble paying stable dividends.

A smaller company that is seeking to grow might have negative free cash flow as it expands its business. But a large, stable company that dominates its industry should be more able to produce strong free cash flow consistently.

Yield must beat the risk-free rate

The dividend yield you receive should beat the risk-free rate of the country you reside in. The risk-free rate is the lowest return you can theoretically get “risk-free” over a period of time.

In the US, if you plan to invest your money for 10 years, then the risk-free rate is usually based on the return of the 10-year US Treasury note which at the time of writing is 3.51%.

In Singapore, the risk-free rate is the lowest return you can get for very low-risk instruments, such as Singapore Government Securities, a type of government bond.

What about Reits?

While they are not exactly dividend stocks, investors often add portfolios with real estate investment trusts (Reits) into dividend-focused investment portfolios.

The reasons are plain and simple. In Singapore, Reits are required to distribute 90% of income earned as dividends to unitholders, an attractive proposition for those in favour of income investing. Distributions to unitholders, which are quarterly or semi-annual, are exempt from tax too.

Globally, Reits have consistently delivered strong total returns (unit price appreciation + distributions to unitholders) over the past two decades.

In summary

Dividend investing is one of the most accessible ways to earn passive income.

If you plan to invest in dividend stocks, always remember to do your due diligence and focus on quality companies which have dividend payout ratios of 50% or more, a track record of consistent dividends and sustainable company fundamentals, among others.

Also, remember not to get too carried away by high dividend yields without considering the future prospects of the stock.

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)