I’m ready to invest, how can I start?

![]()

If you’ve only got a minute:

- Investing is one of the main ways to help you preserve the spending power of your savings.

- Know your investment capital, financial objectives, risk appetite and the type of investment products available to you before you start investing.

- You can fund your investment using cash savings, CPF or SRS, via a lump-sum contribution or smaller regular contributions.

- Some common investment products include equities, ETFs, unit trusts, Reits, bonds as well as gold.

- Tap Plan & Invest on digibank for customised investment picks based on your objectives, risk profile, and preference.

![]()

Regardless of whether you are a first jobber, an experienced professional, a parent with school-going children or about to retire after a long career, investing is an effective way to put your savings to work so that you can build or preserve your wealth.

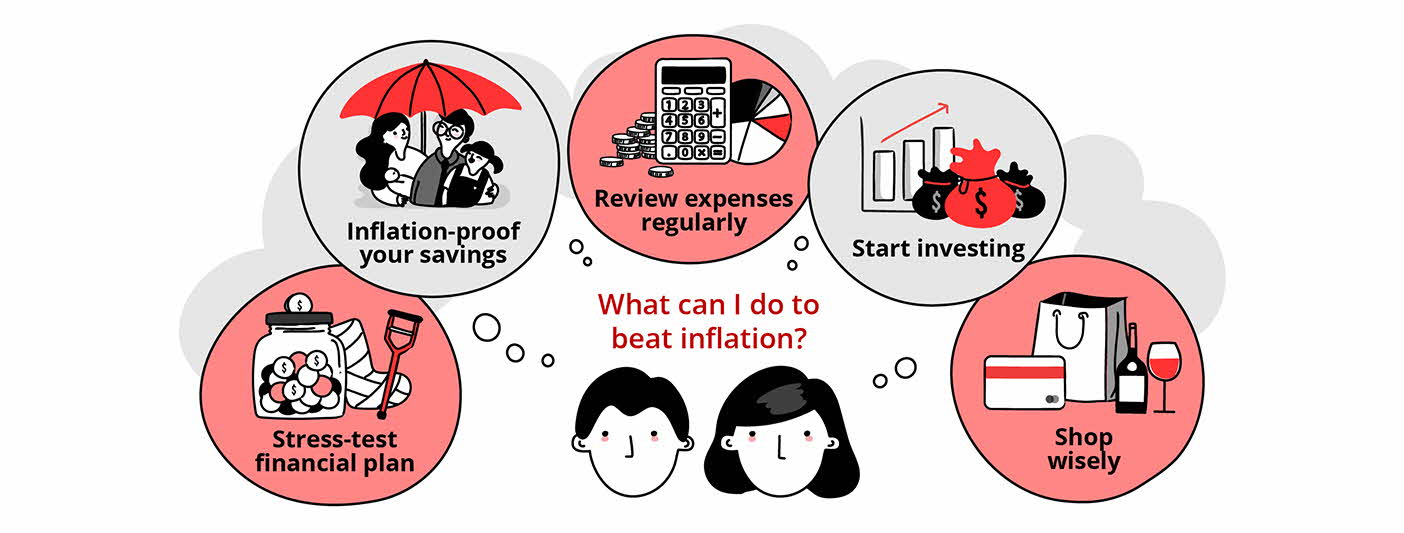

Among the chief benefits of investing is that over time, it can help to combat the effects of inflation. By investing smartly, your savings are able to outpace inflation or at the very least, minimise its effects.

In June 2022, Singapore’s headline consumer price index (CPI) and core inflation rate in has reached levels not seen since the Global Financial Crisis.

Moreover, in DBS’s research report Are you losing the race against inflation?, income was found not to be keeping up with inflation for 40% of 1.2 million DBS retail customers, and that increase in expenditure has outpaced income growth by 2 times.

This is why in times like these, it is vital to look for ways to beat inflation before it erodes the value of your hard-earned money. With a long-term view on investing, you can not only cope with inflationary pressures but benefit from the power of compounding.

While investing has its merits, people often face a lot of inertia, which prevents them from getting started. After all, with so many investment choices in the market, it’s not unusual for new investors to feel overwhelmed by information.

So, here’s a simple introduction to some common investment products and funding options to help you get started on investing and making the right decisions.

Ways to invest

Depending on your financial objectives and situation, you can choose to fund your investments by one or a combination of cash, Central Provident Fund (CPF) monies or Supplementary Retirement Scheme (SRS) savings. This can be done via a lump-sum contribution, regular contributions of smaller amounts or a combination of both.

Lump-sum

If you have been saving up for awhile and have sizeable funds to make investments, you can consider making a series of one-time purchases in a selection of stocks. Lump-sum investing can also be done with a one-time contribution with ad-hoc funds (e.g. when you receive your bonus).

Regular Savings Plan (RSP)

A RSP allows you to invest a fixed sum of money regularly into the same choice of investment over a period. This is usually done monthly and makes use of the dollar-cost averaging (DCA) strategy where your money buys more units when prices are low and fewer when prices are high, thus cushioning the impact of volatility in stock markets. DBS Invest-Saver lets you invest regularly into exchange traded funds or unit trusts from as little as $100 a month.

Read more: Is DCA or lump-sum investing better for you?

Find out more about: Riding the market steadily with Invest-Saver

Types of investments

1. Direct investment into equities

When you buy shares of a company, you are in essence, a part owner of it. As a shareholder, you are entitled to dividends and capital gains if any, but also subject to losses in capital should a company’s share price dip. In this scenario, your losses would be limited to the amount of money you invested into the shares of the company.

Depending on your goals and risk appetite, you can choose to invest in growth stocks or blue-chip stocks.

Growth stocks tend to have higher potential returns with typically higher risks. Meanwhile, blue-chip stocks – shares in established companies with robust growth – may have lower returns but often pay dividends and have a more stable outlook.

Having a DBS Vickers Online Trading Account or a DBS Vickers Young Investor Account allows you to trade in 7 key markets. This account will be linked to the DBS Multi-Currency Account for ease of settlement and dividend crediting.

2. Exchange-traded funds (ETFs) & unit trusts

Both ETFs and unit trusts are pooled investment instruments which offer diversification through having a basket of stocks instead of individual stocks.

An ETF is passively managed and aims to mirror the performance of a specific market index or diversified basket of securities, while a unit trust is actively managed by professional fund managers who will perform detailed research before deploying funds into specific investments in line with their investment mandate. Given the active management required, it generally costs more to invest in unit trusts than ETFs for the same market of assets.

ETFs, unit trusts and/or managed portfolios offered by robo-advisors are considered as diversified investment products, which means you invest in a pool of securities often from a range of business sectors. This makes them good options especially if you don’t have the time to closely monitor market fluctuations.

3. Real Estate Investment Trusts (Reits)

Many Singaporeans are well acquainted with the concept of investing into the property market – buy a suitable property, collect rental for the unit and capitalise on price increases by selling it off at the right time. One common barrier to this investment option is the high prices of properties.

Reits offer a practical way to invest in the property market with smaller sums of monies, while still being able to collect rental in the form of distributions to its unitholders. Reits are professionally managed collective investment schemes that own and invest in assets which generate income (usually through rental) such as office buildings, shopping malls and hotels, among others.

There is also potential for capital gains when real estate prices rise, when the Reit makes acquisitions or if the Reit is managed well. Conversely, should the real estate market take a hit, or if the Reit is poorly managed, your investment could lose its value.

4. Bonds

Bonds are debt instruments. When you invest through bonds, you are basically loaning money to the entity (i.e. company or government) that has issued the bond for a set number of years.

In exchange, you will receive regular interest (coupon) payments until the maturity date of the bond when the principal amount will be returned to you. The coupon amount and payment frequency is usually fixed, providing a level of predictability of income streams to the investor.

If you were to lend money to someone, there is always a chance that the borrower might not be able to pay you back. Similarly, different bonds carry different levels of risks which are dependent on the credit quality of its issuer.

For example, bonds issued by the Singapore government (e.g. Singapore Savings Bonds) are considered to be safer options than corporate bonds as they are backed by a government with a AAA credit rating. Whether you are investing in a government or corporate bond, it is prudent to do your due diligence on the credit rating of the entity before making your decision.

5. Gold

Gold has historically offered good returns and is believed to be a good hedge against investment fluctuations and inflation. Since it can be tough to store heaps of physical gold, retail investors can gain exposure through gold price-tracking ETFs, unit trusts or robo-advisors.

6. Structured Deposits

If you are looking for a safe instrument to grow your savings, fixed deposits will undoubtedly come to mind. However, in an inflationary environment, it is possible that the interest you can earn from a fixed deposit might not be able to beat inflation.

One option that can potentially offer higher returns than a fixed deposit, while remaining relatively low risk, is a structured deposit.

Structured deposits and fixed deposits are similar in that when you hold your investment to maturity, you will receive your initial principal amount in full (except in the worst-case scenario where the Bank becomes insolvent) along with the base interest return.

Apart from that however, they are quite different. The payout of a structured deposit is linked to the performance of an underlying financial instrument and may be fixed or variable. This link offers you an indirect exposure to investments like market indices, foreign stocks, bonds, interest rates and more.

By broadening exposure to other investment instruments, you can potentially improve the overall returns on your portfolio without taking on excessive risk.

Structured deposits are excluded from insurance coverage under the Deposit Insurance and Policy Owners' Protection Schemes Act 2011 as they are considered to be investments and not fixed deposits. (i.e. Think of them as fixed deposits with an investment component. This one of the reasons why they are not held in a standard savings, fixed deposit nor current account). Remember to do the necessary due diligence, including understanding the underlying securities of a structured deposit, before making any investment decisions.

Using the Singapore Financial Data Exchange (SGFinDex), digibank helps consolidate your financial assets and liabilities across different financial institutions to give you a holistic view of your financial wellness.

It also offers personalised financial advisory services tailored to help you work towards your financial goals and guide you in your budgeting, protection, home planning, retirement, and estate planning journey.

What’s next?

You’ve read the articles, you’ve figured out your financial objectives and risk profile, and you’ve done your research. Now it’s time to take the first step into your investment journey.

If you’re still unsure, you can start small with a RSP or robo-advisor but remember to have enough emergency funds set aside first. Begin growing your wealth today!

Ready to start?

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)