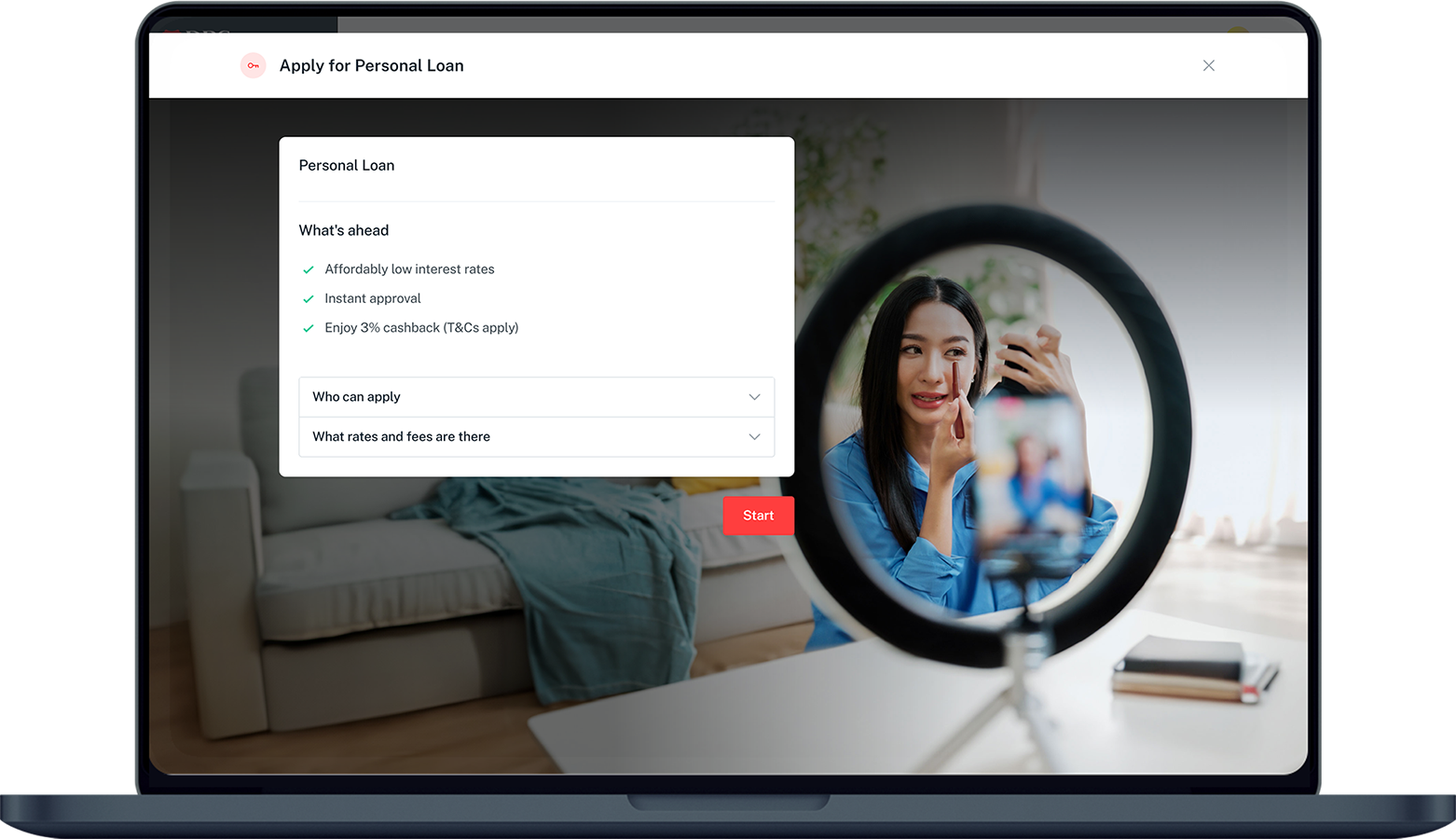

Apply for DBS Personal Loan

Take up a personal loan using your available credit limit easily via digibank.

Part of: Guides > Your Guide to digibank

Important information

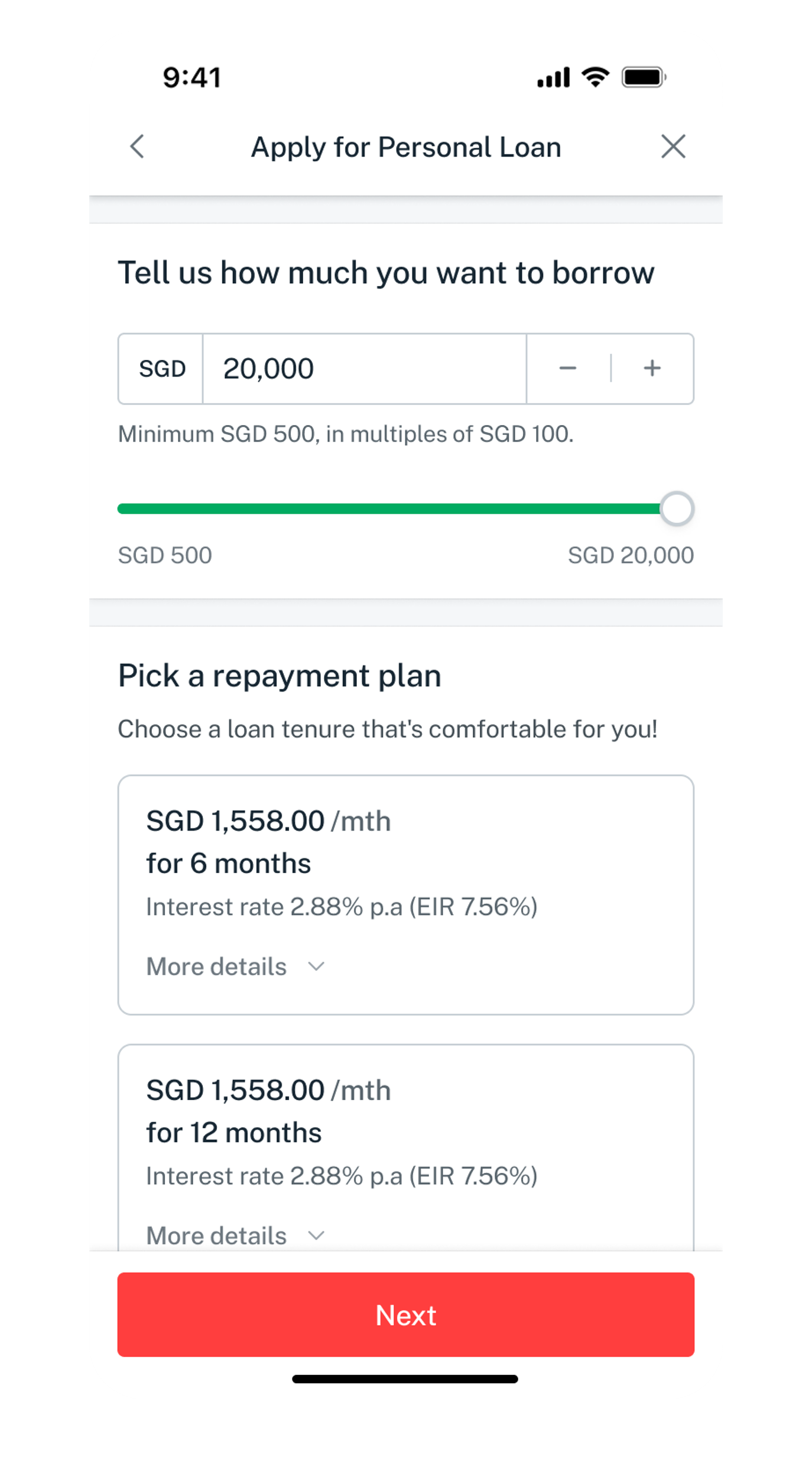

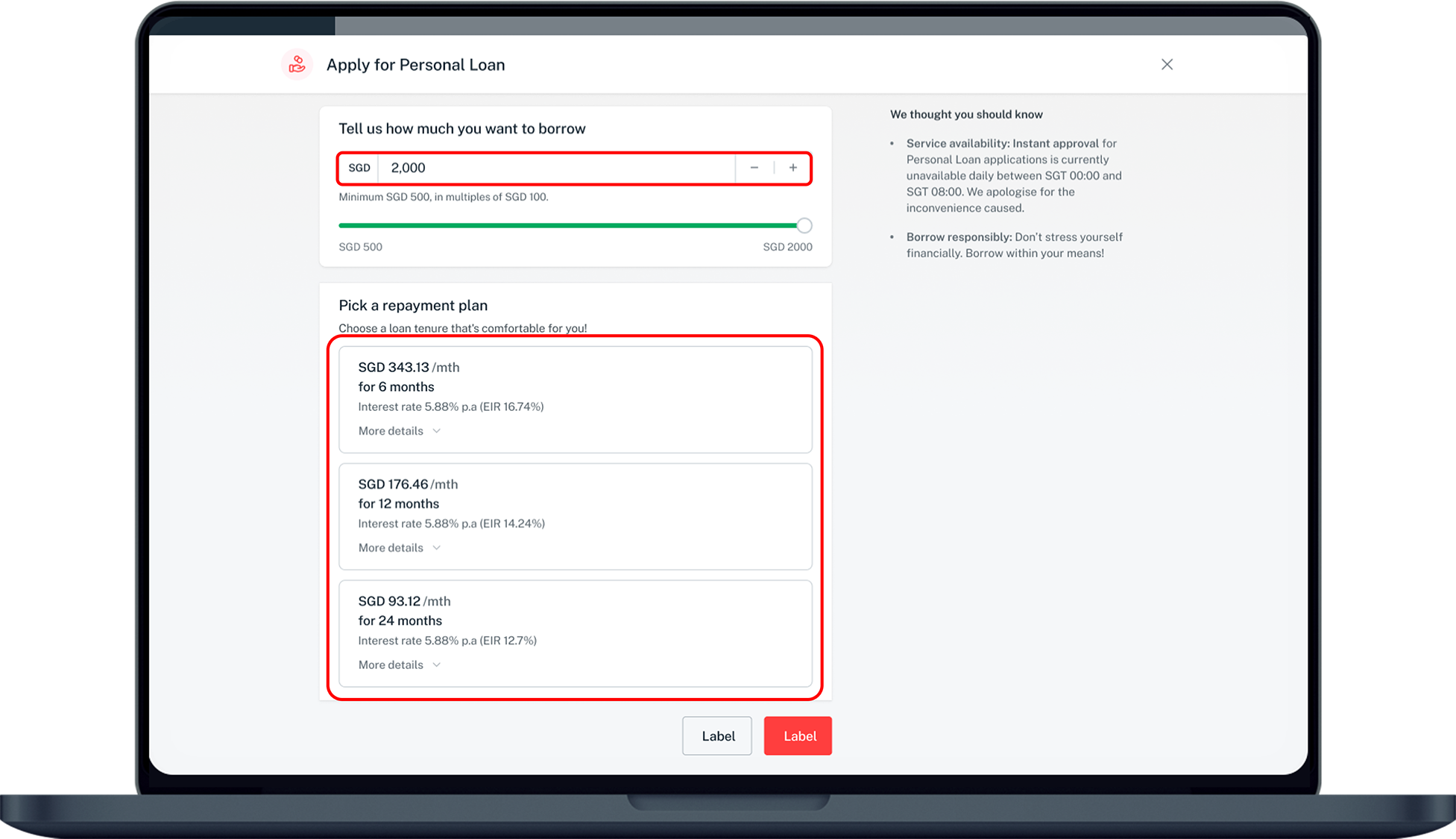

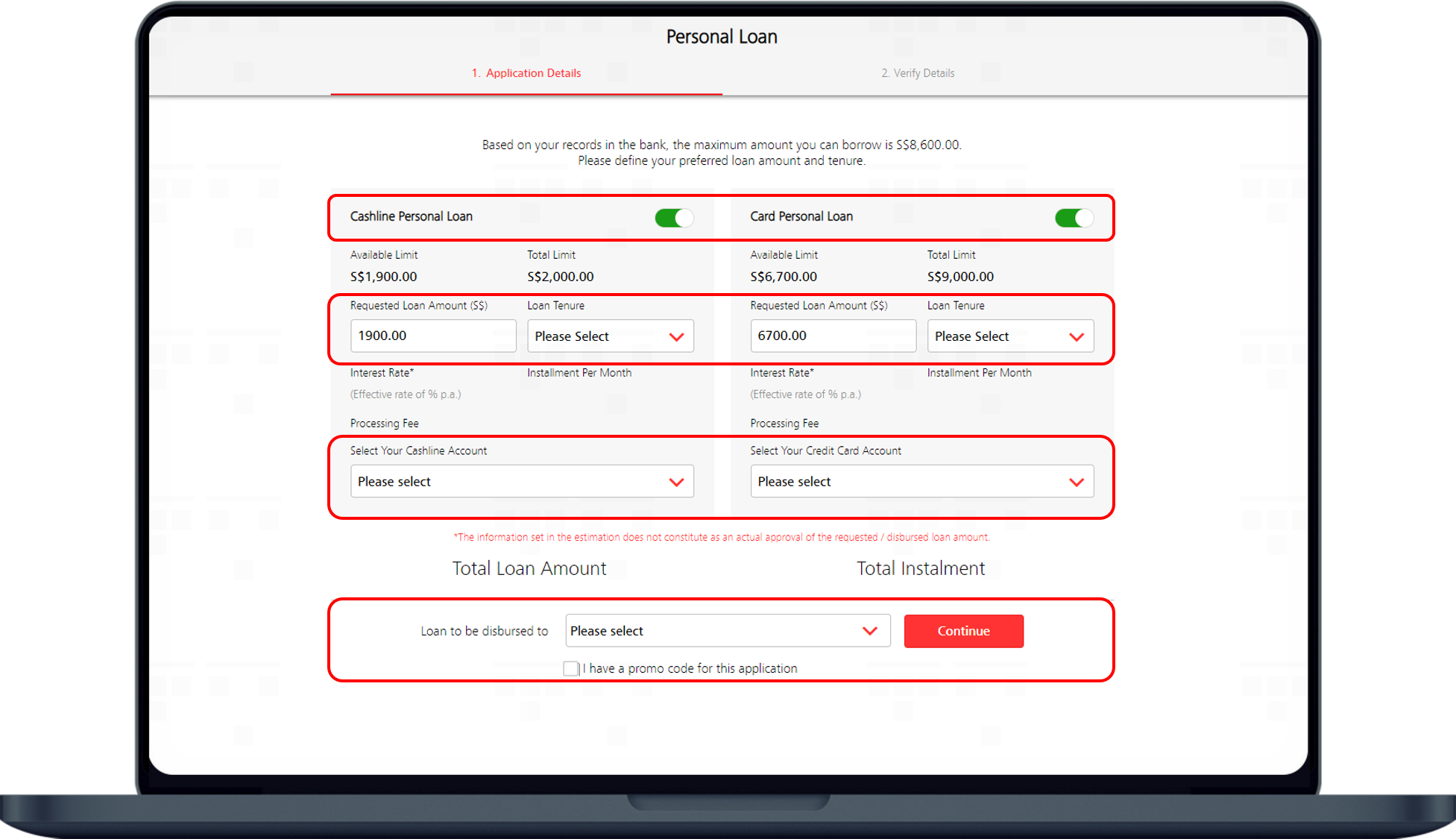

- Apply for any loan amount within your credit limit, subject to a minimum of S$500.

- If you're a Singapore Citizens / Permanent Residents, you can choose to repay your Personal Loan over 6, 12, 24, 36, 48, or 60 months. However if your loan amount is S$3,000 or less, the maximum repayment period is 24 months.

- If you're a foreigners, you can choose to repay your Personal Loan over 6, 12 or 24 months tenures regardless of loan amount.

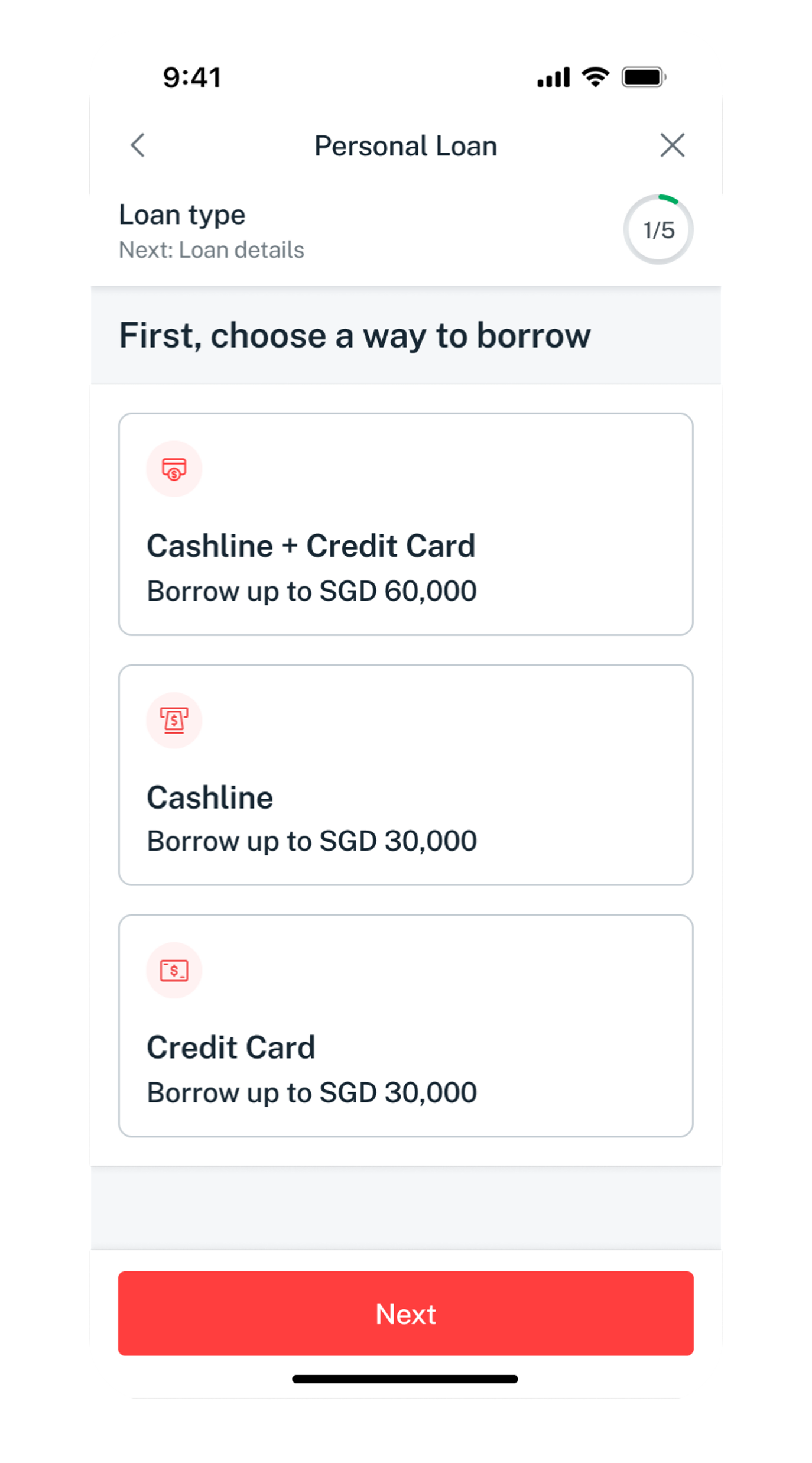

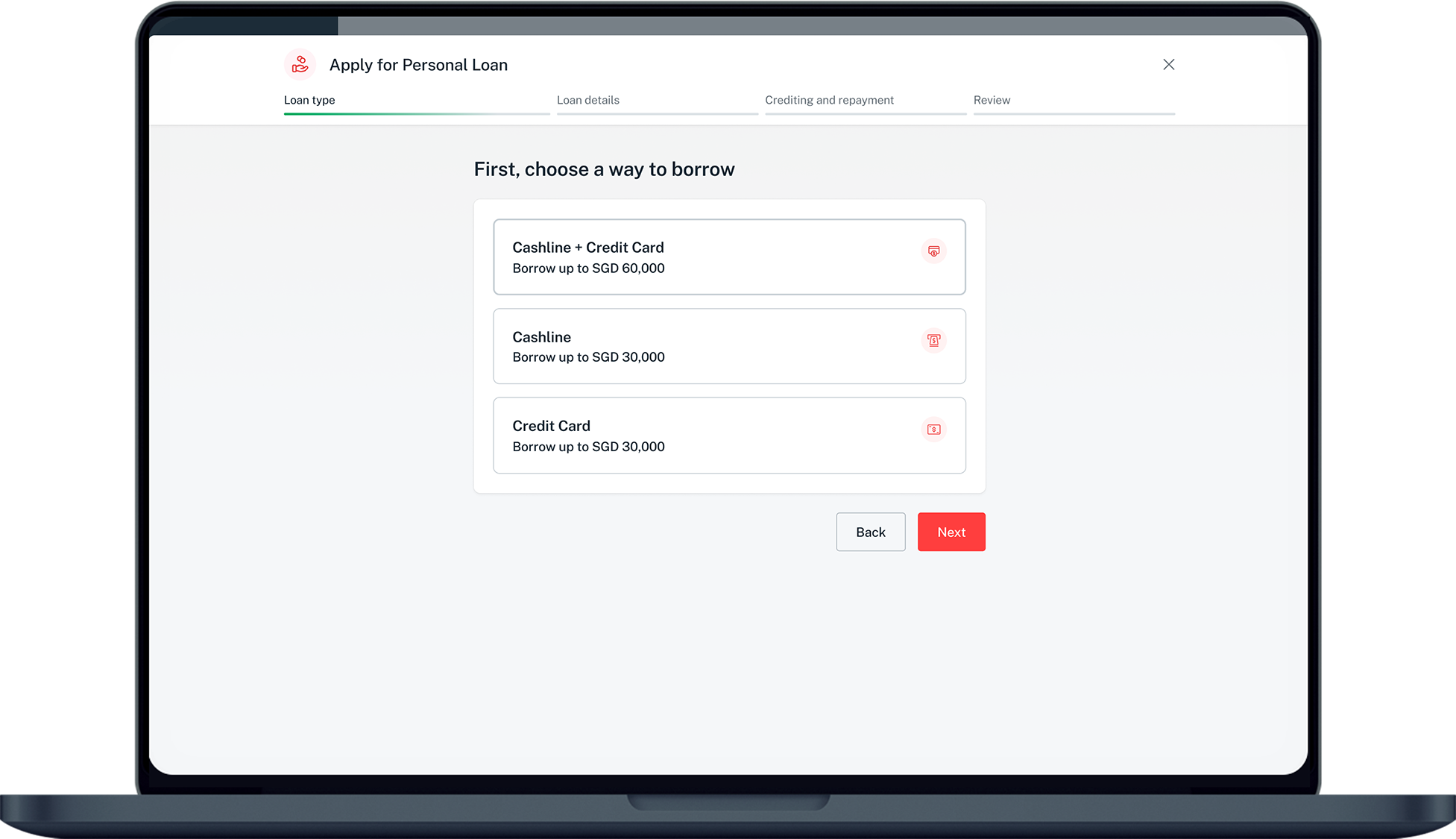

- To get a DBS/POSB Personal Loan, you'll need an existing Cashline and/or Credit Card account. If you do not have an existing Cashline / Credit Card Account, you can learn more on what are the documents required to apply.

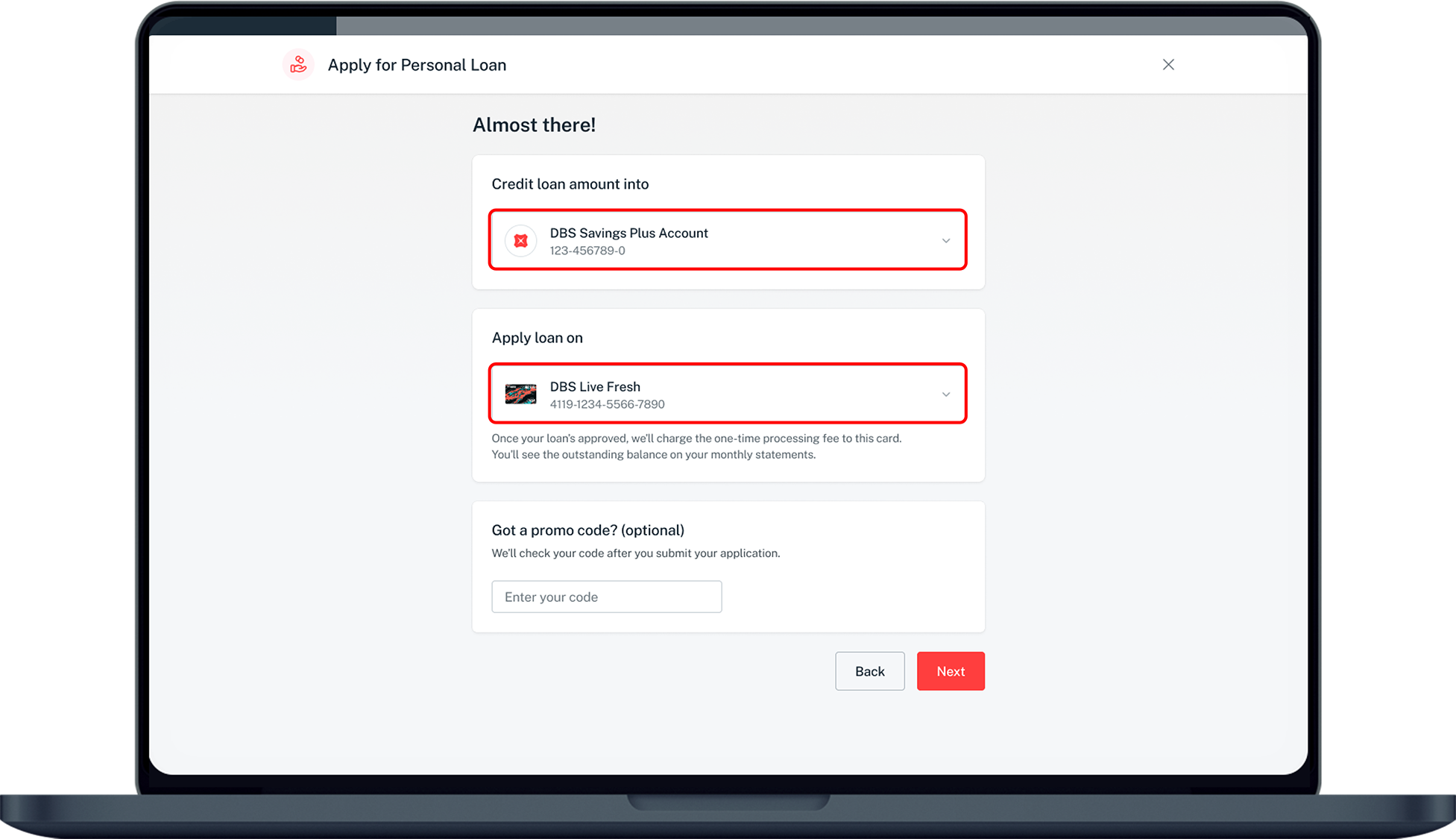

- You will need a DBS/POSB deposit account (excluding Joint All, Trust, MSA, SAYE and POSB current accounts) for loan disbursement. Disbursement into other banks is strictly not allowed.

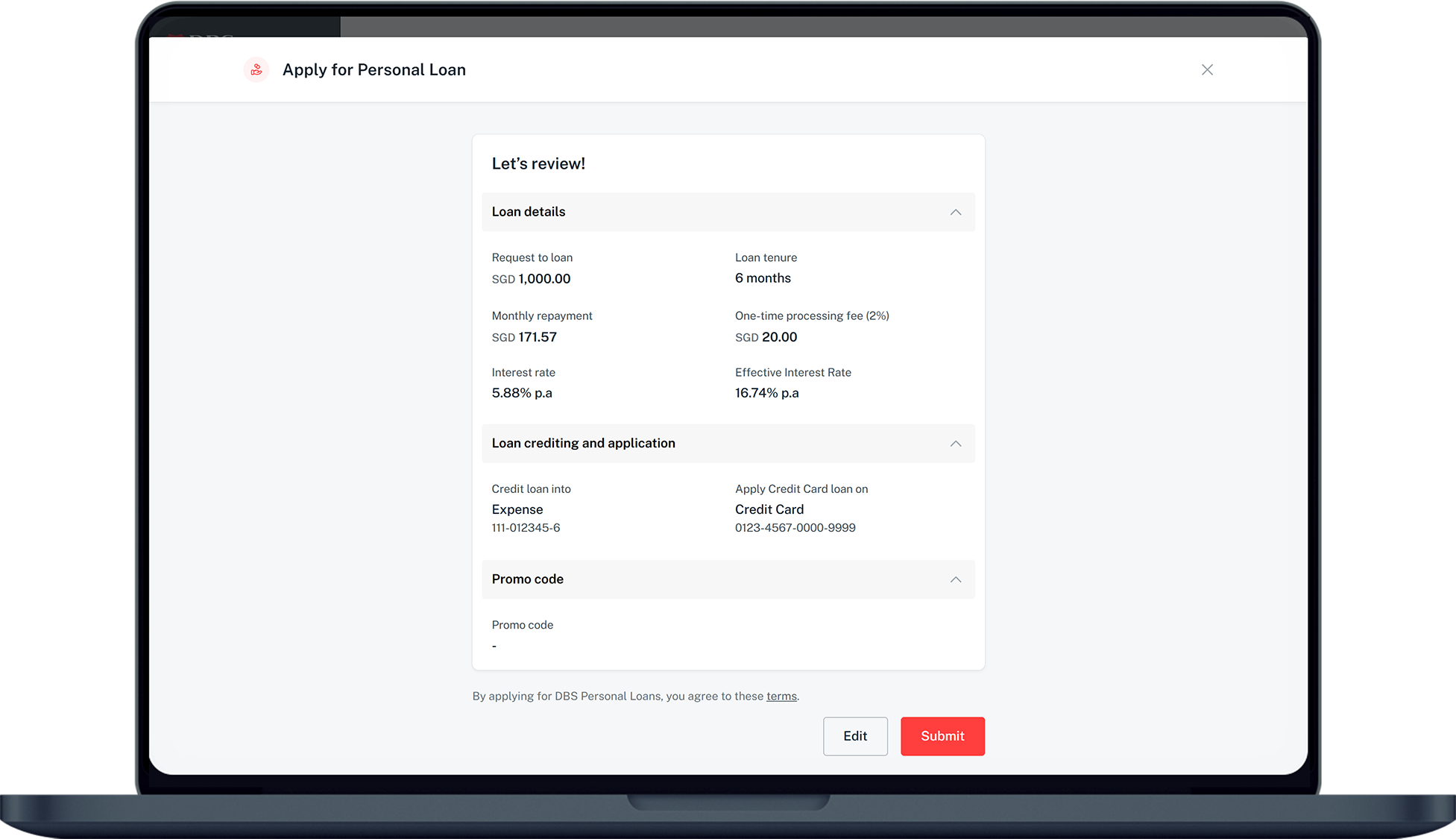

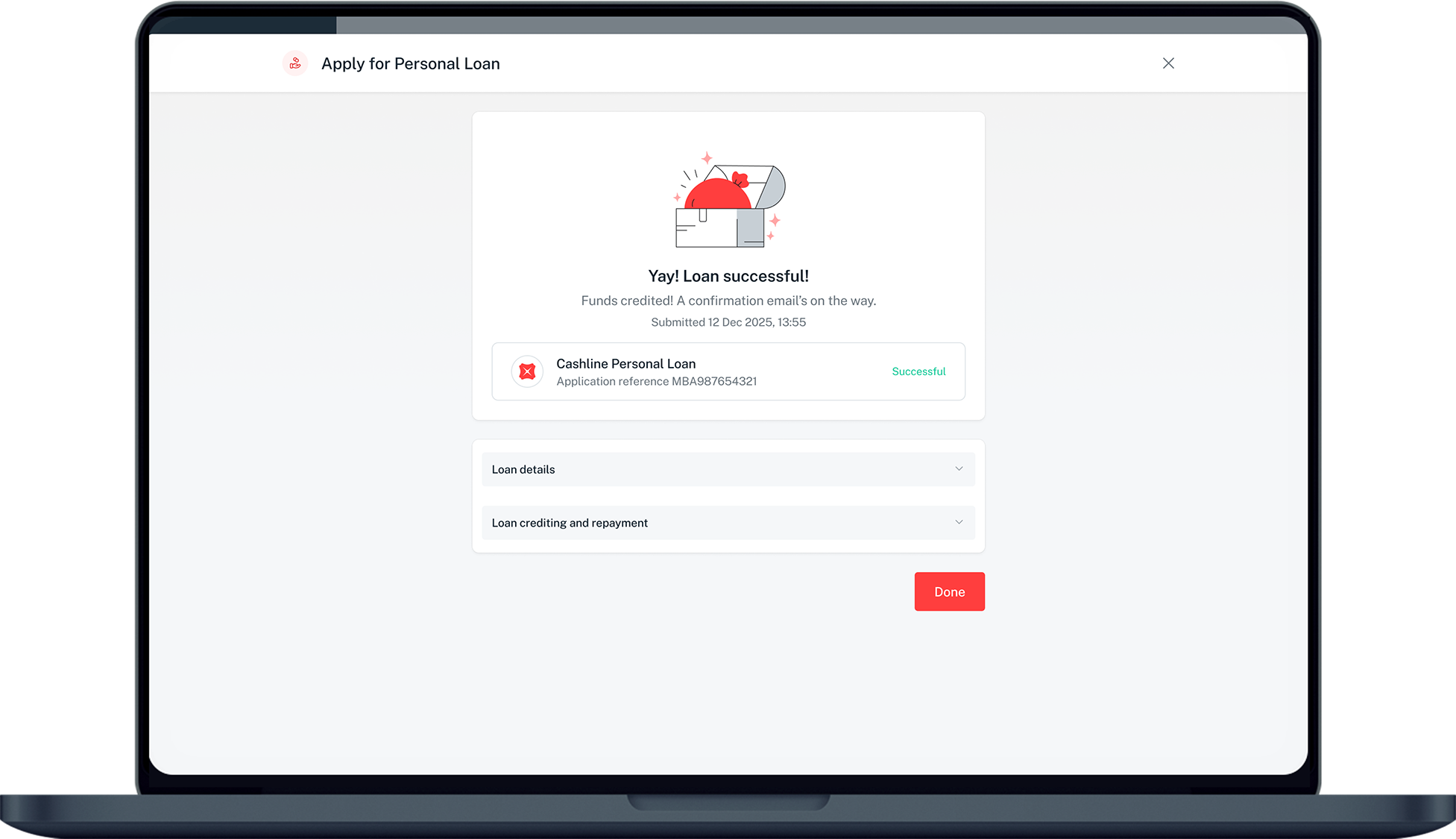

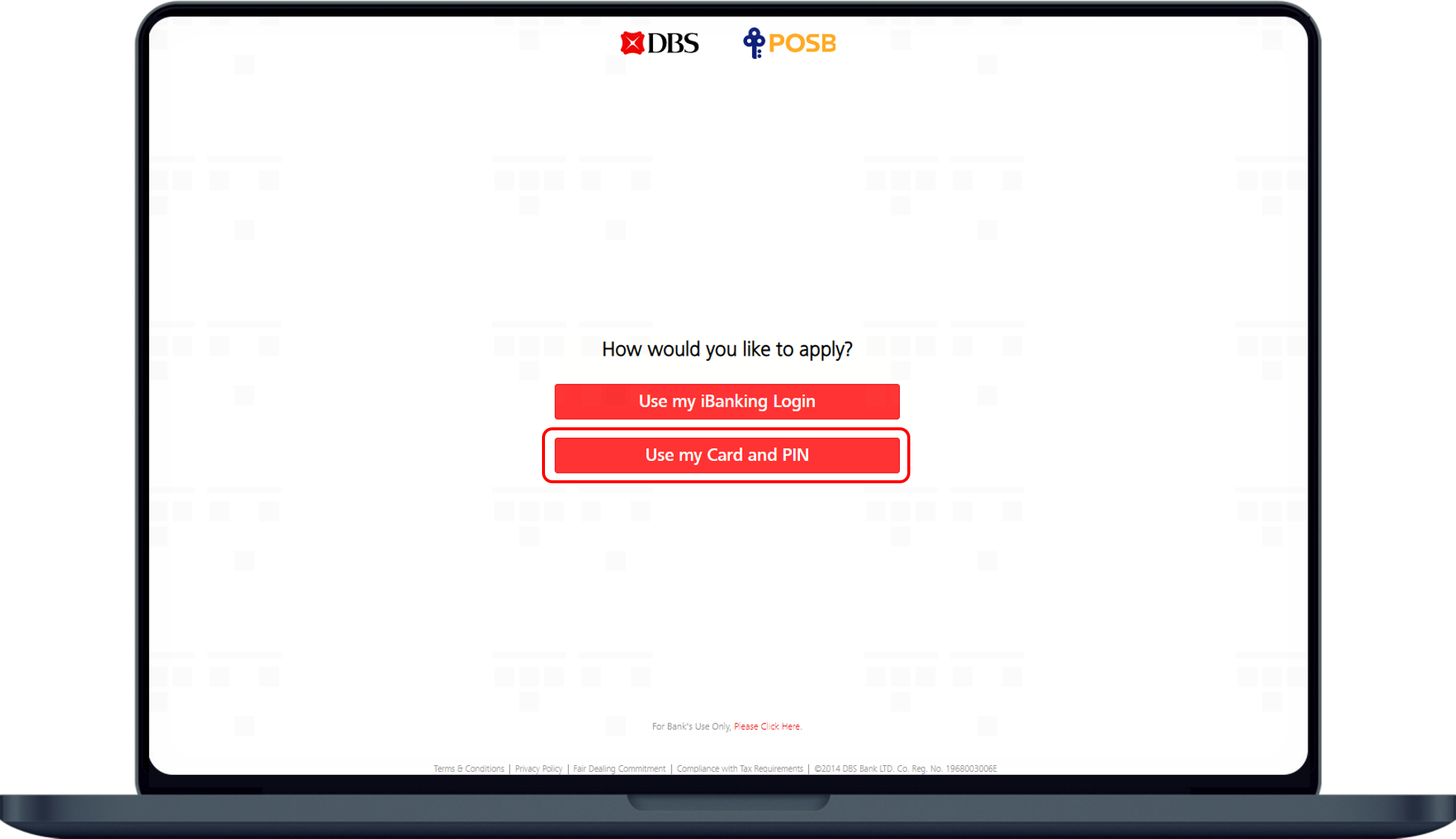

How to apply for DBS Personal Loan

There are various channels which you may apply for DBS Personal Loan with us. The most convenient method would be via digibank mobile.

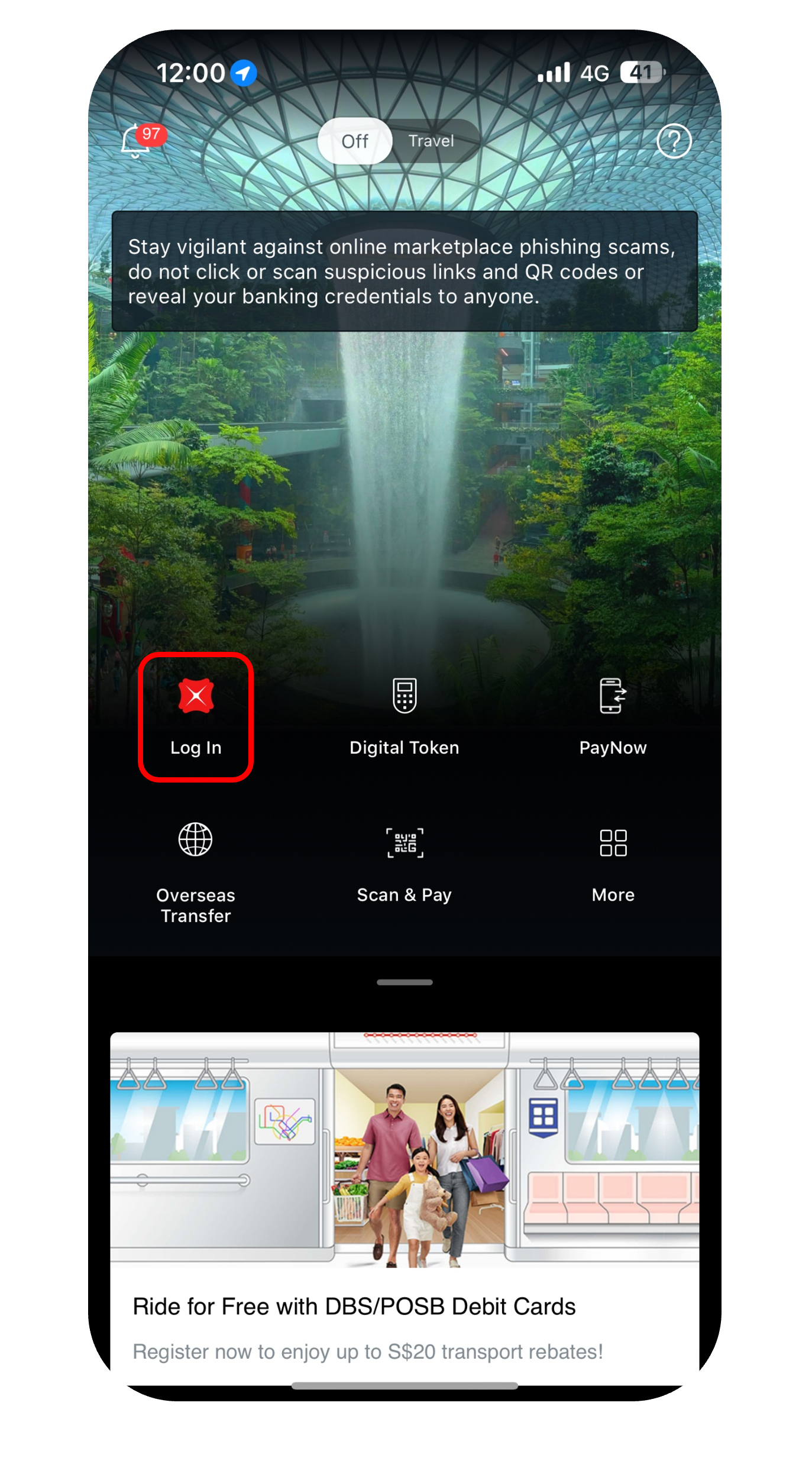

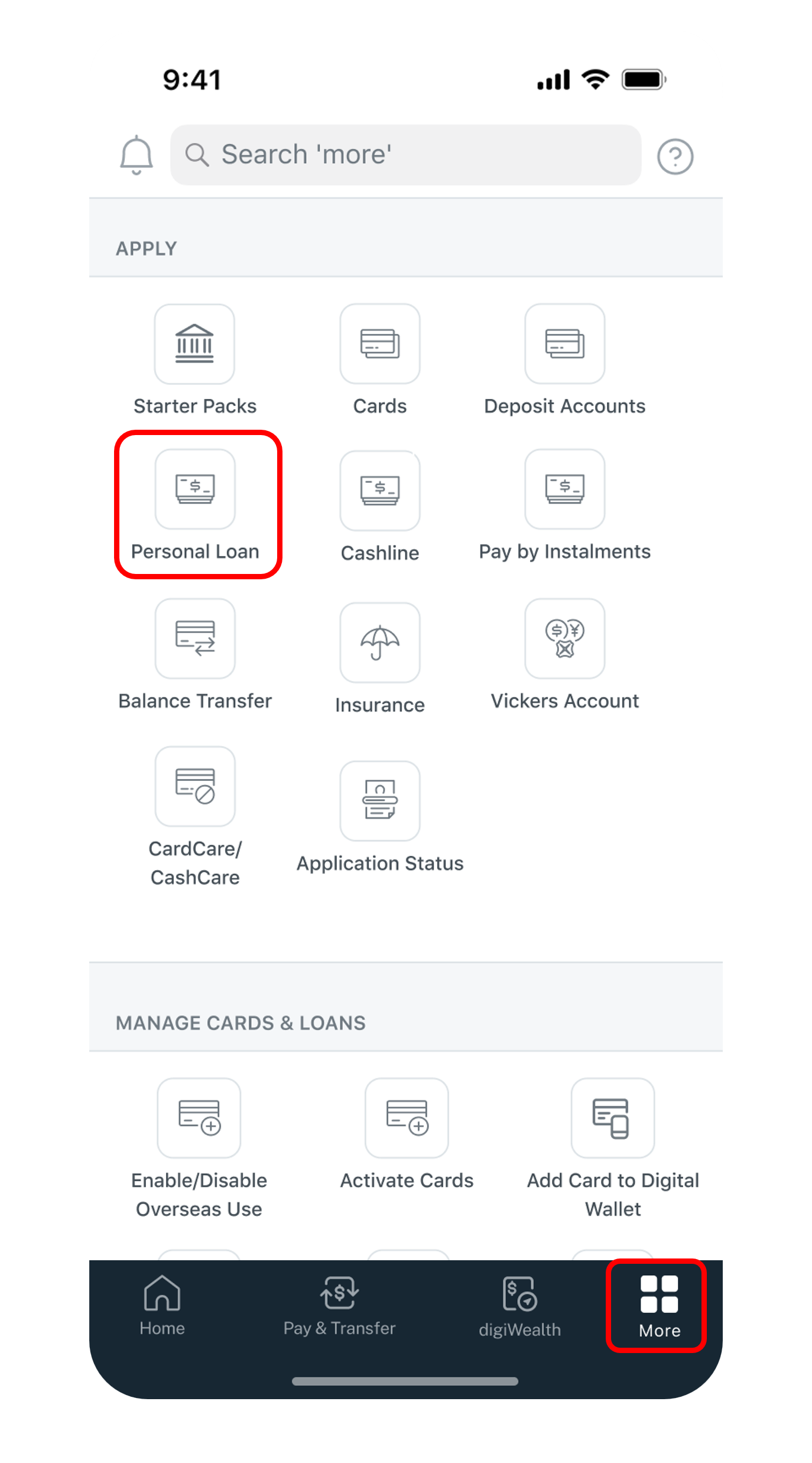

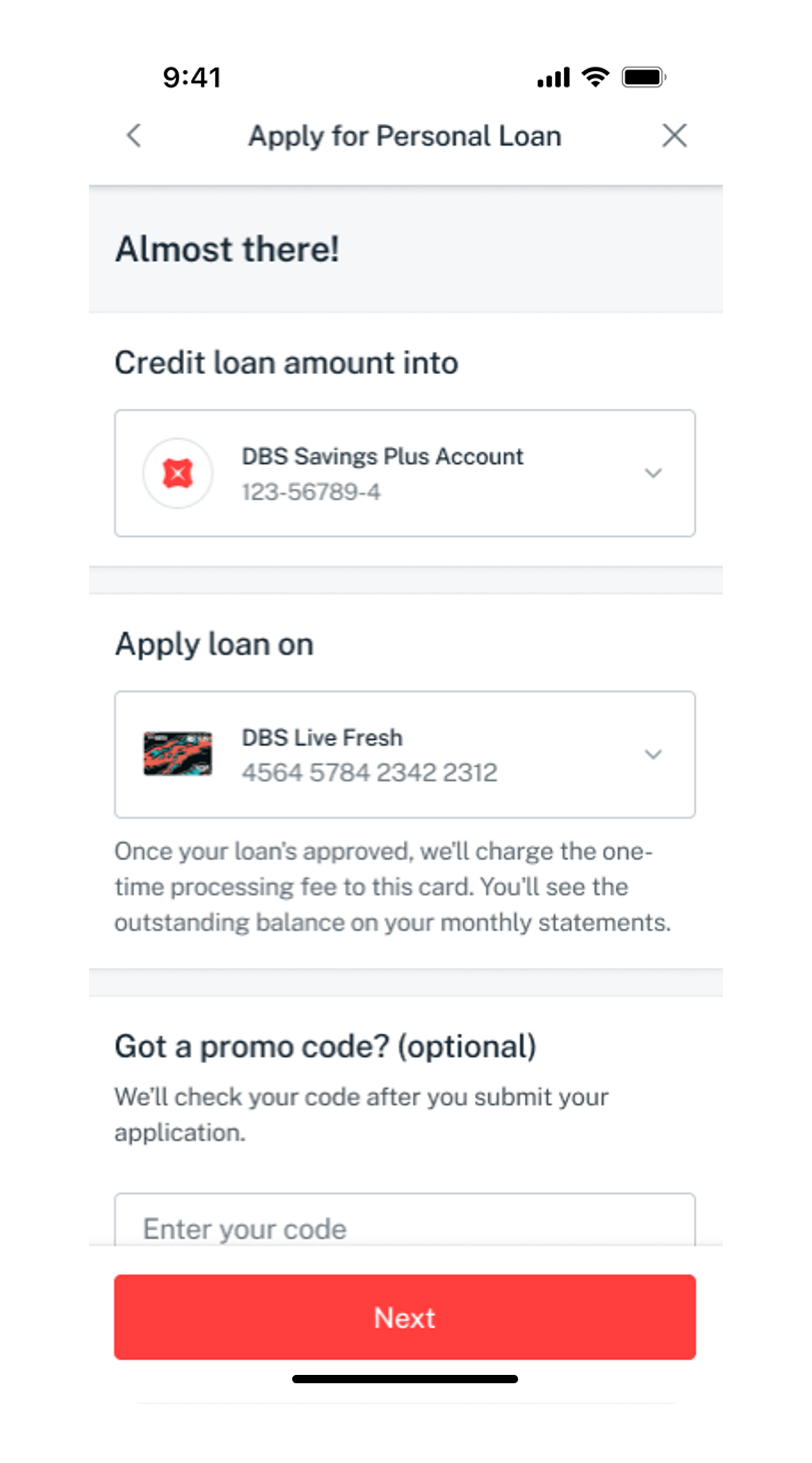

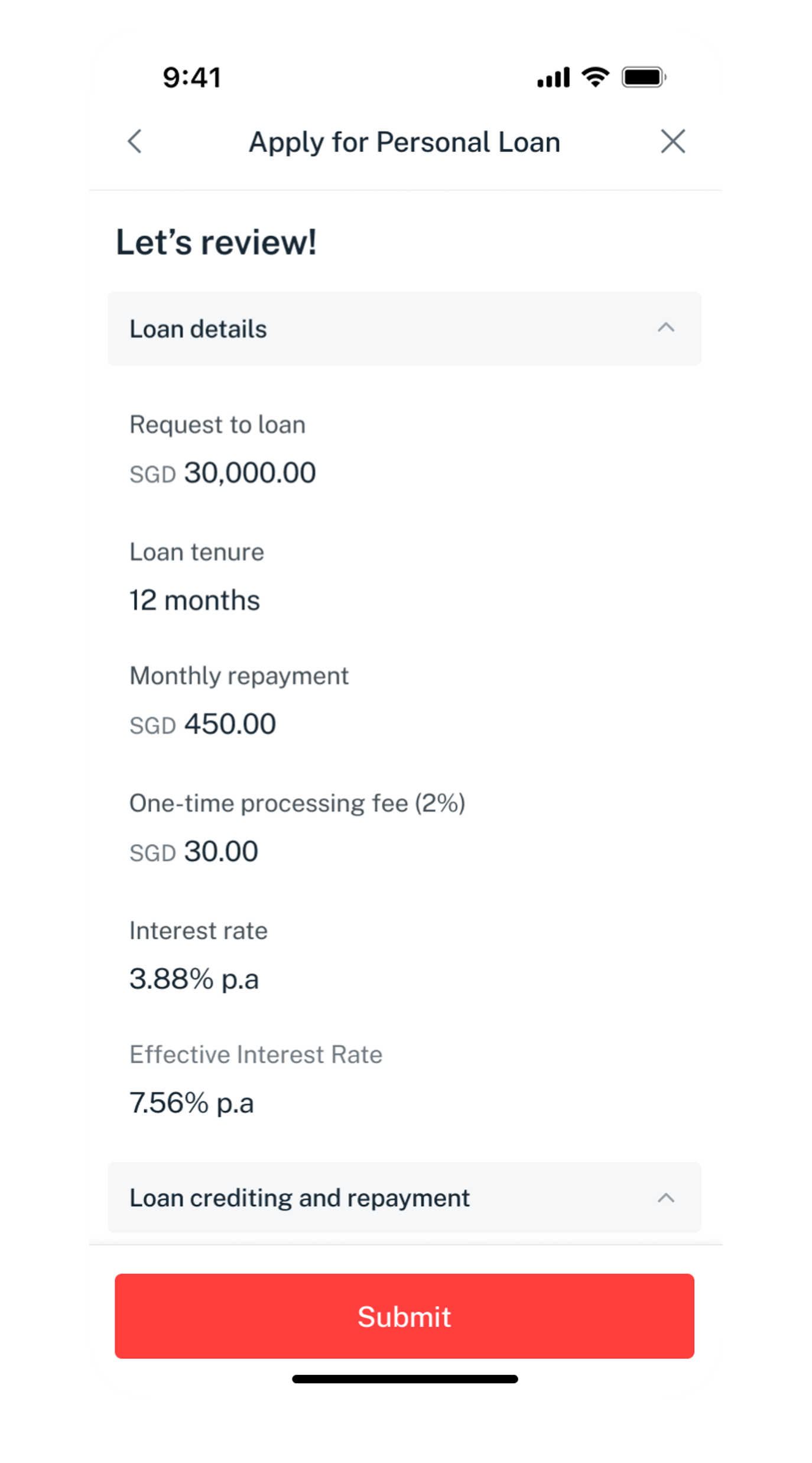

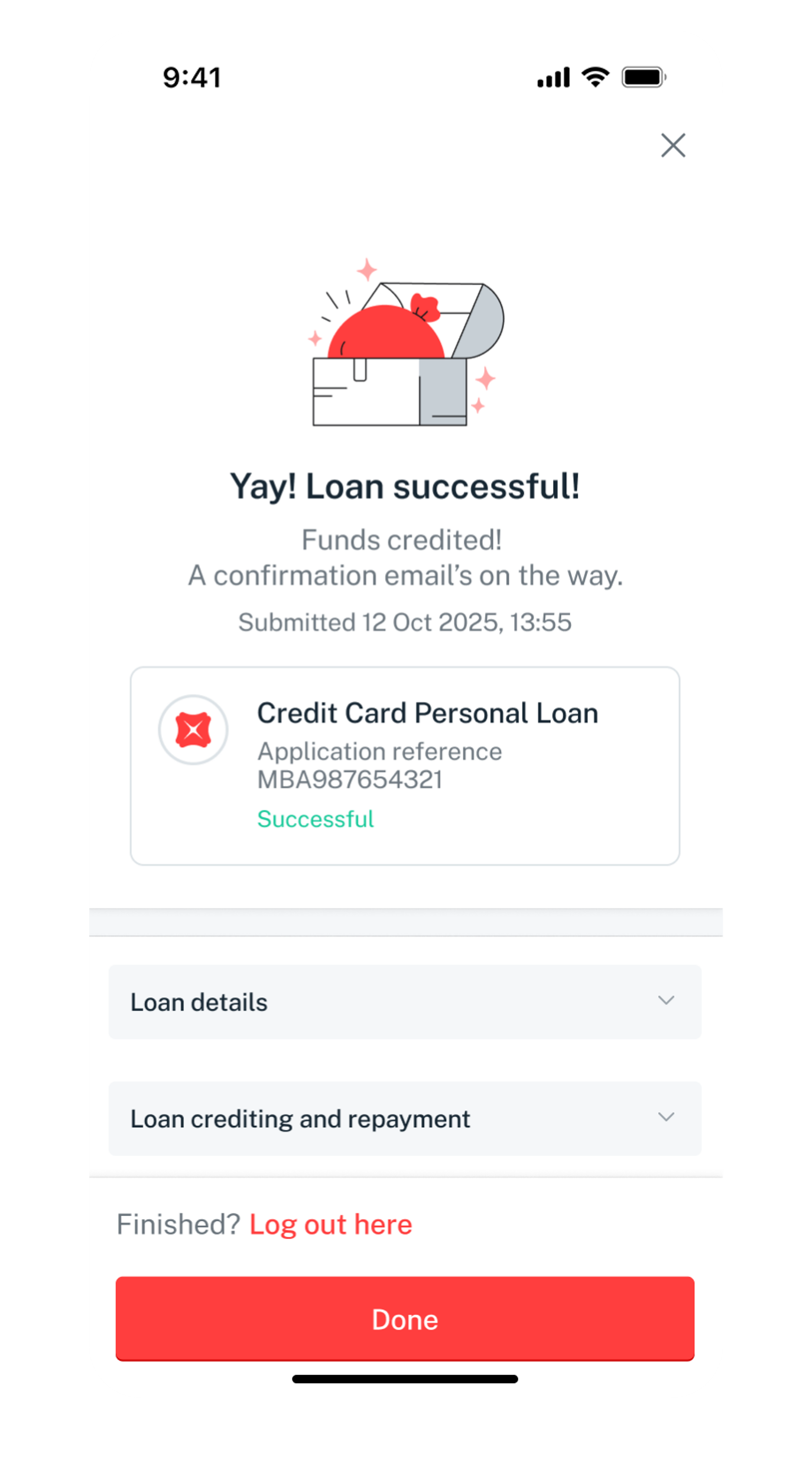

digibank mobile

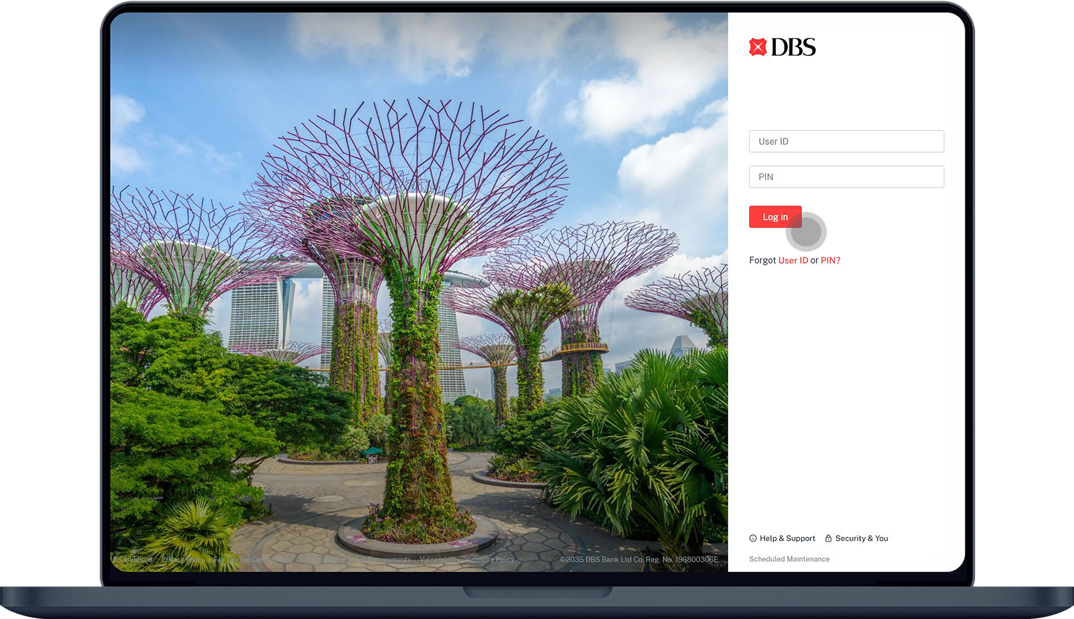

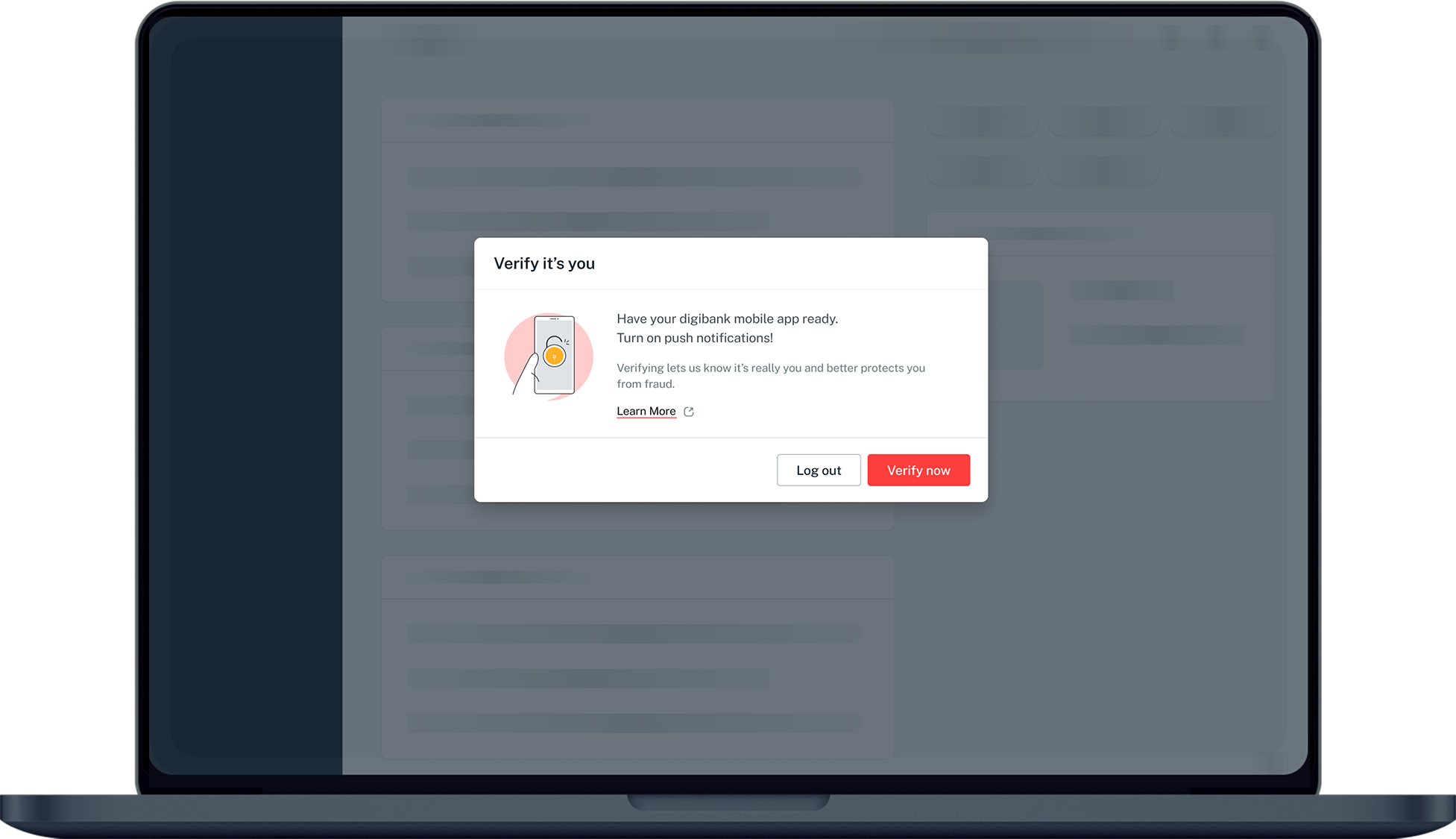

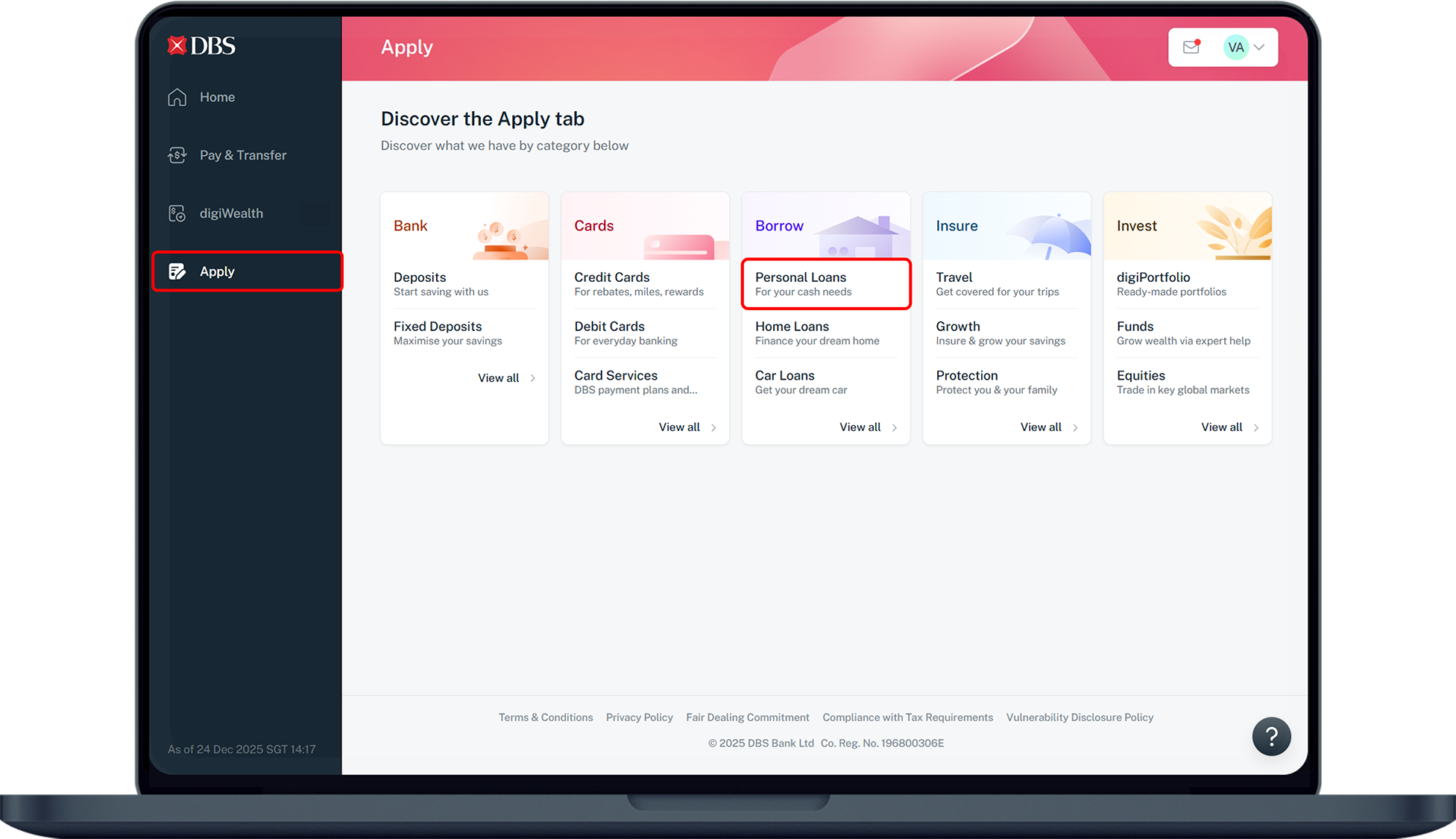

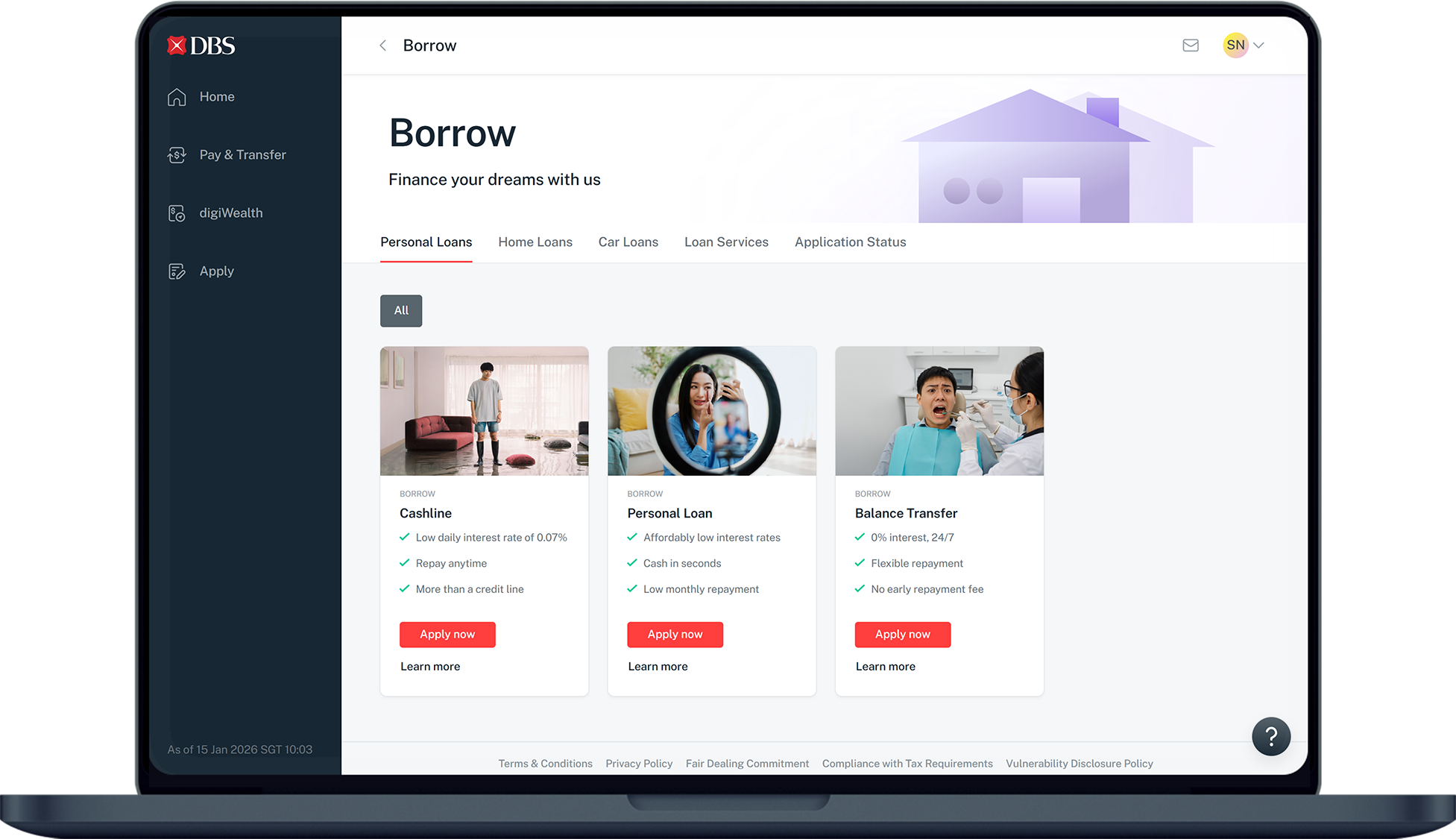

digibank online

Online Form

Was this information useful?