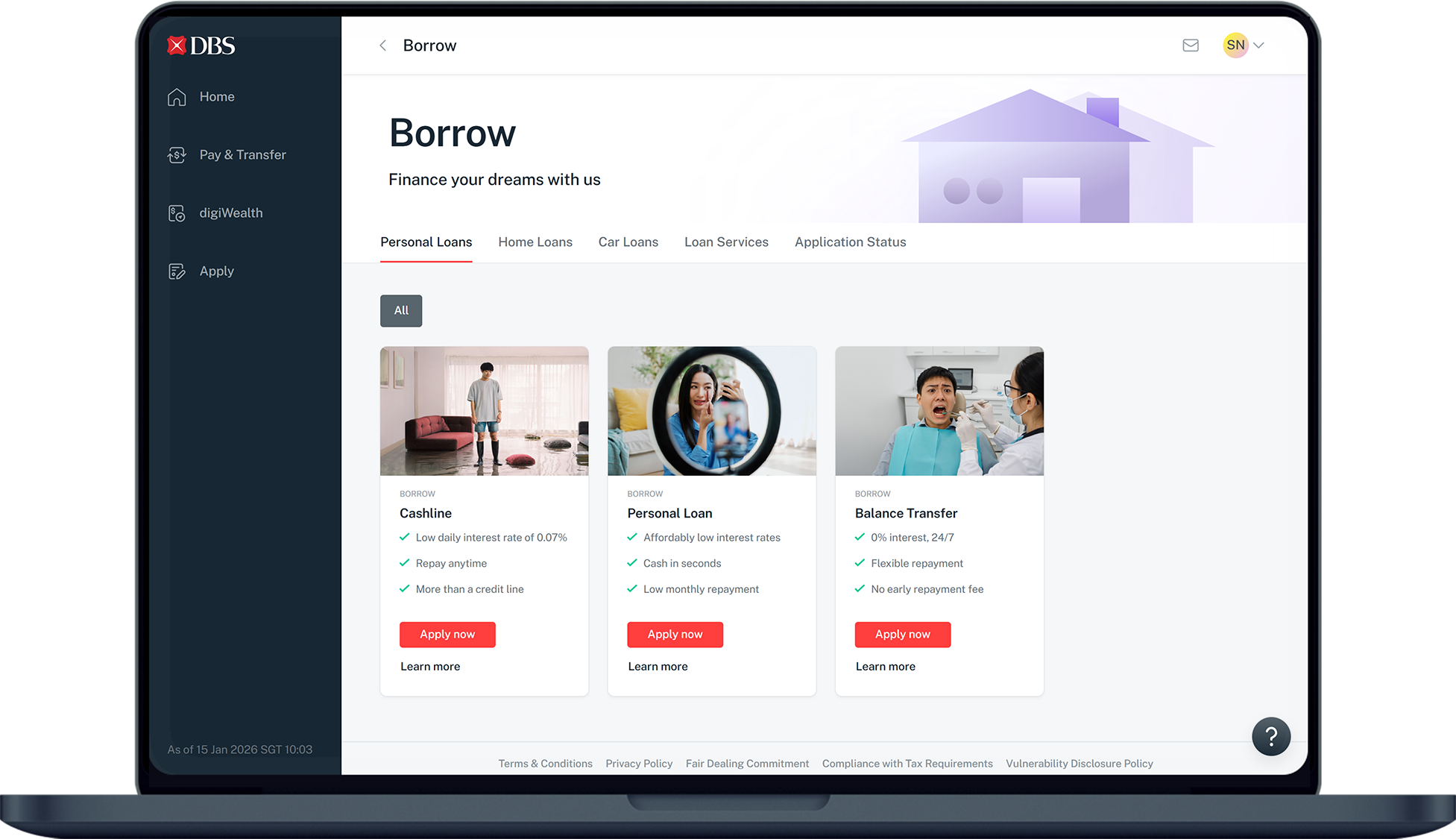

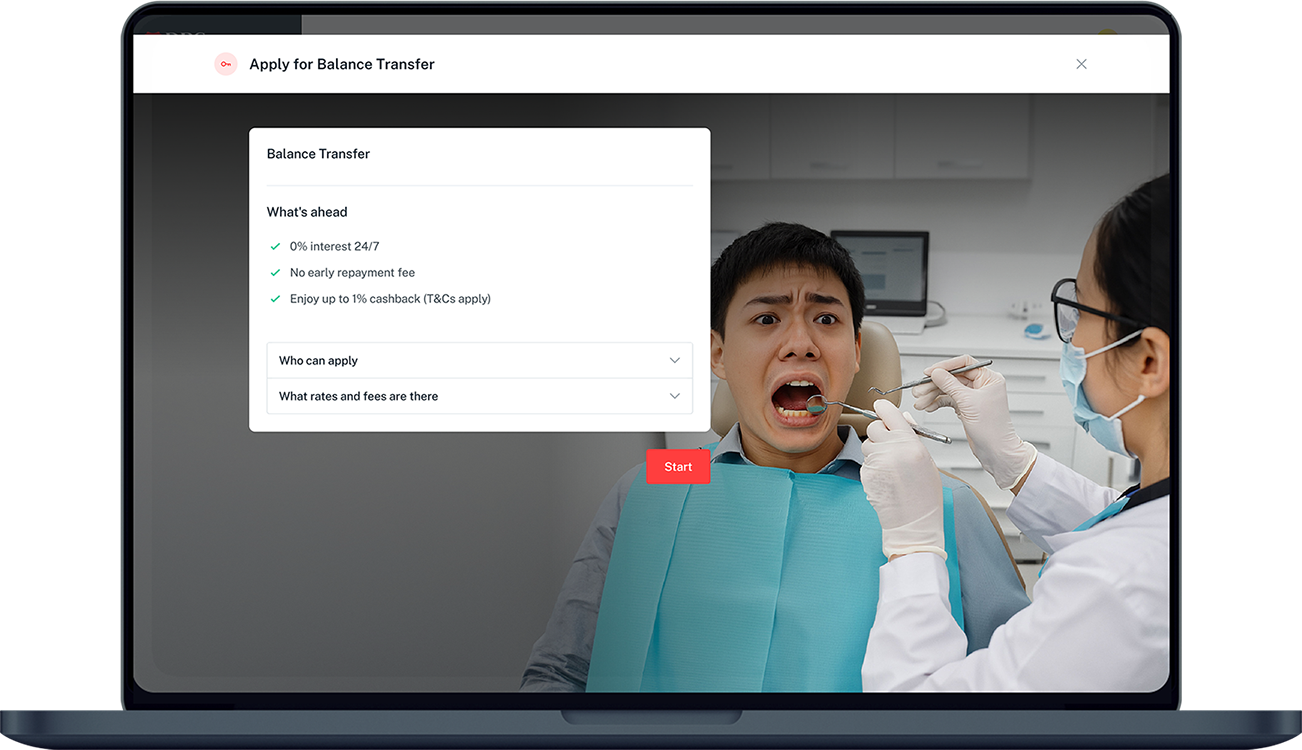

Apply for DBS Balance Transfer

Get quick access to cash to handle what you need urgently with Balance Transfer at 0% interest rate for up to 12 months.

Who can apply?

- Age: 21 – 75 years old

- All nationalities who are existing DBS/POSB Personal Principal Credit Cardholder / Cashline customers

Important information

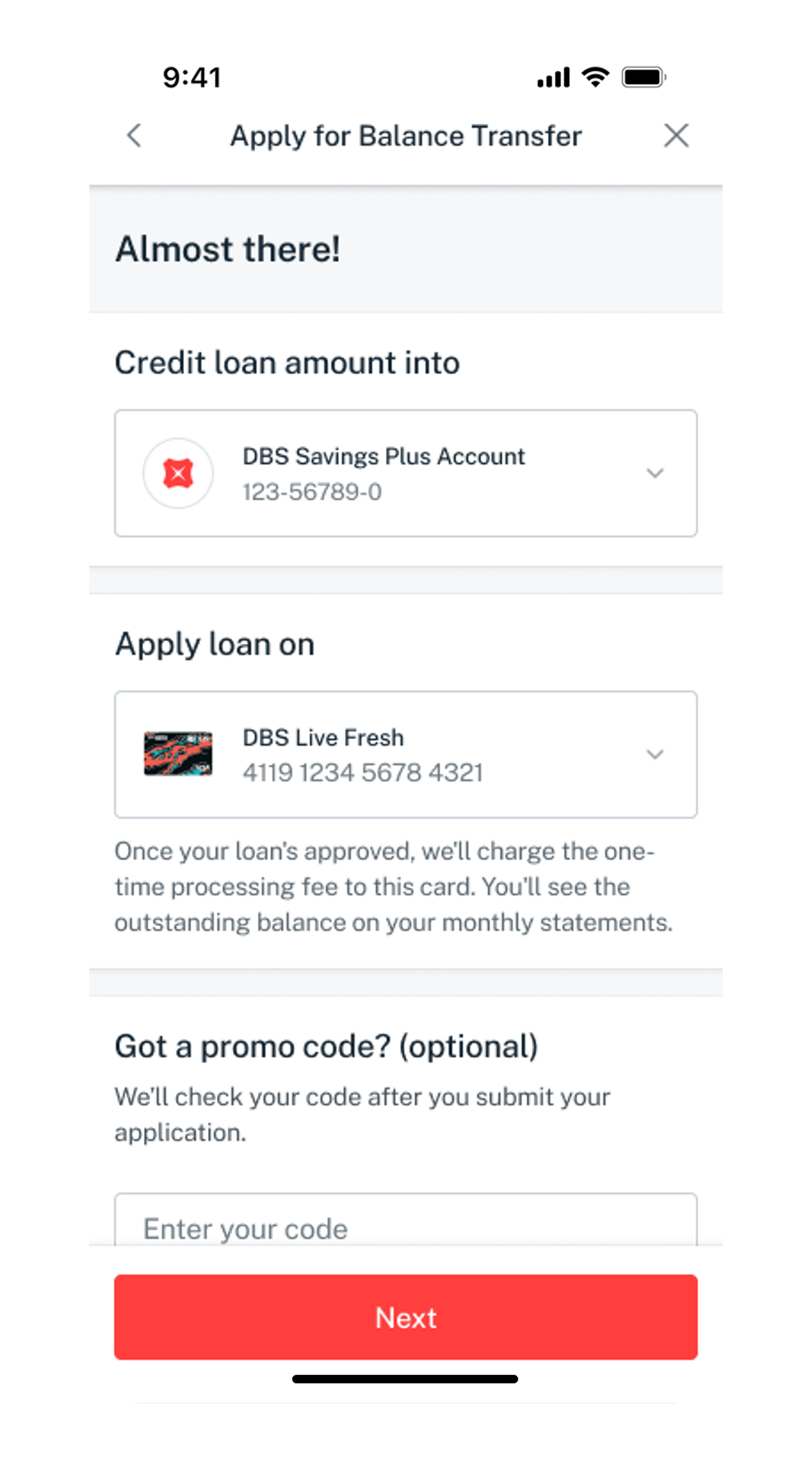

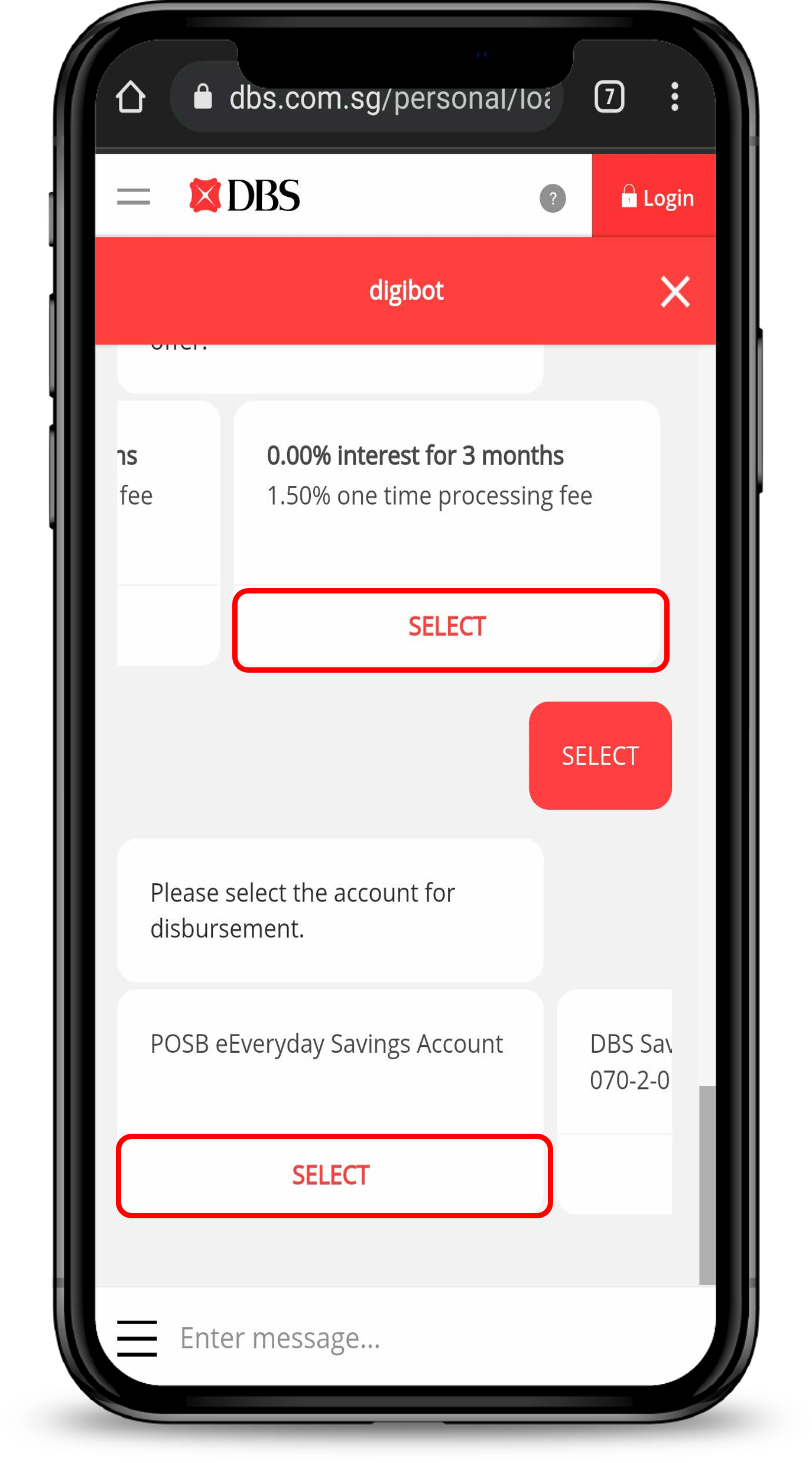

- You will need a DBS/POSB deposit account (excluding Joint All, Trust, MSA, SAYE and POSB current accounts) for the Balance Transfer loan disbursement.

- Your Credit Card or Cashline account must not have a credit balance (excess credit) or a GIRO arrangement in place for Balance transfer application.

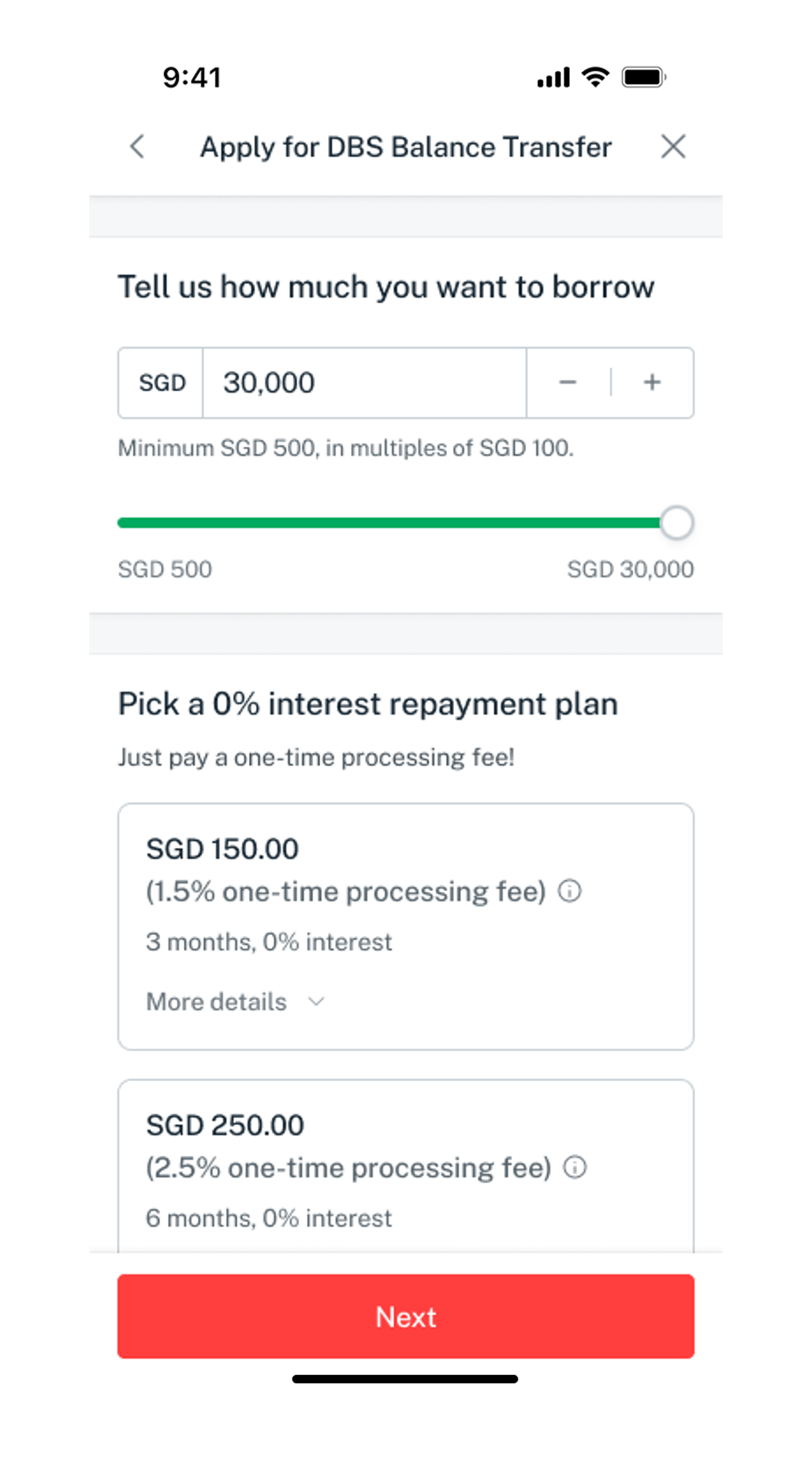

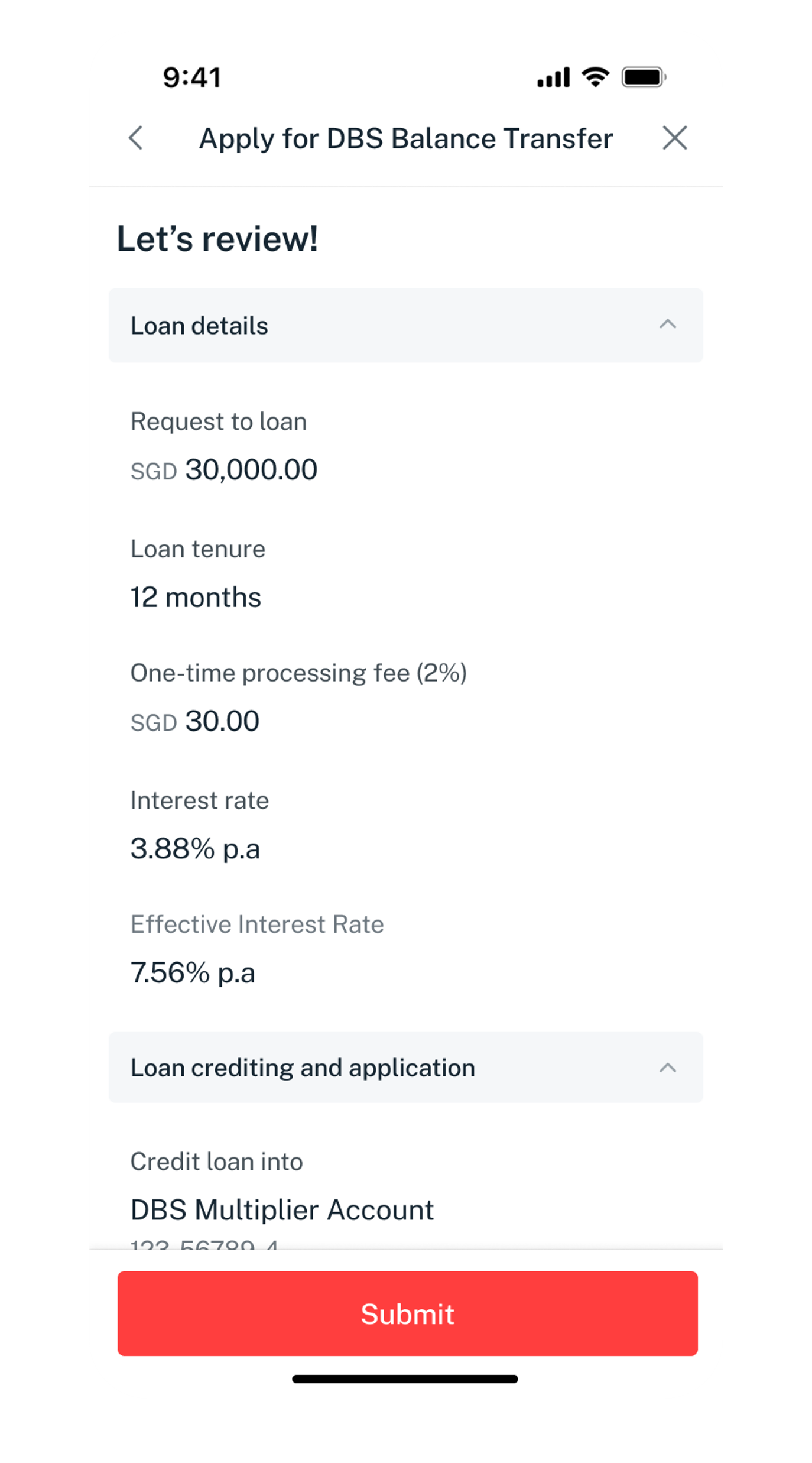

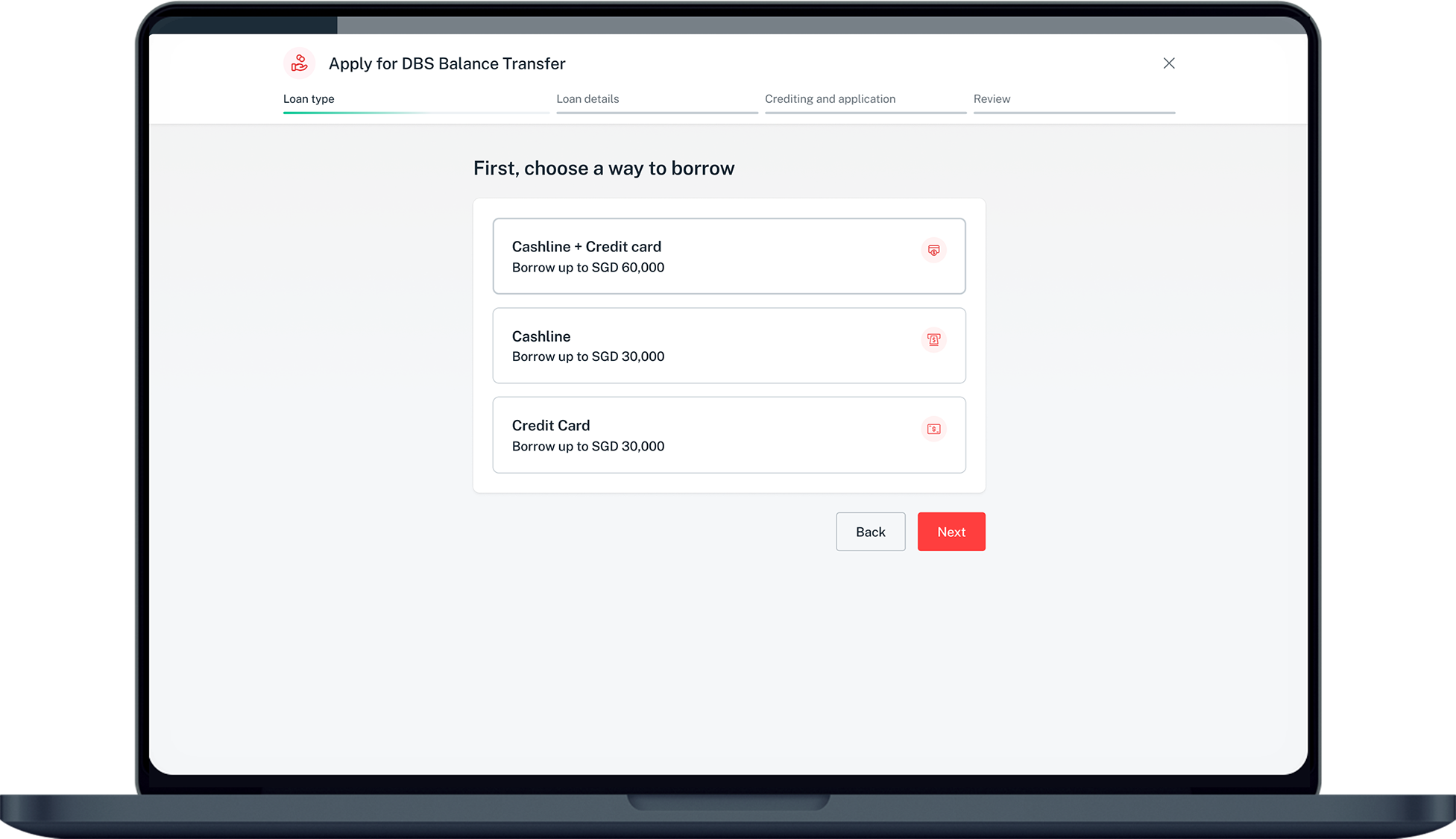

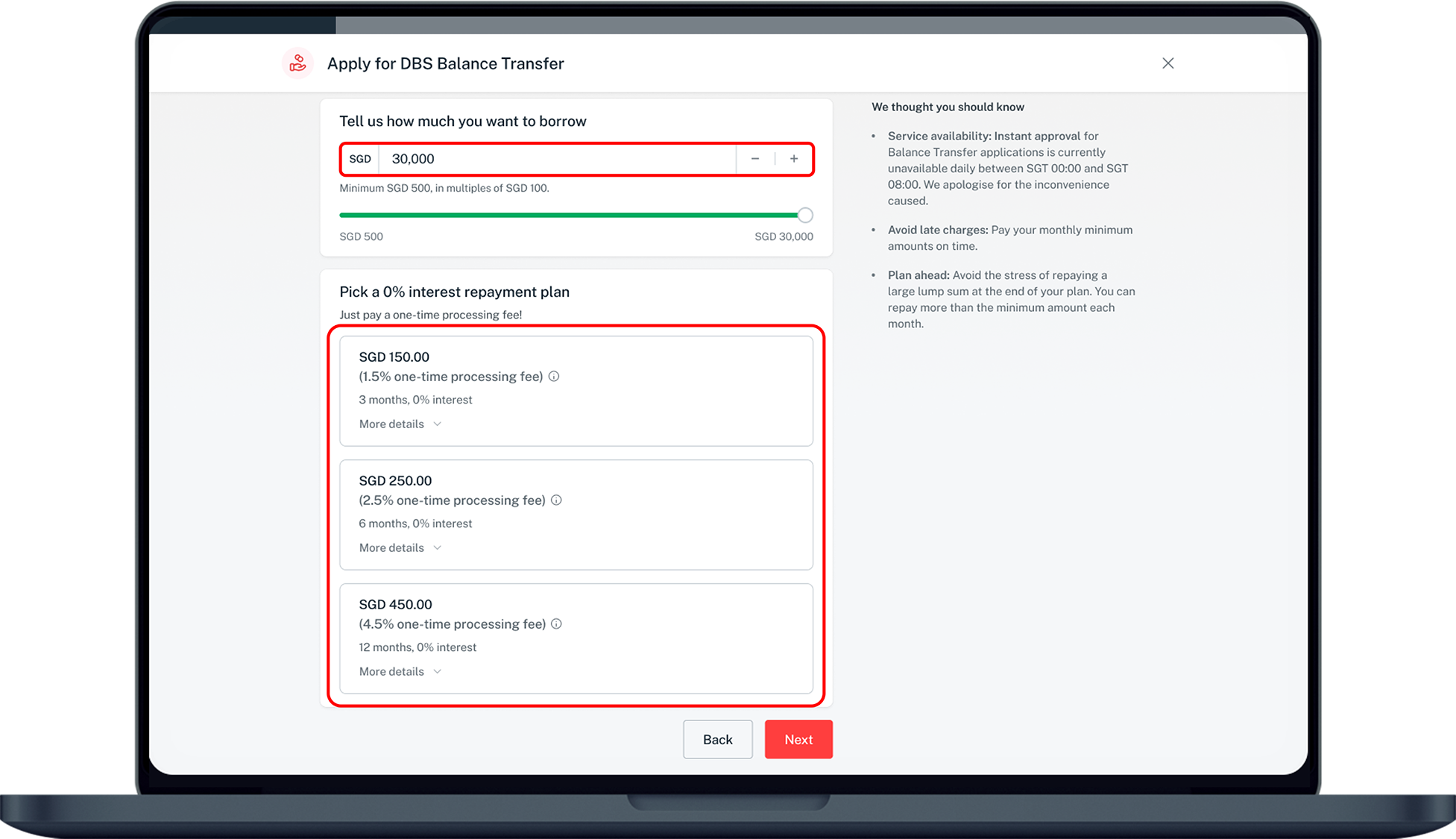

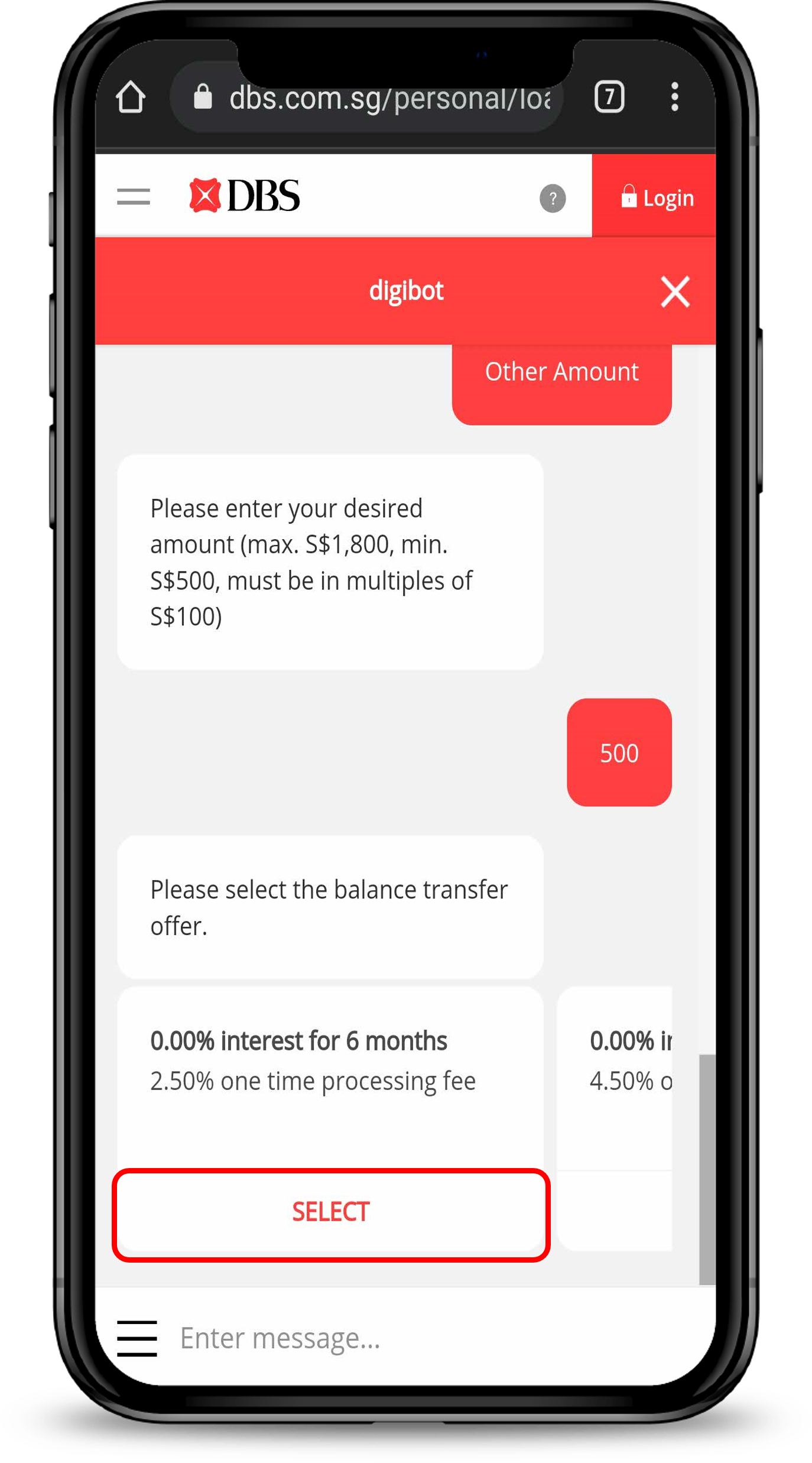

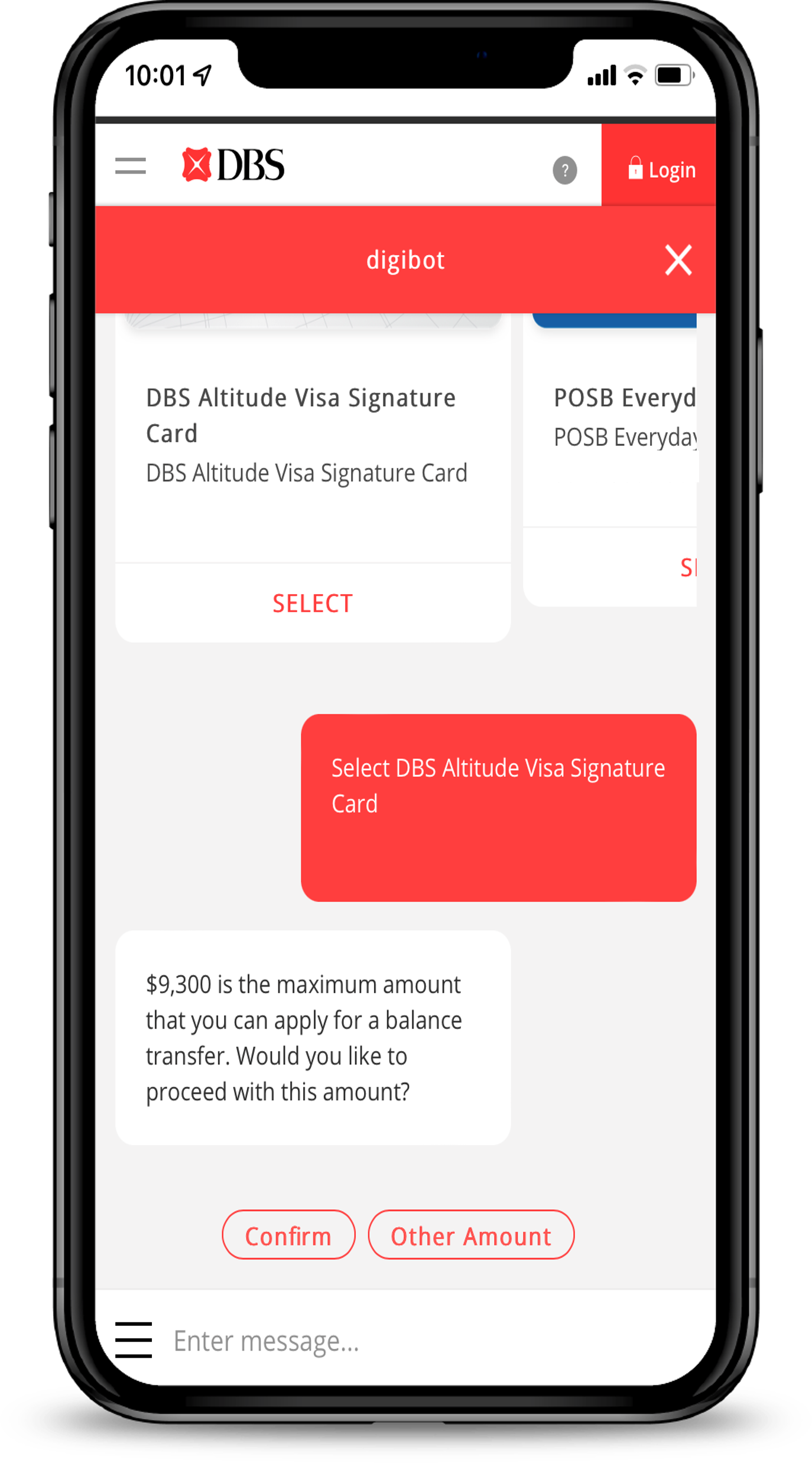

- The minimum loan amount is S$500 and the maximum loan amount up to 93% of your available aggregated credit limit on your DBS/POSB credit card and/or Cashline account. For DBS Insignia customers, the maximum amount should not exceed S$200,000 (per BT) or 93% of your available Credit Limit, whichever is lower.

- Learn more about Balance Transfer.

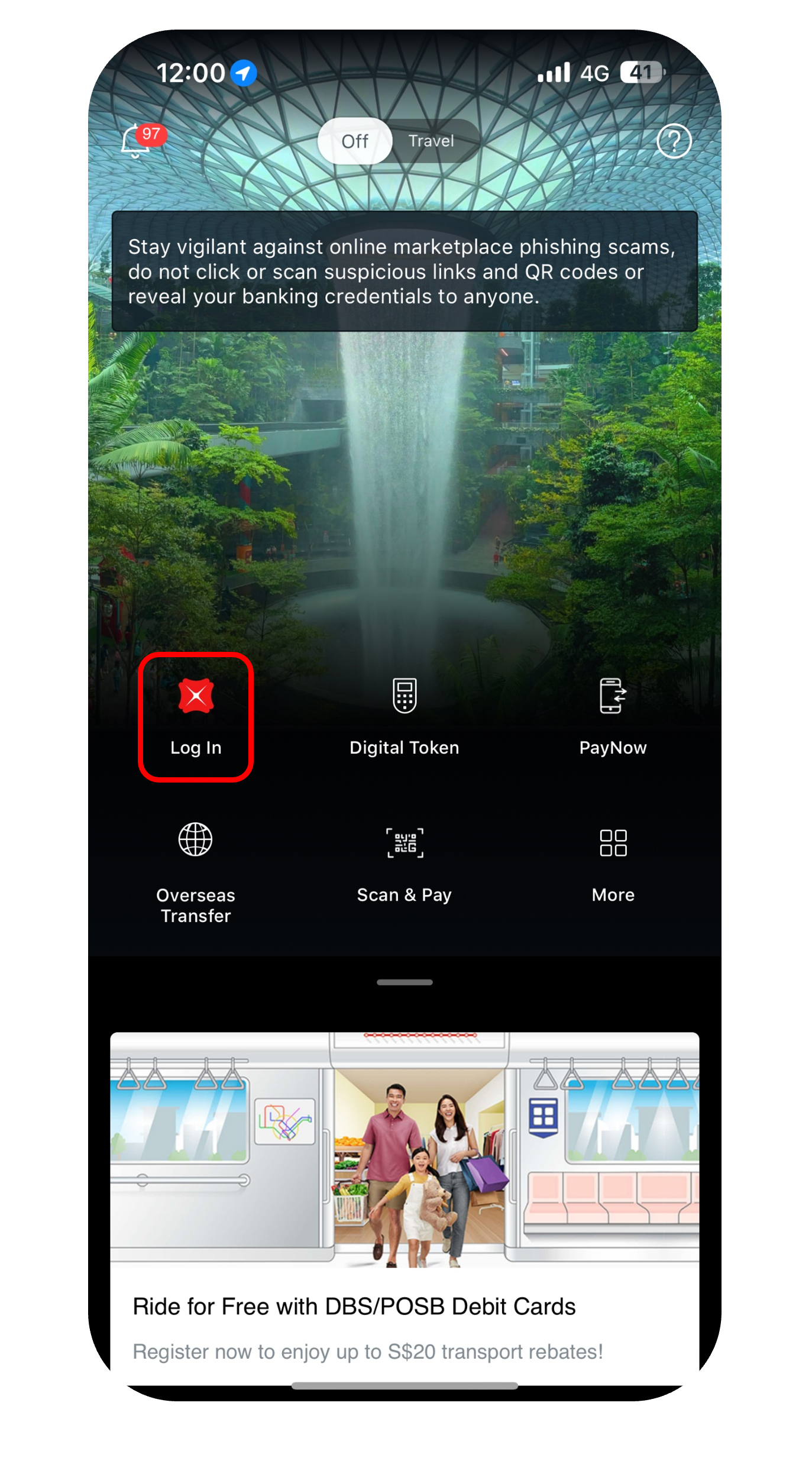

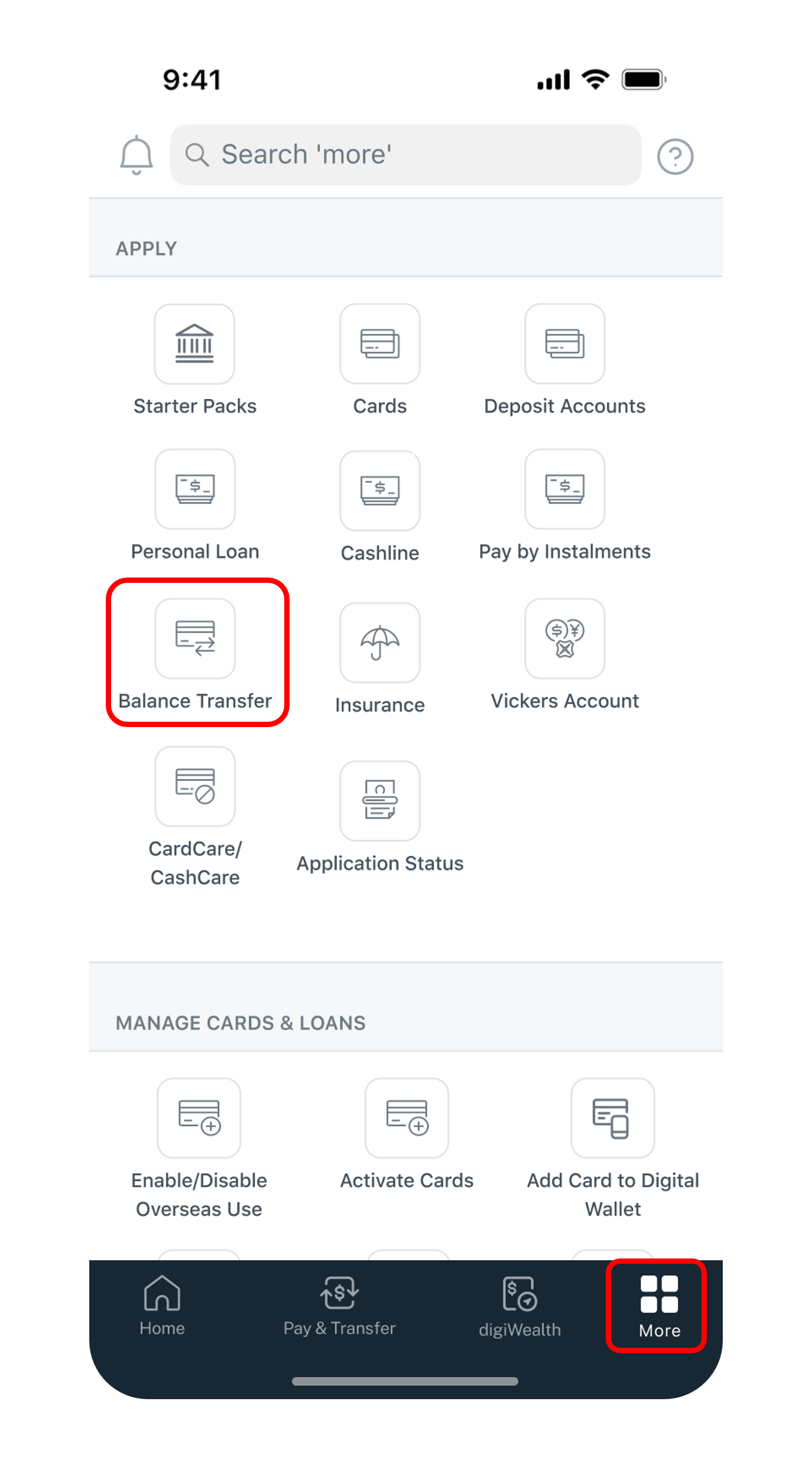

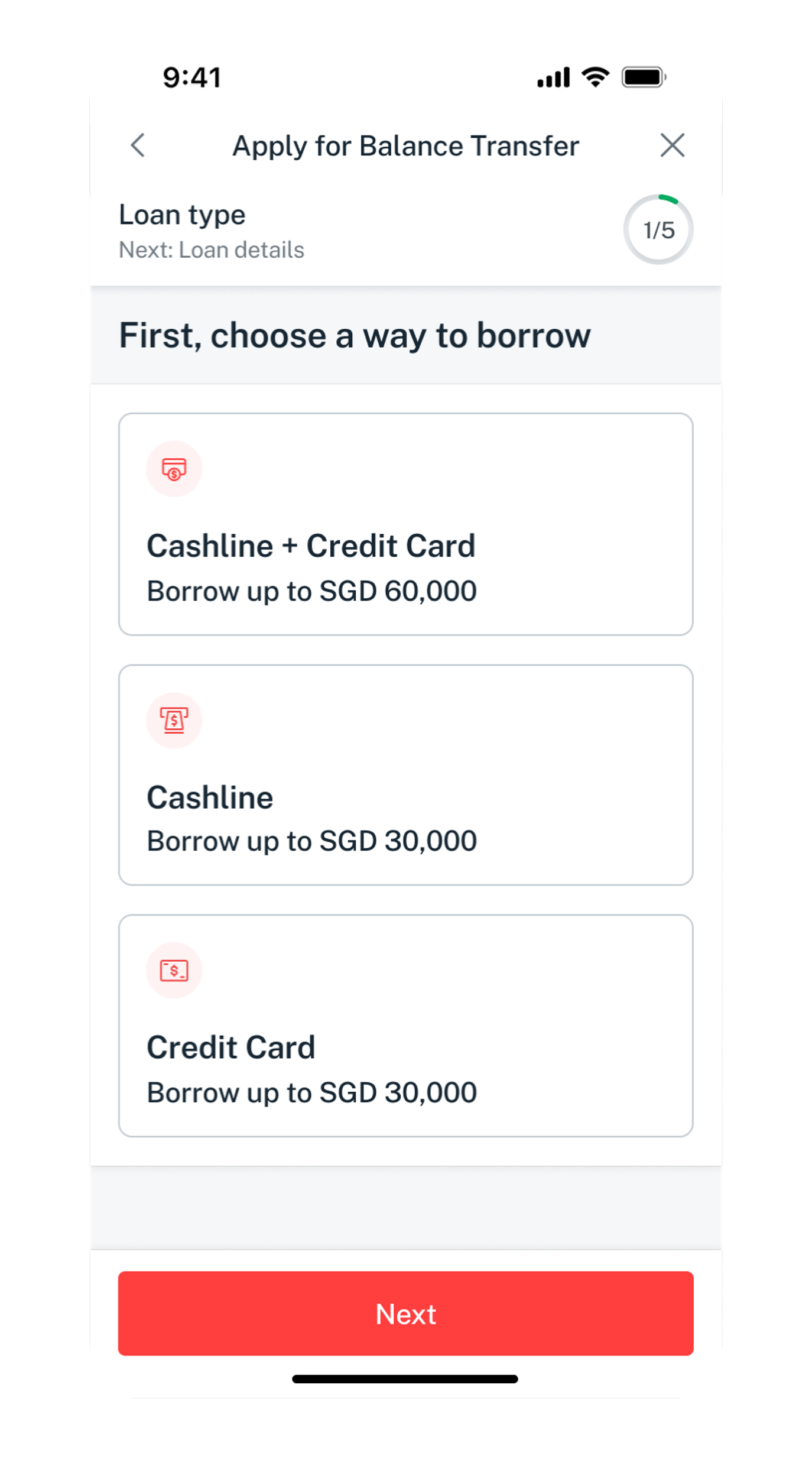

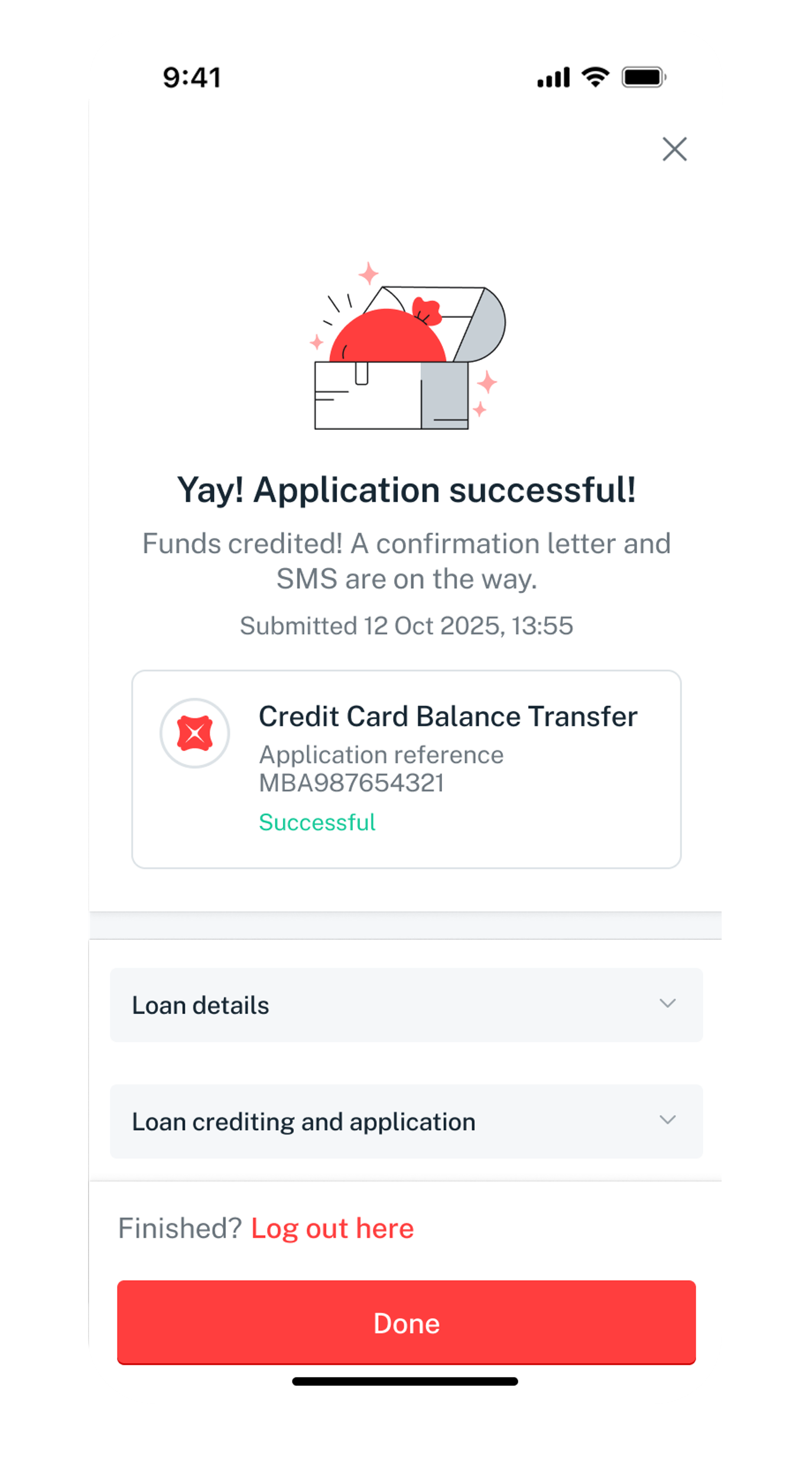

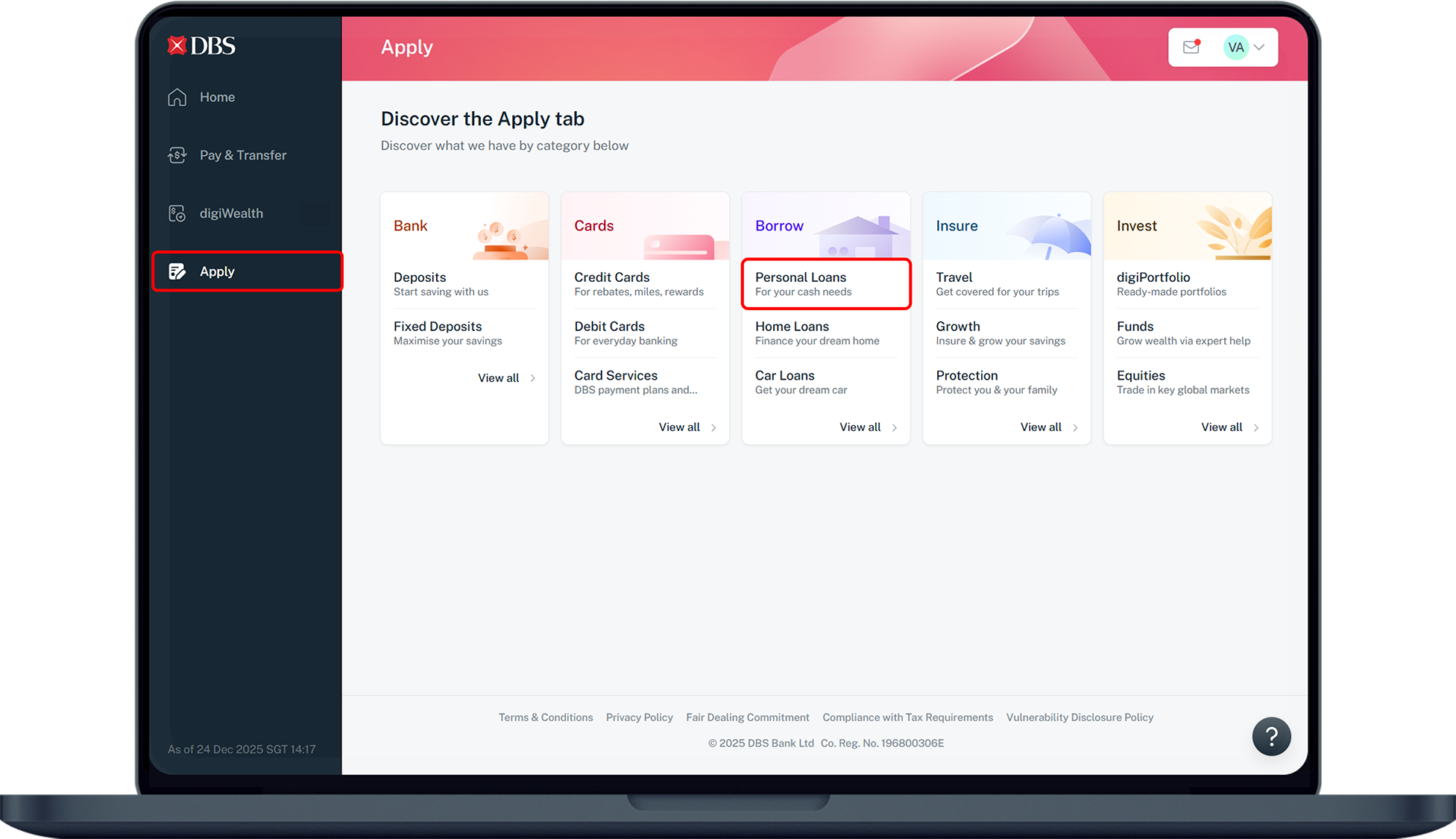

How to apply for DBS Balance Transfer

There are various channels which you may apply for DBS Balance Transfer with us. The most convenient method would be via digibank mobile.

digibank mobile (For Singaporeans/ Permanent Residents only)

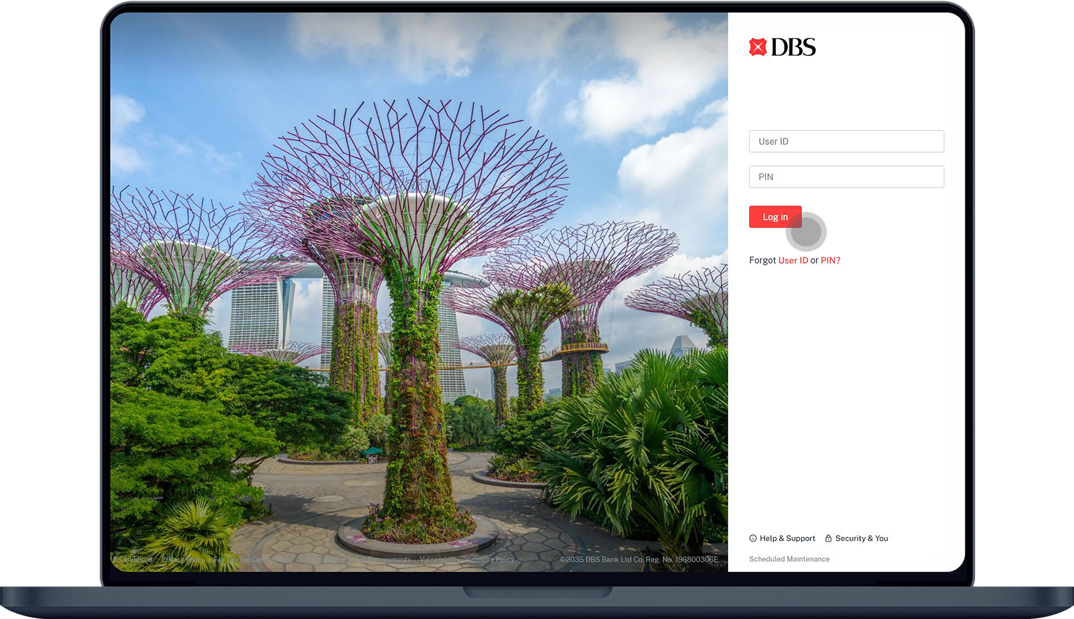

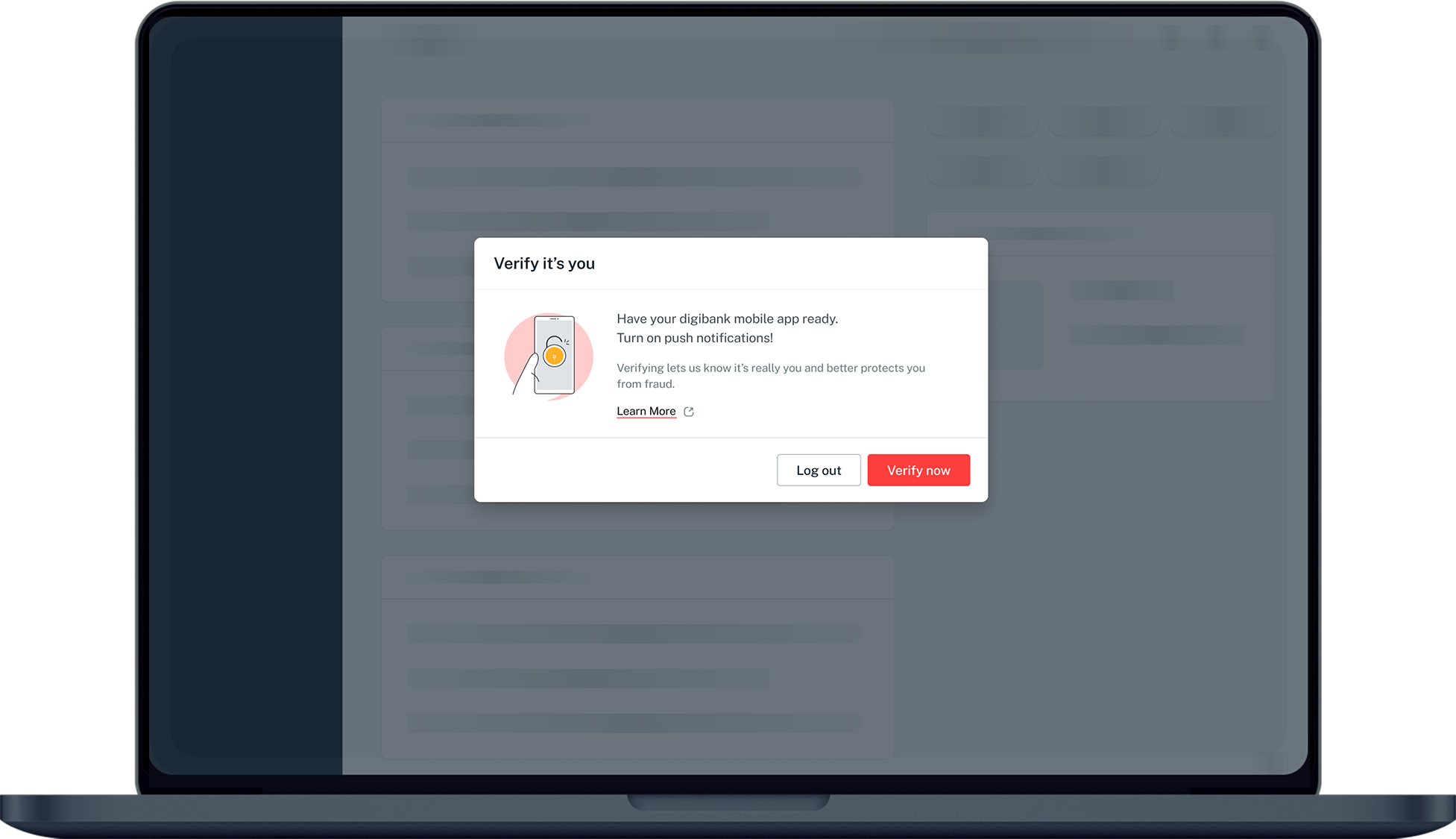

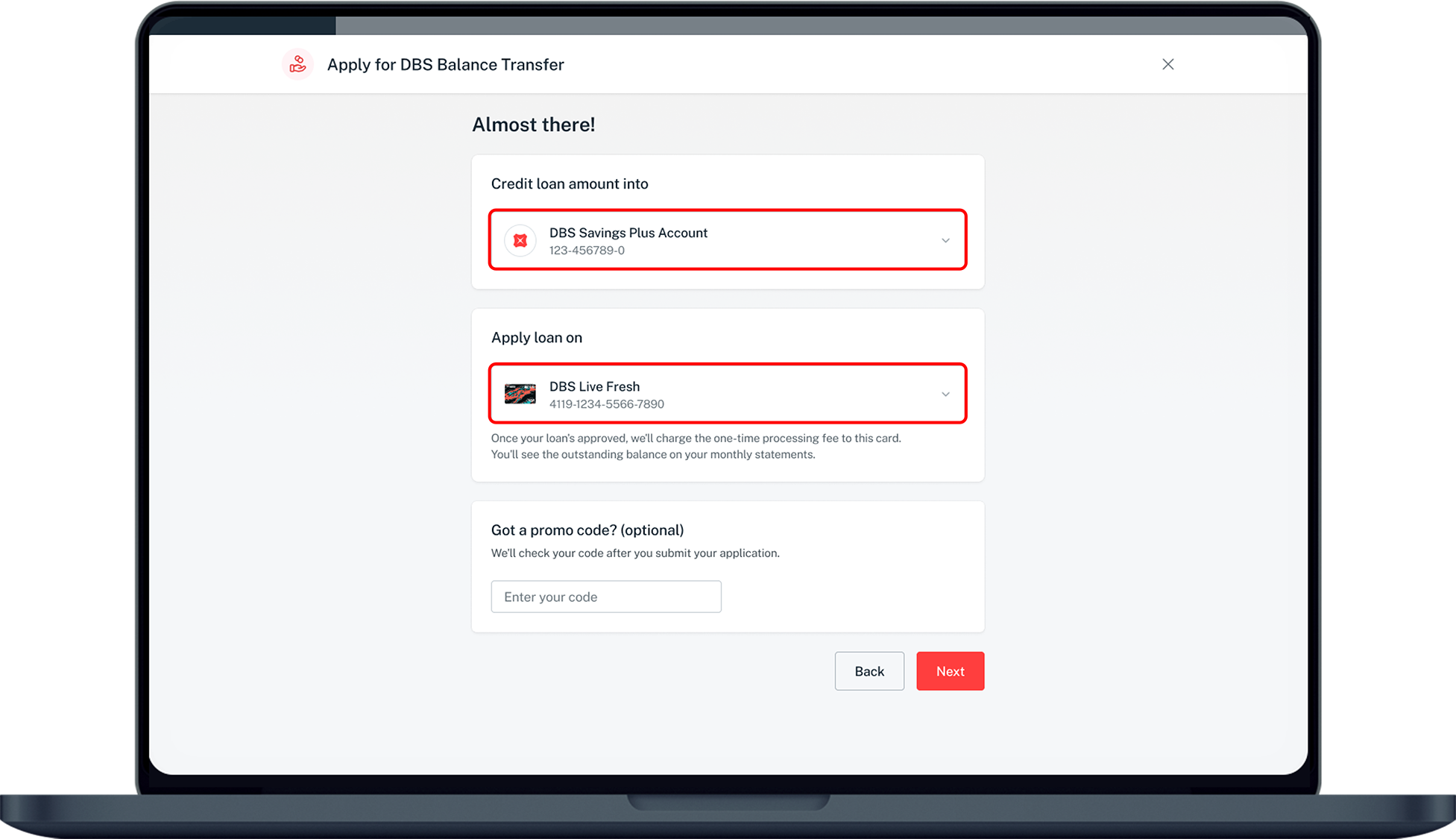

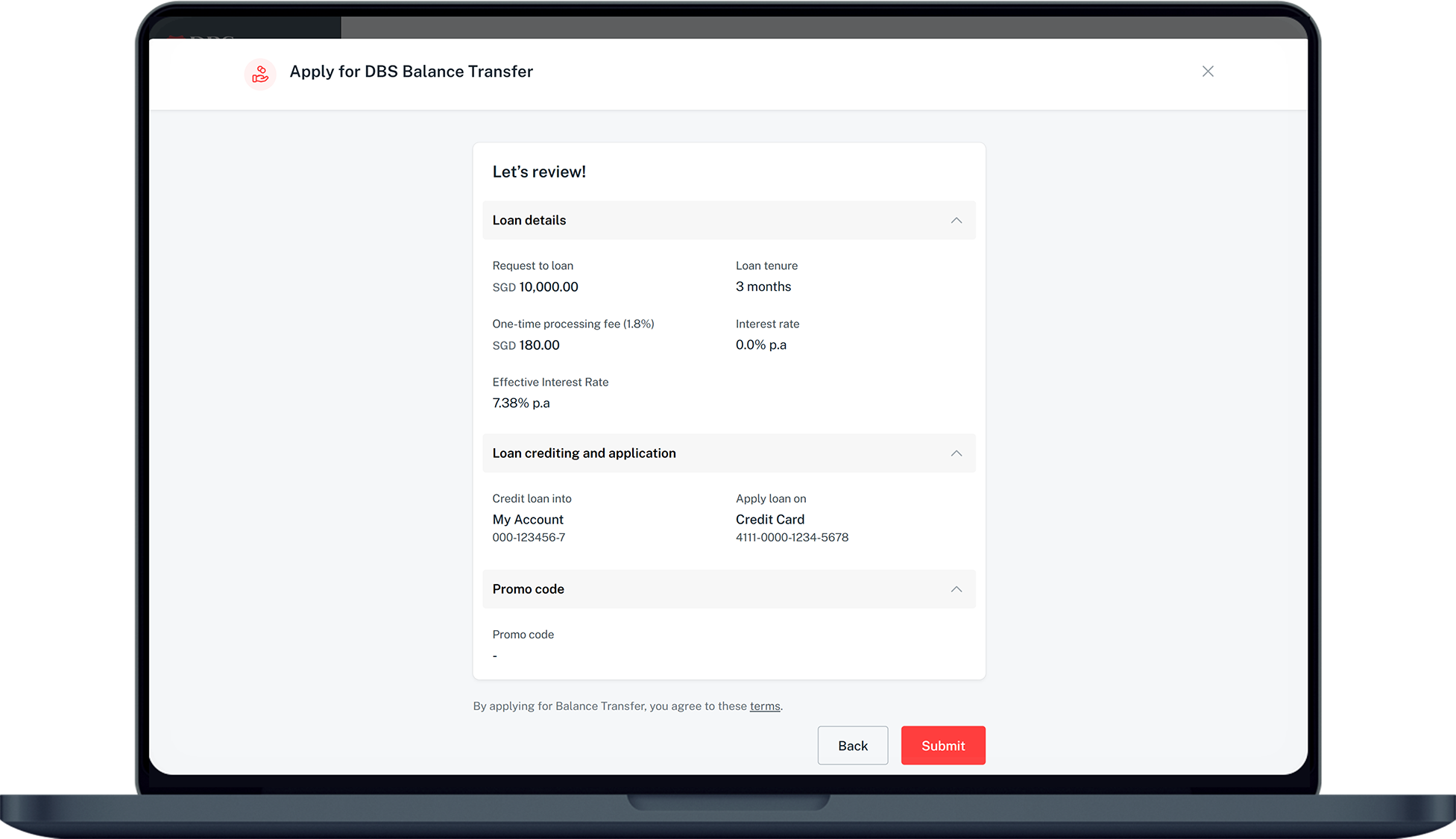

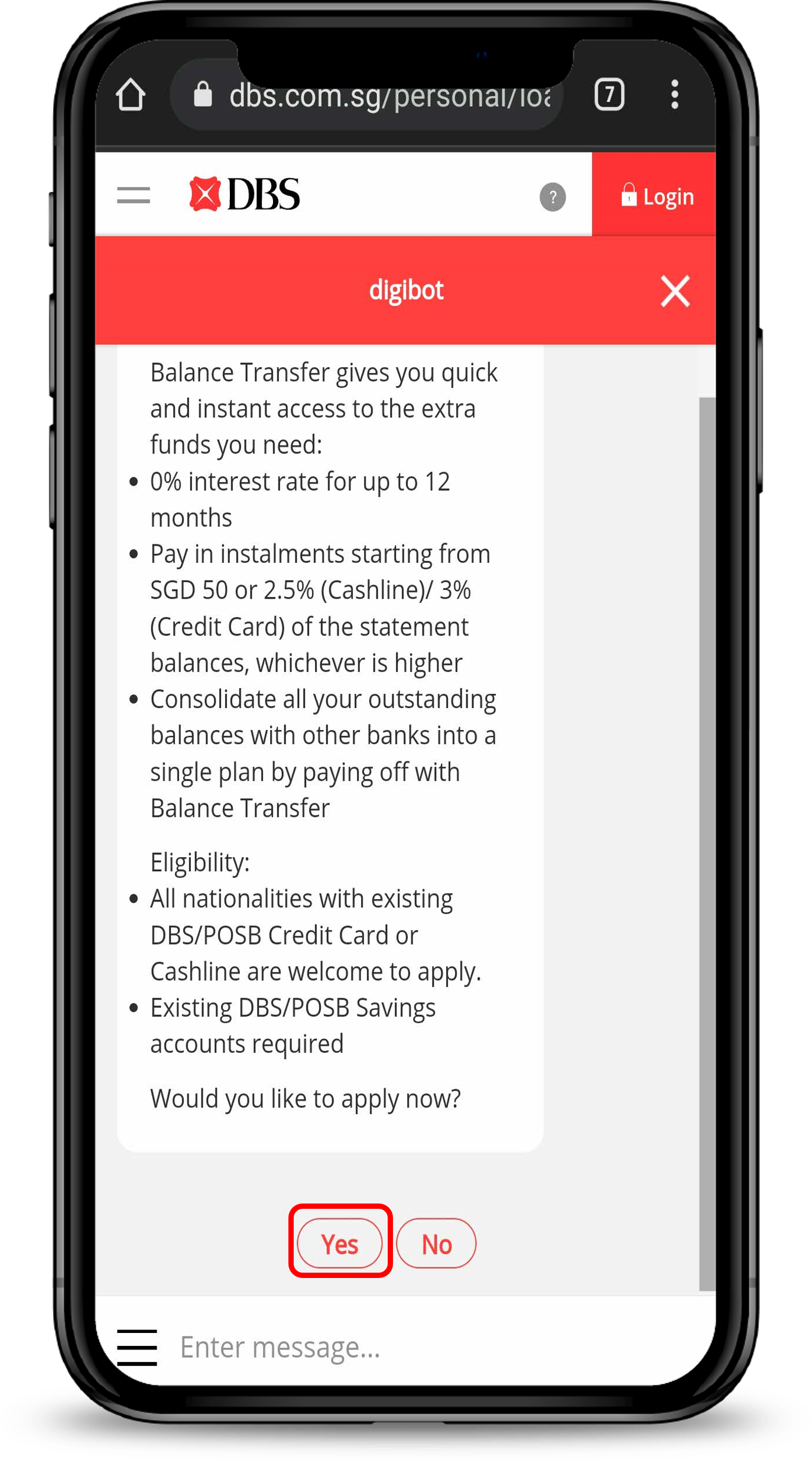

digibank online (For Singaporeans/ Permanent Residents only)

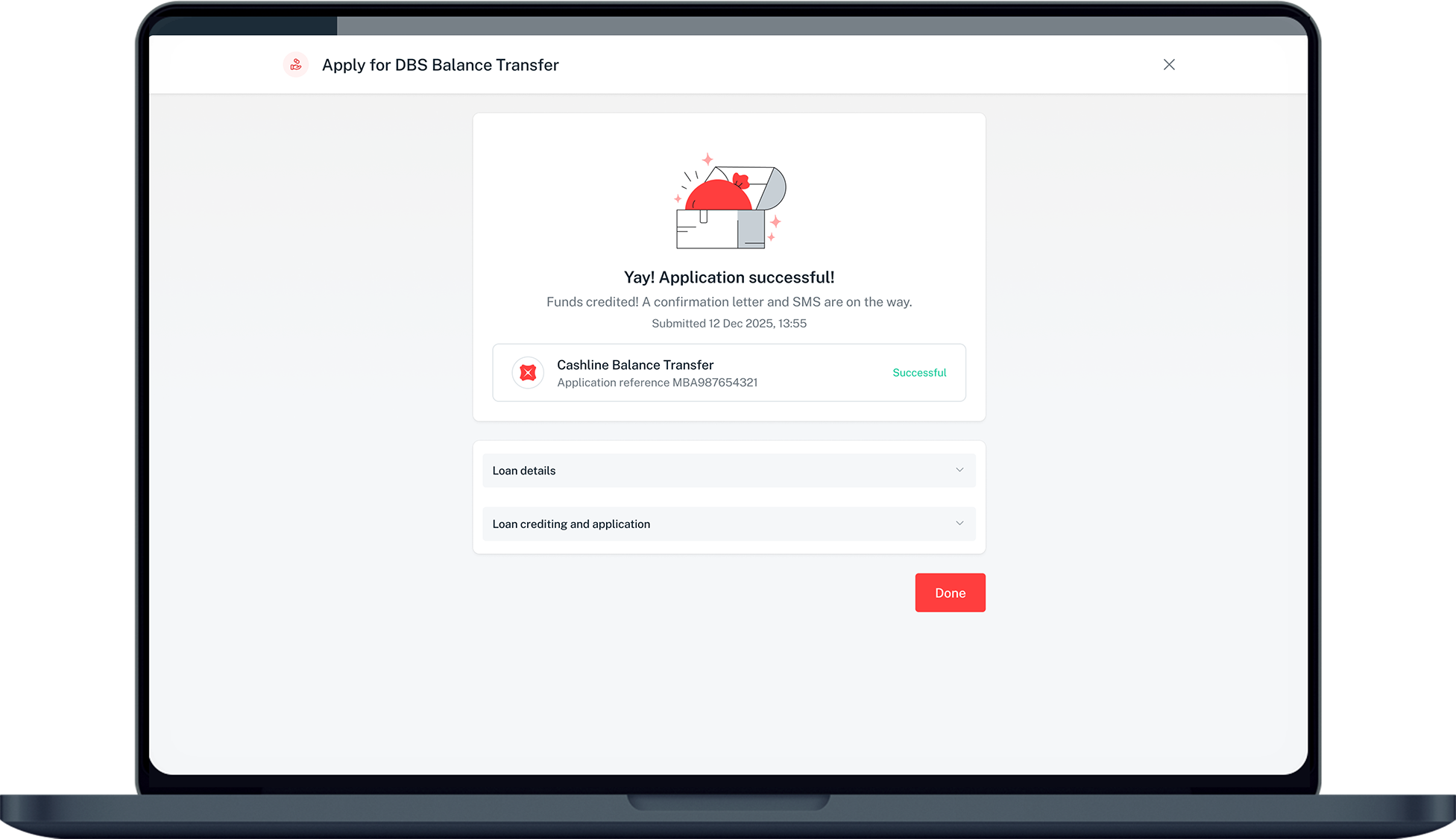

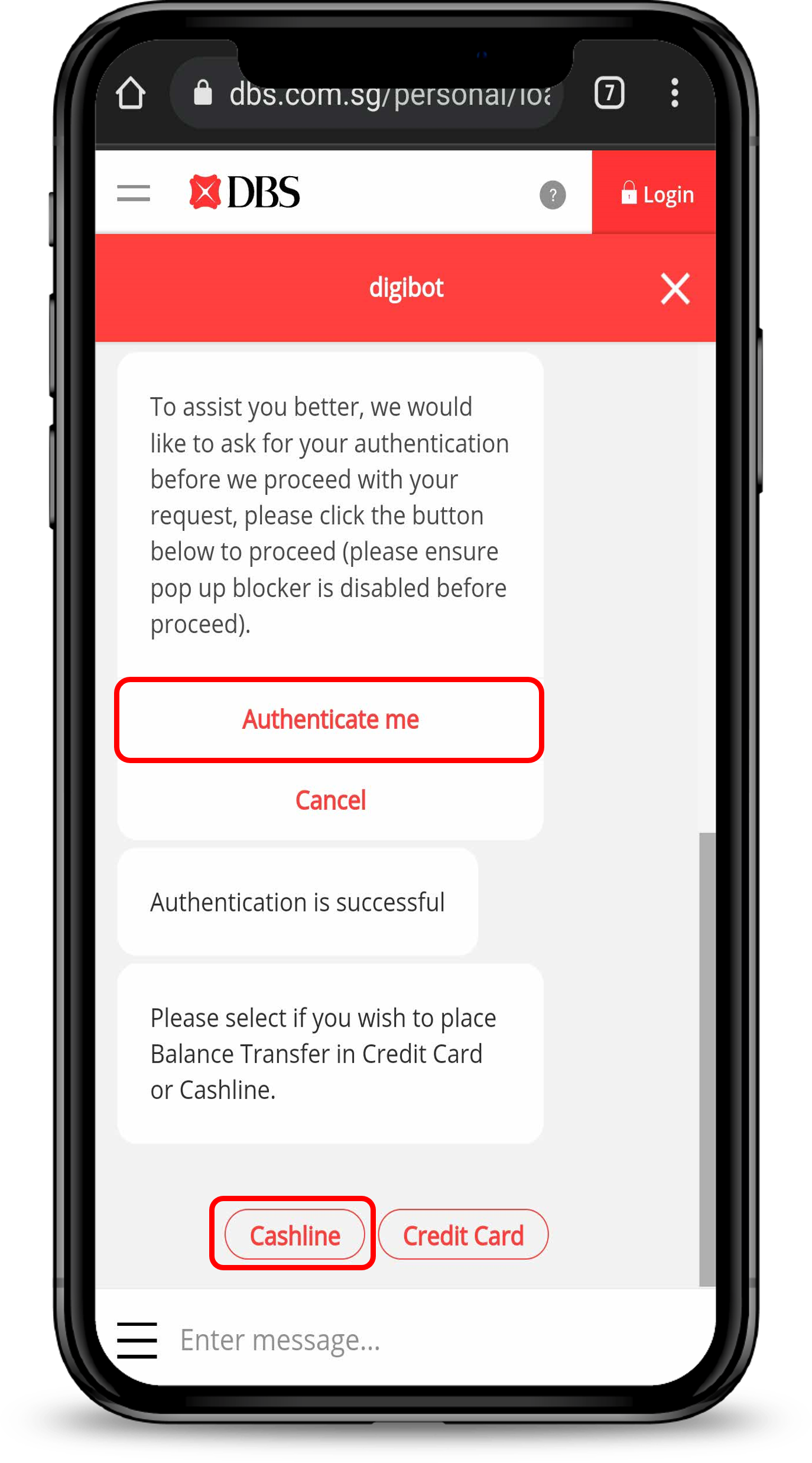

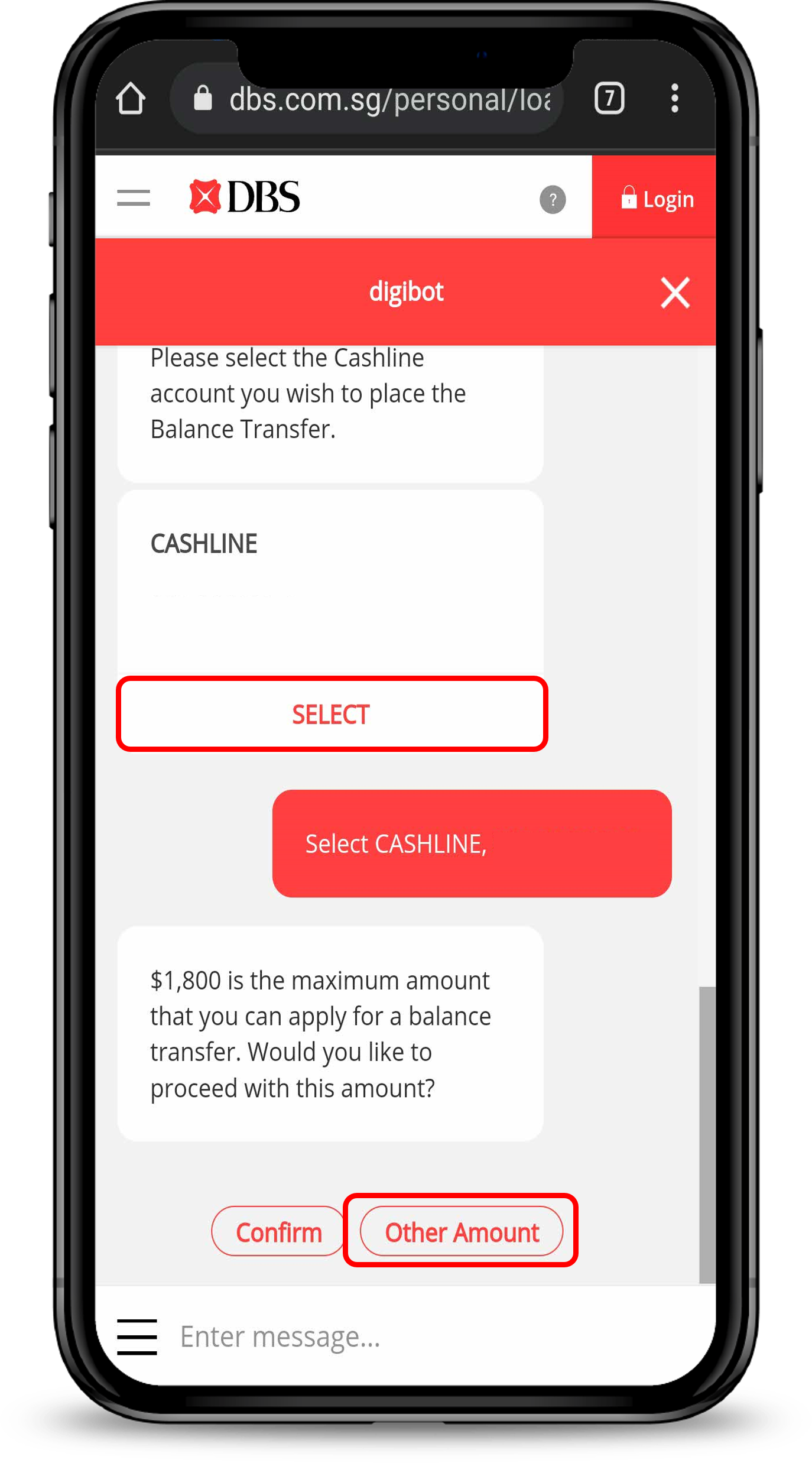

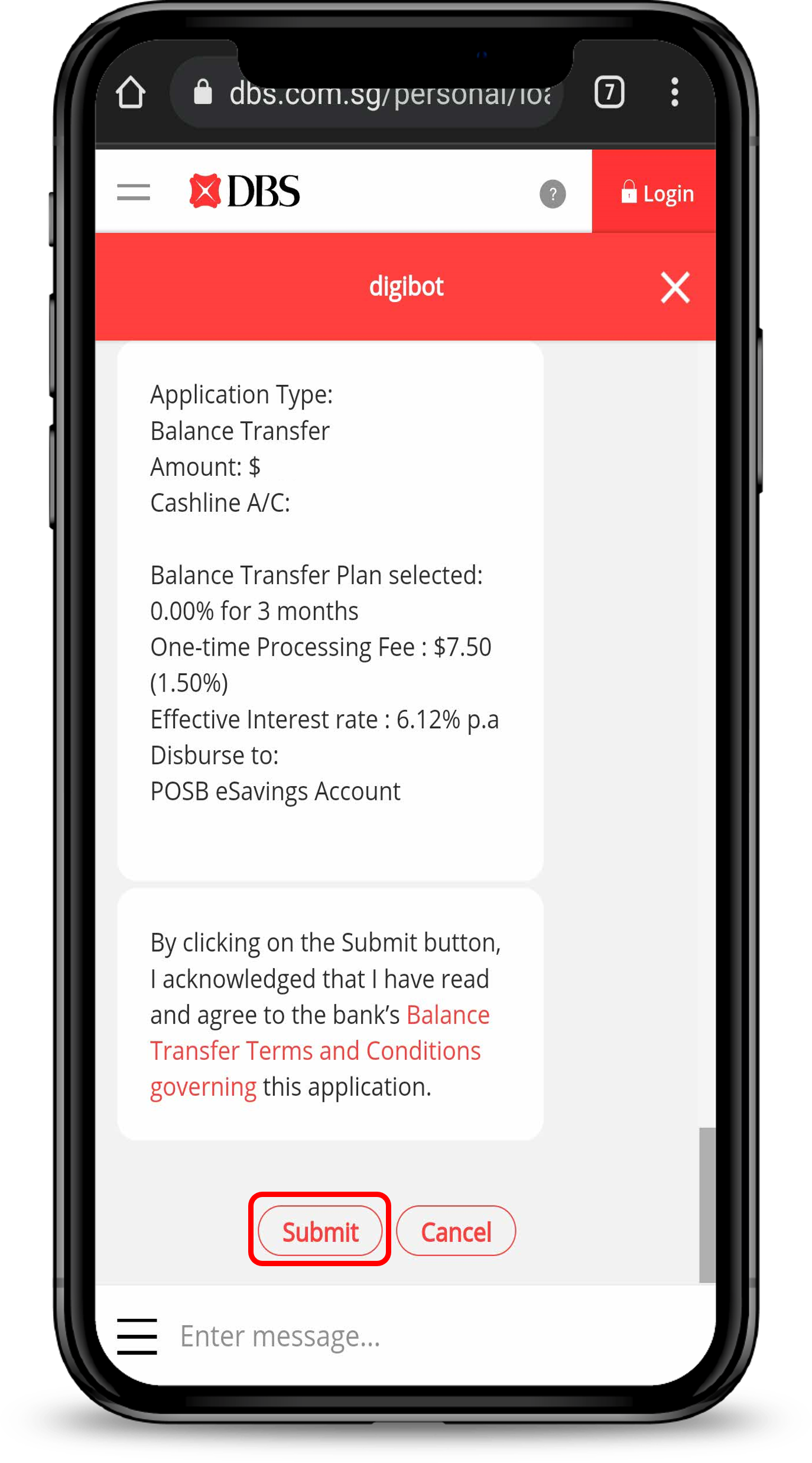

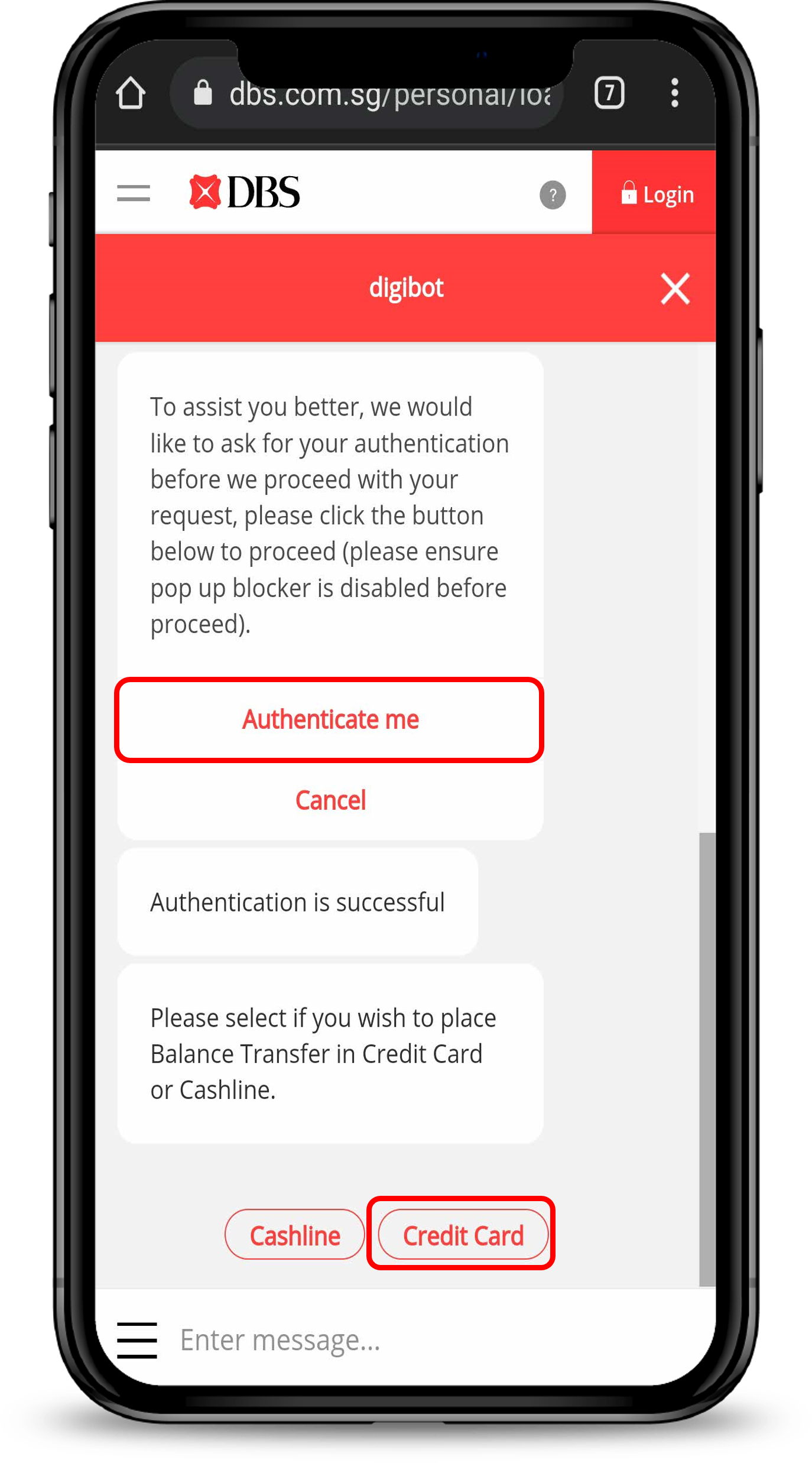

DBS digibot (For Foreigners only)

Was this information useful?