Monetary policy can influence a country’s rate of economic growth, employment, inflation, and currency exchange rates.

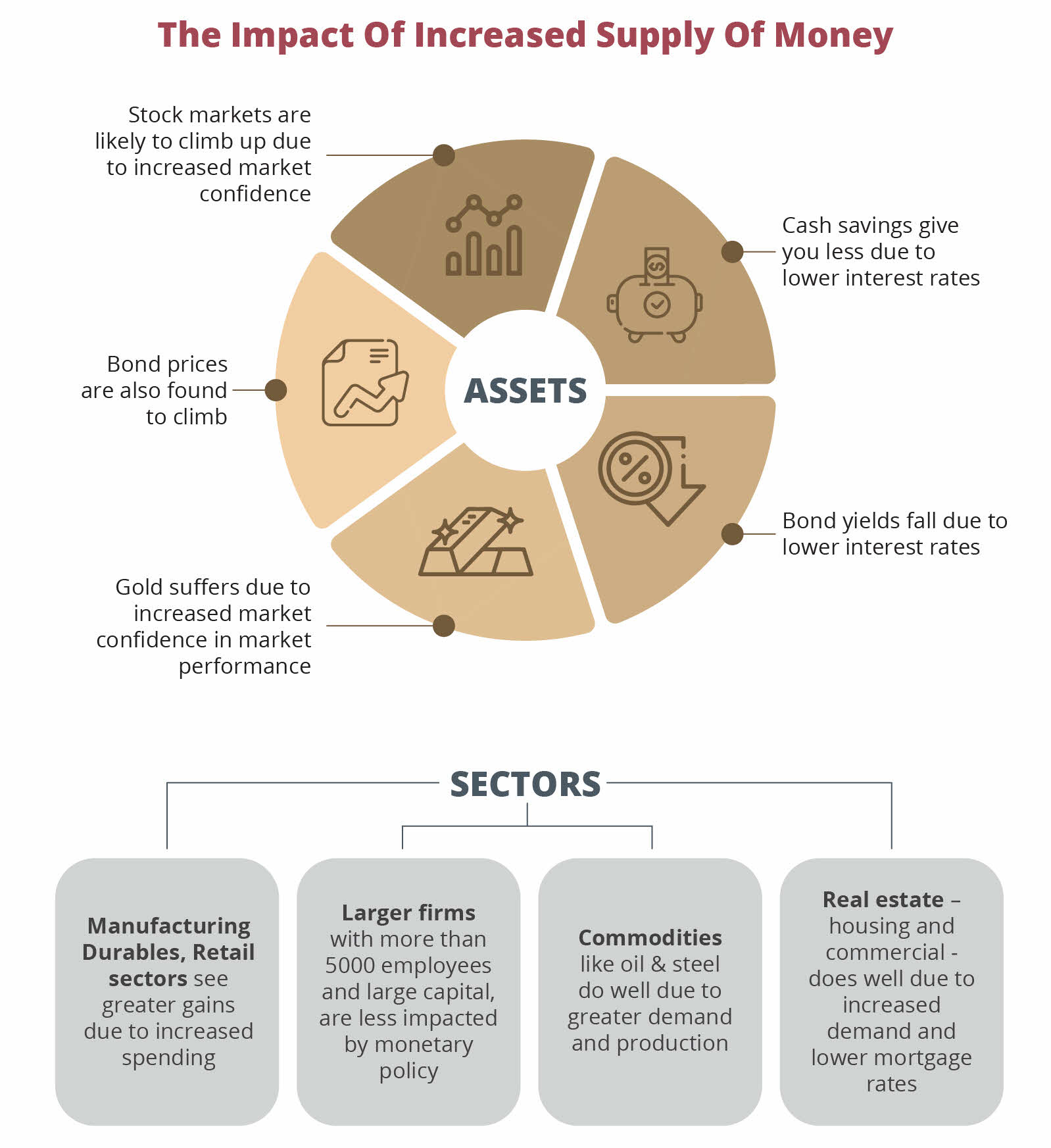

If an economy is facing a downturn, the nation’s central bank would attempt to increase production, jobs, and consumer demand by cutting interest rates. This works to reduce the cost of credit and potentially increase the supply of money in circulation.

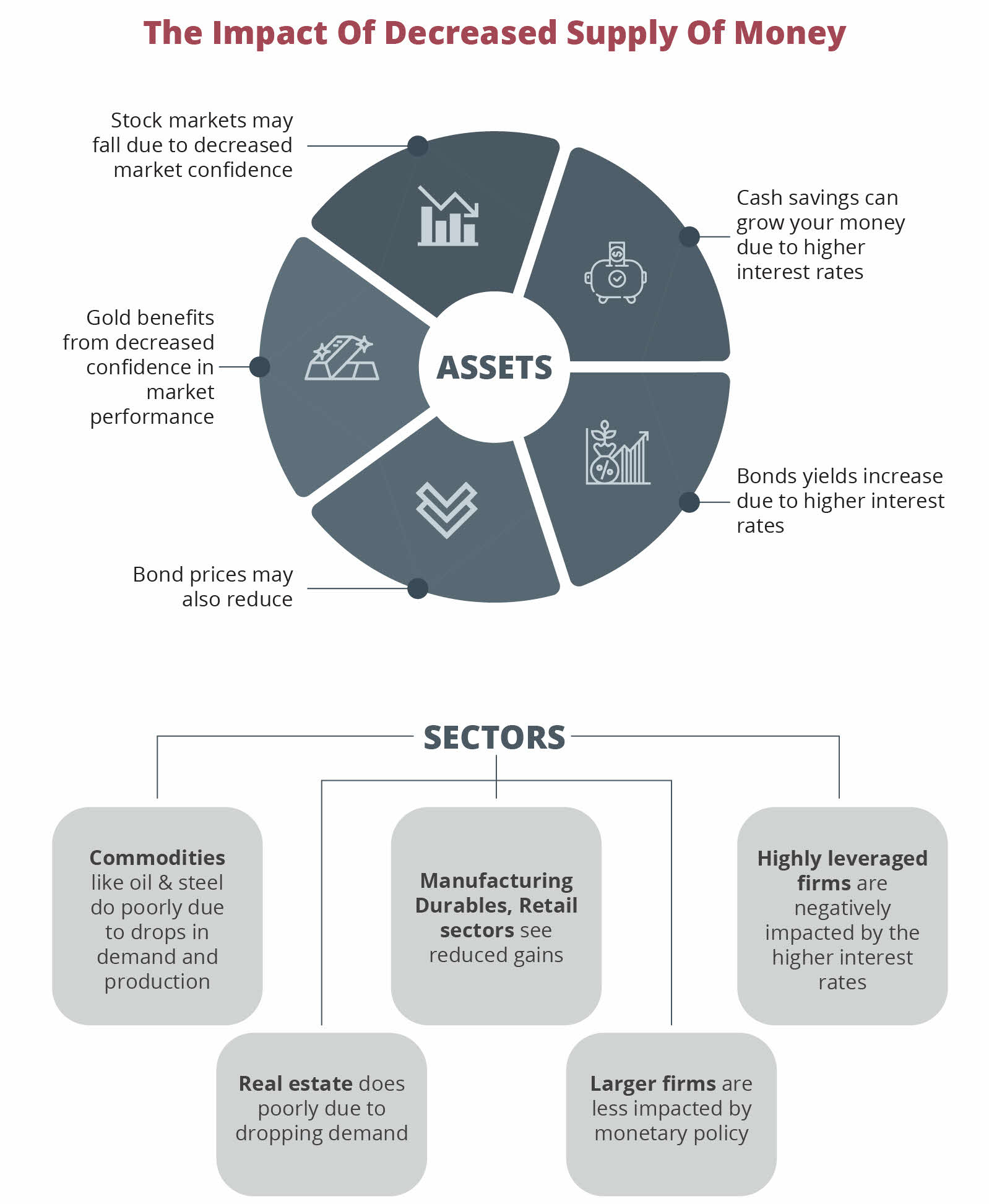

Conversely, if there is runaway inflation, asset price spikes, or excessive lending taking place, policymakers will attempt to introduce demand. This will be done by moderating measures to restore economic and financial stability.

In Singapore, monetary and exchange rate policy is conducted by the Monetary Authority of Singapore (MAS).

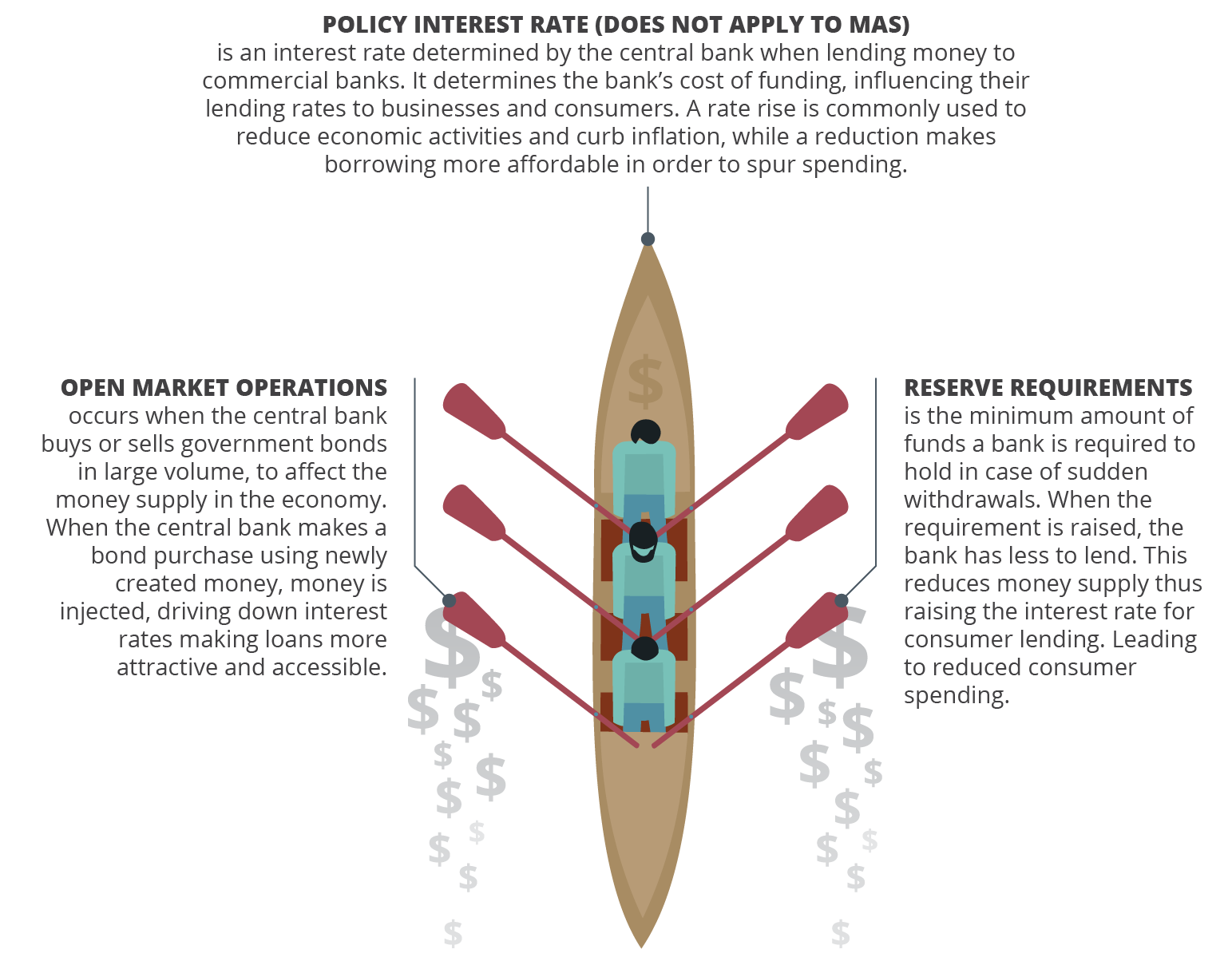

How does monetary policy work?

With economies reopening, inflation is now the new key concern

In 2022, Inflation has become the key consideration for policymakers as economies reopen and leave the pandemic era behind.

Singapore’s MAS was one of the earliest central banks to start taking action, in October last year. Since then, MAS has adjusted the Singapore dollar’s exchange rate policy another two times in January and April. This allows the Singapore dollar to appreciate versus a basket of currencies, providing a buffer against imported inflation, which means we can buy stuff cheaper from other countries as our currency is stronger. This was a far-sighted move, as inflation has started to climb rapidly ever since. In fact, there is room for MAS to strengthen the Singapore dollar even further this year.

Inflation for consumers (also known as headline CPI) is now at 5.6% year-on-year in May, much higher than the 2.5% recorded in mid-2021. Core inflation, which excludes volatile food and energy prices, followed a similar trend and reached 3.6% in May. This is much higher than the inflation we have seen over the past two decades.

How does monetary policy impact investments?

The policies alter the supply of money in circulation and influence interest rates, affecting consumer and business confidence and their spending and investment decisions.

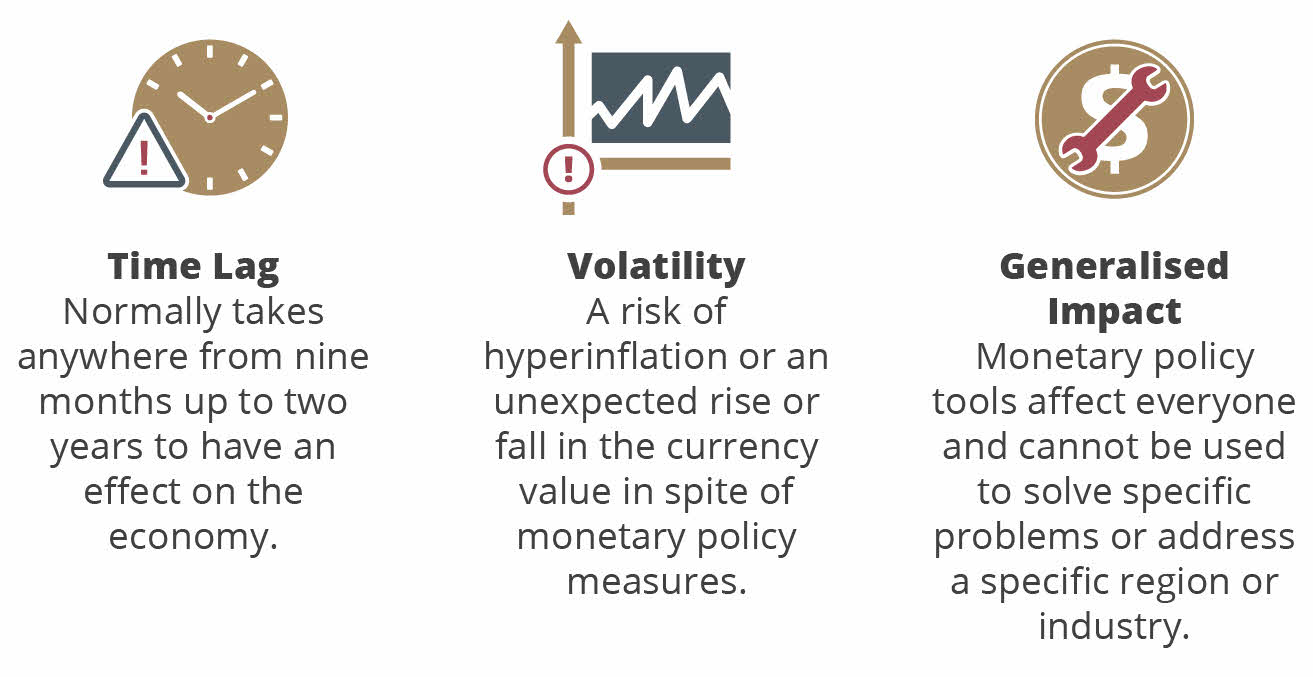

Key pitfalls of monetary policy

The policy’s effectiveness could potentially be compromised due to:

Stay ahead with insights

Guidance from our Chief Investment Office (CIO) and Chief Economist underpins all the insights, analyses and advice you get from us.

At the same time, digital intelligence works behind the scenes to make sure you see what you need to see, so there’s less time wasted searching or sifting through research and reports.

Make investment decisions with confidence, knowing you’re getting advice that’s right for you.

Get the latest market insights and strategies

Or contact your Relationship Manager if you are an existing client