digiPortfolio on digibank

Browse our menu

Choose from the portfolios available

Meet the team of DBS portfolio specialists who curate and manage digiPortfolio.

Find out more about the single management fee.

Navigating your portfolio

Choose from the portfolios available

Select your preferred risk level

and view the holdings for each level.

View projected and historical performance.

Use the slider to select the investment value and view projected returns

Learn what’s in the portfolio and why.

Funding your portfolio

To invest in digiPortfolio, click on “I’m ready to invest”.

Select how you’ll like to fund your investment and the investment amount.

Once you’ve filled in the funding details, click on "next" to complete the portfolio creation.

Holdings will be shown progressively, as orders are filled.

Get insights about your portfolio

Get insights, updates and investing strategies in relation to market movements.

See all transactions made within your portfolio and learn why adjustments were made.

Simply login to DBS digibank and access the ‘digiPortfolio’ tab in the top navigation bar.

- Select the portfolio you wish to invest in.

- Indicate your preferred risk level and funding account, funding currency and amount.

- Then confirm your decision after checking that your order details are correct.

| Funds-based digiPortfolio | Income / SaveUp digiPortfolio | ETFs-based digiPortfolio | |

|---|---|---|---|

| Type of account needed | DBS Wealth Management Account (WMA) | ||

| Eligible account type | Individual/ Joint-alternate | Individual | Individual |

| Investment Experience needed | Customer Knowledge Assessment | Customer Knowledge Assessment | Customer Account Review (CAR) for Global Portfolios |

How To Get Started

For DBS Treasures clients without a DBS digibank User ID and PIN

Not a DBS Treasures client?

Details of the underlying funds in each portfolio are available in the Portfolio Details page in DBS digibank. You will be able to view the fund prospectuses and fact sheets. In addition, there are short commentaries from the DBS Investment Team on the reasons for including each fund in the portfolio.

Management fees are debited once a year. In the event that you close your portfolio, the applicable fees will be debited prior to closure.

Simply log in to DBS digibank via internet banking to view details of your digiPortfolio and holdings.

Yes you can. You only need to maintain the minimum investment sum for your selected digiPortfolio.

It is also possible to withdraw your investment sum partially or fully. This may involve selling some or all of your holdings in the portfolio. The selling process will take several days.

After logging into digibank, select the digiPortfolio you wish to close and submit your closure request. If you have multiple digiPortfolios, you will need to repeat this process for each one. The holdings in the selected digiPortfolio will be sold with the proceeds returned to your funding account. Please ensure that your funding account remains open until the proceeds have been credited successfully as the selling process will take several days: for Funds-based/Income/SaveUp digiPortfolios, it will take between 7-10 business days while the process for ETFs-based digiPortfolios will require between 3-5 business days. These estimated timelines comprise of regular market settlement timelines for funds and ETFs.

No, once the closure request is submitted all the holdings in the digiPortfolio will be sold and the proceeds returned to your funding account. If you wish to remain invested in specific funds/ETFs, you will need to purchase them individually via DBS digibank.

Investments in SaveUp, Global, Asia, Income, Global Portfolio Plus, and Retirement digiPortfolios count towards the Investment category for your DBS Multiplier account.

For new investors, a lump sum investment of at least S$1,000 is required to qualify. Existing investors also need to top up their investments with a lump sum of at least S$1,000 per transaction to qualify.

From May 2025, both new and existing investors can also qualify by making recurring monthly investments of at least S$100 per month on all eligible digiPortfolios.

You will need to top up your account by transfer or deposit.

You will need the following to invest in a digiPortfolio:

- Access to DBS digibank – our digital wealth management platform

For DBS Treasures clients without a DBS digibank User ID and PIN

Get started To open a DBS digibank account - A DBS Wealth Management Account to manage your investments with ease.

Contact me To open a WMA for trading.

- You will need a Wealth Management Account (WMA) in order to manage your investments with ease.

Contact me To open a WMA for trading.

- For funds-based digiPortfolios, you will need to transfer funds into WMA. Monies in your Savings/Current/Multi-Currency Account(s) cannot be access for buying a digiPortfolio.

- For ETF-based digiPortfolios, you will need the following funding accounts, which can be opened instantly online. Please note that only individual accounts are eligible.

- If you are intending to buy a USD digiPortfolio you will need to already have USD in your funding account. Otherwise, you can transfer USD from your Multi-Currency Account (MCA) or do a FX transaction into your WMA.

You can set up recurring top ups for digiPortfolio via the digibank app. Here's how:

For new digiPortfolio customers:

- Login to digibank app

- Tap on 'Invest' at the bottom, followed by the 'digiPortfolio' tile

- Explore available portfolios and tap on 'Pick this portfolio'

- Select 'Yes!' to recurring top-ups.

- Input transaction details. Tap on 'Next'

- Review your transaction details before tapping on 'Submit'

For existing digiPortfolio customers:

- Login to digibank app

- Tap on 'Invest' at the bottom, followed by the 'digiPortfolio' tile

- Tap on 'Top up' and select 'Set recurring' at the bottom.

- Input transaction details. Tap on 'Next'

- Review your transaction details before tapping on 'Submit'

Recurring top ups can be made for these digiPortfolios:

- Income Portfolio

- SaveUp Portfolio

- Asia Portfolio

- Global Portfolio (ETF-based)

Yes. You can modify your recurring top up instruction via the digibank app by following these steps. However, take note that the changes would take 1 day to take effect.

- Log in to the digibank app

- Tap on 'Invest' at the bottom, followed by the 'digiPortfolio' tile

- Select your portfolio

- Scroll down and tap on 'Your Recurring Top-Ups' section

- Tap on 'Modify' to modify your recurring top up instruction

You may terminate your recurring top up instruction any time via the digibank app by following these steps. However, take note that it takes 1 day for the termination to take effect and any top ups scheduled for the same day will continue to occur.

- Log in to the digibank app.

- Tap on 'Invest' at the bottom, followed by the 'digiPortfolio' tile

- Select your portfolio

- Scroll down and tap on 'Your Recurring Top-Ups' section

- Tap on 'Terminate' to terminate your recurring top up instruction

Funds-based digiPortfolios

| Portfolio Type | Global Portfolio (0.75% p.a.) | Global Portfolio Plus (0.75% - 0.85% p.a.) |

|---|---|---|

| Currency Denominated | SGD/USD | SGD/USD |

| Management Fee | $7.50 a year for each $1,000 | $85 a year (0.85% for the first $10,000) $320 a year (0.80% for the next $40,000) 0.75% for portfolios more than $50,000 (as per portfolio value) |

ETF-based digiPortfolio

| Portfolio Type | Asia Portfolio (0.75% p.a.) | Global Portfolio (0.75% p.a.) |

|---|---|---|

| Currency Denominated | SGD only | USD only |

| Management Fee | $7.50 a year for each $1,000 | $7.50 a year (0.75% for the first USD$1,000) |

The prevailing GST is applicable on the management fee for the respective Portfolio type.

There is only one fee.

Based on the portfolio value, the annual management fee is at 0.75% to 0.85% depending on the portfolio you choose. There will be no sales charge, platform fee, switching fee, withdrawal fee or closure fee.

This management fee goes towards the research, investment strategy, market monitoring and rebalancing of the digiPortfolio and is charged once a year, or at the time of portfolio closure.

This portfolio management fee does not include the fund management fee charged by the underlying funds, which is already captured in the fund’s total expense ratio. The underlying funds are selected by our Investment Team for their strong track record and potential to outperform the market net of fund management fees.

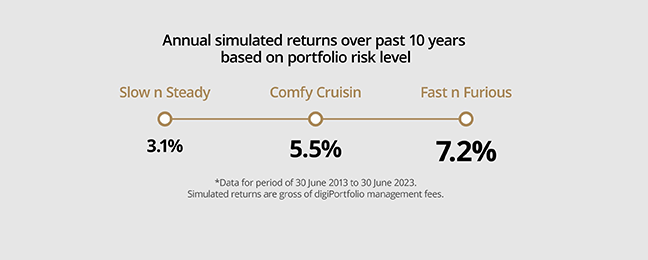

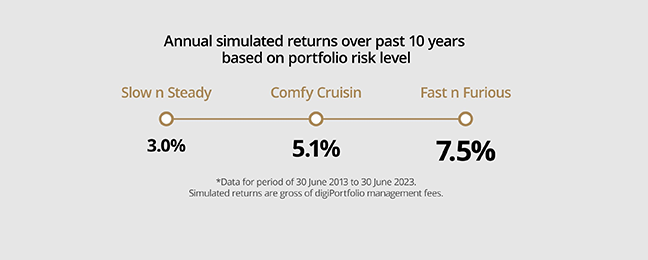

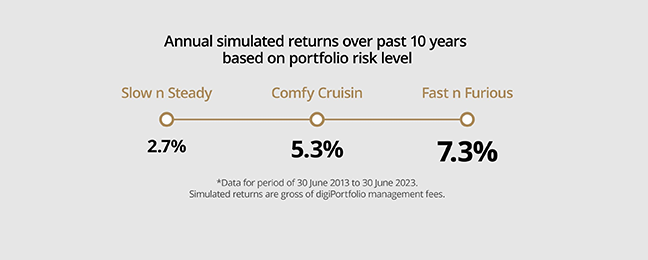

digiPortfolio’s objective is to achieve a return befitting the respective mandate over an investment cycle of 3 – 5 years while managing the price fluctuation (risk) because of the market.

To achieve this, our strategy is to invest in a portfolio of fixed income (bonds) funds and equity funds. Bonds provide steady income streams and equities provide capital growth. For any specific mandate, we will adjust the weights in either bonds or equities depending on our view on the market. We form this view together with our Chief Investment Officer (CIO) team – a dedicated team of analysts that form macro strategy. For example, in the Comfy Cruisin’ Portfolio that is initially 45% invested in bonds funds, 50% in equities funds and 5% in cash, we would increase the weight in equities and decrease the weight in bonds if we believed that equities would outperform bonds over a certain period of time. Our adjustments are calibrated and not excessive.

Funds are an efficient means to gain access to the markets.

The DBS Investment Team undertakes prudent risk management to guard against excessive risk in the portfolios. Our portfolio specialists consider acceptable price fluctuations to achieve certain returns.

Risk management also mitigates downside risks if our projections do not work out as we may have intended. For example, if we took an outsized investment in equities and it corrected heavily, it would cause undue stress to the portfolio. Having risk management standards and practices in place provides safeguards in the decision-making process.

We believe that one should take a long-term view when investing to enjoy the benefit of compounded returns. Staying focused on long term targets will help investors overcome the anxieties caused by short term market volatility. A good guide is an investment cycle of 5 years.

Compounding generates additional gains by staying invested. In the illustration below, based on an initial investment amount of $10,000, a 6% annual return reaps $3,000 over 5 years if the investor withdraws the gains every year. If the investor did not withdraw the gains and stayed fully invested, the profit after 5 years would be $3,382 instead or $382 more.

| Year | 1 | 2 | 3 | 4 | 5 | Cumulative |

|---|---|---|---|---|---|---|

| Simple | $10,600 | $11,200 | $11,800 | $12,400 | $13,000 | $3,000 |

| Compound | $10,600 | $11,236 | $11,910 | $12,625 | $13,382 | $3,382 |

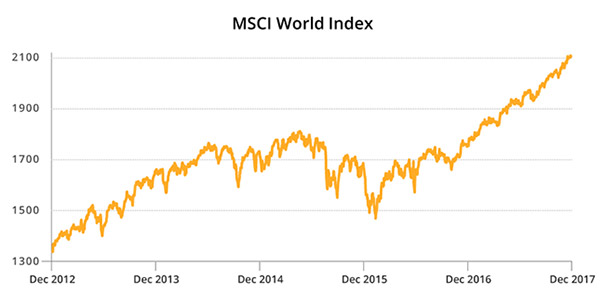

Short term investing requires good skill and timing to achieve success. However, this is difficult to execute during periods of volatility. The chart below is the MSCI World Index from 2013 to 2017. Suppose an investor started investing in 2013, he would have made some profit before meeting the rough patch in 2015. He may then decide to sell his investments to avoid further volatility. He may even wait a while before returning to the market. This may have meant missing out on the rally that proceeded in 2017. If he had stayed fully invested during the whole period, he could have benefited from the full 58% gain.

To make the portfolio effective, the portfolios are reviewed quarterly and rebalanced when necessary.

Regular rebalancing enables the portfolios to remain resilient no matter how the market moves.

Many robo-advisors in Singapore are stand-alone fintech companies with limited market capital, or part of the brokerage platforms of banks, which are separate from the full suite of banking products and services.

digiPortfolio is created and delivered by the Safest Bank in Asia and Best Digital Bank Globally. View Awards & Accolades.

DBS Bank also enjoys the highest credit ratings from the three top credit rating agencies in the world. digiPortfolio’s investment process is completely integrated into the bank’s secure systems so you have peace of mind knowing you are not being redirected to a third-party platform to transact. This also affords greater convenience as your internet banking login details are the only credentials needed to start investing

Robo-advisors are digital platforms driven by algorithms that provide automated financial planning services with little or no human supervision. A typical robo-advisor collects information from clients through an online survey, and then uses the data to offer advice and/or automatically invest client assets.