Access financial tools to hedge against interest rate exposure and navigate global markets more efficiently.

Our comprehensive suite of bespoke and innovative derivatives, across a range of tenors and specifications include:

- Interest Rate Swaps

- Cross Currency Swaps

- Swaptions & Cap/Floor

- Callable Zero Coupons

- Callable Range Accruals

Interest Rate Swaps/Caps/Floors/Swaptions help you manage the interest expense you pay on your loans.

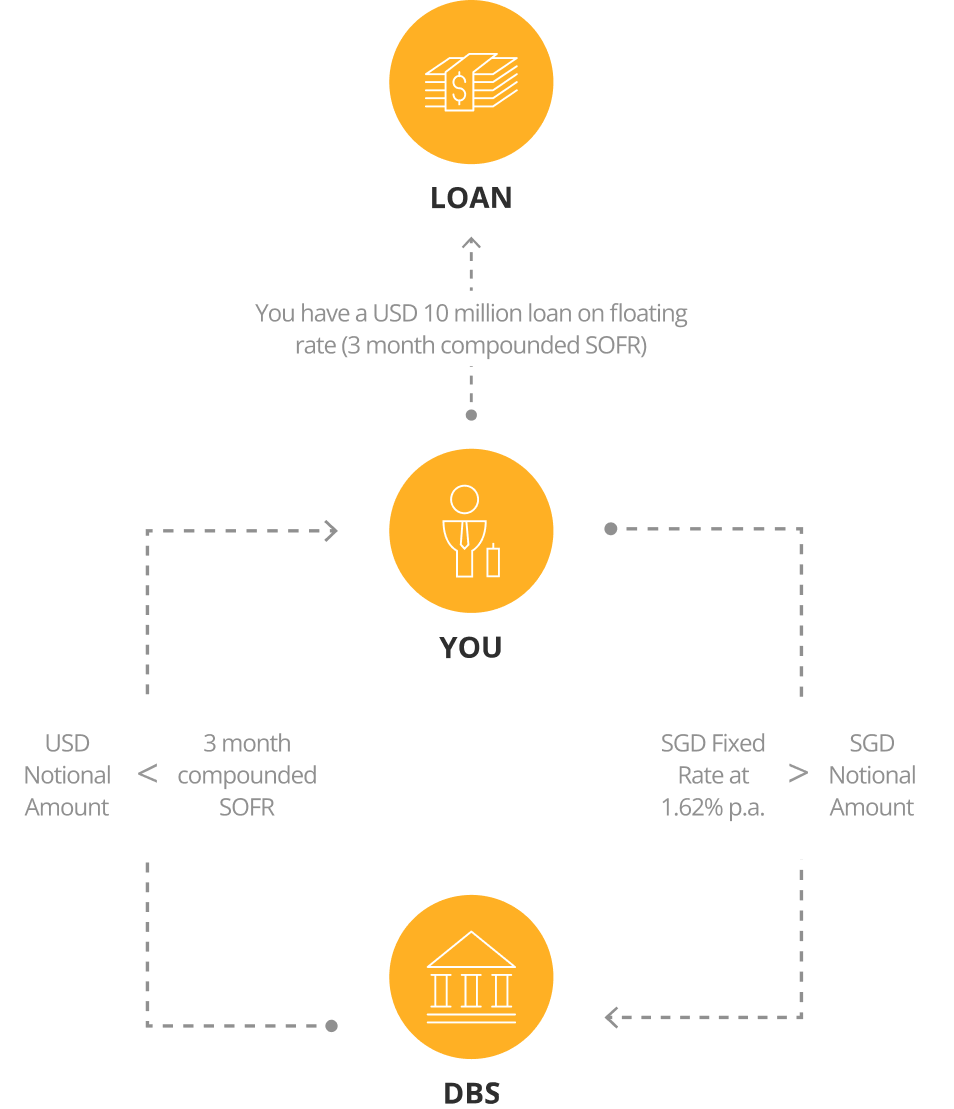

How Interest Rate Swaps Work

Illustration: You have a floating rate loan (3 month compounded SOFR) and

would like to be protected against any rise in the floating interest rate.

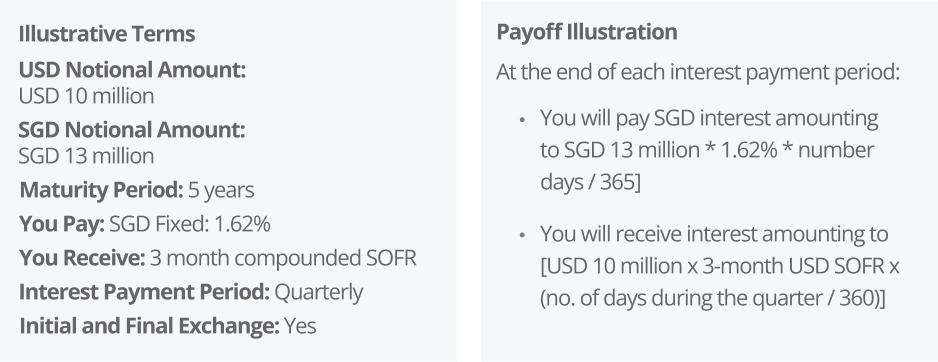

Cross-currency swaps allow you to hedge both currency and interest rates risks conveniently in one transaction.

How Cross Currency Swaps Work

Illustration: You have a USD 10 million loan on USD 3 month

compounded SOFR floating rate and would like to be protected

against interest rate and currency risks.

Call

From overseas: +65 6222 2200

In Singapore: 1800 222 2200

Operating hours: 8.30am to 8.30pm, Mon - Fri (excluding PH)

Explore other related products and solutions for your business and financial success.

-

FX Hedging Solutions

Protect your assets from potential foreign exchange fluctuations and volatility

-

Commodities Liquidity Swaps

Hedge your market position and ensure a stable lock-in price for underlying commodities