Settle your trades conveniently

At a Glance

We are moving towards a single mode of payment facility for all trade settlement via Multi-Currency Account (MCA).

For clients that are currently on EPS/GIRO payment facility, it is compulsory to link your online trading account to MCA to avoid any disruptions to your trading activities.

Trade conveniently by linking your Vickers Trading Account to a Multi-Currency Account (MCA)

Use your MCA funds to seamlessly trade across 7 global markets and settle your trades easily in both local and foreign currencies. Funds are debited and credited automatically through your MCA.

Up to 55% lower online trading commissions

Enjoy one of the lowest commissions on cash upfront trades in 7 key global markets.

Convert currencies at your preferred FX rate

Buy currencies, lock in the FX rate when the rates are favourable to you and save the funds for your investment payments.

Eligibility requirements

Please review the eligibility criteria below before you proceed.

- An individual online DBS Vickers Account that is currently on GIRO/EPS payment mode or does not use an electronic payment mode.

- An individual DBS Multi-Currency Account (DBS Multi-Currency Account or DBS Multiplier Account or DBS My Account).

- DBS digibank access.

If you do not have digibank access, you can apply for it here.

Get Started

If you have an existing individual DBS Multi-Currency Account (MCA)

Step 1:

Log in to your DBS Vickers individual online trading account via web browser.

Step 2:

Follow the pop-up prompts (as shown in the gif below) to complete the steps for linkage.

If you do not have an individual DBS Multi-Currency Account (MCA)

Step 1:

Open a new individual DBS My Account or DBS Multiplier Account.

Step 2:

Log in to your DBS Vickers individual online trading account via web browser.

Step 3:

Follow the pop-up prompts (as shown in the gif below) to complete the steps for linkage.

Commission Rates

| Market1 | Cash Rates | |

|---|---|---|

| Before Opt-in (inclusive of GST) | After Opt-in (inclusive of GST) | |

| Singapore | 0.28% Min SGD 27.25 | 0.18% Min SGD 27.25 |

| United States | 0.18% Min USD 27.25 | 0.16% Min USD 27.25 |

| Hong Kong | 0.18% Min HKD 109 | 0.16% Min HKD 109 |

| Canada | 0.30% Min CAD 31.61 | 0.28% Min CAD 31.61 |

| United Kingdom | 0.35% Min GBP 27.25 | 0.30% Min GBP 27.25 |

| Japan | 0.35% Min JPY 3270 | 0.30% Min JPY 3270 |

| Australia | 0.35% Min AUD 32.70 | 0.30% Min AUD 32.70 |

1Only applicable to trading accounts that are linked to MCA.

Improved Foreign Market Trade Settlement

Why use DBS MCA for foreign market trade settlements?

More efficient and timely settlement

Two or more contracts of the same counter can be settled using Net or Contra.

Lower FX risk and upfront investment

If you made a buy and sell trade of the same stock on the same day, you will only be required to settle the difference in amount of your outstanding trades.

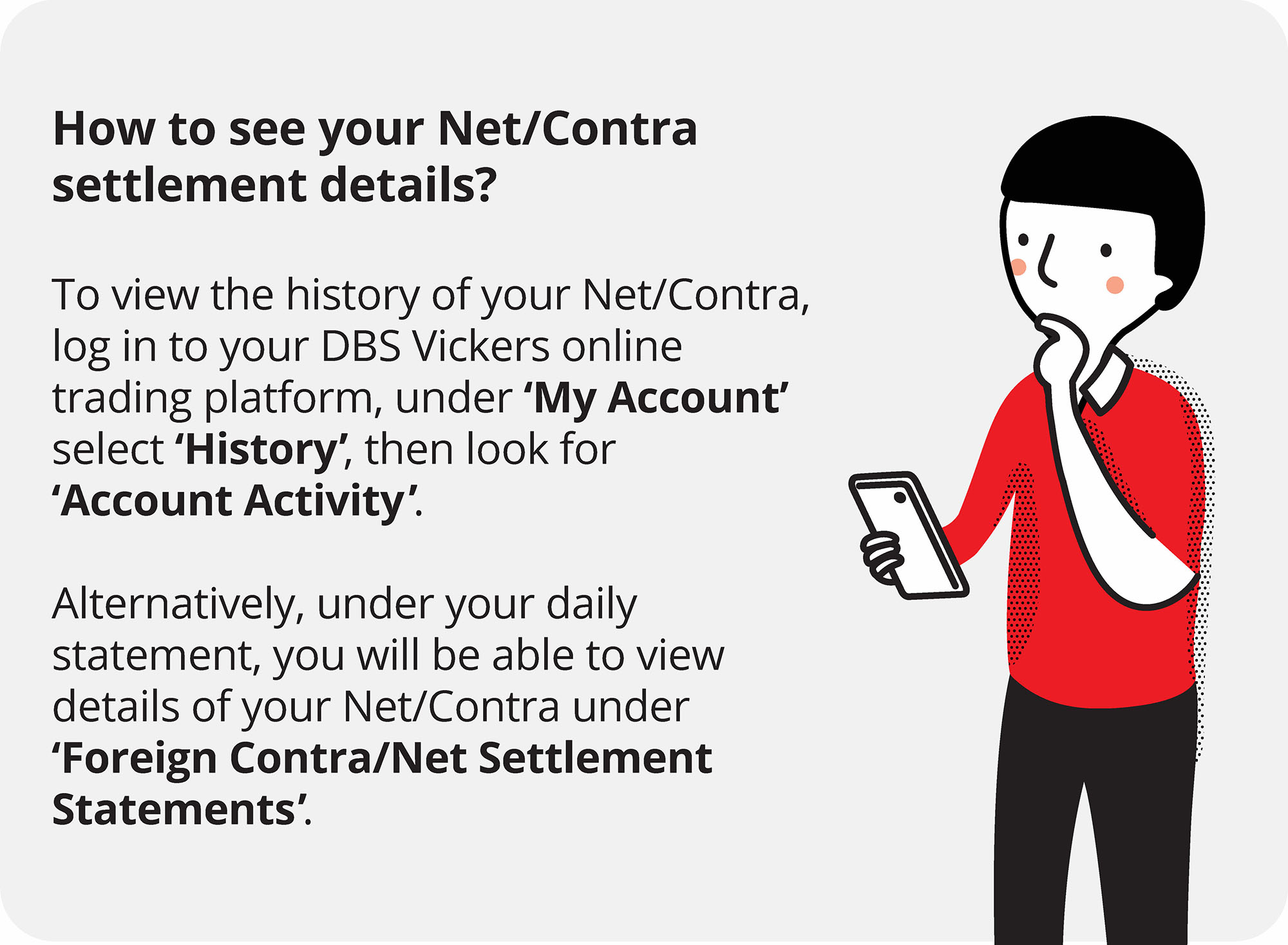

To find out more on Net and Contra settlement process, please refer to the illustrations below.

Keep in mind that these examples don't include fees or charges.

Illustrations

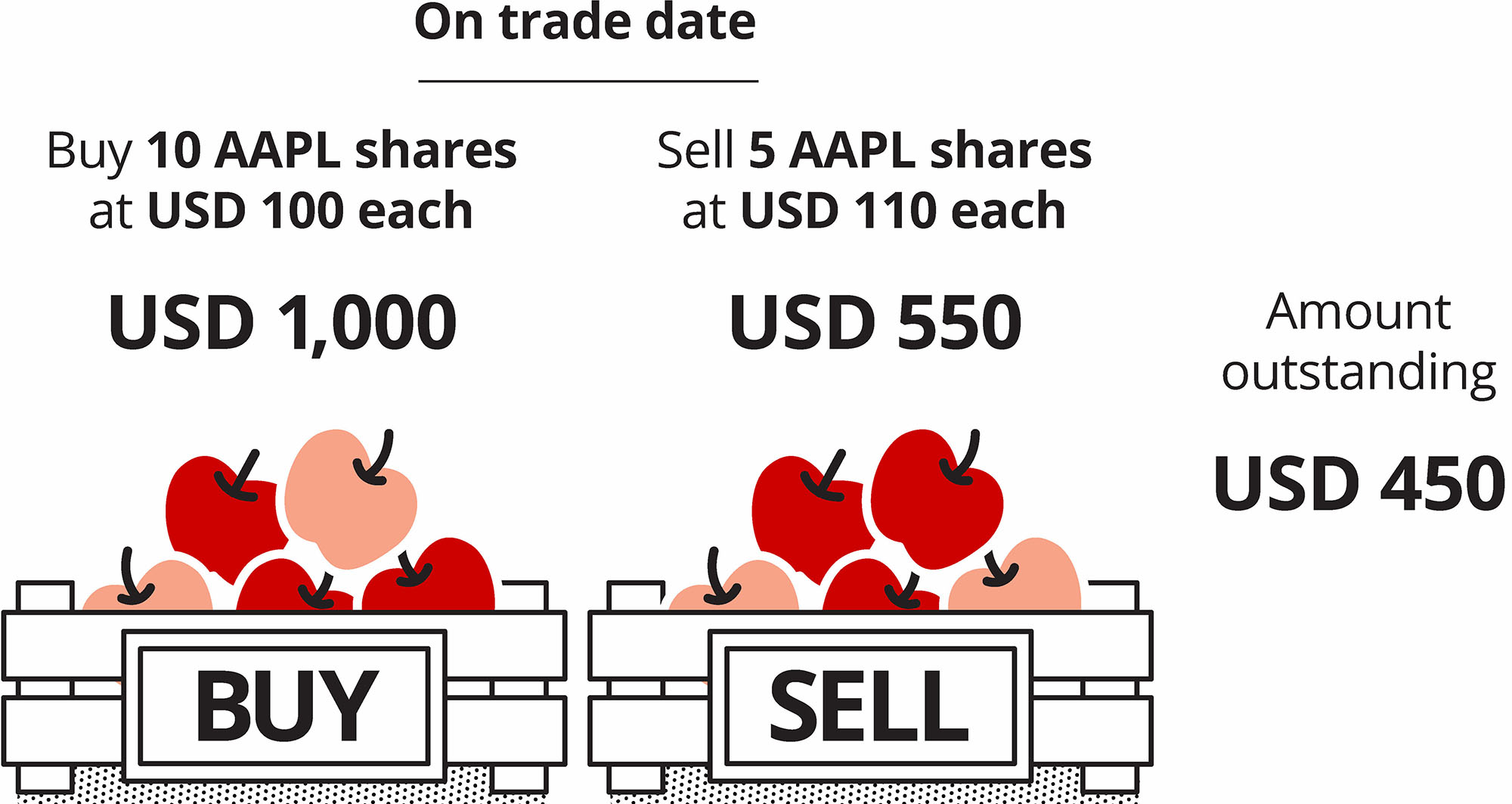

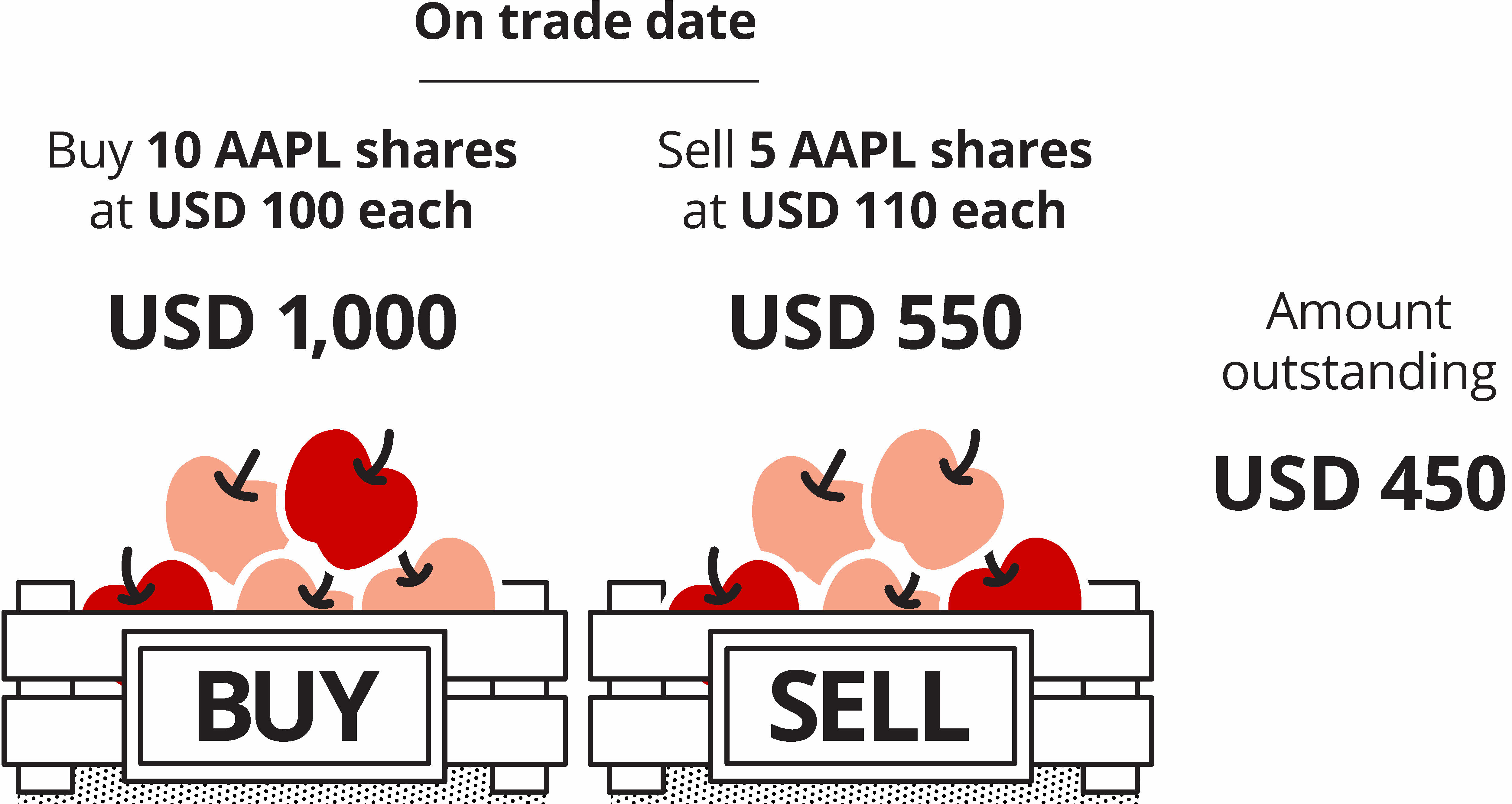

Illustration 1

Let’s say you bought 10 AAPL shares and sold off 5 AAPL shares on the same day, with an MCA balance of USD 700.

Illustration 2

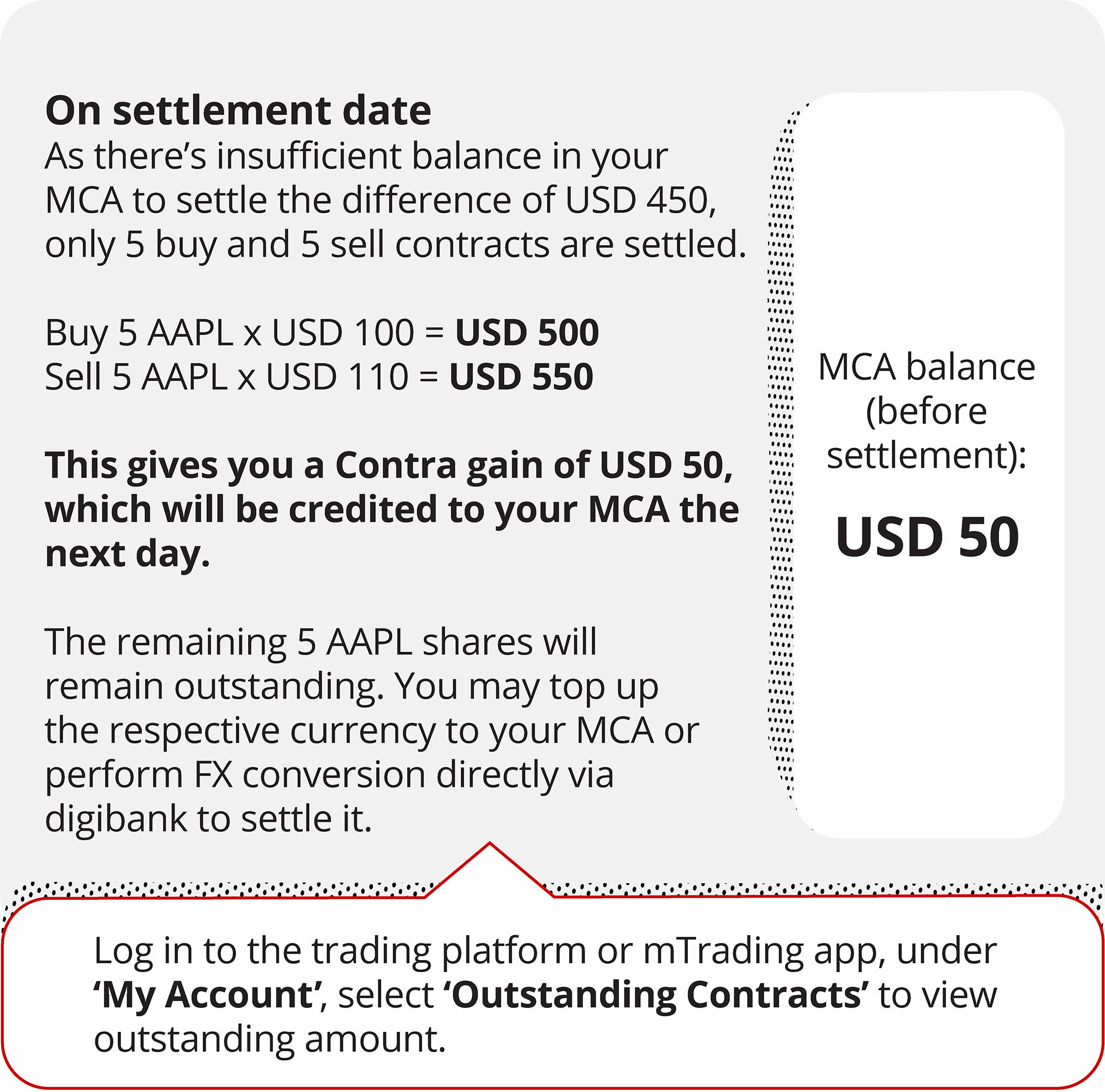

Let’s say you bought 10 AAPL shares and sold off 5 AAPL shares on the same day, but you only have an MCA balance of USD 50.

Illustration 3

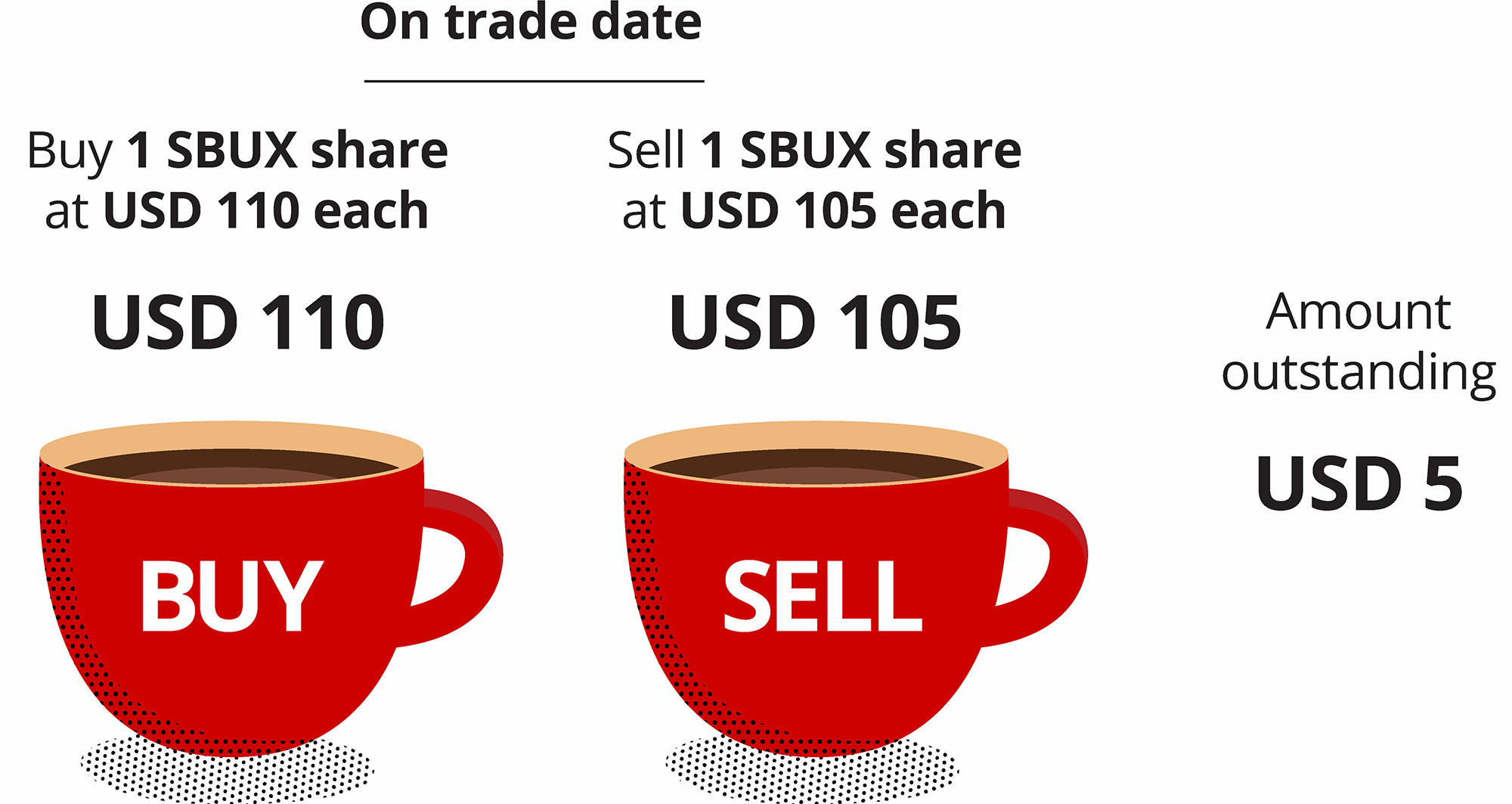

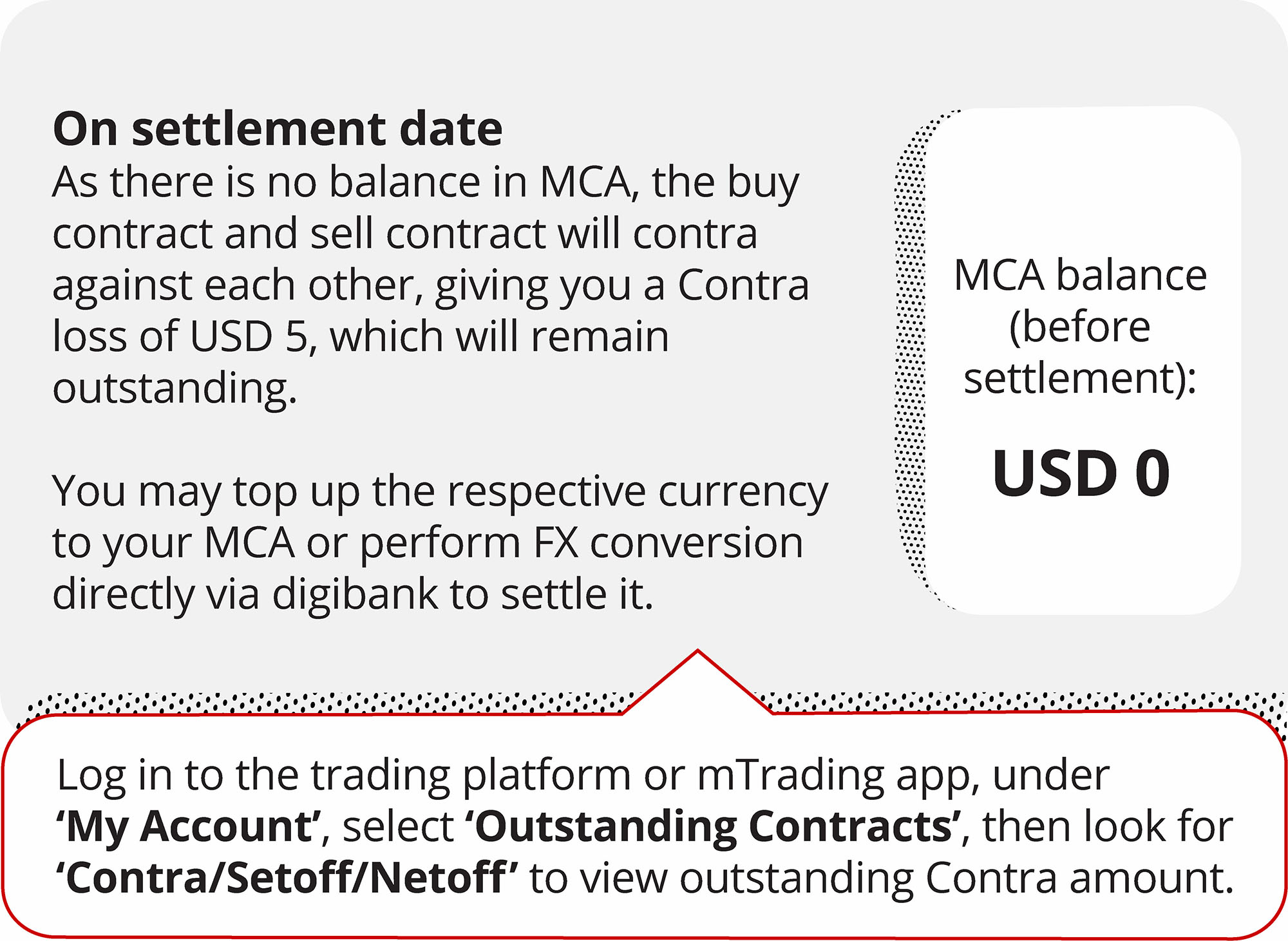

Let’s say you bought 1 SBUX share and sold off 1 SBUX share on the same day, but you do not have any USD balance in your MCA.

Frequently Asked Questions

What are the prerequisites to opt for settlement via Multi-Currency Account (MCA)?

If you fulfil the following requirement, you will be able to opt for MCA settlement. You will be able to opt-in if you have:

- An individual online DBS Vickers Account that is currently on GIRO/EPS payment mode or does not use an electronic payment mode.

- An individual DBS Multi-Currency Account (DBS Multi-Currency Account or DBS Multiplier Account or DBS My Account).

- DBS digibank access. If you do not have digibank access, you can apply for it here.

What are the eligible Multi-Currency Accounts that can be linked for trade settlement?

An individual DBS Multi-Currency Account or DBS Multiplier Account or DBS My Account.

How do I convert my online DBS Vickers online trading account to MCA settlement?

You will be greeted with a prompt to convert your account to MCA settlement when you log in to your DBS Vickers online trading account. This option to opt-in is only available via www.dbsvickers.com or via digibank online > DBS Vickers Online Trading Platform.

Note: If you do not have an existing DBS MCA, you will be directed to open one before you can convert your DBS Vickers online trading account to MCA settlement.

How long will it take for my account to be converted to MCA settlement?

Your account will be converted within 24 hours after you submit the request to link your MCA to your DBS Vickers online trading account.

How will I know when my account is successfully linked to MCA?

You will first receive a SMS and/or email notification upon submitting the request. Once your account is successfully linked, you will receive a second notification.

Note: To ensure you receive the SMS and/or email notifications, please check and set up your Online Instructions Alert preference. You may log in to your DBS Vickers online trading account > My Profile > Set Alerts to update your alert preferences.

Do I need to terminate my current payment mode after my DBS Vickers online trading account is linked to MCA?

Your existing payment mode (GIRO/EPS) will be automatically terminated after your account is successfully linked to MCA and all outstanding GIRO/EPS contracts are cleared.

Do I receive notification on the termination of GIRO/EPS?

No, there will not be any separate notification on your GIRO/EPS termination.

Can I revert back to GIRO/EPS settlement mode after I have converted to MCA settlement?

No, it will not be possible to revert back to EPS/GIRO payment mode. All individual online Vickers account will require the use of MCA settlement moving forward.

Can I convert my joint DBS Vickers trading account to MCA settlement?

Currently this conversion is only available to individual online account.

Are the commission rates on MCA settlement different from GIRO/EPS settlement?

The cash commission rates are the same for MCA and non MCA settlement. However, cash upfront settlement is available in all markets for trading accounts under MCA settlement. You will get to enjoy lower commission when you settle using cash upfront. For more information on our commission rates, please visit our Pricing page.

How do I settle my trades after I have converted to MCA settlement?

All trade settlement for MCA linked accounts will be settled using the traded currency. Funds in the respective traded currency will automatically be debited for buy trades and credited for sell trades into your linked MCA.

For Cash upfront settlement, you will no longer need to do a top up to your DBS Vickers cash upfront account. You will simply be required to maintain sufficient funds in the respective currency under MCA before you place a Cash upfront trade.

Will I be able to view my order history placed on the previous settlement mode after I have converted to MCA settlement?

Yes. You will be able to view orders of up to 1 year through DBS Vickers online trading platform under My Account > History.

Do I have to stop my trading activities before and during the conversion process?

No, we have designed a seamless journey for our customers with no impact to your trading activities.

How will my outstanding Singapore contract(s) be settled after I convert to MCA settlement?

If there are outstanding contracts pending settlement at the point of conversion, the contracts will be settled using the previous settlement mode (i.e. GIRO or EPS).

If there is GIRO deduction failure or non receipt and/or insufficient EPS payment or other form of payments by Settlement Date + 1 working day, all outstanding contracts will be converted to MCA settlement and trigger for debiting via your specified MCA on Settlement Date + 2 working day and any failure in MCA deduction shall subject to force selling subsequently.

Note: There will be no impact to outstanding contracts on CPF/SRS/Share Financing settlement mode.

How will my outstanding Foreign Market contract(s) be settled after I convert to MCA settlement?

If there are outstanding contracts pending settlement at the point of conversion, the contracts will be settled using the trust funds with us.

If there is insufficient trust funds on Settlement Date, all outstanding contracts will be converted to MCA settlement and trigger for debiting via your specified MCA on Settlement Date + 1 working day and any failure in MCA deduction shall subject to force selling subsequently. Buy and sell contract of the same counter and same settlement currency can form Net or Contra. If one of the contract is of different settlement currency, we shall convert the contract to the traded currency to form Net or Contra.

In the future, you can always perform FX conversion in your MCA to settle the contracts.

If I have pending unfilled order(s) when I submit the request to convert to MCA, what will be the settlement mode of the order(s) once they are filled?

Depending on when the order(s) is(are) filled. If the order is filled before the actual conversion, the settlement will be on the previous settlement mode. If the order is filled after the account is linked to MCA, the settlement mode will be MCA.

Note: There will be no impact to CPF/SRS/Share Financing settlement mode orders.

What will happen to my funds in my trading account?

Funds in your trading account will be automatically transferred back to your linked MCA, after all foreign market outstanding contract(s) are converted to MCA settlement and Singapore Cash upfront contracts are settled. If there is negative balance owing to us, we shall initiate a 1 time debiting via your MCA.

Get in touch

Call our Investment Service Centre Hotline

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$100,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$100,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.