Fixed Income Insights

Seizing the opportunity in IG bonds with yields at attractive levels

1 Dec 2023 - With the US Federal Reserve raising interest rates to a 22-year high in July 2023, this presents a unique opportunity for investors to find a combination of both attractive yields and relative safety with Investment Grade (IG) bonds.

In fact, with interest rates hovering at pre-Global Financial Crisis levels, DBS Chief Investment Office (CIO) has stated that the near 6% annual coupon income from holding IG bonds is preferred over dividend-yielding equities and cash deposits as the next yield play.

You can refer to CIO Insights 4Q23: The Next Yield Play for the full report.

Rate cuts on the horizon

On 1 November, the US Federal Reserve’s Open Market Committee paused rate hikes for the second straight meeting, with Fed Chair Powell emphasizing the need for “proceeding carefully” after delivering 525bps of hikes in a short time span. The hurdle for further hikes has been set high and this aligns with DBS’ view that the Fed is likely done for the cycle.

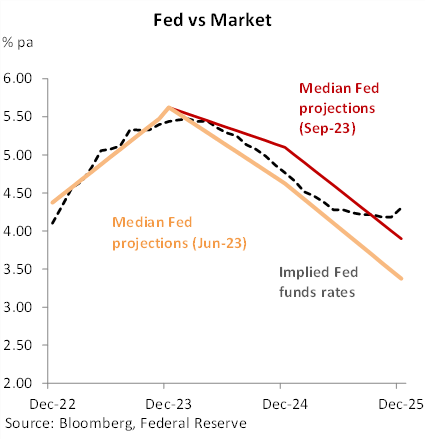

The chart above also shows how Fed projections are indicating rate cuts in 2024 and 2025. This indicates that the opportunity to lock in yields with investment grade bonds may not last, and hence DBS CIO is recommending a focus on investment grade bonds at this time.

IG bonds can mitigate reinvestment risk from shorter term cash deposits

If we are indeed in the vicinity of a rate pause, it is worth noting how safe instruments – namely cash and bonds – tend to perform after. The first thing to note is that cash deposit yields immediately fall on shaky ground, with a tendency to decline rapidly not long after the final hike. This implies that investors who are overweight cash would face high “reinvestment” risks – the likelihood of rolling over fixed deposits into higher yielding instruments from here on rapidly declines with time.

As such, shorter term cash deposits (or other short term investments like T-bills) should be complemented with longer duration investment grade bonds to mitigate such reinvestment risk.

Bonds currently more attractive than equities in the search for yield

From a yield perspective, DBS CIO prefer bonds over income equities at this part of the market cycle, highlighting two key facts:

- Since Aug 2022, the blended yield for bonds (consisting of Treasuries and corporate bonds) has superseded the dividend yield for income equities. This suggests that the addition of income equities no longer boosts the overall yield of a portfolio.

- IG bonds can help to cushion the overall portfolio against any sharp drawdown in equities.

Manage your risk

DBS CIO’s recommended strategy to secure attractive yields while mitigating interest and credit risk is as follows:

| Risk | Mitigation |

|---|---|

| Interest rate risk – bond prices fall when interest rates rise, and could cause you to incur losses if you sell your bond investment before its maturity date | Invest in bonds of a shorter duration. Shorter duration bonds are currently offering comparative or even higher yields than longer duration bonds. Shorter duration bonds are also less sensitive to interest rate changes, so they are more insulated from significant losses if interest rates rise (while still having some potential for capital appreciation when rates fall). |

| Credit risk - the possibility that the bond issuer may fail to pay what is owed | Continue to focus on investment grade bonds. The average default rate of IG bonds up to 2022 was 0.1%, and this remained below 0.5% even during major recessions such as the Global Financial Crisis. High yield bonds, on the other hand have seen default rates rise to close to 10% during recessionary periods. CIO expects that default risks for high yield bonds could increase in 2024 due to sustained high interest rates. |

With the above in mind, the sweet spot remains with A/BBB credit in the 3-5 year segment. You can watch the full webinar - "Seizing Income Opportunities in Volatile Markets" here.

Individual bonds vs. bond funds

Two of the most common ways to participate in the bond market are via individual bonds and bond funds. A comparison of these two channels is below:

| Individual bonds (Over the counter or via a more limited selection of retail bonds on SGX) | Bond Funds | |

|---|---|---|

| Diversification | No | Diversified |

| Minimum transaction Size | High (e.g. S$250,000 for SGD bonds) | Low (e.g. as low as S$1,000 for certain bond funds) |

| Management fees | No | Yes |

| Consistent coupon rate | Yes | Varies |

| Receive full value of bond at maturity | Yes | No – will need to redeem the bond fund at the prevailing Net Asset Value |

As an Accredited Investor, getting started with investment grade bonds is easy. Simply leave us your contact, and our Relationship Managers will reach out to you.

Alternatively, you may wish to browse our list of bond funds available on digibank:

| Step 1: Tap on Invest on the bottom navigation bar Step 2: Tap on Funds Step 3: Tap on Explore Funds and search for your desired fund (you can filter by asset class e.g. ‘Bonds’) |