Discipline, time, and patience in investing

![]()

If you’ve only got a minute:

- Discipline, time, and patience are needed when it comes to long-term investing.

- Set aside a fixed amount regularly for investing and top up when you have spare cash.

- Stick to your investment commitment even when markets fluctuate, knowing that your patience will pay off after having time in the market.

![]()

In a famous children’s tale by Greek storyteller Aesop, a thirsty crow in the desert is overjoyed to find a pitcher containing some water. Unfortunately, his beak is too short to reach the water.

The smart crow devises a solution: He patiently drops one pebble after another into the pitcher. It takes some time, but he persists until the water eventually rises high enough for him to drink it.

The crow exemplifies 3 virtues prized in long-term investing: discipline, time, and patience.

Discipline

In the story, the crow showed discipline by consistently making the effort to drop stones into the pitcher one at a time, not quitting until the water rose to a drinkable level.

Similarly, discipline in investing is making the effort to do your due diligence and research, then coming up with a plan and sticking to it in good and bad times, focusing more on the long-term trends rather than recent fluctuations.

Committing to a plan also ensures that money meant for investments is not spent on something else especially when you have set aside some emergency cash for the rainy day. Moreover, with a plan to act as a guide, the likelihood of making emotionally-driven investment decisions when unexpected scenarios arise is likely to be lower.

Read more: Taking the emotions out of investing

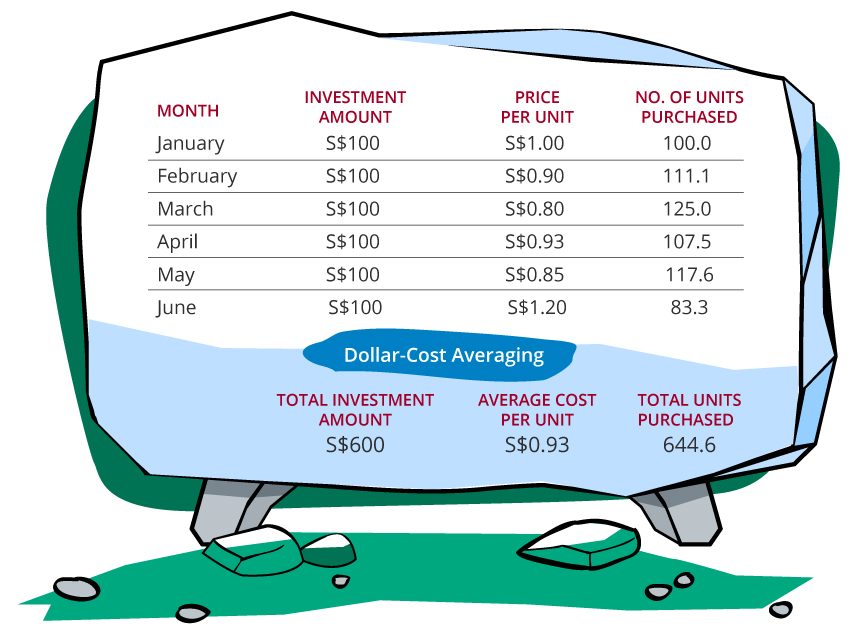

Discipline also means setting aside money for investments regularly. This can be done through dollar-cost averaging (DCA) to help you spread risk over time.

Utilising this strategy involves investing fixed amounts at regular intervals into the same investment over an extended period, regardless of market conditions. While most choose to do this monthly, you can opt to invest at other regular intervals (such as quarterly or semi-annually). The point is to invest at regular, consistent intervals that work best with your financial situation over the long-term thus reducing the overall volatility of your investments.

To remove the need to track your regular investment dates manually, you can automate monthly investments through a regular savings plan (RSP) such as DBS Invest-Saver which allows you to make monthly contributions from as little as S$100 a month.

Read more: Is DCA or lump-sum investing better for you?

Find out more about: DBS Invest-Saver

Time

The crow in Aesop’s fable did not get to drink the water immediately after dropping one or two stones into the pitcher. Time was needed for it to go back and forth, depositing stones until the water rose to the right levels for it to drink.

Investing (as opposed to trading) is a long-term journey. It is better to have time in the market, which means investing as early as you can in your life and then to stay invested to reap the benefits of compounding.

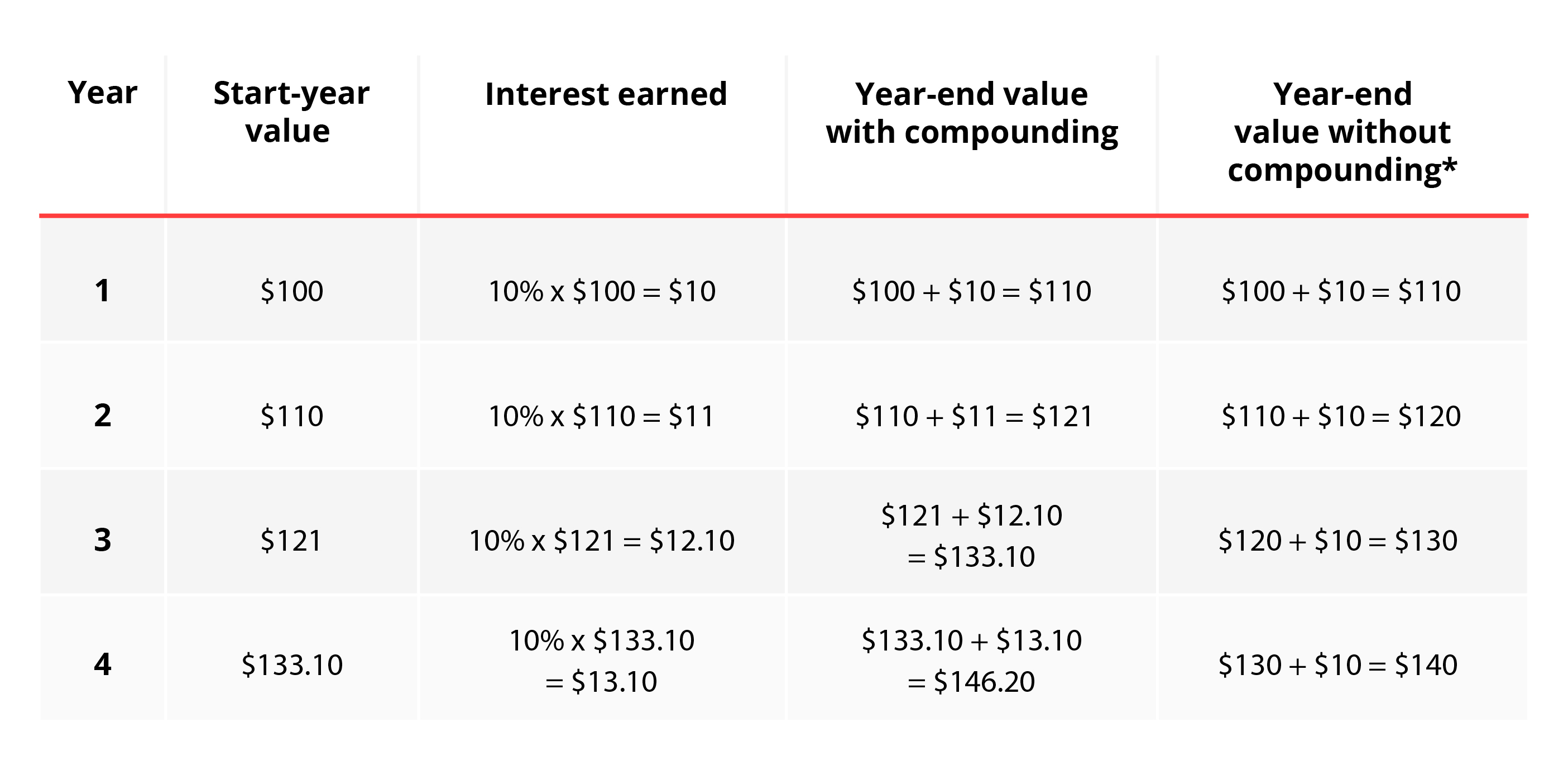

Compounding is when your returns are added to the originally invested amount, increasing the total new invested amount thus generating additional returns. Let’s assume you invest $100 and the investment grows by 10% each year. Without compounding, your investment would grow by $10 per year, bringing your investment value to $140 at the end of 4 years. However, with the effects of compounding as shown in the table below, the value of your investment at the end of 4 years would be $146.20.

Read more: Harness the power of compound interest

*Without compounding, interest earned is 10% of $100 which is a gain of $10 for each period

In the same vein, consider investing additional funds when they become available, perhaps through a year-end bonus or a gift. Instead of waiting for it to be invested through your regular investments, you may invest a portion or all of it to top-up your portfolio as an ad-hoc investment. After all, unless the market is at an all-time high, the earlier you invest the longer time you have in the market.

If you do not have immediate needs for your dividends or bond coupons, they can also be reinvested into your existing holdings to grow your investment pot and leverage the power of compounding. This is done best with unit trusts which allow you to accumulate and reinvest dividends.

Read more: A beginner’s guide to unit trusts

Find out more about: DBS digiPortfolio

Patience

Now, back to the crow (again). It displayed patience and persistence. What this suggests to us is that even though effort and time were required, the crow did not get swayed and kept going until it achieved a well-deserved thirst quencher.

When it comes to the financial markets, there will always be fluctuations. Patience means staying invested even during trying times for markets. This is especially so when you have invested in a company with strong fundamentals, like solid earnings, stable cash flows, and good management.

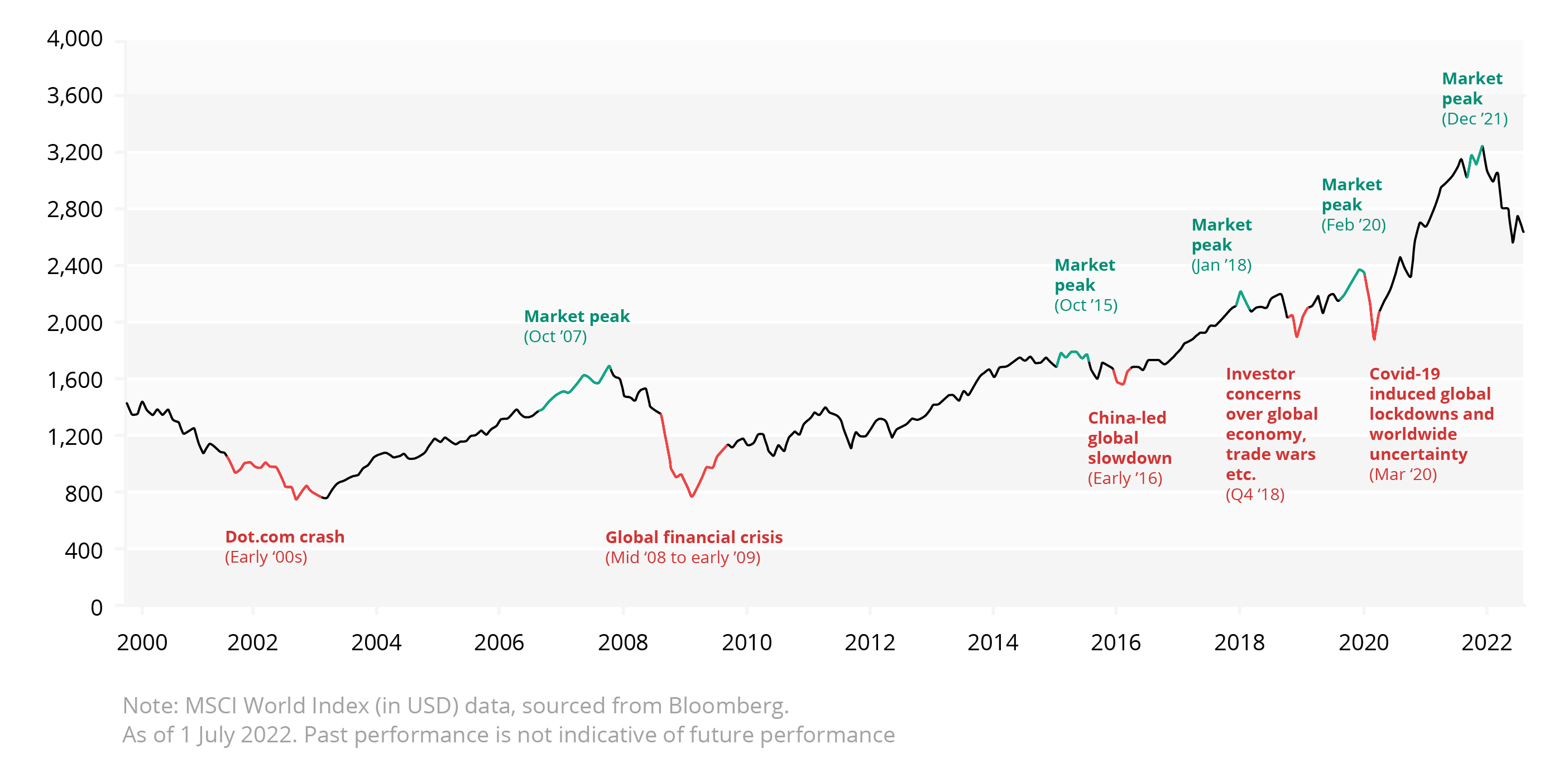

Market peaks and troughs are expected. They are caused by various factors, such as economic indicators, political developments, and company announcements. When markets go awry, it is easy to panic and sell your investment to trim losses. But cutting loss too early may prevent you from potentially enjoying a price recovery later.

Read more: Investing along the economic cycle

For example, if you had invested in an ETF that tracks the MSCI World Index in end 2019 and sold it off to cut losses during the Covid-19 crash, you would have missed out on the market recovery that followed later in the year through till late 2021.

Volatility is part and parcel of investing but with a suitable mindset and risk tolerance level, you can learn to stay calm. Armed with discipline, time, and patience, you are well set for your investment journey ahead.

Ready to start?

Need help selecting an investment? Try 'Make Your Money Work Harder' on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Let's Meet

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)