If you’ve only got a minute:

- You can do your part in protecting yourself from falling prey to cybersecurity threats.

- Ensure you have the necessary authentication measures in place like a strong password and 2FA set up.

- Do not click on links sent via emails or SMSes – instead, opt to go directly to the banks official website by keying in the URL manually.

- Stay on top of your transactions and report any unusual or unexpected activities to the bank immediately.

![]()

Technology has brought the world to our fingertips. From small, day-to-day transactions like ordering food, to larger ones like booking flights or hotels for an upcoming trip, all these can easily be done with a few taps on a screen!

However, with this added convenience brings a new set of risks, which is why it is paramount to adopt good security practices so that we do not fall prey to cyber-attacks.

While the bank proactively predicts, prevents, detects, and responds to cybersecurity threats, here are 5 ways to keep yourself protected.

1. Secure your access on wireless networks

It is common to tap public Wi-Fi networks when you’re out and about, especially when you are overseas. However, doing so puts you at a higher risk of being a target of cyber-crime as public Wi-Fi networks are often unsecured.

Cyber-criminals can steal your personal information or passwords, or even download malware or ransomware into your devices. This is why when it comes to online banking or transactions that require you to key in sensitive information, opt to use secured Wi-Fi networks that require a password or mobile data instead. Otherwise, just stick to browsing the internet and refrain from logging into any accounts.

Before using public Wi-Fi, it is also good practice to verify that the network you are connecting to is legitimate. Use a VPN where possible and opt to “Forget This Network” when you have finished using it. You should also ensure your computer software is up to date, your data is backed up, and be extra vigilant when clicking on any links.

2. Set up 2FA

By now, most of us would be familiar with the prompt to “approve” log-ins to government services and portals through our Singpass app along with needing to key in a one-time-pin (OTP) to authenticate online payment transactions with our debit/credit cards.

2FA is a method of authentication that requires users to provide 2 forms of identification before access to a system or service is granted. This additional layer of protection reduces the risk associated with stolen or compromised passwords.

When it comes to banking transactions, the digital token is used to provide 2FA and is included as a feature within your digibank app.

Convenient

Digital tokens are built into your digibank mobile app, providing a more seamless and secured authentication journey for your online transactions.

Authentication is done with a tap of your Digital Token while mobile banking transactions are authenticated in the background. You no longer have to wait for SMS OTPs or look for your physical token.

If an OTP is required, the digital token generates one almost instantly, making authentication quicker than if you had done so with an SMS or email OTP.

Secure

Traditional SMS OTPs can be intercepted even before they reach you! And this is one of many ways savvy cyber-criminals use to commit fraud.

Using a digital token minimises the risk of this as authentication is done directly through digibank. Each authentication request sent and received via the digital token is encrypted, making it much harder for cyber criminals to intercept the process and illicitly access your money.

Besides this, the digibank app can only be registered to and used on one mobile device – yours.

Easy to set up and use

The set up of your digital token is easy. It only takes 3 simple steps where you will need your mobile device and a bank-registered email address.

Remember to enable push notifications for your digibank app on your mobile device. To authenticate a banking transaction, simply tap on the pop-up notification that appears and you will be redirected to the digibank app to approve or reject your transaction.

Never approve transactions if they are not initiated by you. Always check the message prompts to ensure that the details of the transaction are accurate before approving it.

Find out more about: DBS digibank – the smartest way to bank

3. Change your PIN and password regularly

With cyber-crime on the rise, usernames and passwords are becoming increasingly vulnerable to a variety of attack methods. Changing your Personal Identification Numbers (PINs) and passwords regularly can reduce the risk of your password and account being compromised.

Besides this, it is important to set a strong password – one that you can memorise easily so as not to get locked out of your accounts, but not easily enough for hackers to guess.

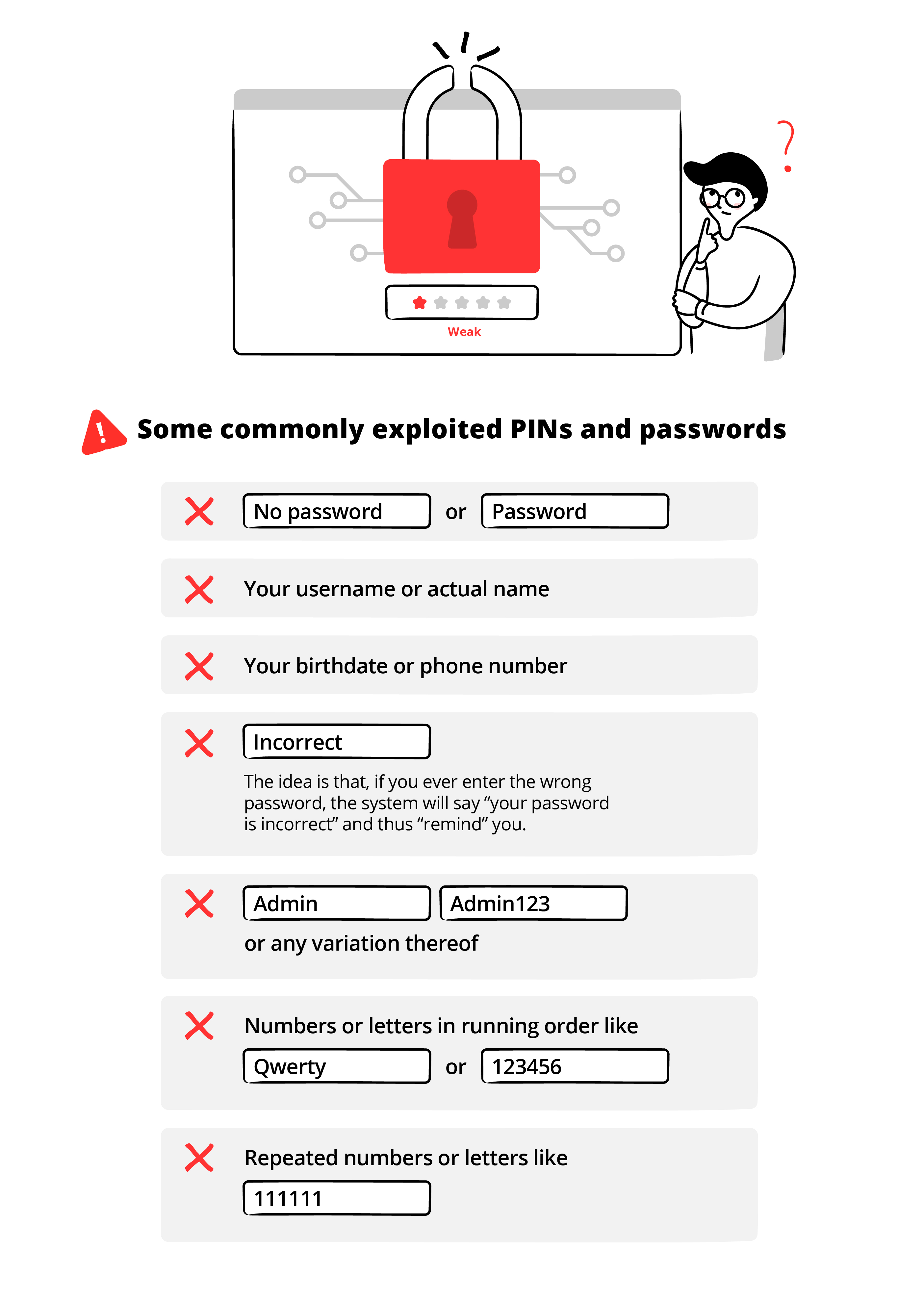

Avoid common and weak passwords

Avoid repeating passwords across accounts

As much as possible, avoid using the same password for different accounts. If your email password is also your banking PIN number, the hacker who cracks one of your accounts will get a 2-for-1 access (in some cases, more).

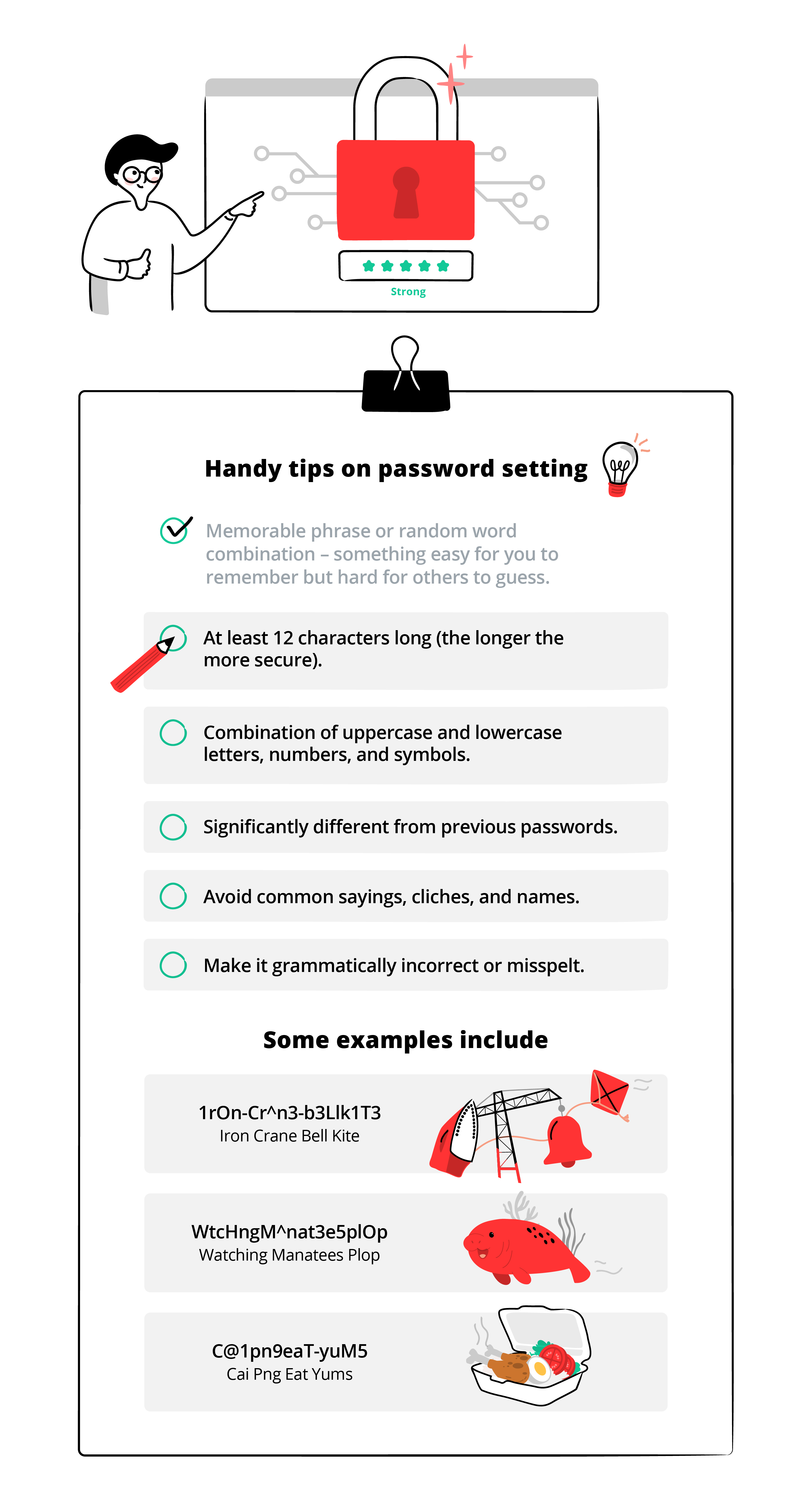

Setting a strong password

Using randomly generated passwords like “@#37KTmm-Y2%” may seem like the most secure option, but it is nearly impossible to remember it without writing it down (which would defeat the purpose of password security).

Use biometric authentication

Depending on your mobile device, technologies such as fingerprint and facial recognition can help authenticate you securely.

4. Be wary of “important notices”

While previously easily identifiable through questionable grammar and flashing headlines, phishing scams have increased in sophistication. If you’ve received emails purportedly from your bank asking you to login to your account, here are some basic precautions to take.

- Beware of links sent through mediums such as email, SMS, WhatsApp or social media.

- Do not enter sensitive banking account information on any third-party websites.

- Do not give out your password or PIN via email, SMS, or other messaging programmes.

- Remember that DBS will never request for your bank login credentials.

- Go directly to https://www.dbs.com.sg or https://www.posb.com.sg to ensure you are on our official websites.

A healthy dose of scepticism will protect you – if an offer sounds too good to be true, it probably is. If still in doubt, contact your bank or supposed sender directly to confirm that the communication came from them.

Read more: #BSHARP Protect yourself online

5. Set transaction limits and alerts

A lower daily limit for transactions will cap your potential losses in the event that your account is compromised. You can set the threshold amount for transfers to other bank accounts (DBS/POSB or not), overseas accounts, and credit card transactions, among others.

This can be done easily via the digibank app, or online banking.

DBS will send you an SMS alert if there are any suspicious transactions on your account. These include transactions of an unusually large sum or unexpected overseas payments performed digitally. You can also customise your own notification alerts based on your preferred transaction threshold.

If you receive an alert for a transaction that was not performed by you, call the bank immediately to stop it from going through.

6. Stay up-to-date

Make it a habit to know your bank balance and check it regularly. If you spot any irregularities with your bank balance or in your e-statement, contact the bank immediately.

Only install DBS’s mobile applications from the official Google Play Store, Huawei AppGallery, or Apple App Store to ensure that your application is legitimate. Enable auto updates so that you always have the latest version of the app.

If you notice anything amiss with your online banking experience, call us at 1800 339 6963 or (65) 6339 6963 from overseas at once. Bank online securely and enjoy a world of convenience at your fingertips.