Making Financial Planning Simple

By Lorna Tan

![]()

If you’ve only got a minute:

- The Basic Financial Planning Guide – which comprises 6 short guides that are customised to meet the needs of individuals in different life stages - aims to enable everyone to start planning and enhance their financial health by encouraging them to take some simple actions.

- The 6 guides include national schemes and low-cost products, and offer recommended levels of emergency cash, protection levels, investment, retirement, and legacy planning considerations.

- Financial advisory representatives are required to consider the customer’s specific needs, and this could mean recommendations that deviate from the guides which are not designed to be exhaustive.

![]()

Much has been written and talked about on the need for financial planning.

An ongoing process, financial planning looks at your entire financial picture to come up with steps and solutions to achieve your short-, medium-, and long-term goals.

In doing so, you will have greater peace of mind knowing that you can meet current needs as well as being able to fund your kids’ education and desired retirement lifestyle.

But for the uninitiated, the thought of planning for financial wellness can be overwhelming and most do not know where to begin.

Still, it is often said that when you fail to plan, you are planning to fail.

Knowing this, the government and industry associations including the banks have come together to develop an easy-to-use Basic Financial Planning Guide comprising 6 short guides that are customised to meet the needs of individuals in different life stages.

The aim is to enable everyone to start planning and enhance their financial health by making financial planning more accessible to the masses and encouraging them to take some simple actions.

What is the Basic Financial Planning Guide

While guides on financial planning are not new, the new Basic Financial Planning Guide distinguishes itself through its comprehensive nature.

It aims to provide a consolidated view on the diverse needs of financial planning at various life stages (from fresh entrant to the workforce and working adult with kids to pre-retirees and retirees).

The holistic guide offers recommended levels of emergency cash, protection levels, investment, retirement, and estate planning considerations.

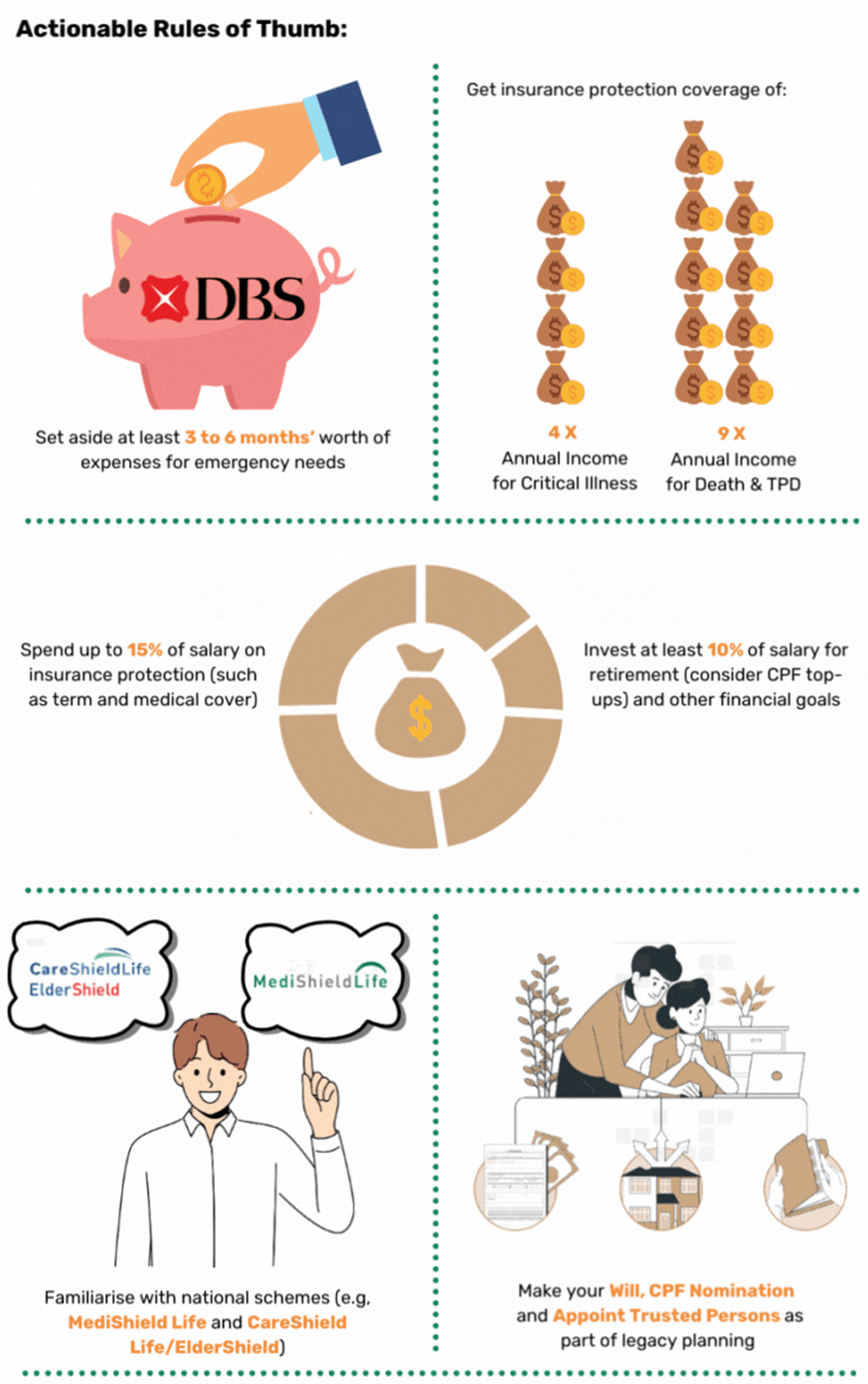

It includes national schemes (like Central Provident Fund, MediShield Life and CareShield Life), low-cost protection and diversified investment product options, and actionable Rules of Thumb for consumers to self-assess, identify, and close their money gaps.

These Rules of Thumb equip Singaporeans with an easy way to get started on their financial journey and allow them to benchmark their current financial situation against the Rules of Thumb.

The inclusion of government schemes and low-cost product options can help Singaporeans fulfil their financial needs more efficiently.

Guides for 6 Consumer Archetypes

Launched in January 2024, the 6 short guides revolve around these consumer archetypes:

- Fresh entrant to the workforce 19 – 29 years old;

- Working adult (starting a family) 25 – 34 years old;

- Working adult (supporting aged parent) 35 – 59 years old;

- Working adult (parent with children and supporting aged parent) 35 – 59 years old;

- Pre-retiree 55 – 64 years old; and

- Golden years 65 years and above

Each guide comes with a case study that gives a breakdown of an individual’s monthly cashflows for financial planning, rules of thumb on emergency savings, protection and investments, as well as suggestions on product options and the affordable monthly cost.

Factors to consider when using the Guide

1. Do a financial needs analysis

The guide lays out basic and simple steps to set up a financial plan that are broadly applicable to most. This means that the guide may not cater to every individual’s specific needs, circumstances, and preferences.

While it provides guidance on how you can meet your key and basic financial planning needs, it is not exhaustive.

As such, consumers are strongly encouraged to do a financial needs analysis either by themselves or with a professional financial adviser to assess their situation, before making informed decisions on the steps to fulfil their financial objectives.

2. Deviation from Rules of Thumb

As part of the financial needs analysis process, financial advisory representatives are required take into consideration the customer’s specific needs, and this could mean recommendations which deviate from the new guide.

Of course, there should always be a reasonable basis for the financial advice and recommended solutions.

For example, the level of adequate emergency funds could differ from person to person. While individuals who enjoy a steady paycheque can make do with at least 3 to 6 months of emergency cash, freelancers with unpredictable income may require 12 months or more to account for unexpected lull periods in their income.

In the same vein, an individual’s insurance and investment needs will differ depending on his specific circumstances, such as affordability, number of dependants, risk profile and time horizon. This means he may require insurance covers that have lower or higher cover and/or risker investment solutions, than the rules of thumb indicated in the new guide.

While the rule of thumb indicates spending up to 15% of salary on insurance protection (such as term and medical plans), do note that this excludes premiums for bundled products such as whole life insurance as they contain both investment and protection elements.

Furthermore, Integrated Shield Plans may be a suitable additional health cover for those who desire a higher level of medical care.

3. Upgrade your knowledge and review your financial plan

The new guide is an additional resource and an avenue to upgrade your financial literacy and build a strong financial foundation. Putting in place a good financial plan is a gift to your loved ones and to yourself.

It is a prudent to constantly review your financial plan. For example, should you find that you have purchased more or less coverage compared to the guide’s Rules of Thumb, you may wish to review your needs and preferences, to determine if your existing coverage continues to suit your unique circumstances.

After all, it is a good practice for consumers to adjust their insurance coverage at different life stages given that their needs and preferences would evolve over time.

Reviewing your financial plan will also enable you to allocate and invest your financial resources in different asset classes for diversification, and build a portfolio that is better aligned to your situation, risk profile, objectives and time horizon.

4. Voluntary use of guide by industry players

The use of the new guide is not a regulatory requirement. There is no breach of MAS’ laws and regulations for not using the guide.

That said, many FA representatives already incorporate elements of the guide as part of their conversations with customers today, including DBS Bank.

In fact, DBS’s comprehensive financial advisory process – via online and human-facing channels - is based on a robust financial planning model that has already taken into consideration the guide’s Rules and Thumb and more.

DBS digital financial and retirement advisory tool – Plan & Invest tab on digibank – enables you to connect to SGFinDex, so your financial information from banks, CPF, HDB, IRAS, CDP, and insurers, will be pulled onto the platform, with your consent.

The tool will offer comprehensive insights on your finances, and help you identify and close insurance and investment gaps, as well as map your future. It has an investment simulator as well as cashflow projection capabilities so you can visualise how your savings can grow with investments into the future.

So far, 3 million customers have used the digital tool, of which more than one-third are active users monthly.

How do Singaporeans fare in financial health

The National Financial Capability Survey conducted by MoneySense in 2021 found that Singapore residents generally adopted good financial behaviours in money management.

But more need to take active financial planning steps as slightly more than half of the survey respondents had not developed a plan for retirement savings.

Furthermore, the findings from DBS latest research paper “Between a rock and a hard place” underscore the importance of sustainable financial planning for everyone to enhance their wellbeing.

This is particularly so for certain population segments, as relentless inflationary pressures and escalating expenses that outpace growth in wages lead to further erosion of savings. The report analysed aggregated and anonymised data insights from 1.2 million DBS retail customers in May 2023 relative to May 2022.

In particular, boomers, low-income customers and gig workers are most financially stretched. Contrary to other customers, the 3 groups saw expense-to-income ratios inch up to 86%, 93% and 112% in May 2023 respectively. This is significantly higher than that of the median customer at 57%.

The report indicated that generally savings dipped but remain healthy, except for the low-income. The median customer saw their savings decline marginally from 3.7 to 3.5 months of expenses. Yet, savings for the low-income and gig workers could only last them 1.5 months and 1.7 months respectively, which is an area of concern.

The launch of the new Basic Financial Planning Guide is timely and will go a long way to boost Singaporeans’ awareness of financial literacy and their financial security.

It is never too early to embark on your financial journey. So start today!

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)