![]()

If you’ve only got a minute:

- The “Plan and Invest” tab on DBS digibank can help you track your saving and spending patterns so you can gain better control over your finances.

- It conveniently monitors your income, expenses, and savings all in one place.

- It also offers personalised recommendations and insights based on your financial data and provides actionable steps and suggestions to help you achieve your financial goals.

![]()

| Take the guesswork out of understanding your spend habits by tracking it all digitally via the “Plan and Invest” tab on digibank. Having a better grasp of your spending habits is important to help you assess what you’re adding to your spend “cart” and hence, aid you in saving more for a rainy day. |

Track your spending on digibank

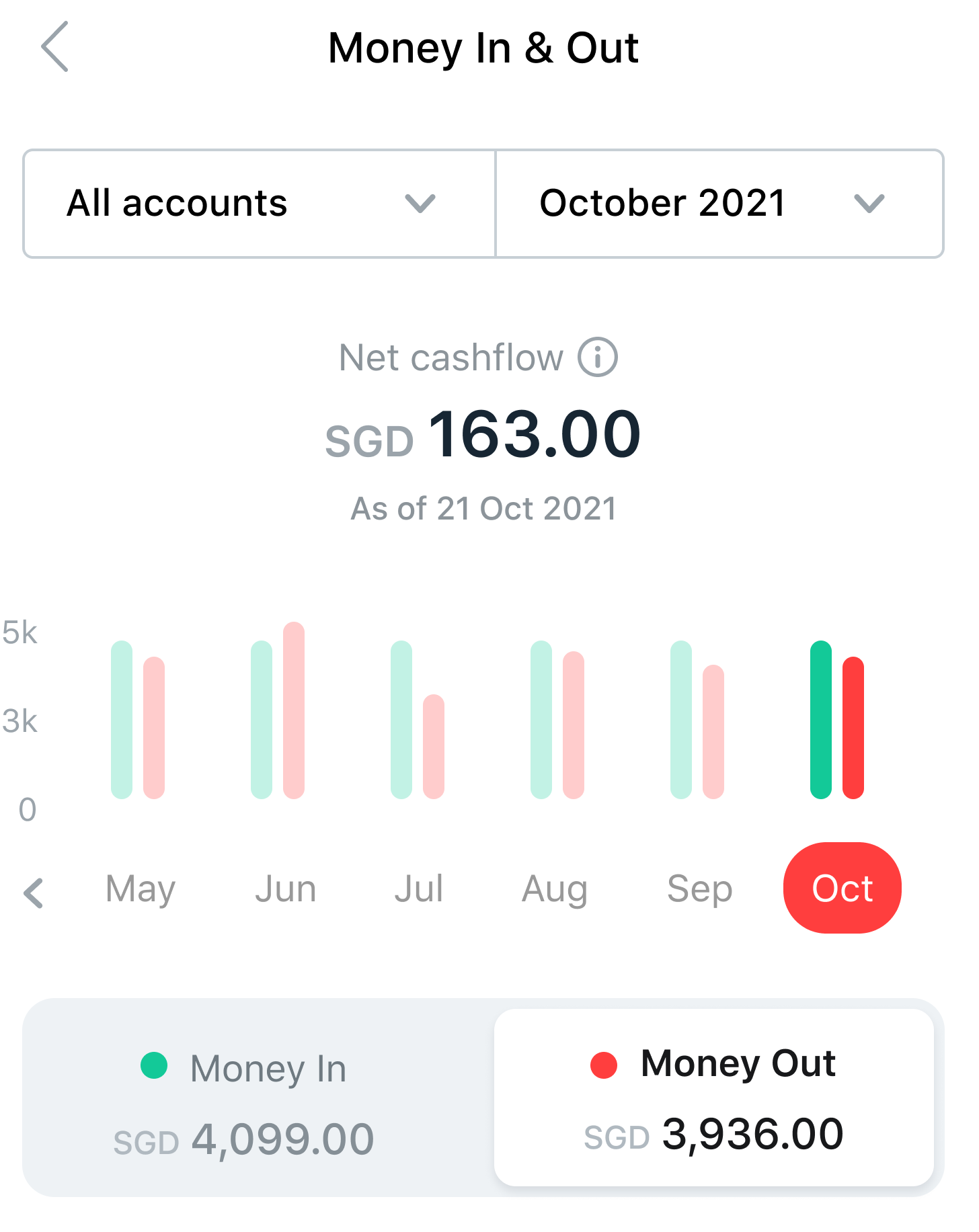

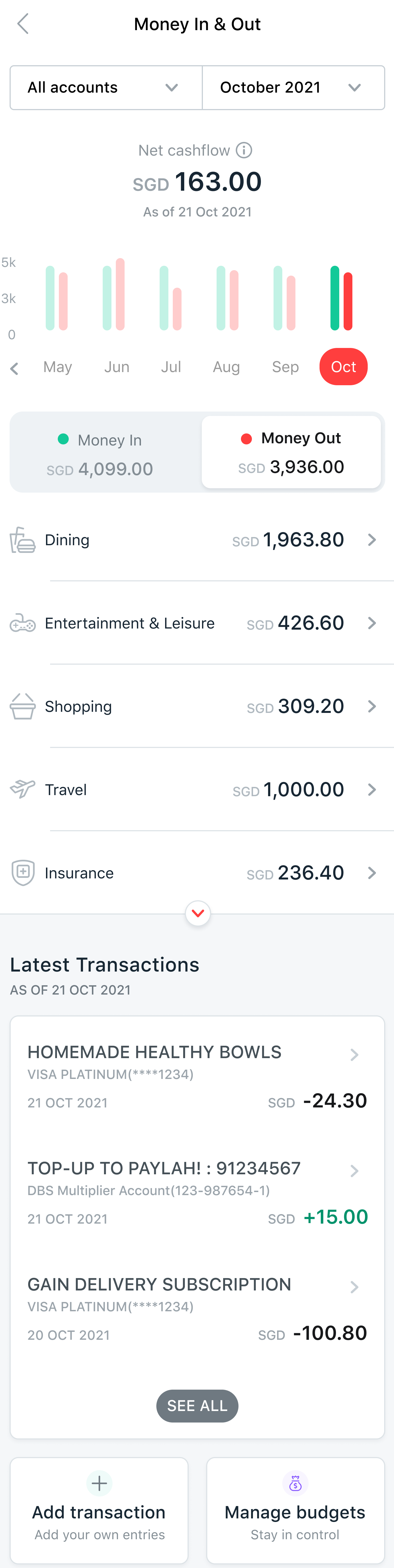

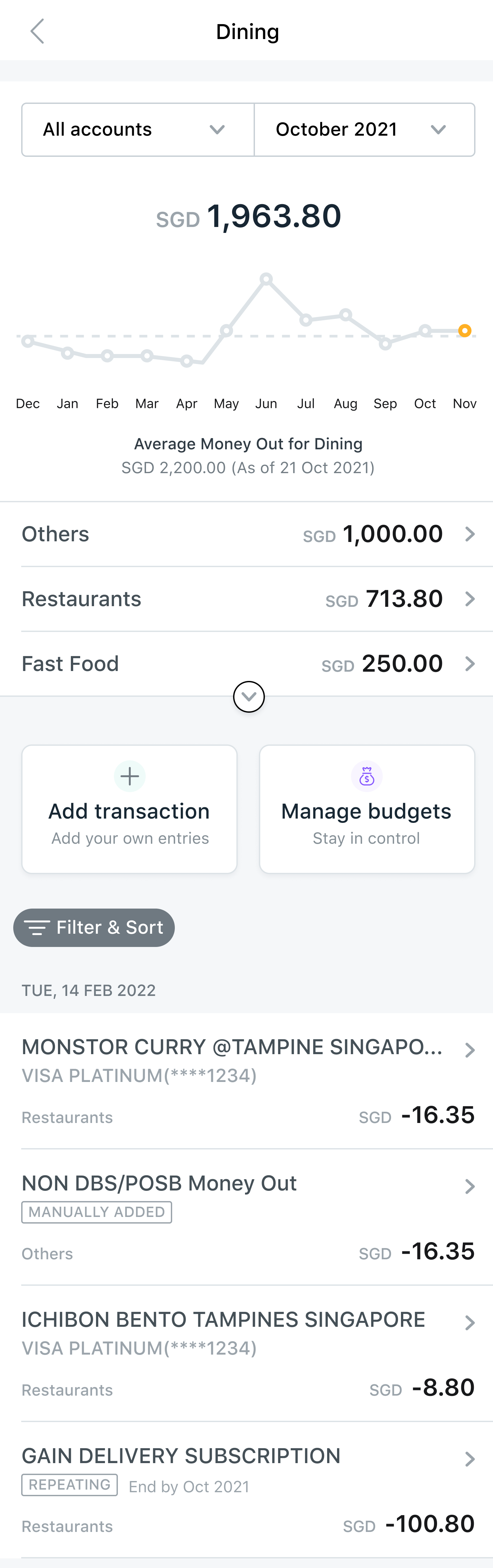

Are you spending within your means, or more than what you get? Here’s how you can skip the manual calculations and paperwork, and get a neat summary of your spending habits: from how much you’re spending, to what you’re spending on.

| STEP 1: Open digibank Log in to digibank and look for the Plan and Invest tab.

| STEP 2: Select “Money In/Out” Toggle between Money In/Money Out (MIMO) to find out your latest transactions. You will find that some transactions have already been categorised for you for easier tracking.

|