Young Parents: Planning for finances in the now and future

![]()

If you’ve only got a minute:

- Raising a child is no easy feat, especially with all the newly minted parenthood responsibilities such as sleep deprivation and having to juggle between naps and feeding schedules.

- With the weight of a young family on our shoulders, it is vital to plan and prioritise our time and efforts to achieve the best outcome not only for our loved ones, but ourselves too.

- Keep your finances in check and on track while planning for your child’s milestones and for your retirement.

![]()

Having a child and starting a family is exciting and is likely one of the most rewarding things you will experience in your life. However, raising a child is no easy feat and costly to boot. For most new parents, focusing on the big picture can often be challenging, especially with all the newly minted parenthood responsibilities such as sleep deprivation and having to juggle between naps and feeding schedules.

With the weight of a young family on our shoulders, it is vital to plan and prioritise our time and efforts to achieve the best outcome for our loved ones. More importantly, with milestones on the horizon, it is important to prepare for them while keeping finances in check and on track.

Here are 5 tips to enhance your finances.

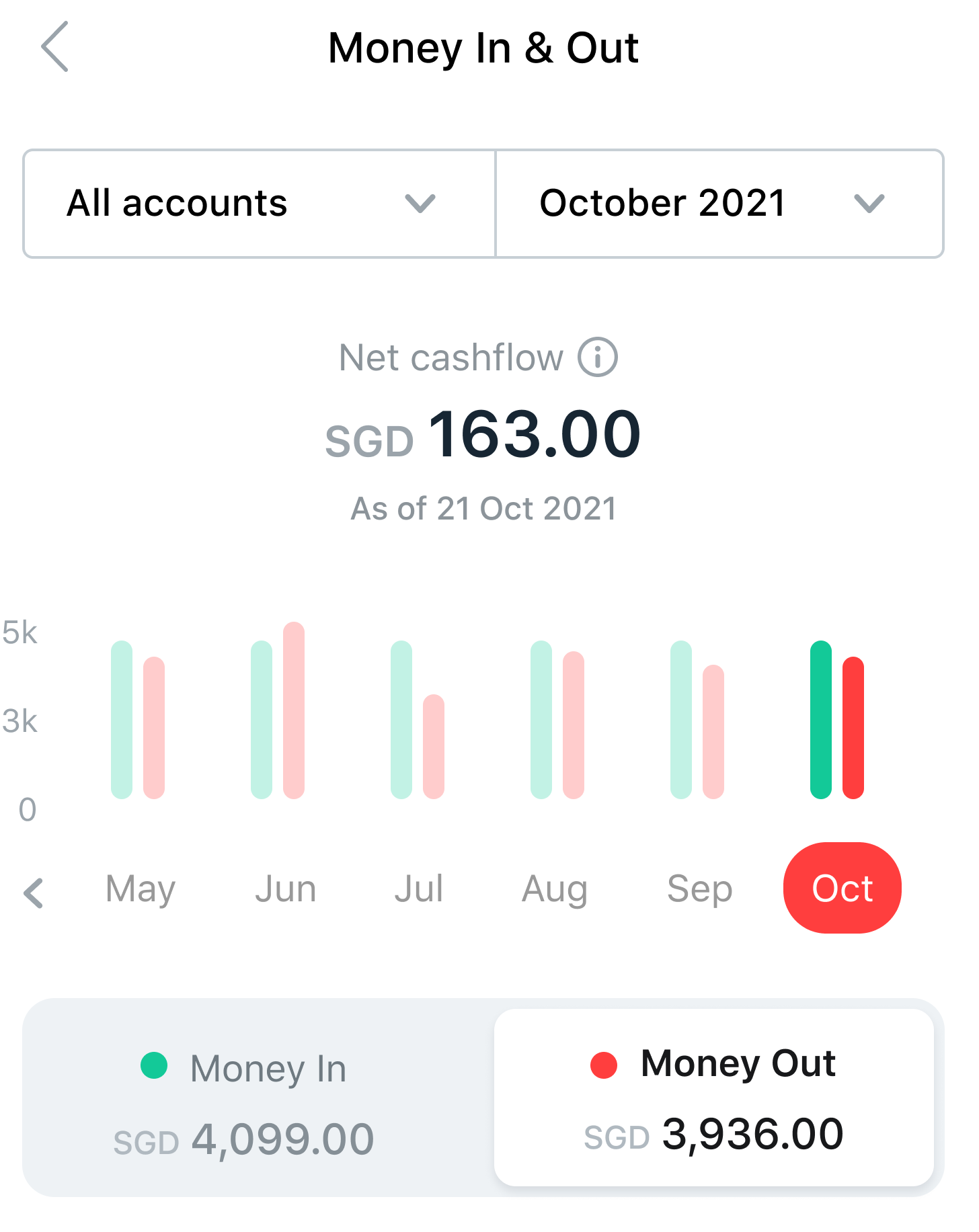

1. Get a good overview to stay afloat each month

The simple rule of staying afloat: Your Money Out (i.e. transport, investments such as a Regular Savings Plan, transfer-outs, food, credit card payment, bills, insurance, etc) cannot be more than your Money In (i.e. salary, dividends, interest, transfer-ins).

You will eventually end up in deficit if your total money out continuously exceeds your money in. This scenario will often lead to undesirable consequences such as a depletion of your hard-earned savings or your child’s education fund, over time. Therefore, it is crucial to note the things you shouldn’t be touching: A rainy day/emergency fund, your child’s education fund, and your retirement nest-egg.

Advanced digital tools like the DBS digibank comes with a Money In & Out (MIMO) feature, which helps you keep track of money flows conveniently.

2. Scrutinise and cut unnecessary expenses

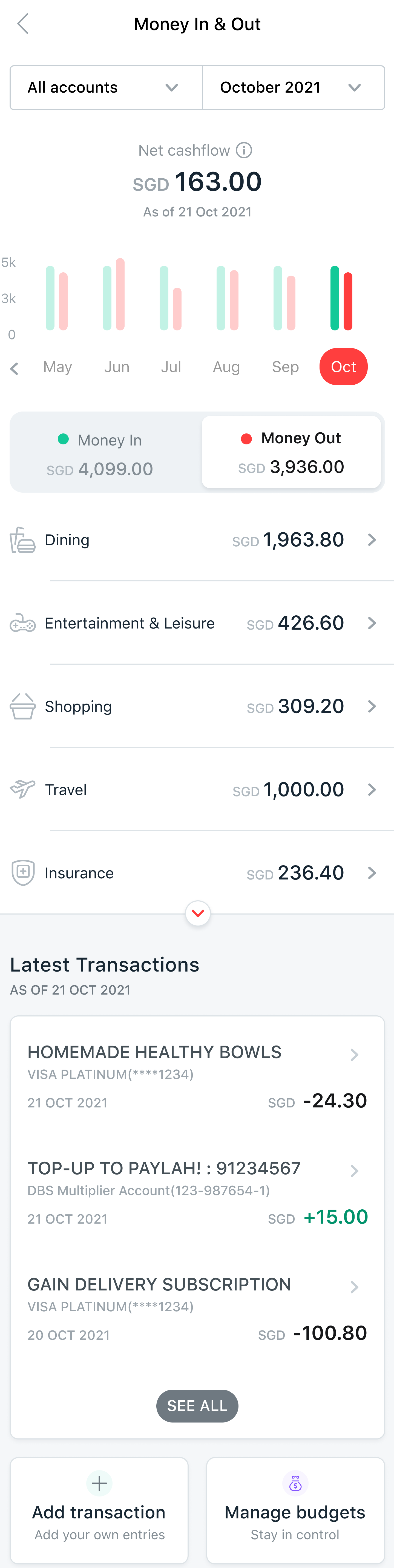

Another feature of MIMO within digibank is that you can see how your money is spent in broad categories such as dining, bills, utilities, taxes, and transport, and if you are spending beyond your budget.

You can also check on your financial ins and outs for the past 6 months to better understand your spending patterns.

Especially for busy parents, once you’re able to zoom in and assess how much you are spending and on which categories, it’s easier to plan/streamline expenses to balance your MIMO. Some areas of concern and possible solutions include:

- Spending too much on private transportation — try to leave the house earlier or minimise your responsibilities/appointments

- Dining out too much/ too dependent on food delivery — with some careful planning or by cooking your own meals, it’s possible to shrink your family’s food budget

Why set a budget?

By setting a budget, you’ll be able to achieve a positive MIMO each month, building up savings for your emergency fund, financial goals, and future planning such as protection (medical bills can be sky-high!) and investments to grow your money. This is something that simply living from paycheck to paycheck will not achieve.

Once you can generate a positive balance every month (more money in than money out), you can then start to channel the amount into protection and investments to achieve your short, mid and long-term goals.

3. Do you have enough emergency savings?

Money meant for your emergency fund is not simply savings — it’s not the money you’re saving up for your holiday, not the cash you’re stashing away for your next big-ticket purchase, and definitely not the money you’re keeping for your home renovation/ child’s education/ retirement.

Neither is an emergency fund the cash value of your endowment fund, nor is it the total amount of your entire investment portfolio right now. That cash is illiquid, which means you cannot access it ASAP in times of urgent need.

An emergency fund is, simply put, cold hard cash that you need for a rainy day, or when something unplanned yet urgent crops up.

Here are some scenarios:

- You’re suddenly retrenched, your emergency fund will help tide your family through while you find a new job

- You’re suddenly stricken with an illness or meet with an accident and unable to work. This emergency fund will see your family through

- Someone in your family urgently needs cash, for example to pay medical bills, fix something in the home, to send to your child who is studying overseas

This brings us to the next part - How much emergency savings should you have?

To form your emergency fund, you need to set aside 3 to 6 months’ worth of monthly expenses. For example, if you spend $1,500 a month, you’ll need to set aside $4,500 to $9,000 (we recommend at least 3 months). If you’re a gig economy worker or freelancer, it’d be prudent to allocate 12 months’ worth of monthly expenses as your emergency fund.

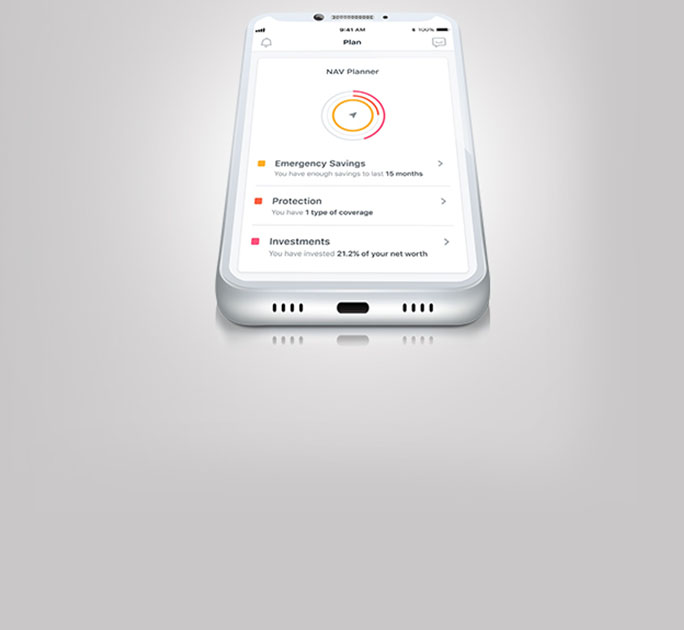

Instead of fiddling with your calculator or trying to recall your monthly household spend, simply login to your digibank - now supercharged by SGFinDex. Click on the “Plan” tab for an accurate view of your emergency savings by incorporating the cash deposits that you have with other banks.

After accumulating enough for your emergency fund, you may consider the use of investments to grow your surplus savings (in excess of 3 to 6 months of emergency cash) to enhance your financial wellness. However, do note that investing always carries some risk (even if you have a hearty risk appetite). Do your due diligence and make informed choices.

Not only does digibank offer a great summary of your emergency savings progress (via your MIMO patterns), it can project how long your emergency fund can last or alert you if it’s insufficient for your needs by spotting gaps while planning for both your child and your retirement.

For the fixed income portion of your portfolio, one product you can explore is the Singapore saving bonds which offers risk-free guaranteed coupon payouts twice a year. Another option is the regular savings plan Invest-Saver, which adopts the dollar-cost averaging approach, from just $100/month. It is also hassle-free as you can set it up to automatically transfer funds every month.

4. Preparing for your child’s milestones and your retirement

Once you’ve gotten your day-to-day finances sorted, it’s time to plan ahead and be financially prepared for your child’s milestones and your future.

For your child, you may consider using an endowment plan that focuses on providing a lumpsum cash benefit when your child starts tertiary education, or a combination of insurance and investments into securities like unit trusts.

As parents, we look forward to a future where our kids become adults and have children of their own. Retiring gives us the luxury to slow down and spend more precious family time with our loved ones and individual pursuits.

But do you have enough for this desired retirement lifestyle?

With digibank, enjoy the flexibility of reviewing your financial details on-the-go for an instantly updated cashflow projection during your golden years.

Taking all your assets and spending habits into consideration, the tool is able to provide clarity on your finances 10, 20, 30 or even 40 years ahead. By projecting them and identifying the shortfalls early, you will have time to close the gaps and work towards a comfortable retirement by actively making smart changes to your finances (save more, spend less, get protection, invest more).

Furthermore, digibank allows you to set money goals for various milestones at various life stages, such as your kid(s)’ education. With each goal, the tool shows how it impacts your future cashflows and how far or close you are in your quest for financial freedom.

5. Don’t neglect protection – check your insurance coverage

In addition to helping you budget and grow your money, you can also use the app to check on your insurance coverage! While insurance provides protection for unfortunate events such as accidents and illness, adequate coverage can really help to offset big medical bills. Particularly for parents of young kids, it would be a nightmare if there’s not enough financial support to take care of their needs — present and future.

All in all

Consolidate all your financial information in one place and view them at a glance with digibank. Skip multiple logins to other financial accounts and simply access everything in one place easily and securely. Tracking your finances has never been easier!

your finances with NAV Planner today

Alternatively, speak to a Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Tell us if this article helps you plan and achieve your financial goals

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add?

We're sorry to hear that. How can we do better?