Beginner’s guide to stock investing

![]()

If you've only got a minute:

- Investing is one of the ways you can ensure the value of your money is not eroded by inflation.

- Before making any investment decisions, take the time to understand your investment objectives, goals, and risk tolerance and ensure they are aligned with your investment options.

- If you do not want to stock pick, you can opt for diversified options like ETFs, unit trusts, or robo-advisors.

![]()

You probably know how inflation works – that plate of mixed rice and cup of kopi-peng is taking more out of your wallet today than it did just a few years ago. In other words, the spending power of $1 decreases over time.

With that in mind, DBS research report Are you losing the race against inflation? has indicated that Singapore’s headline consumer price index (CPI) and core inflation rate in June 2022 has reached levels not seen since the Global Financial Crisis. The report also showed that income is not keeping up with inflation for 40% of our 1.2 million retail customers.

It comes as no surprise then, that people should be and are looking to alternative ways to grow their money while they save. There are a number of ways you can do this including via higher interest savings accounts like DBS Multiplier, fixed deposits, Singapore Savings Bonds and investing in stocks, among others.

In the long run, investing in bonds and stocks tends to outperform leaving cash in the bank, even in higher savings interest accounts and fixed deposits. Therefore, it is important to consider a range of investment options to grow your savings and prevent inflation from eroding the purchasing power.

Before you invest, do set aside sufficient cash savings for emergencies, and pare down any high interest-bearing debts. If you are a salaried employee, you should set aside emergency savings of 3 to 6 months of expenses but if you have dependants and/or are a gig-economy worker, it is recommended that you set aside 12 months.

Investments come with their own set of risks and investing monies you might require in an emergency can lead to irrational investment decisions.

Here are four considerations before embarking on your investment journey!

1. Identify suitable investment platforms

You can start by opening an account with a platform that allows you to trade investment products. Examples include an account with a financial institution that allows you to set up a regular savings plan, make lump-sum investments in unit trusts and invest through robo-advisory platforms. DBS customers can access these services though DBS digibank.

For investors who prefer to purchase individual stocks, bonds and/or purchase exchange-traded funds from financial markets globally, you’ll need to open an online brokerage account with a broker like DBS Vickers.

Your brokerage account allows you to execute your buy or sell orders and would typically also offer you a range of related services, including:

- Letting you execute and settle your trades with ease.

- Providing investment research content to help you with your investment decisions.

- Margin financing facilities to boost your investment power.

- Custodising of your Singapore-listed shares if you are not using the Central Depository (CDP).

When choosing a brokerage account, it is important to look out for one that suits your needs as each might have slightly different services, terminology, fee schedules and interfaces.

Here are some considerations in choosing an investment platform:

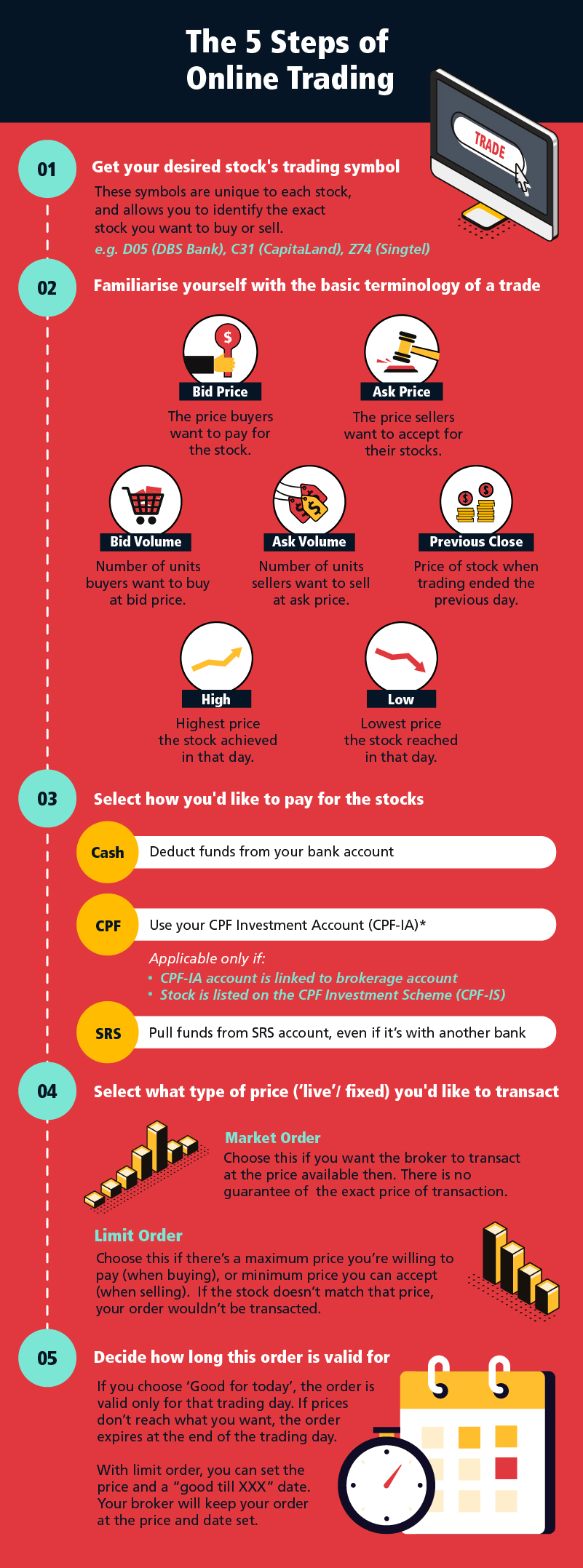

Now that you have a better idea of what to look out for when choosing an ideal online brokage account, you should be familiar with common terms you’ll come across when placing a trade.

Here are 5 steps to online trading that you’ll find useful!

If you’d like to learn more about how you can trade on the DBS Vickers platform, you’ll find this this video and user guide helpful too!

2. Understand your investment objectives

Most investors will say that their end goal is "to make money". This obvious end goal aside, what is more important is to ask yourself some of these key questions:

- Are you investing to make money gradually, or quickly?

- How much risk are you willing to take on?

- Are dividend payouts or capital growth more important to you at your current life stage?

Your answers to these questions will not only form the basis of what investment strategy to adopt but is likely to separate you into 1 of the 2 board types of individual market participants – traders and long-term investors.

Traders

Traders seek to maximise profit through buying and selling frequently as the market moves, with the goal of buying at a low and selling at a high. Traders must understand the skills, resources and limitations involved. This is risky as catching market movements at the best moment is a near impossible feat, even for professionals.

Successful traders are often very attuned to what going on in financial markets and are disciplined.

The investor

Investors tends to think long-term, preferring to take a slow and steady approach to portfolio growth, bearing in mind that history is on the side of those who wait. These individuals understand that in general, markets go through cycles of ups and downs. Investors aim to buy good stocks at reasonable prices and ride through these cycles.

Furthermore, investors understand the importance of risk profiling, setting investment goals and time horizons, by undertaking thorough research to gain knowledge on the investments they are considering making.

Regardless of whether you view yourself as more of a trader or an investor, it is important to take note of some common mistakes made by others so you are better placed to avoid them.

3. Build your watchlist

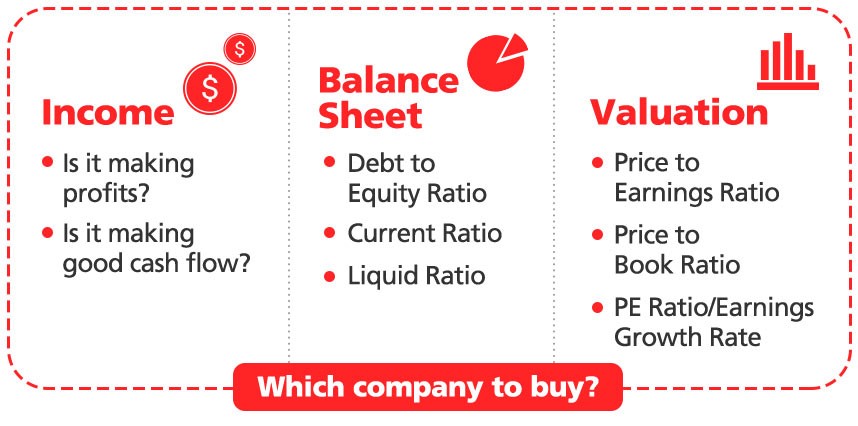

A watchlist is a useful starting point to research the stocks you are considering. It provides a summary of a company’s balance sheet, and allows you to analyse it easily. While considering which stocks to pick, you can also take note of some common investment metrics and financial ratios that investors use to evaluate stocks. In using these metrics and ratios, you are said to be conducting “fundamental analysis” on the stock.

- Search for the name of the stock you are considering. The system will give you a stock code

- Click on that code and the stock will appear on your watchlist.

- Customise the fields on your watchlist to include information you want (or don’t want). Investors typically use dividend yield, EPS (earnings per share) and P/E (price to earnings) ratio.

- You can also check the bid and ask prices, and high and low prices for the day.

4. It’s go time!

You’ve read through the articles, you’ve thought through the questions, and you’ve done your research. What’s next?

As the proverb by Lao Tzu says: “The journey of a thousand miles begins with a single step.” It is time to take that step and start on the exciting investment journey ahead!

If you are still unsure about what to invest into specifically, below are some options that might simplify things for you while providing ample diversification.

- ETFs: These attempt to mirror a specific market index (e.g. S&P 500), sector or even commodity.

- Unit trusts: These are often diversified investment products that are managed by an asset management company.

- Invest-Saver: Invest regularly into ETFs without timing the market taking advantage of the benefits of dollar-cost averaging.

- Robo-advisors: Ready-made portfolios put together for you with the help of our team of experts and powered by technology, in line with DBS Chief Investment Office’s views.

In Summary

When it comes to investing for beginners, your options are plenty. But before you start, it is crucial to have a good understanding of your own goals and objectives as well as the type of investments that are available and suited to your needs and risk tolerance.

Don’t forget to be patient with yourself. Take the time to learn more about how to invest better from trusted sources especially if you are unsure, and most importantly, take the first step!

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)