Investing in Singapore Savings Bonds

![]()

If you’ve only got a minute:

- Singapore Savings Bonds (SSBs) are risk-free and flexible investments issued and backed by the Singapore government that offer step-up interest.

- For as little as S$500, you can invest in SSBs for up to 10 years and enjoy the flexibility to exit the investment anytime without any capital loss and penalty.

- SSBs are an accessible way to diversify your investment portfolio, by providing a stable source of income through half-yearly payouts.

![]()

With rising interest rates and an inflationary environment being top concerns in 2022, it isn’t surprising that more Singaporeans are paying attention to Singapore Savings Bonds (SSBs).

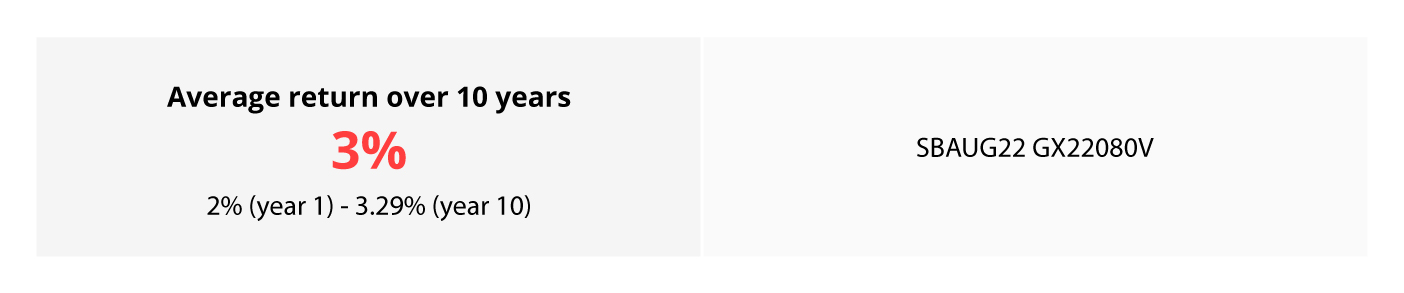

The August 2022 tranche, which offered a 10-year average return of 3% per annum (p.a.), is the highest yield recorded since SSBs were launched by the Monetary Authority of Singapore in late-2015.

Applications for the August tranche 2022 exceeded the issuance amount of S$700 million and was oversubscribed by more than three times. This bettered the July tranche, which offered a 10-year average return of 2.71% p.a., and was also oversubscribed.

This demand for SSBs partly reflects the “flight to safety” attitude of consumers amid recent volatility. The latest DBS research report “Are you losing the race against inflation?”has indicated that there was a shift in investments towards bonds in May 2022 compared to a year ago, across all generations and income groups, with bonds making up 37% of total investments, up from 2% in the previous year.

The rising yields for SSBs has generated quite a buzz, given that it is a risk-free and flexible investment at a time when the general markets remain volatile. Furthermore, it serves as an indicator that in the current market environment, investors continue to look for safe, liquid investments with decent returns.

If you’re keen to invest in SSBs, but are not sure where to start, here’s a primer for you to have a better understanding of these bonds and their unique features.

What are SSBs?

They are bonds that are issued and backed by the Singapore Government, one of the very few administrations with a AAA credit rating. What this means for investors is that securities issued by the Singapore government are among the safest investment offerings as they have a high degree of creditworthiness and a very low risk of default.

One of the features of SSBs is that bondholders are guaranteed to receive their full principal back in any month, without any capital loss or penalty. All they will be charged is an administrative fee of S$2.

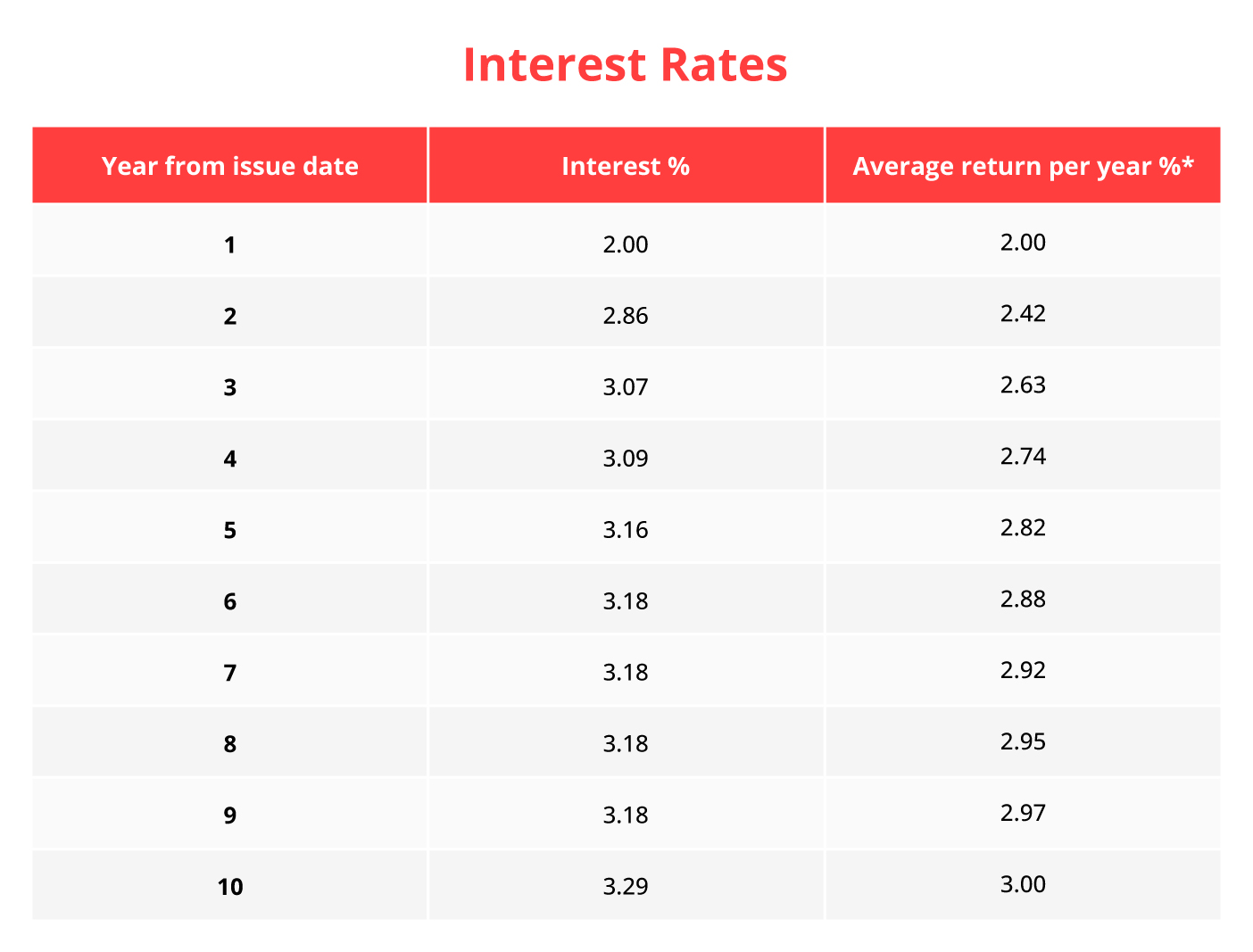

New tranches of SSBs are offered every month at a 10-year tenure. The table below illustrates the yearly interest rates for the August 2022 tranche and its average returns over the 10-year period.

The SSB is also a long-term bond that offers step-up interest. In other words, the longer you save, the higher the rate of your return!

As SSBs feature a step-up interest function, interest payments to bondholders increases over time. For the August tranche, payouts will be at a coupon rate of 2% p.a. in Year 1, followed by 2.86% p.a. in Year 2 and 3.07% p.a. in Year 3. It steps up to 3.29% p.a. in Year 10. If you hold it until maturity in August 2032, the average return over 10 years will be 3% p.a.

The average 10-year rate of returns for SSBs has been on a steady increase in recent months too. Here is a breakdown of the returns of the past 10 tranches.

If you decide to exit the investment before the 10-year period, you will receive a lower average return per year. The easiest way to calculate your projected returns from investing in an SSB is to use the MAS calculator. You will also be able to check how your returns vary with early redemptions.

A summary, SSBs boast the following features:

- Risk-free investment backed by Government of Singapore.

- Interest rate of SSBs is pegged to Singapore Government Securities and is presently higher compared to fixed deposit rates.

- Flexible withdrawals can be made anytime without penalty.

- Low starting investment amount required starting from S$500, capped at S$200,000.

- Step-up interest (the longer you save, the higher your return until Year 10).

- Non-transferable (cannot be traded or pledged as collateral).

Pros of SSBs

Risk free

Backed by the Singapore government, SSBs offer peace of mind with virtually no risk of capital loss.

Accessible to all investors

Since you can start investing with as little as S$500, it gives you the freedom to decide how much you are willing to set aside without taking away a big portion of your savings or disposable income.

Moreover, SSBs are a great investment option for all investor types - beginners, conservative and seasoned investors - who are looking for opportunities to earn higher interest rather than leaving their money idle in a savings account.

Flexible & liquid

With investment products like fixed deposits and endowment plans, there is usually a lock-in period and premature withdrawal charges.

Being able to redeem SSBs within a month without a penalty makes them ideal for conservative investors or retirees who prefer flexibility and liquidity should the need to utilise emergency cash arises.

Regular interest payments

With interest paid every half yearly, those who enjoy receiving passive income can receive regular payouts. The best part is that you get to keep the interest that has been paid out at six-monthly intervals before you redeem the bond early (a win-win situation!).

Portfolio diversifier

When global stock markets are volatile and equities are underperforming, investors may want to consider lower risk investment classes and fixed-income assets to diversify their portfolio and receive stable returns.

SSBs serve as a great tool to hedge against volatility and risks associated with stocks by locking in long-term guaranteed and decent yields. As such, there is a place for SSBs in an investment portfolio.

Cons of SSBs

Low returns compared to other investments

SSBs may offer better interest payment compared to your savings account but pale in comparison to other investments that come with higher risks. Furthermore, if you are young and have a longer investment horizon, you may be better off with investments that allow you to compound the returns for higher yields in the long run.

It is worth your while to seek professional advice on your optimal asset allocation to decide on how much to apportion to SSBs and other investments to achieve your financial objectives.

To do so, you need to gauge your risk appetite and tolerance, investment time horizon, financial goals and personal circumstances in order to make sound investment decisions.

Limit on how much you can invest in SSBs

You can only invest a maximum of S$200,000 in SSBs at any one time. This means that you are unlikely to be able to rely solely on SSBs and would need to invest in other instruments.

How to purchase SSBs

Individuals aged 18 and above – including Singapore Permanent Residents and foreigners, are eligible to buy SSBs either using cash or Supplementary Retirement Scheme (SRS) savings.

For cash applications, you’d need a Bank account with a local bank (DBS/POSB, UOB or OCBC) and an individual Central Depository (CDP) securities account, with Direct Crediting Service activated to allow interest payments from your SSB to be credited directly into your bank account. Once fulfilled, SSB applications can be done via the ATM or internet banking.

For SRS applications, you can open an SRS account (if you don’t already have one) with one of the three SRS operators (DBS/POSB, OCBC, UOB) and then apply through the internet banking portal of your selected SRS operator.

Successful applicants will either be notified by the CDP by mail or by the SRS operator on the 3rd last business day of the month. Do note that a S$2 (non-refundable) transaction fee is applicable for any one transaction.

Alternatives to SSBs

Apart from SSBs, there are a number of other long-term investment products you can consider. These includes fixed deposits (FDs), higher interest earning savings accounts like DBS Multiplier and endowment plans.

Fixed deposits

SSBs and FDs are generally very similar as they are both low risk in nature and involve socking away a fixed amount of cash for a specific timeframe. They do however share some key differences.

Fixed deposits usually offer lower interest but have a shorter lock-in period (up to 36 months vs. SSBs’ 10-year tenure). FDs allow for immediate withdrawals while SSB withdrawals may take up to a month, which could be a hassle if you need cash urgently. Also, premature FD withdrawals typically incurs a fee and may result in ineligibility for any accrued interest.

SSBs are however highly flexible and can be redeemed anytime with no penalty. Furthermore, higher FD rates are usually pegged to a higher placement amount (in most cases, minimally from S$10,000). Unless you have spare cash and can set aside a bigger portion of your savings for a while, SSBs would seem more viable since it has a low entry point of S$500.

Lastly, there is no cap on how much you can invest in FDs unlike the S$200,000 ceiling with SSBs.

High interest savings accounts

Higher interest savings accounts are highly liquid and have no lock-in period at all. Bonus interest can be earned when eligibility criteria are met (by means of salary crediting, credit card spend, mortgage, investments, etc).

However, the effective interest earned is still typically lower than SSBs and FDs and mostly subjected to a cap on the amount applicable.

Endowment plans

Last of all, endowment plans can also be considered for specific savings goals like children’s education. Do note that they are highly illiquid and early policy surrenders usually result in reducing your principal amount.

In comparison, SSBs may seem like a safety net since the principal is guaranteed. There is no one-size-fits-all when it comes to choosing which financial instruments to invest in. At the end of the day, it depends on your risk tolerance, desired tenure, preference for flexibility and liquidity, and most importantly, what is a reasonable investible amount for you to meet your financial goals and needs.

![]()

This is the third article of our series on fixed-income investments. If you’re keen to learn more about this asset class as well as how you can invest in them, check out the other articles:

Part 1: A beginner’s guide to bonds

Part 2: 8 things to know before buying bonds

Part 4: Investing in Singapore Government Securities other than SSBs

Part 5: Investing in T-bills

![]()

Ready to start?

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on digibank to receive specific investment picks based on your objectives, risk profile and preferences.

Invest with DBS Invest with POSB

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)