Storing cryptocurrency safely

By Navin Sregantan

![]()

If you’ve only got a minute:

- With investing in cryptocurrencies growing more popular, the risk of loss of cryptocurrency to hacks or simple mismanagement has never been higher.

- Cryptocurrencies are stored in purpose-made digital wallets. You can either store your cryptocurrency in a custodial wallet or in a non-custodial cryptocurrency wallet.

- Non-custodial wallets offer more control and reduced third party risk, while custodial wallets reduce the risk of loss of cryptocurrencies through mismanagement.

- Custodial and non-custodial wallets can either be hot or cold wallets, or a mixture of both. Hot wallets are web-based and offer greater convenience, while cold wallets are offline and provide more security against hackers.

During the Covid-19 pandemic in 2020, cryptocurrencies entered mainstream conversation as an investment option. Today, cryptocurrencies continue to draw immense interest from both retail and institutional investors despite the high levels of price volatility.

Before embarking on your journey to invest in this growing alternative asset class, an important consideration is deciding how to store your crypto holdings.

But before we go into that, here is quick refresher on cryptocurrencies.

What is cryptocurrency?

For most retail investors, cryptocurrencies can be a daunting topic, mainly due to a lack of understanding of the complexity of the technology that powers the entire crypto ecosystem.

Cryptocurrencies are digital assets that function as a means of exchange, much like fiat currency (i.e government issued currency such as the USD or SGD) but they are not issued by a government. The 2 largest cryptocurrencies by market capitalisation are Bitcoin (BTC) and Ethereum (ETH).

Unlike cash in your wallet, you cannot physically carry cryptocurrencies. They are enabled by blockchain technology - a distributed ledger enforced by a decentralised network of computers all over the world, which records economic transactions, balances and account numbers.

Blockchain technology ensures that data is not replicated or copied, thus ensuring that units of cryptocurrency cannot be reproduced.

The decentralised nature of the blockchain also means that it can exist outside the control of a government. In other words, with cryptocurrencies, there is no central authority, and it is not dependent on the solvency of a government.

As with all investments, it is crucial that you do your own due diligence and understand your risk appetite before considering investing in cryptocurrencies.

Beginner’s guide to cryptocurrency

How is cryptocurrency stored?

In the decentralised world of cryptocurrency, there is no central authority. As it is based on blockchain technology, cryptocurrency involves financial account databases that are shared across a network and spread over various geographical locations.

This also means that if you forget your crypto wallet login details, your cryptocurrency might be lost for good. Blockchain analysis firm Chainalysis estimates that about 3.7 million Bitcoins have been lost by owners. That is nearly 20% of the 18.9 million Bitcoins in circulation.

Crypto crime is also another threat that cannot be ignored. According to the Chainalysis 2022 Crypto Crime Report, in 2021, US$3.2 billion in cryptocurrency was stolen from individuals and services — almost 6 times the amount stolen in 2020.

That is why one of the most important things when investing in cryptocurrency is how to store it. The right storage option can help to reduce risk of loss of crypto to theft or simple mismanagement of keys/login details.

There are various storage options available, from hardware devices and applications to sheets of paper. To find out which option is suitable for you, understand the pros and cons.

Step 1: Buying cryptocurrency

Before you think about cryptocurrency storage, you’ll first need to obtain some crypto.

When buying from a centralised cryptocurrency exchange (e.g. Coinbase, Gemini etc.) your crypto would be stored at the exchange by default. This is known as a custodial wallet (we’ll get into that shortly).

Step 2: Sending your cryptocurrency to your own non-custodial wallet

However, if you have your own non-custodial wallet, you can then send your crypto from the exchange’s custodial wallet to this non-custodial wallet.

Your non-custodial wallet address should contain a public and private key. The public key acts as your personal address where others can send you cryptocurrencies. This can only be done if they know your public key.

Meanwhile, the private key is like the password to your bank account and something you should keep private. With it, you are able to access your cryptocurrencies and send funds to and from your account.

Note: When the term ‘storing cryptocurrencies’ is mentioned, it usually refers to the storage of private keys to access those cryptocurrencies. Your actual cryptocurrencies aren’t stored in your chosen wallet.

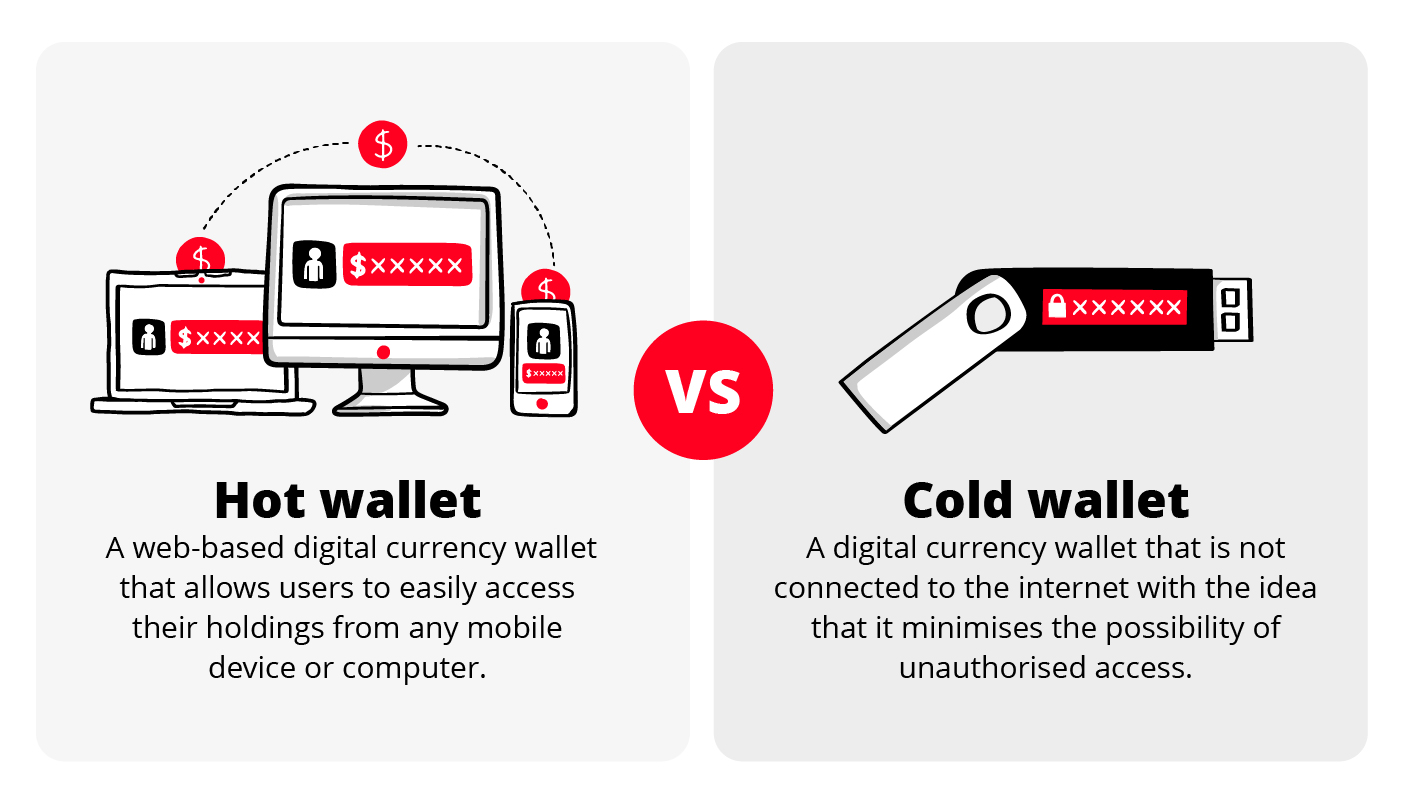

Hot wallets

A hot wallet is web-based digital currency wallet that allows users to easily access their holdings from any mobile device or computer.

This is the most commonly used cryptocurrency wallet, not only for the convenience it affords its users but also because most digital exchanges provide it for free too.

With an online wallet, your private keys are stored online. This makes it much easier to transfer your cryptocurrencies in and out of the wallet. Some of the leading hot wallet providers include Metamask and Coinbase Wallet. However, such wallets are more vulnerable to theft of cryptocurrencies via hacks.

Cold wallets

A cold wallet is a way to store cryptocurrencies offline. This means storing cryptocurrency on platforms that are not connected to the internet with the idea that it minimises the possibility of unauthorised access.

Paper wallets

When Bitcoin – the first ever cryptocurrency – was first created in 2009, paper wallets were the most popular option. As its name suggests, paper wallets are basically a piece of paper with your public key and private key.

A paper wallet is immune to online attacks and are also cheap and easy to create. But that’s where the benefits end.

Given that paper wallets are well… made of paper, they can be easily damaged. Accidental water damage or it being torn by accident could potentially result in a total loss of your funds. Moreover, the print might fade over time, ruining your printed keys. A paper wallet can be easily hijacked if you accidentally show your private key to others.

Due to the high risk of loss and damage, paper wallets are no longer recommended for use.

Hardware wallets

A hardware wallet is often a small plug-in device which is often mistaken for the trusty USB drive. However, they are quite different from USB drives (they cost more) as they are built solely for the purpose of sending and storing cryptocurrency safely and securely.

During a cryptocurrency transaction, you will be required to input your private key to verify that you are authorising the transaction. However, this might not be safe as it susceptible to keyloggers, which are computer programmes that hackers can use to record what you are typing.

This is where hardware wallets come into play as the private keys are stored directly within the device and you will never see it or need to type your private key.

Signing your transaction also requires you to physically press a button on your hardware wallet to confirm. This is why a hardware wallet is often seen as the safest option for keeping your cryptocurrencies.

That said, there are downsides to using hardware wallets. They are not cheap and if you are keeping a small amount of cryptocurrency, it might not be worth investing in a hardware wallet, especially if it costs more than the value of your cryptocurrencies.

Using hardware wallets might also be potentially difficult for beginners. It is also less convenient for day-to-day transactions.

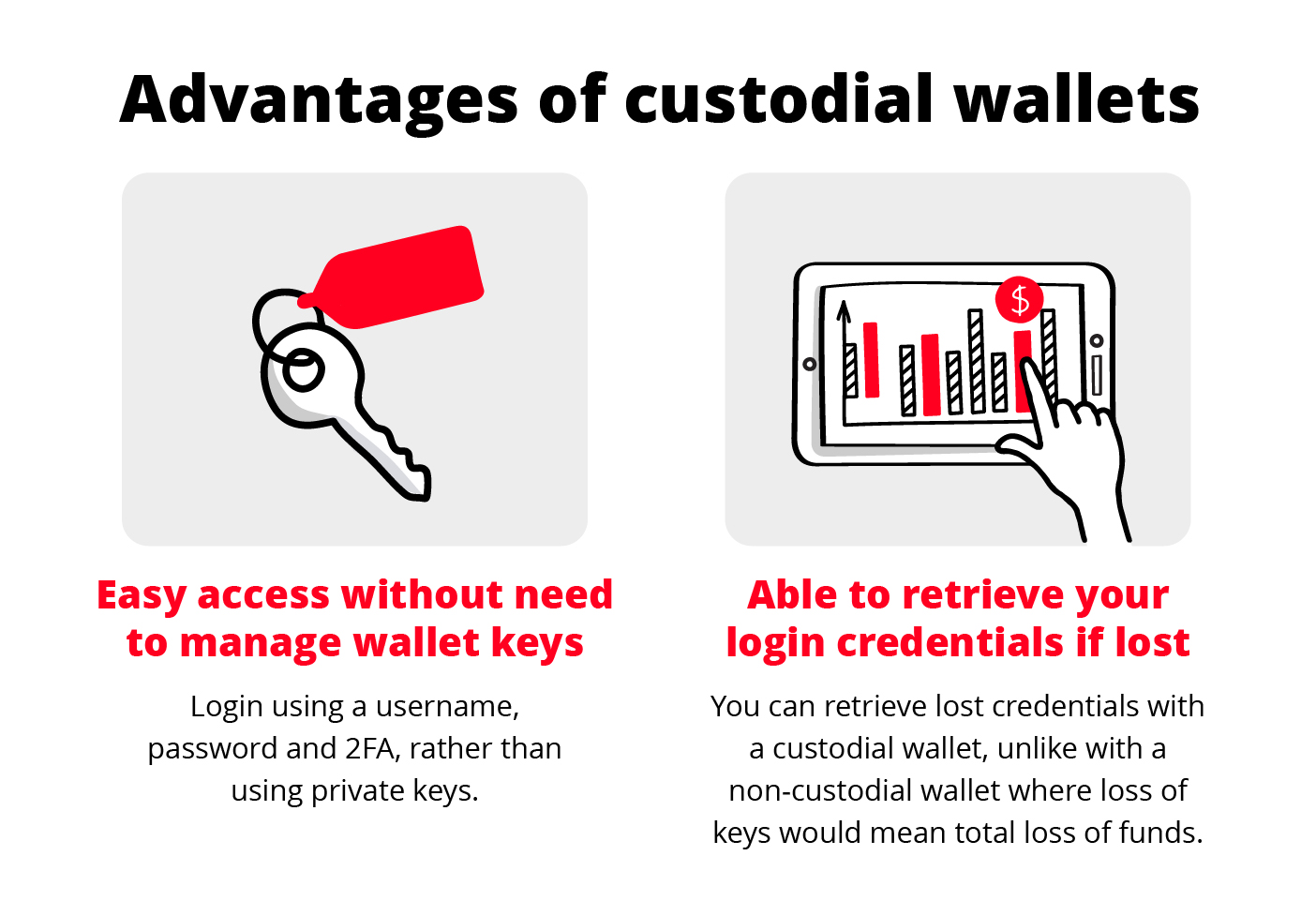

Storing cryptocurrency in a custodial wallet

However, you do not necessarily need to transfer your money to your own non-custodial wallet. Instead, you can continue to store your crypto with the centralised exchange where you bought it from.

Custodial wallets are wallet services offered by a cryptocurrency exchange, platform, or custodian.

Custodial wallets can utilise cold storage, hot storage, or a combination of the 2.

Most custodial wallets also give you the flexibility to transfer funds to your own hot or cold wallet.

However, when using a custodial wallet, you will need to trust the company running the platform because they are managing the private keys for your cryptocurrencies.

A trusted custodian company would have:

- Sufficient security measures in place

- Demonstrated good risk management

- Good financial standing minimising their risk of going bankrupt.

For instance, DBS Bank carries the highest ratings from the 3 biggest credit rating agencies: S&P, Moody’s, and Fitch.

When it comes to safety of your assets, you can go one step further and consider exchanges that hold your cryptocurrencies in segregated accounts. So, in the event that a digital exchange becomes insolvent, your holdings are ringfenced and you do not lose them.

How should I store my cryptocurrency?

While there isn’t a hard and fast rule about how you should store your cryptocurrency, a common practice is to consider having both a hot and a cold wallet.

A hot wallet can be used for your spending needs (when cryptocurrency becomes more common as a medium of exchange). A cold wallet like a hardware wallet can function like your bank account and be used to store the bulk of your cryptocurrency.

If convenience is a factor, consider using custodial wallets that have a good track record and a robust security infrastructure, as well as good financial standing.

Ready to start?

Speak to a Wealth Planning Manager today for a financial health check, and how you can better plan your finances.

Need help selecting an investment? Try ‘Make Your Money Work Harder’ on the Plan & Invest tab on the digibank app to receive specific investment picks based on your objectives, risk profile and preferences.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

All investments come with risks and you can lose money on your investment. Invest only if you understand and can monitor your investment. Diversify your investments and avoid investing a large portion of your money in a single product issuer.

Disclaimer for Investment and Life Insurance Products

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)