Refinancing vs Repricing: What to do with my home loan?

by Lynette Tan

![]()

If you’ve only got a minute:

- If your home loan is out of the lock-in period, you may want to look at repricing or refinancing your mortgage for interest savings.

- Other than comparing interest rates, you may want to factor in your cashflow situation, total fees involved and synergy with the bank’s products.

![]()

Singapore banks see refinancing applications up this year, since mortgage rates have started to fall from late 2024. With some analysts predicting rates to reach below 2% this year, homeowners are busy looking for their best home loan options.

Is it really such a clear-cut decision to opt for refinancing or repricing when your existing home loan is soon exiting its lock-in period? Are interest rates the only factor that you should be considering?

What key factors should you analyse in order to make a sound decision, and what options are available?

Consider these 2 factors

1. Tenure of the loan

Generally, the home loan tenure is inversely proportional to the monthly instalments payable. To put it simply, you’ll need to pay off your total home loan in X number of years:

- A shorter tenure = higher monthly instalments, but less overall interest paid

- A longer tenure = lower monthly instalments, but more overall interest paid

For some home-owners, they may choose to extend the tenure of the loan so that they can manage their monthly cashflows better.

2. Maximum age of the borrower

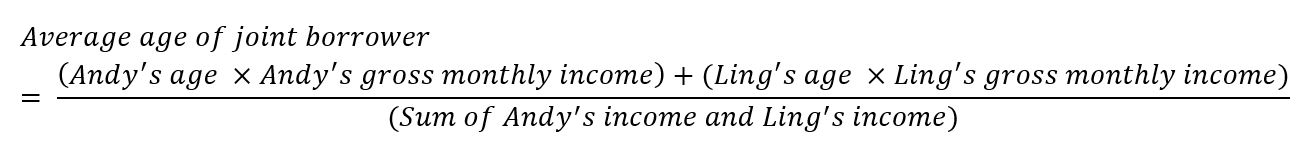

How much you can borrow (Loan-to-Value limit) also depends on your (the borrower’s) age. There will be a cap imposed on the amount you can borrow, if the loan tenure plus your age extends beyond 65. For joint borrowers, an average age is used. For a couple Andy and Ling, this would look like:

Adapted from: MAS Rules for New Housing Loans

Refinance or Reprice?

Most homeowners who are looking to refinance or reprice their mortgage are looking to reduce their monthly home loan repayments. Yet, there are some slight differences between the 2.

Repricing refers to switching to a new home loan package within the same bank while refinancing refers to closing your current home loan account and getting a new home loan with another bank.

When refinancing or repricing your home loan, there will be fees involved.

For example, when you refinance, you go to another bank and hence will need to pay legal/valuation fees of S$3,000 and above. When you reprice, you get a better rate with your current bank; but may need to pay a conversion/administrative fee that could be around S$800.

There may also be early redemption fees incurred if you exit your home loan during the lock-in period. Here’s a summary of the typical costs involved which would be useful to help you decide on refinancing or repricing.

Typical costs involved in refinancing or repricing a HDB flat

| Refinance | Reprice | Notes | |

|---|---|---|---|

| Legal & valuation fees | S$3,000 and above | N/A | Might be able to offset with cash rebates offered by the bank |

| Conversion or admin fee | N/A | About S$800 | Might be free of charge if your bank offers a free repricing option |

| Early Redemption Fees | Approximately 1.5% of your remaining loan | N/A | Incurred if you exit during your lock-in period |

Note: Fees stated are estimates based on HDB flats, and are not an extensive listing.

Those who choose to refinance with DBS/POSB can enjoy enhanced rewards - a S$2,000 cash reward and S$200 shopping voucher for loan amounts of at least S$300,000 for completed HDB flats. Refinancing of home loan for private property of at least $500,000 (completed private properties) earns you S$2,300 cash reward plus a S$550 shopping voucher. The minimum loan amount for all of DBS home loan packages is S$100,000.

Homeowners will need to compare the savings for both options – refinancing may offer cash rebates that can be used to offset the legal and valuation fees. On the other hand, your current bank may be offering repricing options which can give you higher savings, overall.

Another consideration is that when a home loan customer chooses to refinance instead of repricing, you will need to:

- Serve notice to the bank.

- Do a valuation for the property to be refinanced.

- Get lawyers to do the conveyancing for the refinance of the loan.

For repricing, the borrower would not need to go through the steps above.

Other factors to consider

- Look for synergy with the bank’s products

In addition to getting a home loan with a good interest rate, look for synergy with the bank’s other products — where existing customers can earn higher bonus interest on their savings account, benefit from preferential interest rates on other bank products, and so on.

If you already have a DBS Multiplier Account and currently credit your salary, spend with a DBS/POSB credit card, taking up a home loan with DBS/POSB will add yet another transaction category, which can potentially increase your bonus interest rate further.

(Find out how the couple could potentially earn additional bonus interest.)

Paying off your home loan with cash instead of using CPF monies?

If you’re thinking of using your surplus cash instead (after setting aside adequate emergency cash and insurance), the monies in your CPF Ordinary Account (OA) can be kept for retirement planning. After all, your CPF nest egg earns at least 2.5% annual interest, which is not to be sniffed at.

- Lock-in period

There are home loans with lock-in periods and some without (but these tend to have floating interest rates, or could be slightly higher). To refinance or reprice, do ensure your loan is out of the lock-in period so that you do not incur penalties.

If refinancing...

If you have plans to sell your property after the minimum occupancy period is up, you might not want a home loan with a long lock-in period to avoid incurring a penalty when you redeem their home loan (i.e. when they sell their house).

If repricing...

The lock-in period may be a little more flexible for existing bank home loan customers, depending on their contract. Borrowers will also be able to lock in the lower rates faster, as repricing generally takes 1 month to process compared to 2 months if you refinance your home loan with another bank or mortgage lender.

For DBS home loan customers, there could be 2 general scenarios:

- Repricing packages for accounts that are already out of lock-in or will be out of lock-in in 3 months’ time

- Repricing packages for accounts with free conversion feature — these are designed for customers whose DBS home loan accounts are eligible for free conversion during the lock-in period

- To fix or to float?

While you might have decided on the 2 options, you might still be stumped by the timeless dilemma — fixed or floating rates? Which might be more viable or suitable for them? Get more answers from this article.

Ultimately, how much can you save?

Andy and Ling took out a S$500,000 home loan with Bank A for 25 years at 4.25% p.a. (fixed) and a lock-in period of 3 years. Now that they are soon exiting lock-in, they are thinking if they should reprice with Bank A or refinance with Bank B.

Although Bank A and B are offering the same rates, after deducting fees, you might be saving more by repricing. Of course, there are other considerations such as subsidies, processing times, synergy with other bank products, possible penalties payable and interest rates after the lock-in period that could turn the tables in favour of refinancing.

Check your detailed mortgage payable with DBS/POSB’s repayment schedule calculator, to ascertain whether it makes sense for you to refinance or reprice.

S$500,000 Home Loan

|

|||

| Current loan with Bank A (20 years) | Reprice with Bank A (20 Years) | Refinance with Bank B (20 Years) | |

|---|---|---|---|

| Interest rates (For illustration only, check with us on the latest rates) | 4.25% | 3.5% | 3.5% |

| Total interest payable | S$243,080 | S$195,952 | S$195,952 |

| Potential savings | S$47,128 | S$47,128 | |

| Costs incurred | S$800 | S$3,000 | |

| Net savings | S$46,328 | S$44,128 | |

Exiting your lock-in period soon? Find out how much you can save if you refinance or reprice with DBS/POSB.

Alternatively, check out other nifty planning tools for your home-owning journey. You can even save your detailed property budget and cashflow timeline reports!

Work out your Property Budget.

Create your Cashflow Timeline.

Start Planning Now

Check out DBS Home Marketplace to work out the sums and find a home that meets your budget and preferences. The best part – it cuts out the guesswork.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)