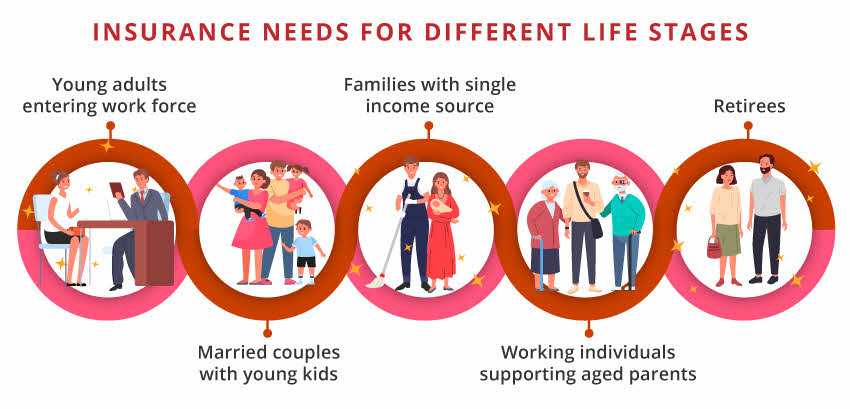

Insurance needs for different life stages

![]()

If you’ve only got a minute:

- Insurance is not one-size-fits-all.

- Everyone can benefit from a suitable health insurance plan.

- If you have dependants, life insurance is of higher importance to reduce their financial burden in the event of premature death.

![]()

A debilitating illness can strike unexpectedly. Other than dealing with the physical and emotional ordeal, the last thing you want during this difficult period is to manage the financial stress of high medical bills and the loss of income.

Having adequate insurance helps you to shore up your finances and it is a key component of financial planning.

Insurance is never one-size-fits-all; each individual has unique needs based on their life stage. If you're unsure about the right type of insurance for you, consider your current life stage as a starting point.

Which life stage are you in? The following table summarises the key and optional insurance coverage for each life stage.

Young adults entering work force

What you can do

|

Life stage |

Key coverage |

Optional coverage |

|---|---|---|

| Young adults entering workforce |

|

|

Getting health insurance will be your best first step to building up your financial defences. Insurance premiums are generally more affordable when you’re younger and healthier. All Singaporeans and PRs are covered with the basic MediShield Life which covers B2/C wards in government hospitals.

Consider enhancing your coverage with Integrated Shield Plan (IP) for more flexibility in choosing doctors and upgraded wards. IPs and their riders complement MediShield Life (MSHL) with higher benefits and can reduce your out of-pocket payment to $3,000/year.

Read more: Guide to choosing an Integrated Shield Plan

Critical illness insurance provides a lump sum payout if you get diagnosed with a serious illness such as a cancer, heart attack or stroke). They cover 37 specified critical illnesses defined by the Life Insurance Association of Singapore (LIA). This payout can replace lost income and cover alternative treatment costs. LIA recommends 4x annual income for adequate late-CI insurance coverage.

Many employers offer group insurance plan, including hospitalisation and critical illness coverage. Understanding these benefits ensures you are aware of the protection you have. However, remember that such coverage is typically not portable, and your coverage ceases when you leave your employer.

As a general guideline, spend no more than 15% of your take-home pay on insurance protection. However, bundled products (e.g. Whole life insurance) may exceed this cap as they contain both protection and investment elements.

Married couples with young kids

At this stage of life, your financial priorities likely include home mortgage and family planning.

It is crucial to plan for the financial security of your family (particularly so if you’re a breadwinner) to ensure your loved ones can sustain a reasonable lifestyle if you’re unable to provide for them anymore.

What you can do

|

Life stage |

Key coverage |

Optional coverage |

|---|---|---|

| Married with young children |

|

|

Death coverage is a high priority as it ensures financial security by covering debts, replacing lost income and managing daily living expenses.

The Life Insurance Association Singapore (LIA) recommends coverage 9x your annual income for death coverage.

A more affordable option to get coverage for death/terminal illness (TI) benefits is to consider a term plan over whole life insurance. Term plans provide more affordable protection compared to whole life as they do not build up cash value.

Disability income protection provide income replacement in the event you are not able to perform material duties of your occupation due to an accident or illness.

Read more: Should you consider disability income insurance?

Families with single income source

It is important for families with single income source to have comprehensive coverage to mitigate the risk of unexpected income loss.

For sole breadwinners, the priority would be to ensure adequate protection so that the family can meet financial commitments for the continuity of normal life.

What you can do

|

Life stage |

Key coverage |

Optional coverage |

|---|---|---|

| Family with single income source |

|

|

The core coverage of hospitalisation, death, and CI remains crucial for financial security.

However, having sufficient income replacement coverage becomes even more crucial for families dependent on 1 income earner.

This includes long-term care insurance to provide for caregiving costs if you are severely disabled.

Read more: CareShield Life in a summary

Working individuals supporting aged parents

Juggling the responsibilities of providing for children and aged parents can be financially stressful.

When planning for your insurance coverage, you should consider the needs of both generations in case of unforeseen circumstances.

What you can do

|

Life stage |

Key coverage |

Optional coverage |

|---|---|---|

| Working adults supporting aged parents |

|

|

Given the rising healthcare costs, the priority is to ensure that your parents are adequately insured against unexpected medical bills and treatment costs.

This includes basic health insurance for essential medical expenses and long-term care insurance for caregiving costs in the event of severe disability.

Read more: Insure to ease the squeeze

Retirees

Singaporeans are living longer, with an average life expectancy of 85 years old.

As you age, health and long-term care becomes a priority. Having the right policies when you are younger ensures insurability, affordability of premiums and helps cushion the cost of treatment without having to dig into your retirement savings.

What you can do

|

Life stage |

Key coverage |

Optional coverage |

|---|---|---|

| Retirees |

|

|

Review your insurance policies and coverage to determine if they still meet your needs and budget. For example, death coverage may be of lower priority since you may no longer have dependants who are financially dependent on you. If premiums of integrated shield plans are beyond your budget, consider downgrading your coverage or removing riders.

The Ministry of Health (MOH) reports that 1 in 2 healthy Singaporeans aged 65 may become severely disabled.

CareShield Life and ElderShield are national long-term care insurance schemes in Singapore. CareShield Life offers lifelong payouts if you are unable to perform 3 or more Activities of Daily Living (ADLs) while ElderShield provides a lower payout for up to 6 years in the event of severe disability.

If you would like to enhance your long-term care coverage, consider purchasing CareShield Life Supplements from private insurers which offer larger benefits of up to S$5,000/month and more lenient payout criteria.

Navigating insurance needs through different life stages is crucial for ensuring financial stability and peace of mind. As your circumstances evolve—from entering the workforce to supporting a family and eventually entering retirement—so too should your insurance coverage.

Regularly reviewing and updating your insurance plans will help you maintain adequate protection and avoid potential gaps in coverage. Taking these steps will help you safeguard your financial future and allow you to focus on what truly matters in each stage of life.

DBS has partnered with major insurers in Singapore to make health insurance easily accessible online for purchase. You can now independently learn, compare and buy a plan most suited to your own needs. Find out more on DBS Health Marketplace.

Ready to start?

Check out digibank to analyse your real-time insurance coverage. The best part is, it's fuss-free - we automatically work out your gaps and provide planning tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)