CPF LIFE or Retirement Sum Scheme?

![]()

If you’ve only got a minute:

- Premiums will be deducted from your Retirement Account (RA) savings when you join CPF LIFE.

- Under Retirement Sum Scheme (RSS), you will receive monthly payouts till age 90 or until your savings runs out, whichever is earlier.

- CPF LIFE allows you to receive monthly payouts for life.

![]()

The Central Provident Fund (CPF) is a key pillar of Singapore’s social security system, and serves to meet our retirement, housing and healthcare needs.

Our CPF savings consist of compulsory contributions from us and our employers. With the interest earned, our CPF balances will compound and help build up our retirement nest egg.

Currently, there are 2 annuity options for Singaporeans to retire with their CPF funds – the Retirement Sum Scheme (RSS) and CPF Lifelong Income for The Elderly (CPF LIFE).

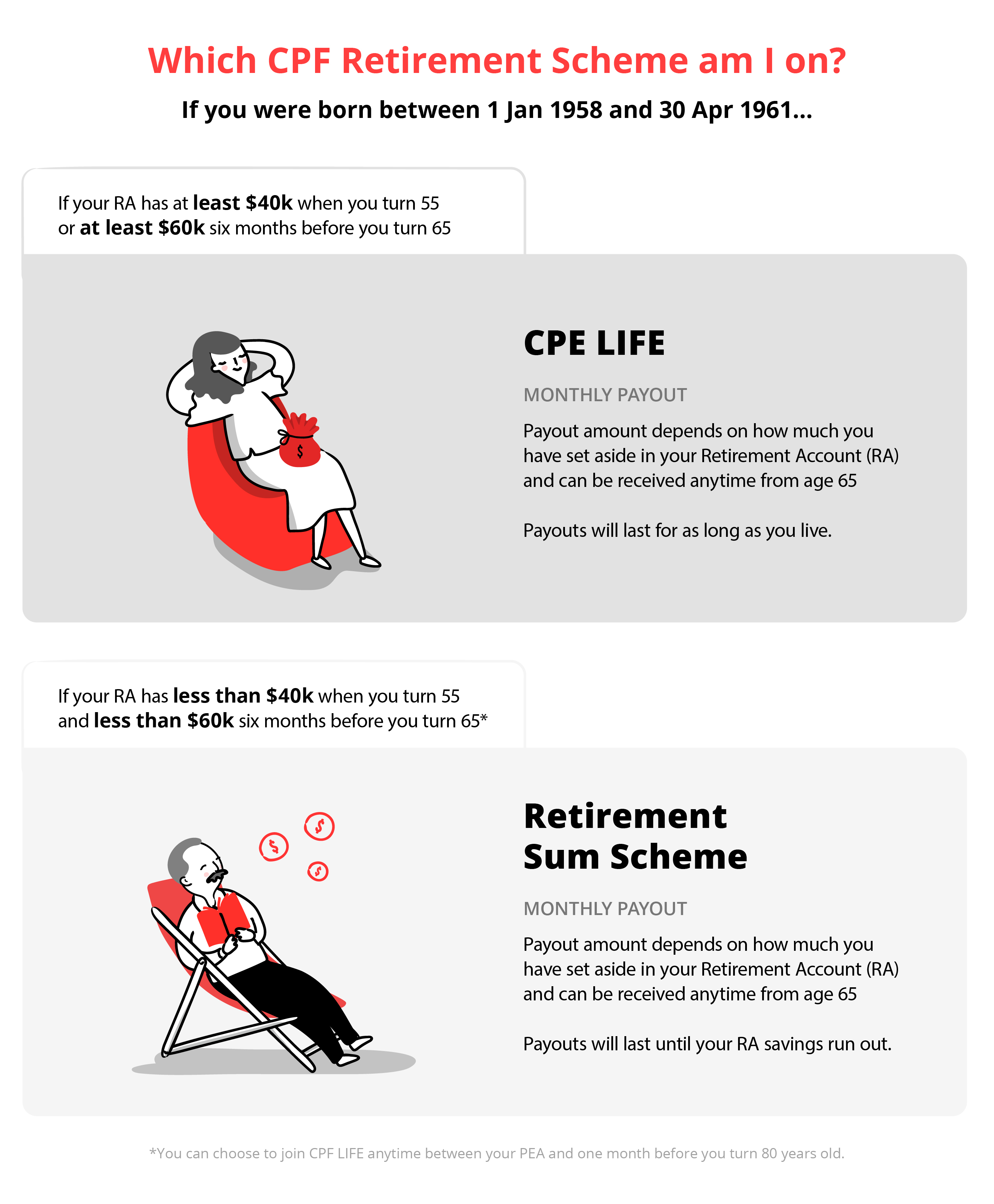

Most of us will be automatically enrolled into CPF LIFE. For those in the Pioneer and Merdeka Generation who were born before 1958, they would automatically join the RSS. However, they have the option to switch to CPF LIFE at any time before turning 80.

Before we take a look at the 2 options, let’s understand what is the CPF Retirement Sum. This is the amount of retirement savings which you have chosen to set aside in your RA to receive monthly payouts from your Payout Eligibility Age (PEA), which is age 65.

Your retirement sum can be used to join CPF LIFE which provides you with life-long monthly payout or the RSS which provides you with a monthly payout until your RA balance is depleted.

If you are in the CPF LIFE scheme, the retirement sums indicate how much of your CPF savings you should set aside in order to have lifelong monthly payouts during your retirement years. These monthly payouts can be disbursed anytime from age 65 to 70.

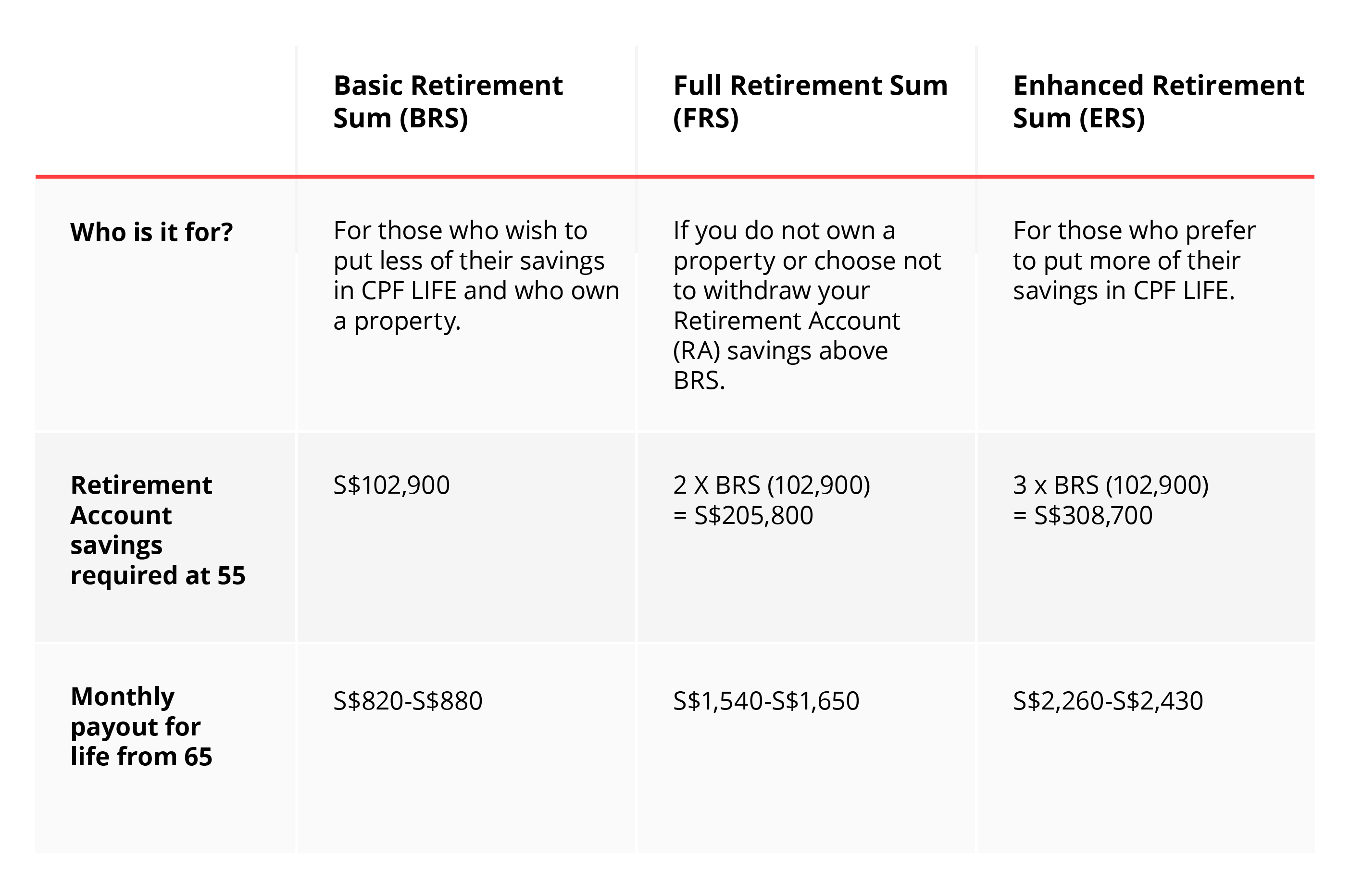

There are 3 CPF Retirement Sums: Basic Retirement Sum (BRS), Full Retirement Sum (FRS) and Enhanced Retirement Sum (ERS).

This table illustrates their differences.

*Based on those who turn 55 in 2024. Monthly payouts are estimates based on the CPF LIFE Standard Plan.

Source: CPF

Retirement Sum Scheme (RSS)

The RSS provides CPF members with monthly payouts to support a basic standard of living during retirement until your RA savings run out or when you turn 90, whichever is earlier.

The RSS will apply to those who are:

- Born before 1958

- Born in 1958 or after and have less than S$60,000 in your RA when your monthly payouts start OR

- Are a non-Singapore citizen or non-permanent resident.

If you are on the RSS and wish to join CPF LIFE to receive lifelong monthly payouts, you may do so any time between your PEA and one month before you turn age 80.

CPF Lifelong Income for The Elderly (CPF LIFE)

Launched in 2009, CPF LIFE is a national annuity scheme that provides you with a monthly payout no matter how long you live. This is to ensure that you will not run out of retirement savings during your golden years.

In general, you will be automatically included in the CPF LIFE scheme if you are:

- Born in 1958 or after; and

- Have at least S$60,000 in your RA six months before you reach your PEA

- A Singapore Citizen or Permanent Resident

Those who are potentially not included in the CPF LIFE scheme include housewives, self-employed individuals and business owners who don’t contribute regularly to their CPF.

If you don’t satisfy the above criteria to be automatically enrolled into CPF LIFE, you can still opt to switch from the RSS to the CPF LIFE scheme anytime before you turn 80.

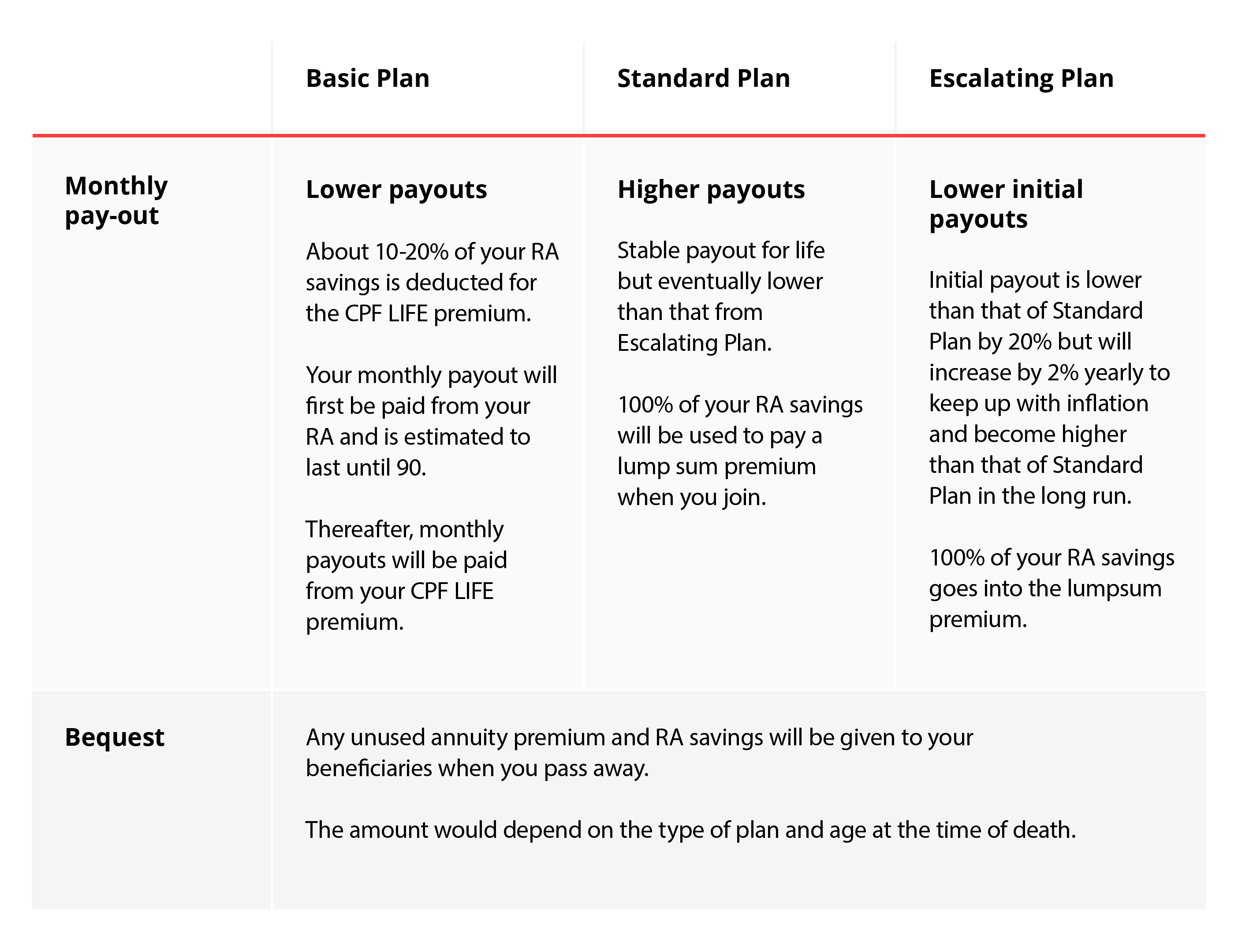

3 CPF Life Plans

- Provides you with a monthly pay-out for as long as you live

- Your RA savings will be used to pay the premiums for your CPF LIFE plan

- These premiums will earn attractive and risk-free CPF interest rates up to 6% per annum

- When you pass away, your beneficiaries will receive your CPF LIFE premium balance together with your remaining CPF savings

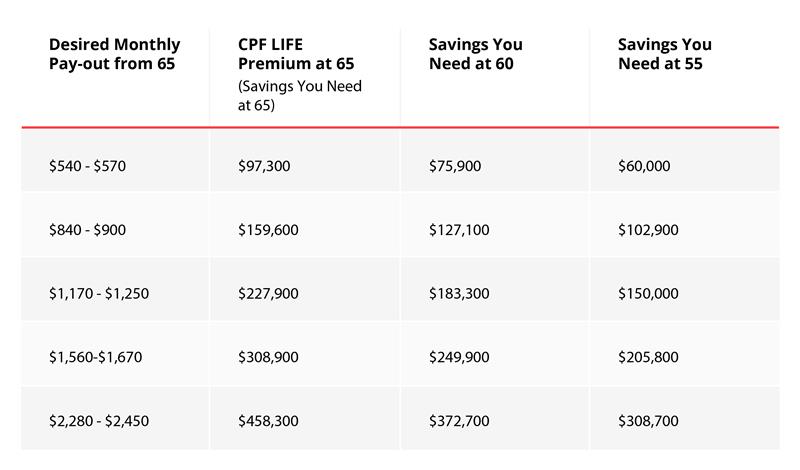

After you have decided on the CPF LIFE plan that best suits your retirement needs, the next step is to work out the amount of monthly payout you require, and the CPF savings you need to achieve it.

You can use the CPF LIFE Estimator to find out the amount of CPF LIFE premium needed to achieve your desired monthly pay-out under your selected CPF LIFE plan.

For example, to receive a monthly payout of S$1,560 - S$1,670, you will need S$308,900 in your RA at 65. A much smaller sum of S$205,800 is required if you set aside the amount in your RA at 55. This is because CPF interest rates of up to 6% will help you grow your savings through compound interest

Source: CPF

Note: These monthly payouts are estimates based on the CPF LIFE Standard Plan, for members who turn 65 in 2034, computed as of 2024. Payouts may also be adjusted to account for long-term changes in interest rates or life expectancy. Such adjustments (if any) are expected to be small and gradual.

Differences between CPF LIFE and RSS

1. Length of payouts

With RSS, your monthly payouts will stop when your RA savings are depleted or until age 90, whichever is earlier. CPF LIFE offers monthly payouts for life.

2. RA savings and interest

There’s also one other factor you need to consider regarding the interest on your RA savings and how it is distributed to your beneficiaries when you pass on.

For RSS, your beneficiaries will receive the remaining savings including interest (if any) when you pass on.

For CPF LIFE, your CPF LIFE premium balance (if any), together with any remaining CPF savings will be distributed to your loved ones. The interest earned, however, will be pooled to the CPF LIFE annuity to ensure that the other CPF LIFE members continue to enjoy monthly payouts for as long as they live.

Note: The interest that has accrued on your CPF LIFE premium (and the premiums of other CPF LIFE members) is ultimately what enables you to continue receiving payouts long after your CPF LIFE premium amount has been used up

You can also ask yourself a few questions - what kind of retirement lifestyle are you looking at? How will your home come into play as a retirement asset? Do you plan to live with your children?

These are important questions to think about as it can affect the type of retirement plan you choose, depending on your dream retirement lifestyle.

Retirement Sum Topping up Scheme (RSTU)

The Retirement Sum Topping Up Scheme (RSTU) helps to build up your retirement savings with cash or CPF top-ups to the Special Accounts(SA) for those who are below 55, up to the current Full Retirement Sum (FRS) or Retirement Accounts(RA) for those who are aged 55 and above, up to the current Enhanced Retirement Sum (ERS).

Cash top-ups can be made to your own CPF account or your family members’ CPF accounts, including your parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings. If you are topping up for yourself, you can enjoy tax relief of up to S$8,000 per calendar year. In addition, if you are topping up for your loved ones**, you are eligible for another S$8,000 per calendar year.

You can only make CPF transfers when your CPF account has at least the BRS.

**Terms and conditions apply

Ready to start?

Start planning for retirement by viewing your cashflow projection on Plan tab in digibank. See your finances 10, 20 and even 40 years ahead to see what gaps and opportunities you need to work on.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)