What you need to know before getting a home loan

![]()

If you’ve only got a minute:

- Find out what LTV (loan-to-value), TDSR (total debt servicing ratio) and MSR (mortgage servicing ratio) means and how they affect the maximum home loan you can borrow.

- HDB loan is more attractive if you prefer to pay less downpayment in cash.

- Weigh the pros and cons of each type of loan before making your choice – lower interest rates is just one of the many factors to consider.

![]()

Checking out showrooms and talking to property agents might make buying a home in Singapore seem like a breeze. However, when you delve deeper into the nitty-gritty, you’ll find that there are more complex aspects at play.

For example, handling finances, paperwork, and navigating through various decisions can add layers of complexity to the process.

There are a number of key considerations such as: Do you go for a HDB or bank loan? How much is the downpayment? And what are LTV, MSR and TDSR?

Here are some questions to consider before taking up a home loan:

- Who can you get a home loan from?

- What is the interest rate on these home loans?

- How much can you borrow?

- How much will you repay every month?

- After making your decision, how do you proceed?

How to get a home loan in Singapore?

If you’re buying a HDB flat, you have 2 loan options – a HDB loan or a bank loan. To help you decide, consider the following factors:

Eligibility

To qualify for a HDB loan, your monthly household income must not exceed $14,000 ($7,000 for singles and $21,000 for extended families).

Additionally, you must not have owned any private property in the last 30 months. If you don’t meet these criteria, you’ll have to consider a bank loan instead.

Affordability

With both a HDB loan or a bank loan, you can borrow up to 75% of the property's purchase price.

If you decide on a bank loan, you will need to fork out 25% of the property’s selling price, with at least 5% in cash.

Take advantage of the DBS MyHome Planning Tool to help you work out your sums.

Which home loan has the best interest rate?

With HDB loans, the interest rate on your mortgage is a standard 2.6% p.a. (based on the prevailing CPF interest rate of 2.5% + 0.1%), which has not changed in years.

Bank loans, on the other hand, offer a diverse range of loan packages, each with its own unique interest rate. This variety allows for more flexibility when choosing a loan that suits your needs.

Banks typically provide 2 types of home loan packages:

- Fixed rate mortgage

- Floating rate

Generally, fixed rate mortgage offers predictability and stability in monthly payments as the interest rate remains constant for a specified period (typically 2 to 5 years). A fixed rate loan is useful in a rising rates environment as it shields potential increases in interest rates during the fixed period

Floating rate loans often comes with lower initial interest rates compared to fixed-rate mortgages. The interest rate is usually pegged to the Singapore Overnight Rate Average (SORA) or a Fixed Deposit Based Rate (FDR).

If interest rates remain stable or decrease over time, you may pay less in interest compared to a fixed-rate mortgage. Do bear in mind that monthly payments can go up if interest rates rise.

DBS’s Two-in-One Home Loan, allows you to have a portion of the loan amount under a fixed rate package for a peace of mind and also benefit from the interest of a floating rate package for the remaining loan amount.

Read more: Fixed or floating home loan – which is better?

In short, a bank loan may offer lower interest rates than an HDB loan. The main trade-off is you’d have to monitor your interest rate since it might change after 2 or 3 years. You may need to reprice your home loan (with the same bank) or refinance (pick another bank for your mortgage).

There is always the option to refinance from a HDB loan to a bank loan at any point to enjoy lower interest rates. Do note that refinancing incurs valuation and legal fees, so it is prudent to look at the package in totality, and not just the rates. The same goes for repricing.

Read more: Should you refinance or reprice your home loan?

How much can you borrow for your home loan?

The maximum home loan you can borrow depends on your:

- Loan-to-Value ratio (LTV)

- Total Debt Servicing Ratio (TDSR)

- Mortgage Servicing Ratio (MSR)

The LTV ratio refers to the loan amount as a percentage of the property’s value. With both HDB loan and bank loan, the LTV is 75%. In some cases, you might not be able to get the full 75% because when you apply for a home loan, the financier also considers your TDSR.

TDSR is the portion of your income that goes towards all your debts, like car and education loans. Together with the home loan, your TDSR cannot exceed 55% of your gross monthly income.

MSR is only applicable if you’re buying a HDB flat or executive condominium (EC). It limits your monthly repayments to 30% of your gross monthly income.

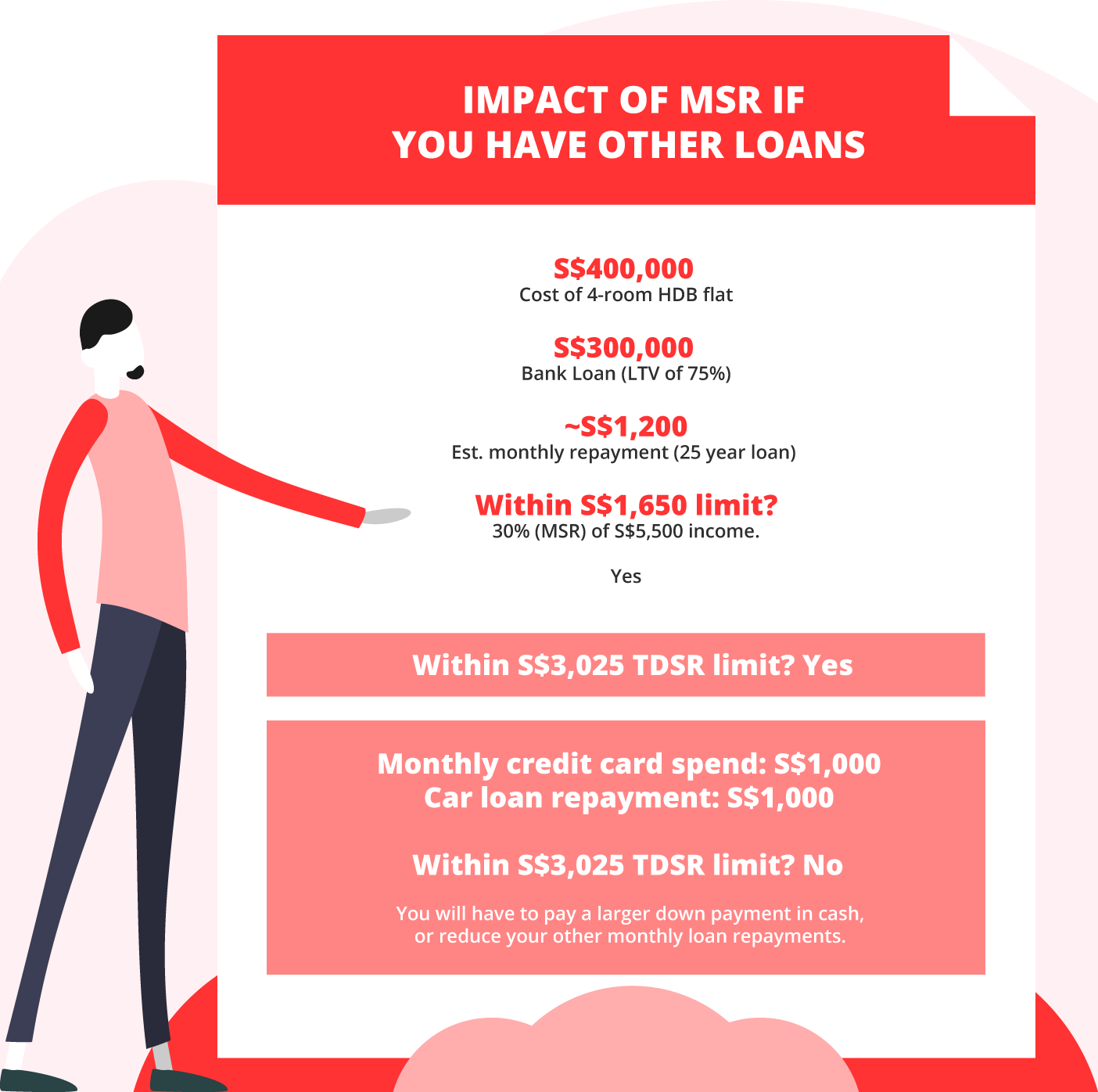

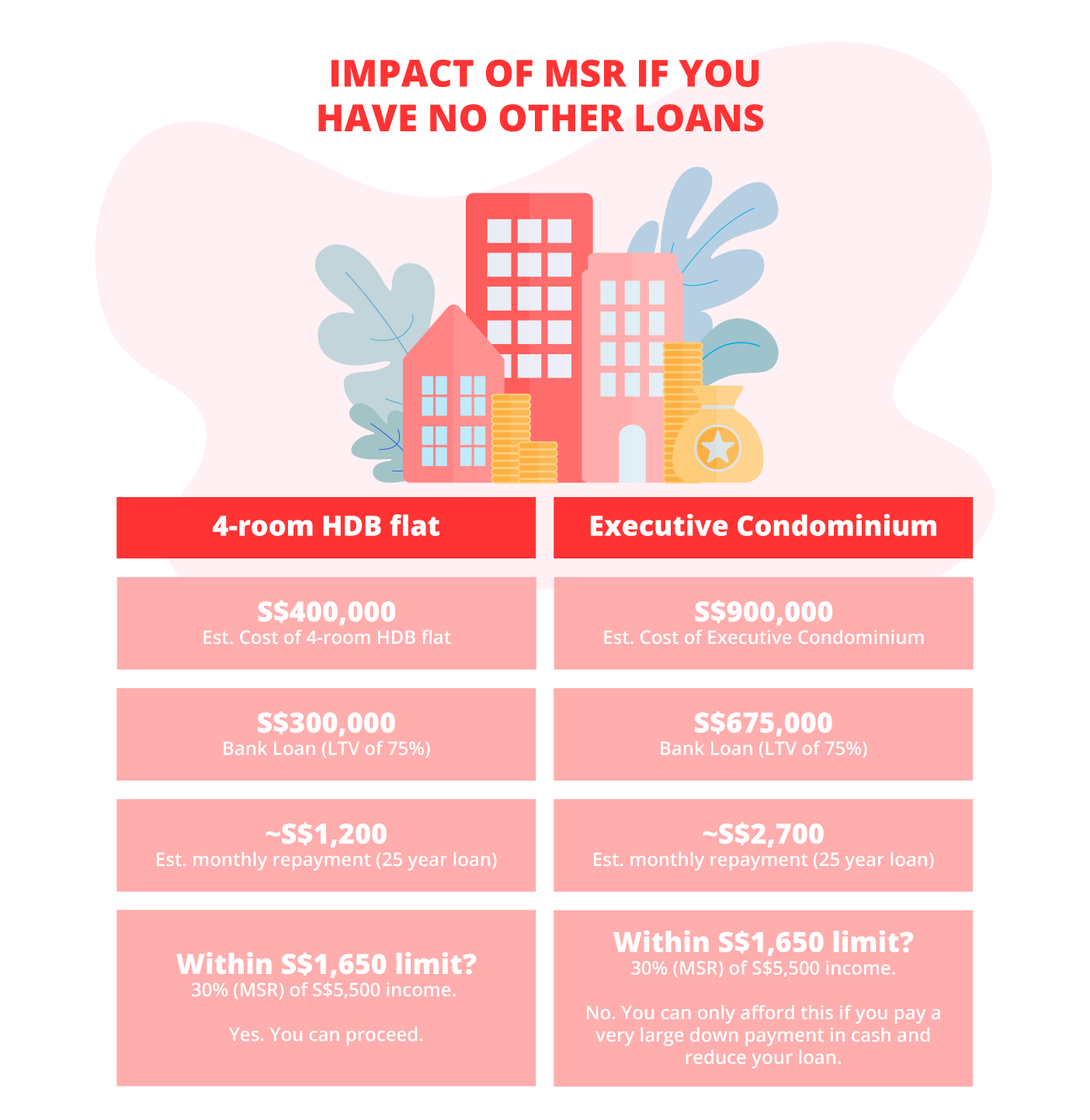

Here’s an example on how TDSR and MSR impact your monthly debt repayment amount (assuming you earn a $5,500 monthly income):

TDSR: Since TDSR is 55%, you can spend up to $3,025 a month on repaying loans (of all types).

MSR: Since MSR is 30%, you can spend up to $1,650 a month on your HDB/EC housing loan. (This $1,650 a month falls under your $3,025 total loan budget.)

These ratios are in place to prevent you from borrowing above your means.

Here’s an example: You’ve shortlisted 2 properties. Can you afford them?

Here’s how your situation could be different if you had other debts/liabilities:

Cash or CPF?

If you take up a HDB loan, most of your CPF Ordinary Account (OA) savings will be used for the down payment. You can consider setting aside $20,000 in your CPF-OA as these funds provide a safety net for you to pay your monthly instalments during unforeseen circumstances, such as a temporary loss of income.

Once the downpayment is made, HDB will disburse the loan amount upon key collection.

If you prefer to leave your savings in CPF and have spare cash on hand, a bank loan allows you to pay the entire downpayment in cash.

For home buyers on a tight budget, the HDB loan is certainly attractive.

Read more: Should I use CPF or cash when buying a home?

To understand the borrowing limits mentioned above, you can use a home loan calculator to figure out your monthly repayments. Longer loan tenures mean smaller, more manageable repayments.

Check out: Mortgage affordability calculator

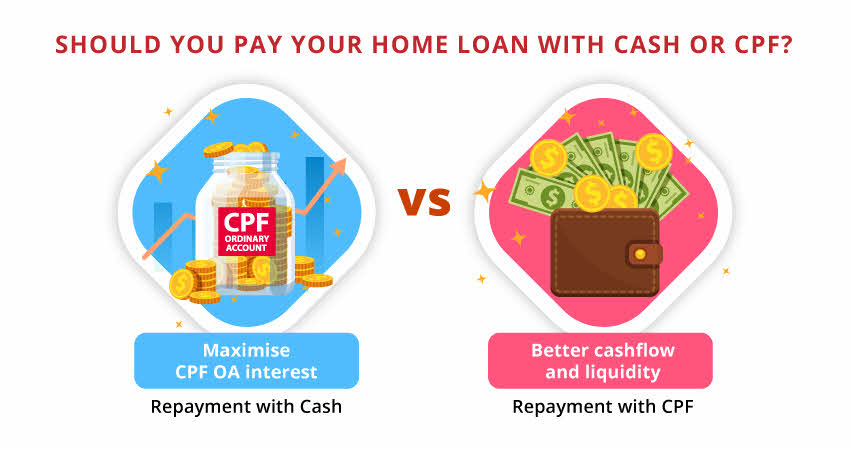

You also have the option to utilise your CPF Ordinary Account (OA) savings to repay home loan instalments.

Paying with CPF is certainly attractive if you need the cashflow for your day-to-day expenses and investments but that also means giving up the 2.5% risk-free interest on your CPF monies.

In the event of a property sale, you will need to return the CPF-OA funds used, along with accrued interest.

Repaying your loan with cash allows you to maximise that 2.5% interest rate on your CPF-OA savings. You will be able to keep the proceeds from the sale without the need to top up your CPF.

If you have spare cash, you can consider partial repayments of your home loan to save on interest payments. It is important to note that some banks charge a fee for partial repayments, so weigh the pros and cons before proceeding.

After deciding on your home loan, what’s next?

If a bank loan is what you’ve decided on, consider getting an In-Principle Approval (IPA) to better understand your borrowing capacity to streamline the purchasing process.

This is a document from the bank stating how much they are willing to lend you, taking into account your TDSR, MSR, income and credit score.

You should secure your IPA before paying the option fee for your home. This is important because if you find out that you can’t borrow enough for the property, you won’t be able to get a refund of the option fee. In some cases, property agents may request for your IPA before they proceed with the transaction.

Having an IPA also helps accelerate the loan disbursal process. More importantly, knowing your maximum loan amount prevents you from getting emotionally attached to homes outside your budget. You’ll be able to set realistic expectations and make informed decisions during your home search.

The process for getting an IPA at DBS is quick and fuss-free.

You can upload the supporting documents into the portal after submitting the application.

Get your IPA here.

Once your application is completed and approved, you are a step closer to securing your dream home!

Start Planning Now

Check out DBS Home Marketplace to find a home that meets your budget and preferences.

Alternatively, prepare yourself with an In-Principle Approval (IPA), so you have certainty on how much you could borrow for your home, allowing you to know your budget accurately.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)