What to look for in a financial advisor

If you’ve only got a minute:

- Know the different types of Financial Advisors (FAs) in the market.

- A good advisor must understand your financial goals and risk tolerance, know the various financial products well, be able to recommend suitable solutions and offer personalised advice that is tailored to your individual needs.

![]()

The meaning of "financial advisor” (FA) can vary from person to person. It can refer to someone licensed to sell insurance, a banker offering investment advice, or a certified professional providing guidance on tax optimisation and estate planning.

It is safe to say that all the interpretations mentioned are valid. Indeed, there are various types of FAs offering different services. More importantly - regardless of the type of FA you engage - you want to be able to pick someone trustworthy and have confidence in.

Types of financial advisors

FA from insurance companies

One of the most commonly recognised types of FAs are from insurance companies. Typically, these FAs exclusively represent a single insurance brand and are authorised to promote only the products from one firm. They are known as tied agents or sometimes referred to as financial planners/insurance agents.

Independent FA

IFAs are similar to the ones above, except that they can provide advice on the products from different life insurance firms. In other words, they are not tied to any specific company and can recommend products from a range of insurers, banks and asset managers. Besides insurance, IFAs may also offer financial advisory advice on investment products like unit trusts and retirement planning services. If you are one who prefers having access to a broader range of products, going with an IFA may be a sound option.

Bank relationship managers (RMs)

Many banks have their own FAs, otherwise known as RMs. They are responsible for managing and nurturing the relationship between clients and the bank.

Some of the main duties of a RM include:

- Meeting with clients to assess their financial needs and goals.

- Developing and implementing financial strategies to meet those needs and goals.

- Recommending banking products and services to clients

- Managing client relationships, including responding to client inquiries and resolving issues

- Providing regular updates to clients on their accounts and investments

You could have the impression that you need to have a certain amount of money (6 figure-sum) before the RM would even talk to you. Well, this is no longer the case.

If you have been to a bank branch recently, you might have seen some bank staff coming to talk to you while you are in the queue. These RMs can usually provide advice on a wider range of products, including savings, home loans, insurance and investments.

Online platforms

In recent years, there has been a surge in the popularity of online platforms that provide segmented financial planning services, such as insurance planning or investment planning. To use these platforms, you typically need to have some financial knowledge and at least a basic understanding of the products you are considering.

While there are advantages to using software for financial advice, such as potentially feeling less pressure to purchase products, some may still prefer human interaction and the reassurance that they are able to reach out to a customer service representative when necessary. As such, some of these online platforms boast hybrid services combining algorithm-directed portfolio services with human interaction capabilities.

Read more: digiPortfolio: A robo-advisor for all

Selecting a financial advisor

It is vital to do your research before you decide on your FA.

Here are 6 key considerations:

1. How much financial advice is needed

Everyone has varying levels of financial literacy and will therefore need different levels of advice.

Do you already have your financial plan worked out and only require access to certain financial instruments? Or are you unsure about where and how to start financial planning? Thinking through these questions can help to narrow down which type of the above FA can fulfil your requirements.

2. Credentials and track record

The first time you meet with your FA, make a note to ask about their credentials – the type of certifications, years or experience, as well as their track record. Doing so can help you gain a better sense of their qualifications and expertise in helping you meet your financial goals.

3. Range of solutions provided

If you are looking at a more holistic suite of financial instruments, do your due diligence and find out which financial institutions offer such advisory service and/or tools.

Look for an FA who can provide the specific services you need, as well as the product offerings you are looking at. A comprehensive financial plan should at least include financial planning, savings, protection, investments and retirement planning.

4. Trust

It is essential to have an FA you can trust, especially since you will be disclosing confidential information about your finances, life circumstances and family situation. In addition to having financial expertise, a trustworthy FA should have a strong ethical code, the ability to empathise with you and the skills to communicate complex financial information in simple terms.

Take some time to research and speak to a few FAs to ensure a good fit. You should feel confident and comfortable in the guidance and advice they provide.

5. How an FA is remunerated

Typically, there are 3 ways in which FAs are remunerated. They can either charge a fee, earn a commission from the financial products that you bought (insurance policies) or invested in (unit trusts), or simply be paid a salary by their employer. Some of them may also earn a basic salary with additional commission.

FAs should be transparent about their compensation structure to ensure that their recommendations are in your best interests, regardless of how they’re compensated.

6. Level of service required

Are you looking for someone who can help you map out your financial journey, and recommend the right solutions as your life change and progress? Or are you simply looking for personal access to buying the financial products you want? Do you need the human touch – someone to call or meet, or do you prefer executing your financial decisions through the click of a mouse?

With these in mind, you should now have a better idea of what to consider when selecting an FA. In part 2, we will talk about what is expected during the financial advisory process.

Before meeting your FA

The first meeting with your FA will most likely be a get-to-know-you session. It may be helpful to reflect on your financial objectives and requirements prior to this meet up. Some questions that you may want to ask yourself include:

- Is your income protected in the event of illness or accident?

- Is your family financially-sufficient in the event of unfortunate incidents (e.g. illness, accident or death)

- What are the savings goals for your children’s education?

- Is your money working hard for you? What is your risk profile?

- What are your retirement goals?

- Have you set up a proper estate plan?

After considering these questions, you can discuss your answers or raise other queries with your FA during the appointment.

Financial Advisory Process

In Singapore, all FAs are required to conduct a Financial Needs Analysis (FNA) prior to any product recommendations with their clients. It involves a series of questions to access your financial situation to identify any needs/gaps you may have.

The information requested may be very personal – such as your financial objectives, employment status, liabilities, assets, existing insurance coverage and current investment portfolio. It is important for you to be as transparent and truthful for the FNA to be useful. However, if you are using a digital advisory service, then the information you need to provide may be less detailed.

Depending on your FA, he/she may make immediate recommendations or take a longer time to get back to you with a more comprehensive solution. Before you purchase any products, consider the following:

- Can the FA build a detailed personal balance sheet to show how your financial decisions can impact your overall financial plan?

- Ask questions about the recommendations (why) and if for they address your financial needs.

- Understand your financial commitments for buying any products – is the commitment sustainable for you in the long term?

- What is the free-look or cancellation period?

- What are the costs and fees for the products? Are there more affordable alternatives.

- What are the risks of the products – is your capital or returns guaranteed?

- You don’t have to buy or sign anything immediately. Take time to review and make comparisons with similar products in the market. Discuss with your family before buying.

Bear in mind that you are not obligated to make any purchases. Stay focused on your financial goals and only acquire or invest in products that serve your needs.

What to do after the meeting

Congratulations on taking a step towards achieving your financial goals! After taking into account the recommendations and purchasing the necessary products, it’d be useful to store all the information in a folder for future reference.

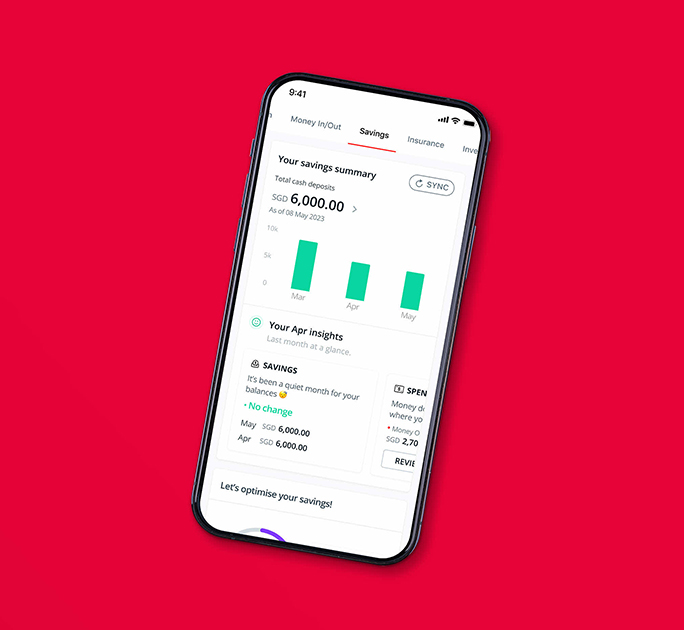

You can also click on the “Plan” tab on DBS digibank and sync your data using SGFindex to have a complete view of your finances in one place.

Do note that the FNA reflects your financial situation at a specific point of time. Your FA should have regular follow ups with you at least once a year for a portfolio review. You may also want to re-examine your protection needs as your life circumstances change - such as marriage, parenthood, a change in career or retirement timeline.

Remember, managing your finances should be a process, not a one-off solution. This is also why choosing a good FA is important - one who will provide ongoing support and guidance throughout your financial journey.

Ready to start?

Check out digibank to analyse your real-time financial health. The best part is, it’s fuss-free – we automatically work out your money flows and provide money tips.

Speak to the Wealth Planning Manager today for a financial health check and how you can better plan your finances.

Disclaimers and Important Notice

This article is meant for information only and should not be relied upon as financial advice. Before making any decision to buy, sell or hold any investment or insurance product, you should seek advice from a financial adviser regarding its suitability.

That's great to hear. Anything you'd like to add? (Optional)

We’re sorry to hear that. How can we do better? (Optional)